Nov 2019

29

BrightPay awarded 'Payroll Software of the Year 2019'

BrightPay was announced as the WINNER of ‘Payroll Software of the Year 2019’ at the ICB Luca Awards.

The annual LUCA Awards recognise outstanding achievement in the bookkeeping world, where ICB members and students vote in an online ballot to decide the winners of the awards. This year, BrightPay was awarded Payroll Software of the Year, over shortlisted contenders Moneysoft, Sage and Xero.

The awards took place earlier this week, during the annual two-day Bookkeepers Summit, where the BrightPay team had great feedback from the ICB members who are using BrightPay.

Payroll Software you can trust…

The award comes just one year after BrightPay was announced as the winner of ‘Payroll Software of the Year’ 2018 at the AccountingWEB Software Excellence Awards.

With over 25 years of payroll experience, our products are used to process the payroll for over 320,000 businesses across Ireland and the UK. BrightPay also has an impressive 99% customer satisfaction rate and a 5-star rating on Software Advice.

Book a demo today to discover how BrightPay’s award-winning software can improve your payroll processes and save you time.

Nov 2019

29

Thesaurus Customer Update: December 2019

Welcome to our December update where you will find out about the latest hot topics and events affecting payroll. Our most important news this month include:

- How will auto enrolment affect you in 2022?

- Thesaurus Connect monthly subscription pricing - How does it work?

- 2019 HR & Employment Law Landscape - What you need to know

Plans to auto-enrol workers in pension schemes by 2022

In 2022, all employers are likely to have certain auto enrolment mandatory duties to complete by law. As a nation, we are not saving enough for our retirement. Many are planning to rely solely on their state pension which could lead to a reduced standard of living. The Irish government aims to bring in an auto enrolment system where all employers will enrol their employees into a workplace pension scheme and contribute towards the employee pension pot.PAYE Modernisation: One year on - was it a success?

Thesaurus Software has teamed up with Revenue for a series of free PAYE Modernisation webinars. In this webinar, we will look back on PAYE Modernisation in 2019 and decide if the new real time payroll reporting system has been a success. We’ll also deep dive into the evolution of cloud technology in payroll.

- Part 1: Discover the common mistakes employers make and learn what’s to come in 2020.

- Part 2: Learn how Thesaurus Connect’s cloud platforms can improve your payroll efficiency.

Watch this short video to see how your business can benefit from Thesaurus Connect

Thesaurus Connect is our cloud add-on that works alongside Thesaurus Payroll Manager. Securely store payroll information in the cloud and enable online access anywhere, anytime for you, your employees and your accountant. You will be up and running in seconds. Find out how Thesaurus Connect can improve your payroll processes with a free online demo.

Employee Gift Cards for Christmas - Purchase One4All Gift Vouchers on Thesaurus

Thesaurus Payroll Manager offers a facility where users can securely purchase one4all gift cards for their employees. Employers can give a gift card of up to €500 tax-free to employees. Gift cards arrive addressed to the employer in an unmarked envelope for extra security.

New BrightPay Connect Feature for Bureaus

This is what you must be offering as part of payroll (And why clients will LOVE it)

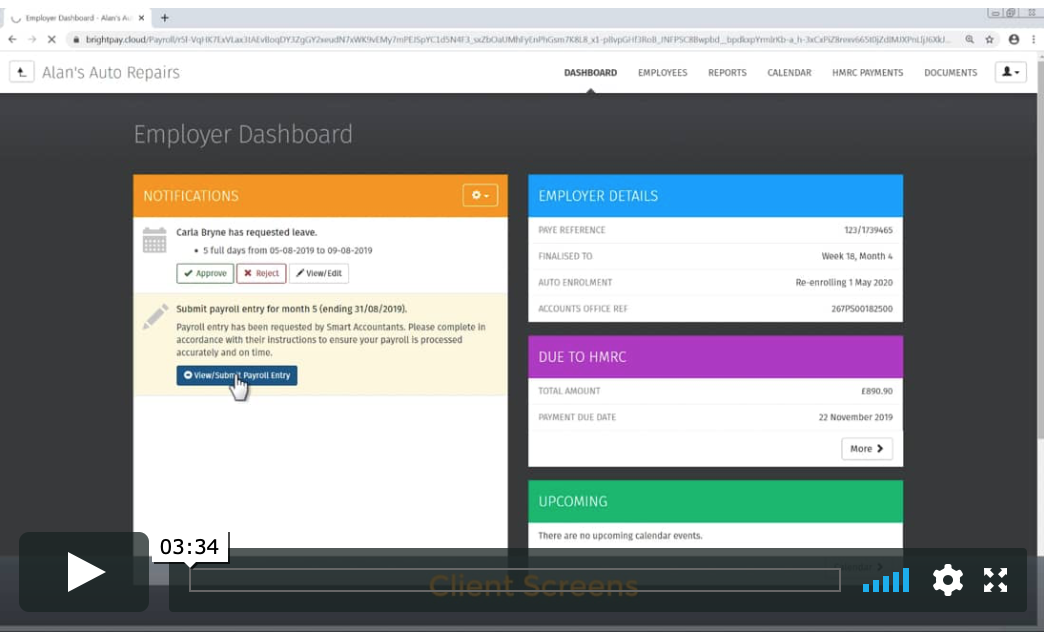

Client Payroll Entry (Exclusive to BrightPay Connect)

The Payroll Entry Request allows clients to easily and securely enter their employee’s hours, saving bureaus hours of administrative time. Additions and deductions that have been set up by the bureau in the payroll software can also be selected by the employer. All of the information included in the Payroll Entry Request (payments, additions, deductions and new starters) will seamlessly flow through to the bureau’s portal, ready for payroll processing.

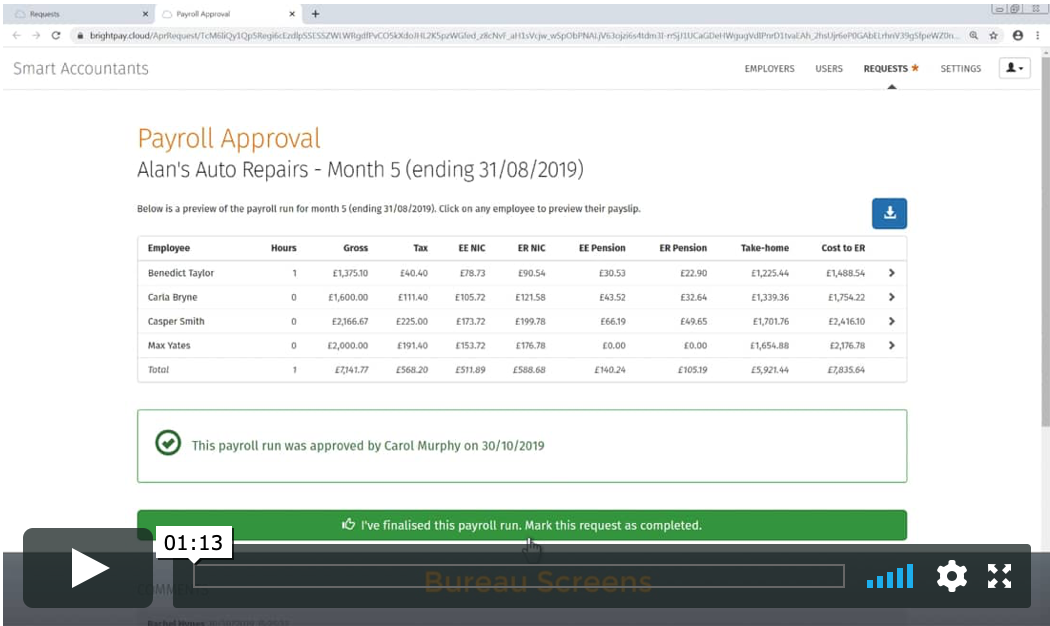

Client Payroll Approval (Exclusive to BrightPay Connect)

BrightPay Connect’s Payroll Approval Request allows bureau users to securely send their clients a payroll summary before the payroll is finalised. Clients can review and authorise the payroll details for the pay period through their online employer dashboard. Ultimately, your client will be accountable for ensuring the payroll information is 100% correct before the payroll is finalised. Additionally, there is an audit trail of the requests being approved by the client.

Nov 2019

28

Auto enrolment is finally on its way

Today we’re living longer and healthier lives than ever before! This is fantastic! Right? Well… sorry to be Captain Buzzkill, but as a nation, with this increase in life expectancy our saving habits haven’t caught up. Put simply, we’re not saving enough for our retirement! It’s no good having all those extra years if you haven’t even got enough to go to bingo with the girls every weekend.

Many people are planning on relying solely on their State pension, but this would lead to a serious decline in the standard of living. Never fear, however, the Irish government is here. To combat this issue, the State is bringing in an automatic enrolment system where all employers will be required to enrol their employees into a workplace pension scheme and contribute towards the employee’s pension pot.

The government has spent the last few years ironing out all the details and, hallelujah... the day is nigh. A date has finally been announced by the Department of Employment Affairs and Social Protection, and from 2022 pension auto enrolment will be rolled out on a phased basis.

Under this new system, an employee will be automatically enrolled into a pension scheme. It will apply to all employees aged between 23 and 60, earning more than €20,000 a year and not already in a workplace pension scheme. To begin with, the employee contribution will equal 1% of their salary, increasing to 6% of their salary in their tenth year of employment.

For employees, the best bit is that your employer will be required to contribute the same percentage, so after 6 years, workers and employers will be saving a combined 12% of salary into a pension. The State will then add a further 2% contribution which makes a whopping total of 14% of salary with a cap of €75,000. That will be more than enough to buy two double books and a couple of cans of Sprite at the bingo on weekends!

So how automatic is automatic? Well, as an employee, it’s completely automated. That’s the beauty. However, if you’re an employer, then you’ll likely have certain mandatory auto enrolment duties to complete. Such as:

- Choosing a workplace pension scheme

- Calculating who needs to be enrolled in a pension scheme

- Informing employees about their rights

- Calculating contributions and showing them on a payslip

- Completing a declaration of compliance to inform the Irish government that you have complied with the law

Wow, that actually sounds like a lot of work I say as I wipe the sweat from my top lip. Not if you’re a Thesaurus Software customer! Thesaurus Payroll Manager is ahead of the auto enrolment curve and will automate all of these pesky auto enrolment tasks to ensure the transition is seamless. The best part is that they won’t charge you anything extra for any auto enrolment features.

Nov 2019

20

Important Pricing Update for Thesaurus Payroll Manager 2020

To ensure that our investment in technology keeps pace with Revenue’s changing landscape and to facilitate the increase in customer support resources, we are changing our pricing for 2020. This new pricing structure is designed to better match usage and support requirements with price.

Unlike many of our competitors, we’ve added hundreds of powerful features and enhancements and heavily invested in additional customer support staff, all so that you don’t have to worry. 99.9% of the time everything will run smoothly but if you ever have problems we will be there to help you. Payroll is way too important not to have a first-class backup service. We believe our pricing remains excellent value and continues to be very competitive when compared to the options from other providers.

Nov 2019

19

Can the Cloud help you attract new staff?

The Cloud is the current buzz-word in technology. Employers in the know are reaping the benefits from its capabilities, including helping them attract and retain new staff.

Why is this important? Becoming an employer of choice has never been more important, especially as we are at near full employment. A quick search of any of the main job boards will show an abundance of available jobs. It’s a jobseeker’s market. The challenge for employers therefore is to attract and retain the best candidates. One way to attract and retain employees is to offer them something new, something edgy… a strong, feature-rich, cloud employee self-service system could be it.

Today’s world has gone online, everyone has social media accounts, we are all familiar with buying many of our goods and services online. This is particularly true for millenials (generally defined as those born between 1984 and 1999) who are are fast becoming the largest sector of our workforce. Understanding how to tap into their fast-paced expectations is crucial for business success.

Businesses who do not compete in this space run risks of being overlooked by prospective employees, millennials in particular. This is where employers should consider a cloud, employee self-service system. Offering online access to their annual leave calendar, their personal details, their employers details, all their HR documents and all of their payslips on their smartphones via a dedicated employee app is the smartest, most cost effective way to show your employees you are in the same digital space that they are.

Book a demo today to find out how your business can benefit from cloud self-service systems.

Nov 2019

15

Parent's Leave is here

The Government’s newest way of enabling parents spend time with their new baby came into force on 1st November 2019. This is called Parent’s leave.

What you need to know:

- This leave is currently capped at 2 weeks. The leave must be used before the child turns 1. In cases of multiple births, this leave can only be claimed once.

- It can be taken as a continuous period of 2 weeks or in 2 separate 1 week blocks.

- Parent’s leave must be taken following the end of maternity leave (paid or unpaid) or paternity leave – there cannot be a break between these leave types.

- Six weeks' notice of the intended use should be given to the employer by the employee.

- Employers are allowed postpone parent's leave in situations where taking this leave would have an adverse effect on the business. However, it cannot be postponed for more than 12 weeks.

- Parents receive a statutory payment, currently set at €245 per week (once they have the necessary PRSI contributions).

There is no requirement for employers to pay employees while on parent's leave. It will be up to each employer to decide if they want to top-up this payment. The advice would be to be consistent with approaches taken on the other family leave types.

What employers need to do now:

Company policies should now be reviewed and updated to reflect these changes. This will help you prepare for staff requests for parent’s leave. Should you get an employee request for parent’s leave, make sure you keep your paperwork & record keeping in order.

Bright Contracts has been updated with this policy so you can have peace of mind in knowing you are fully compliant with the new legislation.

Nov 2019

12

Christmas & Connect…. How to get the most from your Connect this festive season!

- Plan in advance – we all know how crazy the festive period can be; leave requests, last minute plans and staff parties to name a few. Now is the time to start planning. Make sure your employees are using their Employee App to organise all their leave requests in one, easy to access place that you can access 24/7’.

- Get creative – Need to get the Christmas party menu choices sorted? Need to organise the Secret Santa? Use the document upload feature in Connect to take care all of it!

- Stay engaged – It’s very easy for your employees to become distracted by all the craziness of Christmas and become switched off right at the busiest time of year for your business. Use Connect to send out flyers, links to motivational websites, targets and goals and company updates to keep your staff engaged and on top of their game.

- Say Thank You – Did you know that you can buy One4All gift cards directly from your Thesaurus Payroll Manager? Use Connect to let your employees know that you appreciate their hard work and that a One4All gift card is on the way!

Nov 2019

7

Thesaurus Customer Update: November 2019

Welcome to our November update where you will find out about the latest hot topics and events affecting payroll. Our most important news this month include:

-

Important Pricing Update for Thesaurus Payroll Manager 2020

-

Free Webinar - PAYE Modernisation: The story so far

-

Parent’s Leave & Benefit Bill... Paid leave is on the way for all new parents!

Important Pricing Update for Thesaurus Payroll Manager 2020

To ensure that our investment in technology keeps pace with Revenue’s changing landscape and to facilitate the increase in customer support resources, we are changing our pricing for 2020. This new pricing structure is designed to better match usage and support requirements with price.

Unlike many of our competitors, we’ve added hundreds of powerful features and enhancements and heavily invested in additional customer support staff, all so that you don’t have to worry. 99.9% of the time everything will run smoothly but if you ever have problems we will be there to help you. Payroll is way too important not to have a first-class backup service. We believe our pricing remains excellent value and continues to be very competitive when compared to the options from other providers.

Why Customers Love Us

"When I rang support, I was answered straight away, no holding, and my query answered quickly. My payroll is a joy to do, easy and quick."

Félim O'Connor, Photofast Ltd.

"Replaced Sage package and Thesaurus was much simpler and user friendly. Made life a lot easier for a small employer."

Joseph Coughlan, Cographix Premedia Ltd

"Knowing that your exceptional customer service continues after the sale plays a big part in my decision to use and highly recommend BrightPay. Would like to say a big THANK YOU."

Nuala McGowan

"The Thesaurus service is excellent with most queries solved within a working day which saves time and panic. I would give Thesaurus 10 out of 10 for service and products delivered."

Caroline Moynihan, Quiet Moment Tearooms

Free Webinar - PAYE Modernisation: The story so far

This webinar is specifically tailored for employers where we will look back on PAYE Modernisation in 2019 and decide if the new real-time payroll reporting system has been a success. We are delighted to welcome Sinead Sweeney from Revenue who will review some of the most common mistakes employers have made to date and what employers should expect in 2020.

New Thesaurus Connect Subscription Pricing Model

From January 2020, customers will be billed on a usage subscription model based on the number of active employees in the billing month. Once signed up for a Thesaurus Connect account, you will be invoiced monthly in arrears through our new online billing system. There are no contracts or ties. Should you decide to stop using Connect, no notice is required. Payroll Bureaus on a bureau package will be charged based on the total number of active employees in respect of clients that are synchronised to Thesaurus Connect (not on a client-by-client basis). Our 2020 order system will be available shortly.

One4all Vouchers available to purchase on Thesaurus Payroll Manager

Thesaurus Payroll Manager offers a facility where users can securely purchase One4all gift cards for their employees. Employers can give a gift card of up to €500 tax free to employees. Under the small benefits scheme, both company directors and employees can receive a gift card completely tax free each year. Thesaurus Payroll Manager customers can purchase gift cards directly from the payroll dashboard from One4All. There is no additional charges on Thesaurus Payroll Manager to avail of this facility to purchase gift cards.