Dec 2013

29

Payroll Tax Tip - December 2013

Tax Relief for Medical Expenses

Employees don’t forget to claim tax relief on medical expenses!!!!

Time Limit

A claim for tax relief must be made within 4 years after the end of the tax year to which the claim relates. Therefore to claim for 2009 you must submit your claim by the 31st of December 2013.

General Information

Tax Relief may be claimed in respect of certain medical expenses paid by you.

You cannot claim tax relief for any expenditure which:

- has been or will be reimbursed by another body such as VHI, Laya Healthcare, Hibernian Aviva Health, the Health Service Executive or any other body or person

- has been or will be the subject of a compensation payment

- relates to routine dental and ophthalmic care

You may claim relief in respect of any qualifying expenses paid by you in respect of any individual.

Tax Rate

Relief is allowed at the standard rate of tax (20%) with the exception of nursing home expenditure which is allowed at the higher tax rate (41%), if applicable.

Methods of Claiming

- online via Revenue’s PAYE Anytime Service

- completing Form Med 1 and submitting it to your local Revenue Office

- if you use a Form 11 to make a tax return enter the amount of health expenses claim at Panel 1

If the claim includes non routine dental expenses you must obtain a form Med 2, this must be signed and certified by the dental practitioner.

There is no need to send receipts backing up the claim but you need to retain all receipts for a period of 6 years as the claim may be selected for detailed examination in the future.

Full details can be found on Revenue’s website

http://www.revenue.ie/en/tax/it/leaflets/it6.html#section1

Dec 2013

4

What's new in 2014

Thesaurus Payroll Manager 2014 is now available. Click here to download.

2014 Budget Changes to cater for:

- Reduced rate of 4.25% employer’s PRSI to revert to 8.5% (affecting PRSI classes A0 and AX)

- Full year application of LPT (local property tax)

- Illness benefit waiting days increased to six from three meaning that employers will not have to adjust for tax until waiting days have elapsed

- Minor changes to BIK mileage bands

- PRD (pension levy) lower rate reduced from 5% to 2.5%

SEPA

As more banks become SEPA ready, the roll out of payroll software upgrades for these banks will be targeted to those customers affected, so, when preparing a SEPA file, the software will see if a specific upgrade is available for that bank.

As more banks become SEPA ready, the roll out of payroll software upgrades for these banks will be targeted to those customers affected, so, when preparing a SEPA file, the software will see if a specific upgrade is available for that bank.

Other users will not be inconvenienced by these targeted upgrades.

AIB, Danskebank, ABN Amro and Bank of America are currently catered for within Thesaurus Payroll Manager. Permanent TSB, Ulster Bank and Bank of Ireland are planned this month or 1st January at the latest. The remaining banks will follow as they become SEPA ready and we have successfully processed test files with them.

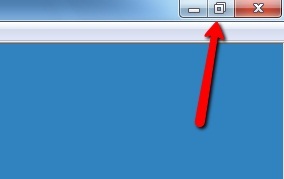

Cleaner graphics

This takes advantage of the fact that only 0.5% of users are now using 800 x 600 resolution and, for those that are, scroll bars will appear for the larger forms.

The “restore down” button at the top right of the main form previously forced users to keep the program in a maximised state. This button will now allow a user to show the program on part of their screen only. So, for example, you might have a spread sheet showing on your screen alongside the payroll. Some payroll sections will still take over the full screen e.g. payslip print to screen.

General improvements to the software upgrade process and many more 'under the hood' enhancements.