Oct 2017

25

Making an Employee Redundant

A redundancy situation can often arise in the following situations:

- an employee’s job ceases to exist

- the employer ceases to carry on the business

- the requirement for employees has diminished

- an employee is not skilled for work that is to be done

In the event of a redundancy, employees are covered under Redundancy Payments Acts 1967-2014, if they meet the following requirements:

- aged 16 or over

- have at least 2 years continuous service (104 weeks)

- are a full-time employee insurable under PRSI class A, or PRSI Class J for a part-time employee

How to calculate Statutory Redundancy Pay

Statutory Redundancy is payable at a rate of:

- 2 weeks’ pay for each year of service. If the period of employment is not an exact number of years, the excess days are credited as a portion of a year

- plus one week’s pay

The term ‘pay’ refers to the employee’s current normal gross weekly pay, including average regular overtime and benefits in kind. The above, however, is based on a maximum earnings limit of €600 per week (before PAYE, PRSI & USC).

An employer may also choose to pay a redundancy payment above the statutory minimum. In such circumstances, the statutory payment element will be tax free but some of the lump sum payment may be taxable.

To keep up with the latest payroll news, check out our new Bright website. There, you'll be able to register for any of our upcoming payroll webinars and download our payroll guides.

Oct 2017

19

Customer Update

Free Webinar: What you NEED to know about PAYE Modernisation

PAYE Modernisation is probably the biggest overhaul of the PAYE system since PAYE itself was introduced back in 1960. It will have wide ranging effects on all employers. Register now for our free webinar to find out what you need to know about PAYE Modernisation. Speakers include Paul Byrne (Thesaurus Software) & Sinead Sweeney (Revenue)

CPD Webinar: GDPR for your Payroll Bureau (Bureaus Only)

Data protection and how personal data is managed is changing forever. On 25 May 2018 the new General Data Protection Regulation (GDPR) will come into force. The GDPR is a European privacy regulation replacing all existing data protection regulations. Register now for our free, CPD accredited webinar to find out how this new legislation will affect your payroll bureau.

"What do you mean... Do I have a backup?” - A day in the life of Customer Support

One of the most common calls on the support line is from a distressed customer who tells us they have lost their payroll information. Reasons for the loss of this information are varied and could be anything from a laptop being stolen, a virus attacking the computer or fire or water damage to the computers in the office.

Thesaurus Connect - Try for Free

We are giving customers one free Thesaurus Connect 2017 licence. With Thesaurus Connect, employers can login to their own personal employer dashboard where they can access employee payslips, payroll reports and a company wide calendar. It also includes a self-service portal for employees to view payslips and request annual leave.

Redeem your free licence / Book a demo

New Automatic Enrolment Pension System to be in place by 2021?

Brian Hayes MEP has called on Minister for Social Protection, Regina Doherty to start work on the introduction of an automatic enrolment pension system, whereby all Irish private sector employees would be automatically enrolled into a pension scheme.

Thesaurus Customer Survey: The Results are in!

In our recent survey, we were delighted to discover that Thesaurus has a 99.6% customer satisfaction rate. Customers are also highly satisfied with our customer support team, with a satisfaction rate of 99.5%.

Oct 2017

11

Budget 2018 - Employer Payroll Focus

Pay As You Earn (PAYE)

- There was no change to tax rates for 2018, the standard rate will remain at 20% and the higher rate at 40%.

- Standard Rate Cut Off Points (SRCOPs) will be increased by €750 from 1st January 2018.

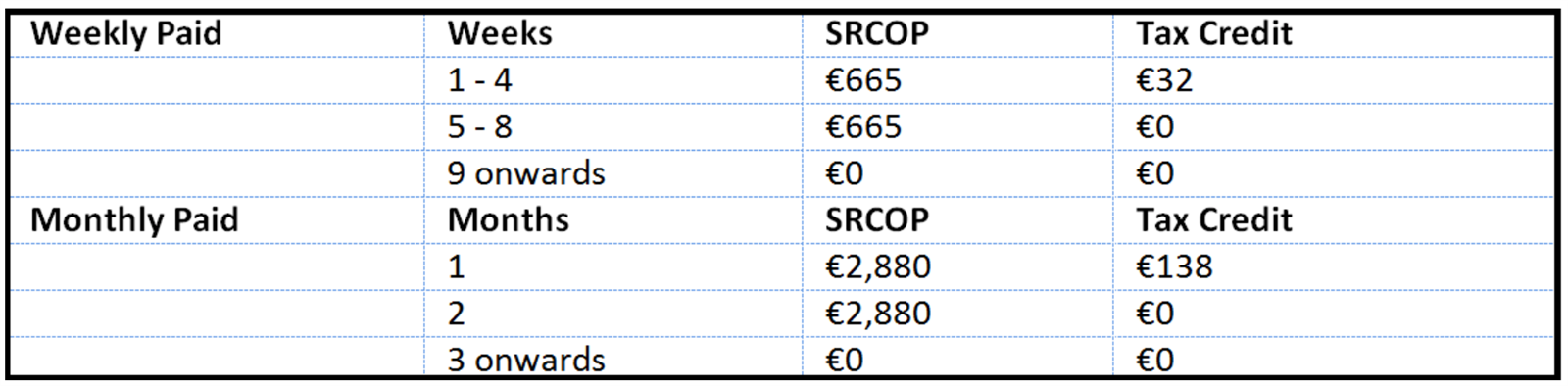

Emergency Basis of PAYE

Employee provides PPS Number:

Where an employee does not provide their PPS Number the higher rate of 40% tax applies to all earnings.

Earned Income Tax Credit

The Earned Income Tax Credit will be increased by €200 from €950 to €1,150.

Home Carer Tax Credit

The Home Carer Tax Credit will be increased from €1,100 to €1,200.

Universal Social Charge (USC)

- Exemption threshold remains at €13,000

- 2.5% rate reduced to 2%, threshold for this rate increased from €18,772 to €19,372

- 5% rate reduced by 0.25% to 4.75%

- No change to 8% rate

Medical card holders and individuals aged 70 years and older whose aggregate income does not exceed €60,000 will pay a maximum rate of 2%.

The emergency rate of USC remains at 8%.

PRSI & USC

The Minister outlined his intention to establish a working group in 2018 to carry out a review of the possible integration of PRSI and USC.

National Training Levy

The National Training Levy of 0.7% which is currently collected as part of the employer PRSI contribution will increase to fund further and higher education, the increases are as follows:

- 0.8% in 2018

- 0.9% in 2019

- 1% in 2020

Pay Related Social Insurance (PRSI)

There were no changes to general PRSI thresholds or employee PRSI announced in the Budget. However, as the National Training Levy is increasing and it is collected as part of the employer PRSI contribution, employer PRSI will increase as follows:

- 8.5% increased to 8.6%

- 10.75% increased to 10.85%

Benefit in Kind (BIK) - Electric Cars

A 0% rate of BIK will apply to electric vehicles provided by an employer to an employee in 2018 which is available for private use. Electricity used by the employee in the workplace to charge the car will also be exempt from BIK.

PAYE Modernisation

PAYE Modernisation will be effective from 1st January 2019. Budget 2018 has allocated €50 million for a project to enhance Revenue's IT capacity and to ensure employer compliance.

National Minimum Wage

The National Minimum Wage will increase from €9.25 to €9.55 per hour in respect of hours worked on or after 1st January 2018.

- Workers under age 18 will be entitled to €6.69 per working hour

- Workers in their first year of employment over the age of 18 will be entitled to €7.64 per working hour

- Workers in their second year of employment over the age of 18 will be entitled to €8.60 per working hour

Social Welfare Payments

There will be a €5 increase in all weekly Social Welfare payments with effect from 26th March 2018. The maximum personal rate of Illness Benefit will be increased to €198 per week. Maternity Benefit and Paternity Benefit will be increased to €240 per week.

Oct 2017

10

Thesaurus Payroll Manager - Customer Survey - The Results are in!

Opinions and feedback from our customers matter to us. We love to hear comments and suggestions from users in order to improve the customer experience. Last month we conducted a customer survey to get an insight into what customers think about Thesaurus Payroll Manager and find out what new features our customers want.

The survey also looked at customer satisfaction rates, software performance and customer support. We were delighted to discover that Thesaurus Payroll Manager has a 99.6% customer satisfaction rate. Customers are also highly satisfied with our customer support team, with a satisfaction rate of 99.5%. Many customers agree that BrightPay saves them time (99.4%) and offers good value for money (99.6%).

Surprisingly, 43% of customers were not aware that Thesaurus Payroll Manager includes integration with One4all. This new feature was added last year and enables employers to seamlessly purchase One4all gift cards for employees.

The survey also looked at awareness of PAYE Modernisation. Nine out of ten accountants, bookkeepers and payroll bureaus said that they were aware of this new PAYE system, which will be effective from 1st January 2019. Meanwhile, one in five employers were unaware of this upcoming change. Thesaurus recently hosted a number of free PAYE Modernisation webinars, with a guest speaker from Revenue. The webinars incorporated everything you need to know about PAYE Modernisation. Watch the PAYE Modernisation training session on demand.

Customer Testimonials

We also received a number of customer testimonials from the survey - all of which will be added to the Thesaurus website in due course. Some of our favourite testimonials received include:

- "We have used Thesaurus for our payroll since 2001. Over the last 17 years our general accounting software has been changed 3 times but we have never found a better payroll system or had a reason for wanting to change..."

- "I found the support I was given by Thesaurus to be of the highest quality, with the empathy shown by Thesaurus employees to be extraordinary."

- "I have used Thesaurus Payroll in a number of companies and I found it much easier to use than any other payroll software I have encountered. It has always provided updates and changes required quickly without fuss. The newest addition, Thesaurus Connect has made life easy for me. Payslips automatically sent out to employees and the facility for them to view and print payslips as required has freed up a lot of management time for other duties."

- "The support staff are brilliant, they answer questions in everyday language and are committed to staying with you until you have a total understanding of the query."

- "Thesaurus Payroll Manager is the most cost effective change we have made to our business. From the standard paying wages to being able to email payslips, work out holiday entitlement and much more, this software package is worth its weight in gold. Saving us time and money. I wouldn't be without it."

Prize Winners

As a thank you for taking part in the survey, we are giving away four €50 One4all vouchers. We are delighted to announce that the winners are:

- John Ganly - Blanchardstown Amalgamated Sports Ltd

- Geraldine Grennan - PJ Grennan Ltd

- Elaine Donnelly - Irish Theatre Institute

- Eugene O'Donovan - SME Finance

The Thesaurus team will be in contact with the winners shortly.

We appreciate all the feedback received from this year’s survey and would like to say a massive thank you to everyone who took part.

Useful Links

Oct 2017

2

Are you ready for PAYE Modernisation?

To raise awareness about forthcoming PAYE Modernisation in 2019, Revenue has commenced its awareness campaign by releasing an information leaflet “PAYE Modernisation – Are You Ready”.

This leaflet highlights the vital steps for new and existing employers to undertake in advance of 1st January 2019, in order to succeed in the imminent taxation system revolution.

The key idea behind PAYE Modernisation is that all communication between employer and Revenue will happen in “real time”. In order to effectively overcome the upcoming challenges, employers are being encouraged to focus on the quality and accuracy of the data they provide to Revenue.

In preparation for PAYE Modernisation, employers are advised to follow several easy steps to guarantee its overall success when it does come into effect in 2019:

- Register as an employer (for new employers)

- Verify the PPSN provided by employees (e.g. check it against a Public Services Card, P45 or other Revenue or DSP correspondence) and where the employee does not hold a PPSN, they should contact the DSP to apply for one.

- Register all employees with Revenue (i.e. P45(3) or P46 where the employee has no P45). Where the new employee has not worked in Ireland before, the employee must register the employment online using the Jobs and Pension service available in myAccount. The Jobs and Pension service can also be used by employees who are changing from one employment to another. Once the employment has been registered, Revenue will issue a tax credit certificate.

- Issue a P45 when an employee ceases employment and submit it to Revenue.

- Ensure an up-to-date tax credit certificate has been received for each employee. The leaflet outlines the basis of tax which should be applied on the first payday of a new tax year in the event that an up-to-date tax credit certificate for that year is not received.

- Ensure a complete PAYE, PRSI and USC record for each employee is held at the end of the tax year.

At Thesaurus Software & BrightPay, we have always strived to deliver excellence in customer service and professional expertise in both Irish and UK payroll. We widely welcome the upcoming PAYE changes. As Paul Byrne, director of Thesaurus Software Ltd, stated during the Revenue's public consultation process held in December 2016:

“Whatever system is adopted, it is important that it represents a step forward for all parties. We are already committed to not charging our customers for the additional development involved. In addition, we are considering making a free version of our software available for micro employers, those with one or two employees.”

Related articles