Dec 2012

19

Submitting your P35 using ROS

We have included a video to help you with submitting your P35 using Revenue Online Service.

This video can be accessed by clicking on the video icon in the ROS P35 screen in the software.

You can also view the video here.

Dec 2012

10

2013 Thesaurus Payroll Manager Availability

The Minister for Finance, Michael Noonan, presented the 2013 Budget to Dáil Éireann on Wednesday 05th December.

Subsequently we have been liaising with all the necessary Government regulators to confirm the changes impacting on payroll for employers from 01st January 2013, upon the completion of this process the 2013 Thesaurus Payroll Manager will be released to all customers.

In line with previous years, the release of the new tax year payroll is expected to be the week before Christmas, i.e. week commencing 17th December.

All customers for whom we hold an email address will be notified of the new payroll release and the availability of the software for download.

CDs will be posted to those customers who have requested a CD this same week, however, due to the busy Christmas post period we cannot guarantee delivery of CDs.

Dec 2012

10

2013 Budget Summary for Employers

The Budget was announced by Ministers Brendan Howlin and Michael Noonan on 05th December. Below is a summary of changes which affect employers.

PAYE

The Income Tax rates remain at 20% and 41% for 2013. There are no changes to Personal Tax Credits or Standard Rate Cut Off Points.

USC

There are no operational changes to the treatment of USC for employers.

From an employee prospective there are no changes to the Standard rates or Cut Off Points in relation to USC, they are the same as last year.

The annual income exemption threshold of €10,036 continues to apply for 2013, the process of employee self election to Revenue still applies.

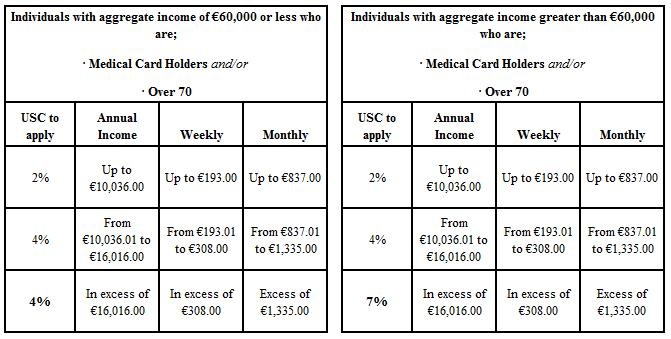

What has changed are the rules applied to medical card holders and those aged over 70. Previously these individuals would have qualified for a reduced rate of USC of 4% (reduced from 7%) on earnings in excess of €16,016. From 01st January 2013 this USC break no longer applies, to previously qualifying individuals, whose aggregate income for 2013 will exceed €60,000

- Medical Card holders (regardless of age) with aggregate income of €60,000 or more

- Individuals aged 70 or over with aggregate income of €60,000 of more

The P2C (Tax Credit File) issued by Revenue will allocate the correct USC rates and Cut Off Points per employee. As was the case in 2012, no action is to be taken by the employer other than to apply the details of the latest tax credit file.

It is important that you apply the latest detail as per the 2013 P2C/tax credit file as soon as it is received and if possible before completing the first pay period in order to avoid a claw back of USC for any individuals who qualified for the reduced higher rate of USC in 2012 but no longer qualify in 2013.

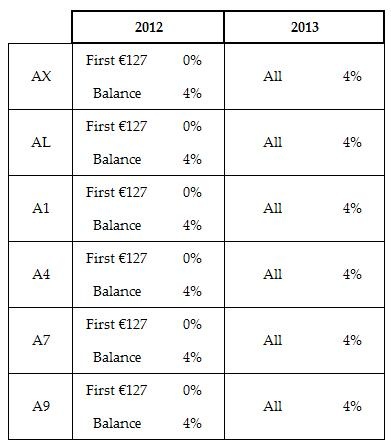

PRSI

The Employee's PRSI-Free Allowance of €127 per week (for those paying PRSI Class A, E and H) and €26 per week (for those paying PRSI Class B, C and D) will be abolished from 01st January 2013.

Employees who earn €352 or less per week continue to have no liability to make a PRSI contribution and are not affected by the abolition of the weekly PRSI-Free Allowance.

For those employees in private sector employment the changes are;

From 01st January 2014, the exemption from PRSI applying to all employees with unearned income only, i.e. income generated from wealth such as investment income, deposit interest and rental income, will be abolished.

PRSI minimum contribution

The minimum annual PRSI contribution for people with annual self-employed income over €5,000 increases from €253 per annum to €500 per annum.

Maternity/Adoptive Benefit

Maternity and Adoptive Benefit will be taxable for all claimants with effect from 1 July 2013. As with all Department of Social Protection benefits it is not subject to USC.

Health and Safety Benefit, payable to pregnant or breastfeeding mothers, is a form of Maternity Benefit and will also be subject to the same tax rules as Maternity Benefit.

Once Revenue issue guidelines relating to the procedures to be adopted by employers to operate the taxation of Maternity Benefit we will issue a payroll upgrade, this will be prior to effective date of 01st July 2013.

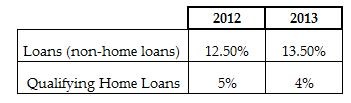

Preferential loan rates

Where an employer extends a loan to an employee, with effect from 01st January 2013, there are the following changes apply;

Top Slicing Relief

Top Slicing Relief will no longer be available for persons who receive an ex-gratia payment, excluding statutory redundancy, where the amount is €200,000 or more. This provision has effect for payments made on or after 1 January 2013.

Revenue Job Assist and Employer Job (PRSI) Incentive Scheme

A scheme called the ‘Plus One Initiative’ will replace both the Revenue Job Assist and Employer Job (PRSI) Incentive Scheme. Full details of this change have yet to be will be announced.

Local Property Tax (LPT)

From 1 July 2013, residential property owners will be liable for an LPT based on the self-assessed market value of their property on 1 May 2013. Once Revenue issue guidelines relating to the procedures to be adopted by employers to deduct and remit this tax to Revenue we will issue a payroll upgrade, this will be prior to effective date of 01st July 2013.

See our article “Local Property Tax (LPT) effective from 01st July 2013” for further information.

Statutory Sick Pay Scheme

Despite speculation throughout the latter half of 2012 a Statutory Sick Paye scheme was not announced in the 2013 Budget.

Bright Contracts – Employment contracts and handbooks.

BrightPay – Payroll Software

Dec 2012

10

USC Exempt Status v USC Exempt Income

Employers should be wary of the difference between USC exempt status (as per P2C/tax credit certificate) and employees in receipt of USC exempt income.

If an employee expects their income to be less than €10,036 in the tax year they can contact Revenue to make a declaration of same, it is only the employee themselves that can make this declaration. Revenue will update the employees USC status to USC exempt and issue a new P2C/tax credit to the employer. The employer will follow this instruction and USC will not be deducted from the employee accordingly.

If an employee is in receipt of USC exempt income, e.g. Community Employment Participants, Department of Social Protection payments, these employees will not necessarily hold USC exempt status on the P2C/tax credit certificate. The exempt income itself should be flagged as USC exempt within the payroll.

Bright Contracts – Employment contracts and handbooks.

BrightPay – Payroll Software.

Dec 2012

10

Illness Benefit - New Employer Obligations from 1st January 2013

During 2012 Revenue issued notifications advising employers that the treatment of Illness Benefit will change from 01st January 2013.

From 01st January 2013 the employer will be responsible for collecting PAYE due on Illness Benefit issued to employees, without exception. There is no alternative treatment or option but for the employer to calculate and collect the PAYE regardless of whether or not;

- the employer receives confirmation, from either the employee or the Department of Social Protection, of the Illness Benefit issued

- the employee retains the Illness Benefit

- the employer receives the Illness Benefit (either directly or indirectly)

- the employer continues to pay the employee when they are on sick leave.

The employer should assume the employee is in receipt of Illness Benefit once the period of illness exceeds three consecutive days and start to account for Illness Benefit in this first pay period. The employer should assume the employee is in receipt of the full €188 until notified otherwise.

In the majority of cases the employee’s tax credit and SRCOP will cover the PAYE payable on the Illness Benefit within each pay period.

2013 Thesaurus Payroll Manager will include an amended Illness Benefit feature to automate the process of taxing the Illness Benefit for the employer. It is important that employer’s access and use this feature for any Illness Benefit issued to an employee from 01st January 2013 in the very first pay period in order to;

- treat Illness Benefit correctly

- capture the Illness Benefit figure for 2013 Revenue returns (P45, P35, P60)

We are including a wizard in the 2013 payroll software to assist you in calculating the taxable Illness Benefit, the software will treat it accordingly for PAYE thereafter. We will also include a video offering a step by step guide on how to enter Illness Benefit in the payroll.

Despite much speculation throughout the latter half of 2012, a statutory sick pay scheme was not announced in the 2013 Budget.

Dec 2012

10

Local Property Tax (LPT) Effective From 1st July 2013

The EU/IMF Programme of Financial Support for Ireland commits the Government to the introduction of a property tax; accordingly the Government introduced the Household Charge in 2012 as an interim measure. The 2013 Budget announced the introduction of a more comprehensive and equitable valuation based property tax with effect from 01st July 2013, with penalties attached for late payment. As a result, homeowners will escape paying six months worth of property tax in 2013. Householders will pay the full amount in 2014.

The Revenue Commissioners will be in charge of collecting the payment and given powers to chase those who attempt to avoid it.

How will Revenue know who to contact?

- Revenue data and other sources such as Local Government Management Agency (LGMA) Household Charge data, Non-Principal Private Residence (NPPR) data and Private Residential Tenancies Board (PRTB) data

- Once LPT legislation is enacted, Revenue will have the necessary statutory basis to obtain information from other bodies, such as utility providers, which will be used to further develop the register of residential properties. This will allow Revenue to contact liable persons in March 2013

How will LPT be calculated?

- LPT will be administered by Revenue and a half-year charge will apply in 2013

- LPT will be charged on all residential properties in the State, including rental properties

- The market value of residential properties on 1 May 2013 will be the basis of assessment for the tax

- Revenue will write to residential property owners in March 2013 and will include an LPT Return form for completion along with an LPT explanatory booklet

- The booklet will explain everything you will need to know about assessing the value of your property, working out how much you will have to pay, completing the LPT Return form, and deciding what option will suit you best to pay your LPT

- The return that you submit in 2013 will be valid for the years 2013 to 2016 unless your circumstances change or you wish to select an alternative payment method

How much LPT will you pay?

- The initial band will be €0 - €100,000

- Subsequent bands will be organised in values of €50,000 width up to €1,000,000

- The tax liability will be calculated by applying the tax rate to the mid-point of the band

- The rate of LPT will be 0.18% for properties up to a market value of €1m

- Residential properties valued over €1m will be assessed at the actual value at 0.18% on the first €1m in value and 0.25% on the portion of the value above €1m (no banding will apply)

- Revenue has developed an on-line LPT calculator, which is available from the Revenue website at http://www.revenue.ie/lpt_reckoner/index_en.html to assist you in the calculation process

LPT Payment Methods available

- The completed LPT Return form will have to be sent back to Revenue by 7 May 2013 if filing a paper form

- If you file your LPT Return form electronically you will have until 28 May 2013 to file it online through www.revenue.ie

- The return that you submit in 2013 will be valid for the years 2013 to 2016 unless your circumstances change or you wish to select an alternative payment method

- If you opt for a phased payment arrangement, such as direct debit or deduction at source, payment will be spread evenly over the remainder of the year and will commence from 1 July 2013

- It can be deducted from their wages and remitted to the Revenue by your employer

Once guidelines are issued we will upgrade the payroll software as necessary in good time, prior to any deadlines, to include a facility for the employer to deduct LPT from employees pay if requested to do so.

For further information visit the Revenue website to view the LPT FAQ document published on 05th December 2012.

Dec 2012

10

SEPA Banking

SEPA for Credit Transfers, including Payroll files goes live on 1st February 2014. The individual banks will commence to accept SEPA files between now and February 2014.

What is SEPA?

SEPA (Single Euro Payments Area) is an initiative to effectively remove the borders of banking within the 27 EU member states and EFTA. Once fully implemented SEPA will make cross border bank transfers across the Euro zone simple and effortless so that in effect the Euro zone becomes one banking zone. Once fully implemented you will need to use IBAN (International Bank Account Number) and SWIFT-BIC code (Bank Identifier Code) for all transfers both domestic and cross border; chances are you are already familiar with these!

How will this help you?

If you are transferring funds from your own domestic bank to that of another Euro member state then this transfer will be as easy, cost effective and efficient as a current domestic bank transfer.

How can this help you as a Thesaurus customer?

If you are paying employees by credit transfer using the Bank transfer file within Thesaurus Payroll Manager you will be able to offer employees the option of having their net wages transferred to their bank account within another Euro member state.

If you are a business owner purchasing supplies and/or services from both domestic and cross border Euro member states then you will be able to consolidate the payment process to all suppliers using one Bank transfer file from Solutions Plus. (The option to create a supplier bank transfer file with Solutions Plus to pay domestic suppliers is available from 2013).

When will this facility be available?

As of December 2012 we are still waiting on file formats, implementation dates and directives from the national banks in order to proceed. The background file structures of our software have been expanded to accommodate the BIC and IBAN fields.

Once Irish banks fully implement the new SEPA bank transfer file option for customers, then Thesaurus products will be upgraded immediately to offer you the full functionality and convenience of SEPA banking.

Bright Contracts – Employment contracts and handbooks

BrightPay – Payroll Software

Dec 2012

10

Cloud Features - Thesaurus Payroll Manager

“The Cloud” is such a pervasive term these days and is used to describe almost anything where data is accessed or transmitted over the Internet.

We are amazed to see some software companies raving about their web based software, an old technology, as being the new trend in cloud computing. Of course web based software is handy in some respects but it is usually slower and less feature rich than anything you will run from your desktop computer.

We believe that if you want to use your iPad, then you should have software designed for your iPad, which then accesses the same data that you processed using your desktop. Obviously the data must be stored in the cloud for this to work. This, we believe, is the future of cloud computing. We also believe that it should be up to the end user to opt in or out of cloud functionality.

This is our development goal and our cloud strategy!

Numerous cloud features have already been included in Thesaurus Payroll Manager, namely:

- Automatic updates - The software will always check to see if a more up to date version is available and will tell you what is included in any upgrade. This it does by checking in with our website every time you launch the software. The upgrading is then performed by downloading the latest version from our website.

- Dropbox integration is provided within the backup and restore screens. Backing up to Dropbox makes it really easy to access the payroll data from your laptop at home.

- Payslip & P60 emailing is facilitated by encrypted transmission through our secure web server. If you haven’t yet used this feature, give it a try. You do not need any extra software and it will save you time and money. Once our server has emailed the payslips/P60s to your employees, they are then deleted to ensure that we do not hold any sensitive information.

- Video help, which will become more widespread in our 2013 software, is accommodated by the software accessing videos which reside on a remote website.

Dec 2012

10

SFA Awards 2013 - Thesaurus Software shortlisted as Innovation finalist

The finalists in the SFA National Small Business Awards 2013 have been officially announced by Ian Martin, SFA Chairman. The aim of the awards is to celebrate the achievements of small business in Ireland, and to recognise the vital contribution of the small business sector to Irish industry.

We are delighted to announce that Thesaurus Software Ltd has been shortlisted as a finalist in the “Innovator of the Year” category.

As an indigenous thriving business, formed over 20 years ago, we are overwhelmed to gain recognition from such an esteemed evaluator as SFA.

Better known for our products, being shortlisted as a finalist in innovation, presents a valued opportunity to showcase the hardworking team who are the backbone of our forward thinking policy to maintain our business momentum as trendsetters and innovators in software development.

Bright Contracts – Employment contracts and handbooks

BrightPay – Payroll Software

Dec 2012

10

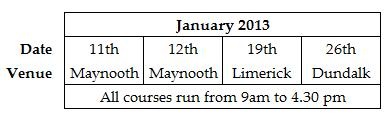

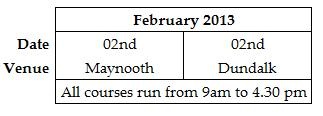

2013 Computerised Payroll Training

In association with our training partner, Oiliúna, computerised payroll training courses are now open for bookings for the months of January and February 2013.

Simply click here to download thebooking form for complete booking information.

Alternatively, should you wish to contact a trainer in your area our network of trainer details are available at http://www.thesaurus.ie/Training.aspx

Bright Contracts – Employment contracts and handbooks

BrightPay – Payroll Software