Sep 2013

29

How to manage sickness absence

Managing sick leave can be a challenge for every employer. It is essential that businesses find the balance between supporting those employees who are genuinely sick and minimising unnecessary absences in order to reduce costs. Costs can include:

- Loss of productivity

- Employing temporary cover

- Paying other employees additional overtime costs

The 2011 IBEC Guide to Managing Absence found that over 11 million days are lost to absence in Ireland every year, costing businesses €1.5 billion or €818 per employee. The report also found that employees missed 5.98 days on average, an absence rate of 2.6%.

Managing Absences

Absence levels can be addressed by taking some simple steps:

- Sickness Policy: there should be a policy in place that clearly sets out the procedure that will be followed by both employees and management in cases of absence through illness. The policy should be clearly communicated and consistently implemented. The default company handbook in Bright Contracts contains such a policy.

- Record, Monitor & Measure: monitoring and measuring enable employers to identify trends and recognise points at which absence levels need to be further investigated.

Return to Work Interviews: these are informal meetings between a line manager and an employee on the first day the employee returns to work. Return to work interviews are consistently rated as one of the most effective methods of managing absenteeism levels and it is recommended that they should be included in all sickness absence policies.

Bright Contracts – Employment contracts and handbooks.

BrightPay – Payroll Software

Sep 2013

24

What our customers say!

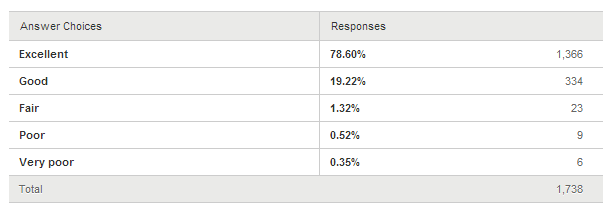

In a recent customer survey, 97.82% of respondents ranked the quality of our customer support as Excellent or Good.

This customer support covers our payroll software (Thesaurus Payroll Manager and BrightPay), our employment contracts software (Bright Contracts) and our accounts software (Solutions Plus) and is free to all registered users.

While the excellent/good percentage achieved would be way ahead of industry standards, we hope to reduce the 2.18% who ranked our support as fair or poor!

Sep 2013

23

PAYROLL TAX TIP – SEPTEMBER 2013

Employees do you know when your employer pays or partly pays medical insurance on your behalf you do not get Tax Relief at Source (TRS)?

When you pay your own medical insurance premium you automatically receive tax relief at the standard rate of tax, currently 20%. When your employer pays or partly pays medical insurance on your behalf you will not have been allowed Tax Relief at Source. The good news is you are entitled to the relief when your employer has paid the medical insurance on your behalf but you have to claim the relief due from Revenue.

Individual Paying Medical Insurance:

| Gross Premium | €1,000 |

| Tax Relief at Source: | €200 |

| Cost to Individual: | €800 |

Employer Paying Medical Insurance:

| Gross Premium | €1,000 |

| Tax Relief at source (employer pays this to Revenue through Tax Return) | €200 |

| Benefit in Kind | €1,000 |

Using the example above although the employer has only paid €800 to the medical insurance provider the employee will pay benefit in kind of €1,000.

If your employer pays or partly pays your medical insurance you should contact your local tax office to ensure you are receiving the tax relief.

Details can also be found in the help file for Thesaurus Payroll Manager and BrightPay.

Sep 2013

12

FREE BUSINESS EVENT FOR IRISH SMEs – TAKING CARE OF BUSINESS

Very few things in life are free so why not avail of a free event to help your business. If you own or manage a small business or are thinking of starting your own business you should visit www.takingcareofbusiness.ie to register as places are limited.

Attendees will:

- Meet with representatives from a number of State Offices & Agencies

- Get information & advice

- Find out ways to save your business money

- Receive support to help you in your business

Speakers on the day will include representatives from National Employment Rights Authority, Companies Registration Office, Department of Social Protection, Enterprise Ireland, Revenue as well as many others. Please see the eflyer for full details - https://www.takingcareofbusiness.ie/eflyer.pdf

Free Admission

Printworks Conference Centre, Dublin Castle

22nd October 2013 8.30am to 2.30pm

Initiative of the Department of Jobs, Enterprise & Innovation

Sep 2013

9

Not registered for LPT? - then no Tax refund!

Revenue are now getting tough with those who had failed to file a property return, and officials will not issue refunds to them.

Those who have not filed a property return will not be in a position to reclaim tax refunds for Medical expenses and tuition fees etc..

A spokeswoman for the Revenue said it will eventually issue refunds to those who have yet to register for the property tax, but it will first deduct the tax due from the refund amount.

In general, in advance of issuing a refund, a taxpayer's record will be reviewed to ensure no outstanding liability exists. Where a liability exists, an offset will be made before the refund will be issued.

Sep 2013

6

Kite Flying prior to Irish Budget

A new report presented to Social Welfare Minister Joan Burton recommends the PRSI rate for self employed and proprietary directors should go up from current rate of 4% to 5.5% to fund extra social benefits for those who work for themselves.

The higher PRSI rate would be used to fund the paying of long-term illness and disability benefits for the self employed, which are not available to those who work for themselves at the moment.

However, the higher PRSI payment that the advisory group recommends for all the self-employed to pay for disability benefits, is set to be opposed by business group ISME The report also states that it would provide a safety net for those who want to start a business.

The cabinet has approved publication of the report, however it remains unclear if the recommendations will form part of next month's budget.