Sep 2016

10

Jobs & Pensions Service – New Online Service for Employees

The Jobs & Pensions Service available from Monday 12th of September 2016 is a new online service for employees. Irish employees can register their new job (or private pension) with Revenue using the service.

The Jobs and Pensions service replaces the Form 12A, meaning employees must register their first job in Ireland using the service. After registering employment using the service a tax credit certificate will issue to both the employer (P2C) and employee.

The service can also be used by employees who are:

• changing jobs provided the previous job has been ceased on Revenue records, employees will be able to see when they log in if the previous job has been ceased

• starting a second job in addition to their main job

• starting to receive payments from a private pension

Access to the service is available in myAccount, employees must register to use the service.

Employers should:

• encourage new employees to register for myAccount

• provide new employees with the information required to register their new job (registration can be done in advance of the start date):

- tax registration number

- start date of the new job

- pay frequency

- staff number is one has been allocated

• no longer submit a P46 form where employees register their own job using the service

• continue to upload P45(3) as normal

• continue to issue P45s immediately on cessation of employment

• operate the emergency basis for PAYE & USC if a pay day occurs before receipt of either P45 or P2C

Further information on the service can be found in Revenue’s Employer Notice September 2016, which can be found here.

Oct 2015

27

Small Benefit Exemption Scheme - Increase in threshold

The Minister for Finance Michael Noonan is set to fast track an increase in the threshold for the Small Benefit Exemption Scheme. The current threshold is €250; this will double and will increase to €500. The last time the threshold was increased was in 2005 when it was increased from €100 to €250. The move is contained in the Finance Bill, published last week. The new rules were expected to be implemented from 1st January 2016 however, The Department of Finance say the change will be implemented in time for Christmas.

Under the Revenue Commissioner’s Approved Small Benefit Exemption Scheme employers can provide employees with a small benefit, this small benefit is not subject to PAYE, USC or PRSI.

The following rules apply:

• The benefit cannot be cash, cash payments are fully taxable

• Only one such benefit can be given to an employee in one tax year

• Where a benefit exceeds the threshold the full value of the benefit is subject to PAYE, USC & PRSI

• The benefit can not form part of a "salary sacrifice" scheme

The small benefit is traditionally given as a voucher often at Christmas, as mentioned above only one such benefit can be given to an employee in one tax year. Where more than one benefit is given in a tax year only the first benefit will qualify under the Small Benefit Exemption Scheme.

Full details of Finance Bill 2015 can be found on Revenue’s website

http://www.revenue.ie/en/practitioner/law/bills/finance-bill-2015/index.html

Oct 2015

15

Budget 2016 – Employer Payroll Focus

Tax Rates and Standard Rate Cut Off Points (SRCOPs)

There has been no change to tax rates or SRCOPs. The standard rate of tax will remain at 20% and the higher rate of tax will remain at 40%.

There has been no change to the SRCOP and Tax Credits on the Emergency Basis of tax.

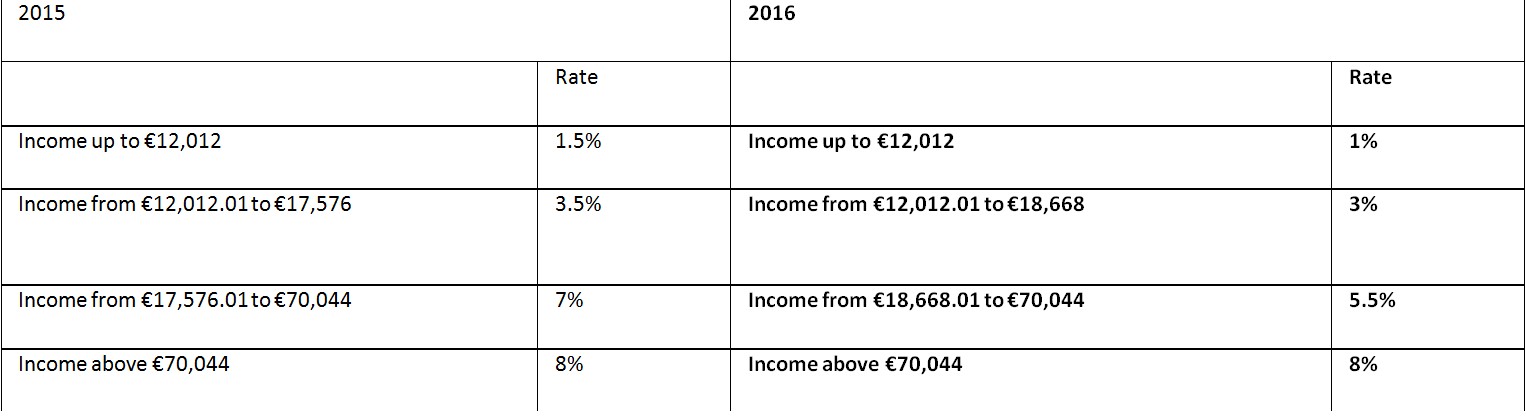

Universal Social Charge (USC)

The annual threshold for USC has been increased to €13,000 from €12,012.

Please note full medical card holders and individuals aged 70 and over whose aggregate income does not exceed €60,000 will pay a maximum rate of 3%.

The emergency rate of USC remains at 8%.

PRSI

Increase from €356.01 to €376.01 in the weekly threshold at which liability to employer’s PRSI increases from 8.5% to 10.75%.

A tapered PRSI credit has been introduced for employee PRSI; the PRSI credit will commence in respect of weekly income of €352.01 and will taper out as a weekly income reaches €424.

For earnings between €352.01 and €424, the maximum weekly PRSI credit of €12.00, is reduced by one-sixth of earnings in excess of €352.01.

Example:

Gross weekly earnings of €377

Maximum PRSI Credit €12

One-sixth of earnings in excess of €352.01

(€377-€352.01 = €24.99/6) (€4.17)

Reduced PRSI Credit €7.83

PRSI @ 4% €15.08

Less: Reduced PRSI Credit €7.83

Employee PRSI Weekly Liability €7.25

Sep 2015

28

Free business event for employers in the North East - Taking care of business

After previous successful events, Revenue is participating in another free one-stop-shop event for SMEs, “Taking Care of Business”. If you own or manage a small business, or are thinking of starting your own business, you should visit www.takingcareofbusiness.ie to register as places are limited.

This is an initiative organized by the Department of Jobs, Enterprise & Innovation.

The events have been designed to help small and start-up businesses understand and benefit from the services provided by a range of State Bodies.

Attendees will:

• Meet with representatives from a number of State Offices & Agencies

• Get information & advice on running your business

• Find out ways to save your business money

• Receive support to help you in your business

This half-day event will take place on Thursday, 8th October in the Westcourt Hotel, Drogheda, Co. Louth.

To find out more and to register, please visit www.takingcareofbusiness.ie

May 2015

22

IPASS - Annual Payroll Conference

IPASS (IRISH PAYROLL ASSOCIATION) held their annual payroll conference in Croke Park on the 21st May. Paul Byrne and Audrey Mooney from Thesaurus Software Limited attended the conference. They enjoyed meeting the other exhibitors, the delegates and listening to the guest speakers. The speakers included Lindsay Melvin the CEO of the Chartered Institute of Payroll Professionals (CIPP), John Kelly from the National Employment Rights Authority (NERA), representatives from Revenue and Department of Social Protection (DSP).

It was also an opportunity to show our payroll product BrightPay which is available for Irish and UK payroll. BrightPay is a simple but powerful payroll software package that makes managing payroll quick and easy. It is designed for small to medium sized businesses, accountants and other payroll bureau providers.

BrightPay Ireland can be downloaded from www.brightpay.ie

BrightPay UK can be downloaded from www.brightpay.co.uk

BrightPay installs as a trial version, which you can use licence free for 60 days at no cost.

Thank you and congratulations to Noelle Quinn and the IPASS team for another successful and enjoyable annual conference.

Apr 2015

26

FRIDAY 1ST MAY 2015 – SEPA PAYMENT PROCESSING RESTRICTIONS

The Banking & Payments Federation Ireland (BPFI) has issued a customer payments notice in light of Friday 1st May 2015 being a European Bank Holiday.

Friday 1st May 2015 is a European Bank Holiday; the Euro payments clearing and settlement system will be closed. Although Irish banks are open for business on the 1st May 2015 it is not possible to exchange payments with other banks. In addition Monday 4th May 2015 is a bank holiday in Ireland. SEPA Credit Transfer Bulk Files submitted with a debit date of Thursday 30th April 2015 or Friday 1st May 2015 may not be with the beneficiary bank until Tuesday 5th May 2015.

Employers due to pay wages on Friday 1st May 2015 may wish to submit their payments early to ensure beneficiary accounts are updated (credited) on Thursday 30th April 2015.

For further details on Euro payments processing over that weekend please check with your own bank.

Apr 2015

3

GOOD FRIDAY IN IRELAND – PUBLIC HOLIDAY?????

A common misunderstanding as we approach Easter is that Good Friday is a public holiday; Good Friday is a bank holiday but it is NOT a public holiday in Ireland. Banks are closed on Good Friday and many businesses also close, but as it is not a public holiday there is no entitlement to Public Holiday pay for this day. Many employees use a day’s holiday to have the day off.

There are ten Public Holidays in Ireland each year. Easter Monday, however, is one of the ten Public Holidays in Ireland each year. The 10 public holidays are:

• New Year’s Day

• First Monday in February, or 1 February if the date falls on a Friday

• St. Patrick’s Day

• Easter Monday

• The first Monday in May

• The first Monday in June

• The first Monday in August

• The last Monday in October

• Christmas Day

• Stephen’s Day

If the holiday falls on a day on which you normally work, you are entitled to either:

• A paid day off on the holiday

• A paid day off within a month

• An extra day’s pay

• An extra day’s annual leave

If the public holiday falls on a day on which you do not normally work, then you are entitled to one fifth of your normal weekly wage for that day.

If you are asked to work on the public holiday, then you are entitled to either:

• An additional day’s pay

• A paid day off within a month of the day

• An additional day of paid annual leave

Part-time employees qualify for public holiday entitlement provided they have worked at least 40 hours during the five weeks ending on the day before a public holiday.

Public Holiday entitlements are set out in the Organisation of Working Time Act 1997.

To keep up with the latest payroll news, check out our new Bright website. There, you'll be able to register for any of our upcoming payroll webinars and download our payroll guides.

Nov 2014

25

Irish Employer’s Responsibilities - Payment of Wages Act

The Payment of Wages Act 1991 gives all employees the right to a payslip which shows the gross wages and the details of all deductions. A payslip is essentially a statement in writing from the employer to the employee that outlines the total pay before tax and the details of any deductions from pay. Payslips can be provided in electronic/hard copy format.

The Payment of Wages Act 1991 gives all employees the right to a payslip which shows the gross wages and the details of all deductions. A payslip is essentially a statement in writing from the employer to the employee that outlines the total pay before tax and the details of any deductions from pay. Payslips can be provided in electronic/hard copy format.

Deductions from employees’ pay are allowed when:

• It is required by law i.e. Income Tax, Universal Social Charge (USC) & PRSI

• Provided for in the contract of employment e.g. pension contributions

• Employee has given written consent e.g. trade union subscriptions

• They are to recover an overpayment of wages or expenses

• They are required by a court order e.g. attachment of earnings order

• They arise due to employee being on strike

Where a loss is suffered e.g. employee breakages, till shortages deduction is only allowed where:

• It is allowed for in the employee’s contract of employment

• It is fair and reasonable

• Employee has received written notice

• The amount of the deduction does not exceed the loss or the cost of the service

• The deduction takes place within 6 months of the loss/cost occurring

Failure to pay all or part of the wages due to an employee is considered to be an unlawful deduction and a complaint can be made under the Payment of Wages Act 1991.

To keep up with the latest payroll news, check out our new Bright website. There, you'll be able to register for any of our upcoming payroll webinars and download our payroll guides.

Nov 2014

5

Local Property Tax 2015 - Ireland

The third year of LPT is fast approaching!!! Revenue will be writing to the majority of homeowners shortly, the letters will give homeowners the opportunity to decide how and when they would like to pay their LPT. The letter will include the Property ID and PIN and will also confirm the amount due for 2015. If you wish to avail of a phased payment option such as Direct Debit/Deduction at Source you should confirm your payment method by the 25th November 2014 to allow sufficient time for the payment method to be in place for the beginning of the year.

The third year of LPT is fast approaching!!! Revenue will be writing to the majority of homeowners shortly, the letters will give homeowners the opportunity to decide how and when they would like to pay their LPT. The letter will include the Property ID and PIN and will also confirm the amount due for 2015. If you wish to avail of a phased payment option such as Direct Debit/Deduction at Source you should confirm your payment method by the 25th November 2014 to allow sufficient time for the payment method to be in place for the beginning of the year.

Revenue will not be writing to homeowners already paying LPT through deduction at source or by direct debit instead their payment method will continue in 2015.

A number of Local Authorities have reduced the rate of LPT for 2015; Revenue will automatically make those deductions. Homeowners can confirm the amount of LPT due for 2015 on their property by accessing their LPT record online using their PPS Number, Property ID and PIN.

Key Dates for 2015:

• 7th January 2015 – Deadline for paying in full by cash, cheque, postal order, credit card or debit card

• January 2015 – Phased payments by Deduction at Source and regular cash payments through a Payment Service Provider to commence in January

• 15th January 2015 – Monthly Direct Debit payments commence and will continue on the 15th of each month thereafter

• 21st March 2015 – Single Debit Authority payment deducted

If you are the liable person for the residential property on 1st November 2014 you have to pay LPT for 2015 even if it is sold before the end of 2014.

Full details can be found on Revenue’s website www.revenue.ie

Sep 2014

22

Irish Employers - show your staff your appreciation!

Have you employees with 20 plus years of service? If so why not say thank you with a gift.

Have you employees with 20 plus years of service? If so why not say thank you with a gift.

Revenue Commissioners offer tax relief on long service awards, which is considered to be at least 20 years of service. Tax relief on long service awards can be in addition to the small benefit exemption.

Employers can reward employees for long service with tangible articles with a value up to a maximum of €50 per year of service, starting at 20 years of service and every 5 years thereafter.

20 years of service – value up to €1,000

25 years of service – value up to €1,250

30 years of service – value up to €1,500

35 years of service – value up to €1,750

The award must be a tangible article e.g. a gold watch, it does not apply to awards made in cash.

Tax will not be charged provided:

• The cost to the employer does not exceed €50 per year of service

• The award is made in respect of service not less than 20 years

• No similar award has been made to the recipient within the previous 5 years

Where any of the conditions are not met PAYE, PRSI & USC must be applied on the full amount.

This concession applies to directors as well as employees.

Full details can be found on Revenue’s website www.revenue.ie