Jan 2022

26

Remote working legislation set to be introduced

On the 21st of January, Taoiseach Micheál Martin announced the lifting of nearly all COVID-19 restrictions. This meant that beginning this week, employees could begin a phased return to offices where they are no longer required to adhere to social distancing. While many businesses welcomed the news, there was a renewed concern on whether employers would give their staff the option of remote or hybrid working.

Those concerned will have welcomed the news that a Right to Request Remote Working Bill will be introduced to the Oireachtas. On Monday the 24th of January, Tánaiste Leo Varadkar made an announcement on the right to request remote working and stated that the government wants remote working to be a choice to help with work life balance and that it should be facilitated where possible by the employer, however there will be circumstances where an employer will be within their rights to not grant a request which will be laid out in the bill.

What is the purpose of the bill?

Currently, there is no legal framework for remote or hybrid working. In order for remote working to become a permanent feature in Ireland, the government wants to introduce legislation that will underpin employees’ right to request remote work. It is their aim that remote working will become a permanent feature of Ireland’s workforce, with benefits for the economy, society, and the environment. These goals have been outlined in the national Remote Work Strategy published last year.

The proposed bill does not seek to make remote working an absolute right for employees. With many jobs requiring employees to be present in the workplace, Varadkar says it would not be “practical”. Instead, the proposed legislation will provide them with a legal right to request to work remotely from their employer.

What exactly does the bill propose?

To have the right to request remote working, the bill proposes that the employee must have 6 months continuous service with the employer. The employee must give a written request with the following details:

- Proposed remote working location

- Proposed start date for the remote working arrangement

- Proposed number, and timing, of working days to be worked remotely

- Whether the employee has previously made a request under this Act and the date of the most recent previous request

- A self-assessment of the suitability for the proposed remote working location regarding specific requirements for carrying out the job such as data protection and confidentiality, minimum levels of internet connectivity, ergonomic suitability of the proposed workspace and other furniture requirements

The employee may also be required to give further information and evidence about the remote working location, if the employer requests it.

Once the request has been made, the employer must reply with a decision within a “reasonable time period”. The employer will have 12 weeks from receipt of the request to reply and the employer can approve the request wholly or partially and they can decline the request. The employer can also counter offer the employee’s request which the employee will have one month to accept or refuse.

The legislation outlines 13 potential reasons for an employer to decline a remote working request. They include:

- The Nature of the work not allowing for the work to be done remotely

- Cannot reorganise work among existing staff

- Potential Negative impact on quality of business product or service

- Potential Negative impact on performance of employee or other employees

- Burden of Additional Costs, taking into account the financial and other costs entailed and the scale and financial resources of the employer’s business

- Concerns for the protection of business confidentiality or intellectual property

- Concerns for the suitability of the proposed workspace on health and safety grounds

- Concerns for the suitability of the proposed workspace on data protection grounds

- Concerns for the internet connectivity of the proposed remote working location

- Concerns for the commute between the proposed remote working location and employer’s on-site location

- The proposed remote working arrangement conflicts with the provisions of an applicable collective agreement

- Planned structural changes would render any of (a) to (k) applicable

- Employee is the subject of ongoing or recently concluded formal disciplinary process

If the employer declines the request to remote working, the employee is entitled to appeal the decision. They can appeal this decision either through an internal appeal process or through the Workplace Relations Commission, or both. The presumption is that an employer should aim to facilitate remote working where possible but if they are to decline the request reasonable justification must be given. Under this bill employees will be able to submit another request, however it must be 12 weeks after the initial request. Varadkar believes that “we’re not going to see loads of cases going to WRC or going to court...and that the vast majority of employers are going to want to facilitate remote working.”

Varadkar also stated that a requirement of this strategy will be that all employers must have a Work from Home (WFH) Policy in place therefore we would suggest to employers that in advance of this strategy being written into law they must get Working from Home policies in place which our sister product Bright Contracts already has in place in its software. Download a trial version of the software to have a look at what a WFH policy should include.

Book a demo of Bright Contracts, our HR Software to see how Bright Contracts can help your business today.

Related Articles:

Jan 2022

25

The Sick Pay Bill 2021: What to Expect

The proposed Sick Leave Bill 2021 will see the introduction of a Statutory Sick Pay (SSP) scheme, beginning in 2022. The introduction of SSP will likely impact your payroll. As your payroll software provider, Thesaurus Payroll Manager will equip you with the necessary tools to make implementing and managing sick pay as seamless as possible.

Here’s what you need to know about the proposed Sick Leave Bill 2021.

What is the purpose of the Sick Leave Bill 2021?

In Ireland, unlike other European jurisdictions, employees have no legal right to be paid while they are off work ill. Typically, sick leave is negotiated in an employment contract, which is at the sole discretion of the employer. However, access to paid sick leave is unequal, with lower-income earners less likely to have it. This disparity was highlighted during the COVID-19 pandemic.

In an attempt to address this issue and to bring Ireland more in line with other European countries, the Tánaiste Leo Varadkar, received cabinet approval in June 2021 to draft the Sick Leave Bill 2021. Speaking about the bill he said, “It’s not right that people feel forced to go to work when they are sick and it’s not good for public health”.

The Statutory Sick Bill 2021 is separate to the Enhanced Illness Benefit for COVID-19 where different conditions and payment apply.

What does the Sick Pay bill propose?

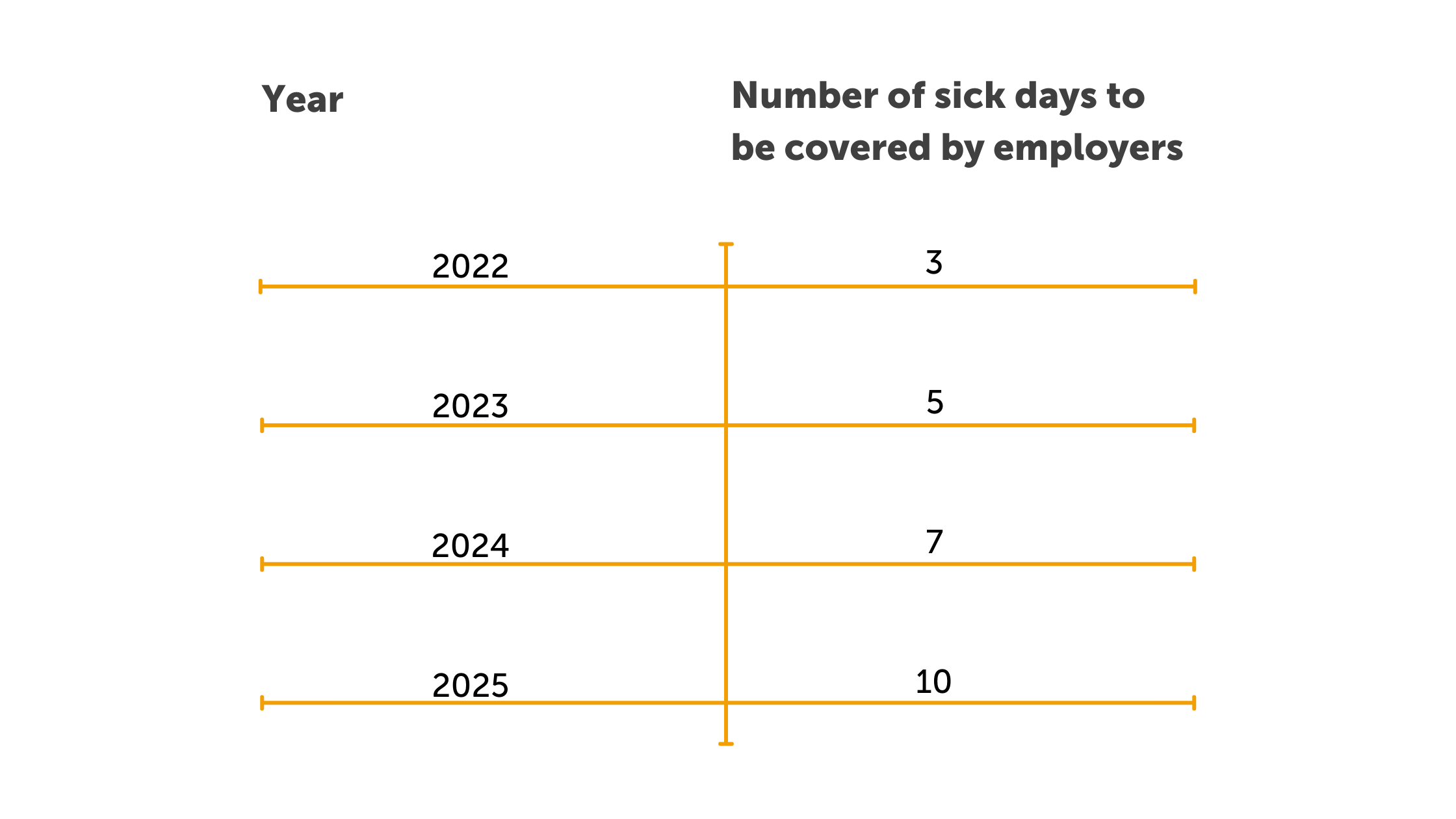

A draft of the Sick Leave Bill 2021 was published by the government on the 4th November 2021. The bill proposes that the scheme is rolled out through four phases, with an initial introduction of three days’ sick pay from 2022, rising to five days in 2023, and seven days in 2024. This will be eventually extended to 10 days’ sick pay in 2025.

Eligibility and criteria for the Statutory Sick Leave scheme

Currently, the bill proposes that only employees who have worked 13 weeks’ continuous service will be entitled to a sick leave payment from their employer for up to three days of certified sick leave per year. The employee must provide a medical certificate signed by a registered medical practitioner stating that they are unfit to work, in order to avail of the scheme.

How will the scheme impact employers?

From 2022, employers who do not already provide sick pay to their employees will have to pay their employees Statutory Sick Pay for up to three days off due to illness. The rate of payment will be 70% of the employee’s normal daily wages and this is capped at a maximum of €110 per day.

The entitlement to SSP is in addition to any other leave the employee is entitled to, such as annual leave, parental leave, maternity leave or paternity leave.

Employers who already provide employees with a sick leave scheme, will not be required to meet the bill’s obligations if the terms of the scheme they offer, is as favourable or more favourable to the employee. When determining whether their current scheme is as or more favourable to the employee than the SSP scheme, the employer should consider the following:

- How long a service must the employee work before sick leave is payable

- How many days must an employee be absent due to illness before sick leave is payable

- How long is the period for which sick leave is payable

- What is the amount of sick leave that is payable

- What is the reference period of the sick leave scheme

Employers must also keep records for each employee, recording the statutory sick leave taken by their employee. Each employee’s records must include

- Their period of employment

- The dates of statutory sick leave taken

- The rate of statutory sick leave payment

How do you prepare for the Statutory Sick Leave Bill 2021?

If you’re an employer who already provides a sick pay leave through the employee’s contract or through union agreements, you’ll need to consider your current scheme under the proposed legislation. As mentioned above, review whether your scheme meets or is more favourable than the statutory provision. If it is, your obligation under the legislation is met. If it does not, it will need to be modified to bring it up to par.

If you’re an employer who does not already provide sick pay, the new bill will likely result in additional costs for your business. There will be the direct cost of the sick payments and there may also be indirect costs due to additional administrative duties. On the other hand, SSP can benefit employers, resulting in a reduced employee turnover, a safer working environment, as well as reducing presenteeism and absenteeism.

When will the Sick Leave Bill 2021 be phased in?

As the Sick Leave Bill 2021 is being phased in over a four-year period, beginning in 2022, SSP will likely have an impact on your business this year. While this scheme was expected to become mandatory on 1st January 2022, there are still no current legal obligations to comply with it. The bill is still before the Oireachtas and may be subject to future amendments.

To learn more about how Thesaurus Connect can help you manage your employee’s leave, why not book a free online demo today.

Related Articles:

Jan 2022

19

Automatic enrolment for accountants: Lessons learned from the UK

It is a decade this year since auto enrolment was rolled out in the UK. Created to address a growing pensions crisis caused by a lack of retirement savings, an increasing life expectancy, and an overall older population, it was brought into law with the Pensions Act 2008.

The policy is widely considered to have been successful as it has certainly reversed the decline in workplace pension saving. The introduction of auto enrolment led to a tenfold increase in total membership of defined contribution occupational schemes, up from 2.1 million in 2011 to 21 million in 2019.

What is auto enrolment?

In the UK, auto, or automatic enrolment requires employers to automatically enrol eligible workers into a workplace pension scheme. Both the employer and the employee must pay minimum contributions into the pension pot. All other employees have the right to join or opt-in to the workplace pension scheme, depending on their age and earnings.

It began with a phased rollout, first by employer size, starting with large employers in 2012, followed by mid-sized employers in 2014, and then small employers between 2016 and 2018. The minimum contributions rates were also phased in, beginning at a 1% employer contribution and a 1% worker contribution before steadily increasing to its full amount in April 2019, that of 3% from employers, 4% from employees, and 1% tax relief.

Find out what to expect with auto enrolment in Ireland here.

The opportunities of auto enrolment

Auto enrolment will mean different things for different people. While it may offer employees reassurance for their future, it may also cause a considerable challenge for employers to fund this extra expense. However, if its rollout in Ireland is similar to the UK, it will also create considerable opportunities. By introducing auto enrolment, the UK government effectively created a new market for pension providers, asset managers, and other financial institutions, while also creating a new and considerable service that accountants and bookkeepers could offer to their clients.

UK accountants, bureaus, and bookkeepers offering auto enrolment typically package their AE services as one that offers expert knowledge on the topic, ensures compliance, and will see payroll processed without a hitch. Common features of this service include:

- Assessing clients’ employee eligibility

- Assist on pension scheme selection and assistance with set-up on the scheme

- Auto enrol clients’ employees into their chosen pension scheme

- Issuing employee communications on behalf of their clients

- Provide on-going administration of auto enrolment

- Manage employees opting out or postponing auto enrolment

- Re-enrolment of employees

- Submitting Declarations of Compliance to The Pensions Regulator

- Ensure their clients legal obligations are met

Avoiding the pitfalls of auto enrolment

While auto enrolment may represent a potential new service you can offer to your clients, you should be cautious as to how you present this service. At the beginning of the auto enrolment roll-out in the UK, accountants and bookkeepers were uncertain of how to offer these services and how much to charge for them. Many were caught out by undervaluing the service. It’s important to get the pricing right from the start, to avoid having to increase costs on your clients.

How do I choose the correct pricing strategy for auto enrolment?

A number of pricing strategies are now in use, including a tiered pricing strategy, a monthly retainer fee, and a price list strategy.

- A tiered strategy allows you to provide AE services at different price points for different levels of service. For example, with each higher tier you can add on services such as postponement, declaration of compliance, and payroll & pension reporting.

- A monthly retainer fee sees bureaus increase their monthly charge for processing payroll to include the additional AE duties. The monthly payment will spread the cost of auto enrolment over a period of time, and it is typically offered as part of a contract.

- Alternatively, you can choose a price list strategy where you present a menu of the services with each item priced. With this strategy, there is also an option to offer bundle deals, for example if the client buys more than five tasks or services.

Each of these different pricing strategies outline clear deliverables for the client. They offer clarity, choice and control for the client, while being a profitable service for you.

How do I choose the best payroll software for auto enrolment?

The rollout of auto enrolment may be stressful, for both you and your clients. The payroll software you use will not only decide what auto enrolment services you can offer but also the time you spend carrying out these services, and thus, the extra workload you must take on.

In a letter sent in July to Tánaiste Leo Varadkar, Chartered Accountants Ireland wrote that payroll service providers have requested a lead in time of at least 18 months in order to adopt auto enrolment. However, with 9 years' experience providing full auto enrolment functionality to our UK customers, Thesaurus Software have the resources and knowledge necessary to quickly begin updating the payroll software with these features.

Thesaurus Payroll Manager will offer full auto enrolment functionality at no additional cost. All Thesaurus Payroll Manager packages will include auto enrolment plus free phone and email support to help you through your auto enrolment journey.

Discover more:

To discover more about Thesaurus Payroll Manager and how it can improve your payroll services and save you time, download a 60-day free trial.

Related Articles:

Jan 2022

6

Transform your payroll this year with digital banking

Similar to their European counterparts, Irish consumers have increasingly moved online, both for their shopping and for their banking. Over the past year, consumers who had previously never used digital channels turned to online and mobile banking for the first time. The use of cash declined while contactless payments surged, with a record €1 billion payments made in May 2021. While the use of digital banking has been on the rise for a number of years now, the pandemic urgently accelerated a shift in digital behaviour. A survey conducted at the start of this year found that 69% of Irish consumers trust digital banking providers with 62% of these saying it was due to the simplicity of their services.

It should come as no surprise that this change in digital behaviour is also reflected in how businesses are managing their payments. As technology continues to advance and consumers become more experienced with digital banking, their behaviour is reflected in their decision making in the workplace. This has already been seen in the payroll sector.

In the UK, we’ve seen payroll processors adopt digital banking solutions in order to improve their payroll workflow, have more flexibility with making payments, and to send faster payments to their employees. Accountants and payroll bureaus have also begun offering it as a new service to customers.

How does digital banking improve the payroll workflow?

An integrated system between the payroll software and the digital finance platform can offer a smoother, more efficient payroll workflow. Using an API (Application Programming Interface) users can initiate payments from within the payroll software enabling them to pay employees and subcontractors with a few clicks of a button. It saves time and is more efficient.

How does digital banking offer more flexibility?

Those payroll processors experienced with using traditional bank payment methods will be used to the overly long process of submitting bank files every month or even every fortnight, to pay employees’ wages. You’re typically required to submit bank payment files at least three days in advance of when the payment is due which can be quite a manual process with numerous steps involved in it.

Digital banks offering access to the Single Euro Payment Area (SEPA) allows businesses to send payments across the EU member states (and 8 other countries) and can also offer the option of EUR and GBP accounts. Payments can be sent on the day they’re due (before 2.00pm) and if they’re sent any time after that or sent on a non-working day, they’ll arrive by the following working day.

How can payroll processors access digital banking?

Thesaurus payroll software users now have access to Modulr, the payments platform behind banking app Revolut, to pay employees. Payroll processors looking to speed up their workflow with a more convenient payment method will have access to SEPA credit transfers. By signing up to Modulr, the payroll processor can initiate payment from within Thesaurus payroll software once the payroll has been finalised. The payment then needs to be approved by two-factor authentication using their phone before being sent to employees.

Learn more about Thesaurus payroll software’s integration with Modulr.

What is the future of SEPA?

SEPA is a much better alternative to bank payment files which is why there has been such an uptake of it across the EU. It allows for quicker payments and faster processing times. However, as part of their long-term strategy, the European Payments Council have developed SEPA Instant Payments. With this, users can send payments instantly 24/7. While this has not been rolled out by retail banks in Ireland yet, it’s likely we’ll see the rollout of this by more digital banks in the near future. Stay posted!

To keep up with the latest payroll news, check out our new Bright website. There, you'll be able to register for any of our upcoming payroll webinars and download our payroll guides.

Related Articles:

Dec 2021

20

2021 Christmas Opening Hours

All of the staff here at Thesaurus Software would like to thank you for your valued custom in 2021. We would like to take this opportunity to wish you and your families a Merry Christmas and a prosperous New Year.

Here are our opening hours for the Christmas period:

| Monday 20th | 09:00 - 13:00 | 14:00 - 17:00 |

| Tuesday 21st | 09:30 - 13:00 | 14:00 - 17:00 |

| Wednesday 22nd | 09:00 - 13:00 | 14:00 - 17:00 |

| Thursday 23rd | 09:00 - 13:00 | 14:00 - 17:00 |

| Friday 24th | Closed |

| Saturday 25th | Closed |

| Sunday 26th | Closed |

| Monday 27th | Closed |

| Tuesday 28th | Closed |

| Wednesday 29th | 09:00 - 13:00 | 14:00 - 17:00 |

| Thursday 30th | 09:00 - 13:00 | 14:00 - 17:00 |

| Friday 31st | 09:00 - 13:00 | 14:00 - 17:00 |

| Saturday 1st January | Closed |

| Sunday 2nd January | Closed |

| Monday 3rd January | Closed |

To contact our support team, you can call us on 01 8352074, email us at support@thesaurus.ie or complete our online form.

Nov 2021

29

Your payroll resolutions for the new year

New year’s resolutions can divide people into two camps. Those who love to start the new year with a clean slate and fresh goals, and those who’ve lost all optimism and scoff at their naivety. Understandably, there are cynics. Changing your behaviour is hard and more often than not, these resolutions fail. The resolutions most likely to fail are those that are too vague with no clear path on how to achieve them.

If you’re setting resolutions for your business or job this year, then break them up into manageable and uncomplicated steps. You’ve likely heard of SMART goals – specific, measurable, achievable, realistic, and time limited. If you’re looking to improve your business, for example, the payroll service you offer, then using this established tool is how you can go about it. Rather than simply saying “I want to make my payroll services better for clients” or “I want to reduce the time I spend on payroll”, decide on specific goals which will help you achieve this.

Achieving payroll goals for 2022

1. Provide an employee app for your clients

This one is a specific, easily achievable goal that can help you provide a better payroll service to your clients. Employee apps have risen in use in recent years and are popular among employers and employees alike. Thesaurus Connect, the cloud add-on to Thesaurus Payroll Manager, includes one and your clients will immediately gain extra value from it. Their employees can book their annual leave through the employee app, view confidential documents, and use it to view their payslips. From a marketing perspective, an employee app can also have multiple benefits. The extra value if offers can encourage customer loyalty, and its frequent use by clients and their employees can increase awareness of your business.

2. Offer clients instant access to reports

Similar to the goal above, this is a simple and achievable step that you can take to improve your payroll services. By using Thesaurus Connect, you can offer your clients access to payroll reports whenever they like. This can be more convenient for your clients and can reduce the amount of back-and-forth communication between you and the client.

Once you finalise payroll on Thesaurus Payroll Manager, the report will automatically become available for the client to view via their Thesaurus Connect self-service portal. Your clients will also be able to use the portal to access a number of preprogramed reports, as well as any other payroll reports which have been set up and saved on the payroll application.

3. Spend less time on manual entry

By setting this goal you can reduce the overall time you spend on delivering your payroll services. How can you go about this? First, decide where you want to reduce manual entry. For example, how you pay employees is a good place to start. By using a payroll software which is integrated with a payments platform, you can send wages on behalf of your client to their employees instantly. This means you no longer need to spend time creating bank files. To learn more about the integration with Modulr, click here.

4. Review your GDPR compliance

It’s always advisable to review your compliance with GDPR and ensure you’re keeping your client’s payroll data secure. By keeping on top of this, you can assure clients that security is a priority for your practice. Make sure the data you collect is the minimum amount required and remember to provide your clients and their employees access to their personal information. Again, an employee app can help with this. Using Thesaurus Connect, employees can view and update their personal information, whenever they like.

Discover more:

Now that you’ve decided on what steps you can take to improve your payroll services, make sure you have the right payroll software and employee app to support you. Book a demo today to discover more about Thesaurus Connect.

To keep up with the latest payroll news, check out our new Bright website. There, you'll be able to register for any of our upcoming payroll webinars and download our payroll guides.

Nov 2021

22

Christmas bonuses and One4All gift cards: your festive payroll guide covered

It’s coming close to the end-of-year madness, and as payroll processors you’re likely to be particularly busy in the lead-up to Christmas. Between managing the annual leave requests, Christmas bonuses, and holiday pay, there are a quite a few payroll tasks to sort out. To help you with this, we’ve put together a few key points to remember if you’re processing the payroll this Christmas.

Christmas Bonuses:

A Christmas bonus can put a smile on every employee’s face and can be the perfect way to say ‘thank you’ for all the hard work done during a difficult year. However, it’s important you don’t get caught out on tax implications.

Under Revenue’s Small Business Exemption Scheme, employers can gift employees and directors a small benefit of up to €500 in value, tax free, each year. Certain guidelines must be followed:

- This benefit cannot be in cash.

- Only one such benefit can be given to an employee in one tax year. Only the first one qualifies for tax free status, even if you do not offer the full €500.

With this tax-free benefit, you have the potential to save up to €653.65 in tax per employee as the total cost of a net €500 gift paid through payroll is €1,153.65. Remember though, if a benefit exceeds €500 in value, the full value of that benefit is subject to tax.

In order to qualify for the small benefit exemption, it is important that gift cards are not given to employees as a salary sacrifice. This means you cannot fund the bonus from a deduction of your employee’s salary. The rewards must be invoiced and paid external to payroll.

Vouchers:

- Tax-free vouchers are a popular way of gifting a Christmas bonus to employees.

- Tax-free vouchers can be used only to purchase goods or services.

- The tax-free vouchers must be purchased from the business bank account or credit card.

- Employees or directors cannot purchase a voucher themselves and seek reimbursement for it.

One4all gift cards are commonly used as they allow employees to choose a gift from over 11,000 retailers. They also don’t charge over administration, service, or delivery.

If you’re a Thesaurus Payroll Manager customer, you can purchase One4all gift cards through the software. The software's integration with One4all allows you to easily purchase the cards, and more importantly, it can keep track of your purchases. This ensures that you’ll be notified if you attempt to purchase more than one gift card for an employee in any one tax year. Click the link to discover more about how the integration between Thesaurus Payroll Manager and One4All works.

Please note: to use the One4All feature on Thesaurus Payroll Manager you must have upgraded to the latest version of the software.

When to pay employees in December:

It’s common for many businesses to have a different payroll date in December. Often, employees will be paid earlier in December so they can cover their holiday expenses and because many businesses are closed at the end of the month.

It's likely only your monthly paid employees will be affected by this. If you plan to pay employees early, make sure you give yourself enough time to process the payroll in advance. Give your employees notice of the change in pay date and enough time that they can submit their expenses if they have any. Remember to make provisions to ensure that you report your employees’ pay to Revenue on or before the pay date.

Managing annual leave requests:

Christmas can be a very busy time for many businesses, and it may also be a time when employees are most looking to take annual leave. While you need to ensure you have enough employees working to cover this busy period, you should also look to be as fair as possible.

It’s recommended that you have a clear policy on holiday requests. Most often, a “first-come, first-served” approach is used. This provides a fair and transparent method for all employees. One way of achieving this is by using an employee app. Thesaurus Connect, a cloud add-on to Thesaurus Payroll Manager, includes an employee self-service platform which can be accessed online or through the Thesaurus Connect employee app. The app gives employees access to a self-service portal that they can use to request leave at any time. Once a request has been made, the employer or their manager, will be notified of it. When a request has been made it is time stamped, allowing you to see the order in which they come in. The employee will then be notified if the request has been accepted or rejected. Thesaurus Connect also includes a company-wide calendar for the employer to view so that you can ensure that there is adequate staffing before approving an annual leave request.

Discover more

Interested in learning more about annual leave management on Thesaurus Connect? Book a free online demo here for a detailed walkthrough of everything Thesaurus Connect has to offer you and your business.

Related Articles:

Oct 2021

5

Report calls for pension reform

On the 17th September, a new report, Population Aging and the Public Finances in Ireland, was published by Minister for Finance, Paschal Donohoe. It highlighted the need for significant structural reforms to address the aging population, longer life expectancy, and the associated age-related expenditure. It found that current revenue increases will not be sufficient and suggested that policy reforms such as linking the Stage Pension Age to life expectancy will be required.

What are the report’s findings?

At the moment, two major factors are contributing to a worrying financial situation for the state and for those most vulnerable in our society. One, people are living longer. Life expectancy is expected to grow by three and a half years between 2019 and 2050. Two, similar to other developed countries, the birth rate is expected to fall. Such developments will have a substantial impact on the age-profile of Ireland’s population. It is predicted that 8% of people in Ireland will be aged 80 or over in 2050, up from 3% in 2019. This means that there will be fewer people of a working age generating the necessary funds to support an older population.

As a result of the aging population, the report expects the GDP (Gross domestic product) to slow relative to current growth rates and that the associated costs of an older population will be €17 billion higher than in 2019, in today’s terms. A slowdown in output growth will impact government revenue which in turn will create considerable pressure to fund this increase in demographically sensitive expenditure such as the state pension. It states, that without reforms, this will push the public finances onto “an unsustainable path”.

Proposed policy reform:

It is proposed that the most important reform to tackle the estimated cost of an aging population is to increase the State Pension Age (SPA), aligning it with the increased life-expectancy. However, in December of last year, the Social Welfare Act 2020 was signed into law preventing the previous plans to increase the SPA from 66 to 67 in 2021 and to 68 in 2028. The report estimates that the cost of keeping the SPA at 66 will be €50 billion over the long term.

This publication is part of the Finance Department’s submission to the Commision on Pensions which was set up in November 2020 in order to examine sustainability and eligibility issues in respect to the State Pension and the Social Insurance Fund.

The Pensions Commision only recently submitted their report to Minister for Social Protection Heather Humphreys in early September. It is understood, but not yet confirmed, that the report recommends that the SPA rise in quarterly increments to 67 between 2028 and 2031, before gradually increasing to 68 by 2039.

What about auto enrolment?

The report published by the Minister of Finance included no mention of auto enrolment. Looking at the UK, auto enrolment was introduced in 2012 to address similar issues facing Ireland; lack of retirement savings, increasing life expectancy, and the long-term repercussions that this would have on their State Benefits system. The Pensions Act 2008 requires all UK employers to offer workplace pension schemes and to automatically enrol eligible workers into the scheme.

In February of this year, it was announced that the proposed auto enrolment scheme in Ireland would be delayed yet again, until at least 2023. The auto enrolment scheme would see workers automatically enrolled into a pension scheme, with contributions made by the employer, the employee, and the state. The most recent figures from 2019 showed that only 30% of all employees are making regular contributions to their pensions and the gross income point at which most employees make a pension contribution is between €40,000 and €45,000. The COVID-19 pandemic exacerbated the issue, creating a growing divide between who are saving for retirement and who cannot.

Auto enrolment is undoubtedly necessary to address serious vulnerabilities in Ireland’s existing pension model. Cróna Clohisey, the Public Policy Lead with Chartered Accountants Ireland, previously spoke in March 2021, on how the SPA should not be changed without parallel reform to private pensions. Commenting on the issue, she said “Introducing auto-enrolment is the obvious answer to what is now a huge problem. This scheme will incentivise people to save and that in turn will reduce the reliance on the state pension”.

To learn about auto enrolment and how Thesaurus Payroll Manager will cater for it speak to a member of our team today.

Sep 2021

28

BrightPay joins forces with Relate Software to create an accounting and payroll software champion

We are delighted to announce that BrightPay has joined forces with Relate Software, a leader in post-accounting, practice management, and bookkeeping software. The partnership will aim to create a software champion, serving payroll and accounting bureau and SMEs across Ireland and the UK.

Owned by Thesaurus Software, BrightPay is a modern payroll and HR software which takes care of every aspect of running your payroll, from entering employee and payment details to creating payslips and sending real-time payroll submissions. The software has been designed from the ground up to be clear and simple, and yet no compromise has been made on payroll features.

Likewise, Relate is dedicated to building innovative and focused products designed specifically for the accounting profession. Its offering includes Surf products, a cloud native product suite of bookkeeping, post-accounting, and practice management software. Relate is an industry-leader in Ireland and has been building software for over 25 years.

By partnering with Relate and combining products and strengths from both businesses, we can provide a greater offering to our customers, with scope and backing for further innovation and development. This is an exciting moment in BrightPay’s journey to delivering a one stop solution for businesses and accountancy firms. Together we will aim to provide a best-in-class software suite with a clear value proposition to drive efficiency and reduce errors, all with increased flexibility from working with a cloud offering.

For more information, please see the press release and customer FAQs.

Sep 2021

8

A spotlight on employee-led sustainability efforts

Earlier this year Thesaurus Software moved into our new energy-efficient offices in Duleek, Co. Meath. Employees have formed the 'Green Team', a company-wide committee tasked with identifying and implementing opportunities that can improve the sustainability of our company.

From the start the Green Team have demonstrated their enthusiasm for environmental sustainability and passion for sharing their knowledge. This is highlighted below in a number of projects they’ve undertaken:

Making the Garden Bloom:

While the initial focus was on the new purpose-built offices, the Green Team soon turned their attention to the green spaces outside. Inspired by their Earth Week guest, Dr Emma Reeves, a Senior Ecologist at the Forest, Environmental Research, & Services (FERS), the group was particularly keen to plant native, bee-friendly plants and trees that would help pollinators and further benefit biodiversity. The first planting phase has been completed with the group planning the layout of the garden and planting shrubs, flowers, and trees. In September, the second phase will begin, with the team planting Spring bulbs including hyacinths, tulips, and daffodils.

Single-Use Plastics Awareness Campaign:

On the 3rd of July, the Single-Use Plastics Directive came into effect for all EU member states. In Ireland, this means that certain single-use plastics such as straws and coffee cups have been banned from the Irish market. Supporting this initiative, the Green Team created an awareness campaign highlighting the use of plastic in the beauty industry and introduced a single-use plastics ban in the office. With 10 of the most commonly found single-use plastic items representing 70% of all marine litter, this is an important and useful step all employees can take.

Future projects:

The Green Team’s future plans are focused on tackling pollution and engaging with more employees at Thesaurus Software. In September, the company will take part in a clean-up at a local beach and will also develop a new project highlighting the unsustainable nature of fast fashion and what options are available to address it.

If you’re interested in keeping up to date with Thesaurus Software’s journey, sign up to our sustainability newsletter for future updates.