Jul 2023

12

200 companies named for not paying staff minimum wage

Making sure employees are paid the minimum wage is something which sounds obvious and straightforward. Last month, however, HMRC named over 200 employers who failed to pay their employees the minimum wage. This breach of National Minimum Wage (NMW) law by 202 employers, added up to £5 million in underpayments, and left around 63,000 workers out of pocket. Among the businesses named were major high street brands like Marks and Spencer, Argos and WH Smith, as well as various SMEs and sole traders.

Regarding the naming of these businesses, here’s what Minister for Enterprise, Markets and Small Business Kevin Hollinrake had to say:

“Paying the legal minimum wage is non-negotiable and all businesses, whatever their size, should know better than to short-change hard-working staff.

Most businesses do the right thing and look after their employees, but we’re sending a clear message to the minority who ignore the law: pay your staff properly or you’ll face the consequences.”

The consequences of not paying employees the minimum wage

The investigations by HMRC took place between 2017 and 2019. The businesses which were listed have paid back what they owed their staff and have also faced financial penalties. However, the loss of trust and the reputational damage these underpayments have caused, may be much harder to repair.

The most common payroll mistakes that lead to employees being underpaid

The employers named last month were found to have underpaid workers in the following ways:

- 39% of employers deducted pay from workers’ wages.

- 39% of employers failed to pay workers correctly for their working time.

- 21% of employers paid the incorrect apprenticeship rate.

The responsibility of a payroll processor

As a payroll processor, you’re responsible for making sure that clients’ employees are paid fairly and according to the law— and that means understanding the ins and outs of minimum wage calculations. It’s important to keep in mind the different minimum wage rates that apply to different age and work categories. The rates are updated annually, so make sure you’re always using the current rates. Check out our blog to see the NMW rates for this tax year. Your payroll software provider should update their software each year to reflect new minimum wage rates.

How clients are responsible

It’s the responsibility of the client to make sure that you have all the information you need, and that the information you have is correct, to ensure that employees are paid the correct rates. Examples of this information could be an employee’s date of birth, their employment status, the hours they worked, details of any overtime and training or travelling time.

With the right payroll software, you and your clients can rest assured that their payroll is in compliance with Irish law.

Jun 2023

14

Revenue’s Enhanced Reporting Requirements from 1st January 2024: What you need to know

From the 1st of January 2024, the introduction of Section 897C into The Finance Act 2022 will require employers and payroll processors to report details of certain payments made to employees and directors. Where you make one or more of the payments listed below, you must submit the details electronically to Revenue. This submission must be made on or before the payment date.

It should be noted that the new requirements from January 2024 represent phase one of Enhanced Reporting Requirements (ERR). Revenue has not yet indicated what will be included in future phases.

Phase one will apply to the following payments

1. Small benefit

Since January 2022, employers have been able to reward employees with up to two small benefits each year. From 2024, employers will be required to report to Revenue, the value of the benefits paid to each employee.

These non-cash benefits are tax free and must not exceed a combined total of €1,000 in value. After surveying 125 of our payroll customers, we discovered that 76% of them offer their employees a small benefit, such as gift cards during the festive season. It's always nice to see employers going the extra mile for their valued staff!

2. Remote working daily allowance

For the days an employee is working from home, they may be eligible for tax relief on expenses such as their heating, broadband and electricity. To ease the financial burden, employers can pay employees up to €3.20 a day without paying any tax, PRSI or USC on it.

For each employee you are paying a Remote Working daily allowance to, you are required to report the total of number of days they are receiving the allowance for, and the rate being paid.

3. Travel and subsistence

If you have employees who travel for business or who are working away from their employer’s base, you can reimburse them for their travel expenses. You can also reimburse them for subsistence costs when they are temporarily away from their usual place of work, such as the cost of staying in a hotel or the cost of a meal.

The following items and the amounts paid must be reported for each employee and/or director:

- Travel vouched

- Travel unvouched

- Subsistence vouched

- Subsistence unvouched

- Site based employees

- Emergency travel

- Eating on site

How will this information be reported to Revenue?

Revenue (through ROS) will provide a means of manually submitting ERR details. It is our intention to provide an alternative to this manual system, working alongside your payroll software, to save time and provide more accuracy. We also hope to provide guidance in relation to qualifying criteria and backup documentation required in the event of a query by Revenue.

From our customer survey, we found that 14% of those surveyed reimbursed employees’ expenses as part of the normal payroll run, 34% reimbursed employees as soon as they submitted a claim, and 22% reimburses both through payroll and on an ad hoc basis. We aim to design our system in such a way that where travel and subsistence is paid as part of a normal payroll run, the relevant ERR submission can be made as seamlessly as possible. Further information on ERR will be published by Revenue in due course.

To keep up with the latest payroll news, check out our new Bright website. There, you'll be able to register for any of our upcoming payroll webinars and download our payroll guides. For more information on ERR, please visit our hub by clicking the button below.

Related articles:

Jun 2022

17

Living wage to replace minimum wage in Ireland

It was announced this week that a new living wage, to replace the current minimum wage, is to be phased in for Irish workers, starting in 2023. A living wage is an hourly rate of pay calculated to be the minimum amount that a worker needs to earn to cover the basic cost of living.

The memo which Tánaiste and Minister for Enterprise, Trade and Employment, Leo Varadkar has brought to Cabinet proposes that the living wage is to be set at 60% of the median wage in a given year. Based on this percentage, if the living wage rate were introduced today, it would be set at €12.17 per hour.

Minimum wage in Ireland

The National Minimum Wage was first introduced in Ireland in April 2000 and was also roughly 60% of the median wage at the time. The minimum wage has increased by around 47% since it was first introduced, but it has not kept up with the average earnings or the cost of living.

Since 1st January 2022, the National Minimum Wage is €10.50 per hour for those aged 20 and over.

Rates for other workers are as follows:

| Age Group | Minimum hourly rate of pay | % of minimum wage |

| Aged 19 | €9.45 | 90% |

| Aged 18 | €8.40 | 80% |

| Aged under 18 | €7.35 | 70% |

What does the living wage mean for employers?

The national minimum wage will remain in place until the living wage rate is fully phased in, in 2026. The minimum wage rate will increase between now and 2026, closing the gap between the minimum and the living wage. However, the full living wage may be introduced faster or slower than the proposed time frame, depending on prevailing economic circumstances. The Tánaiste has said that the reason the living wage is being introduced gradually is because if it is brought in too quickly businesses could close, or employees could see their hours cut. Leo Varadkar will consult with various interested parties, including employer and worker representative groups, unions and the public on the draft plan.

The living wage is just one of the improvements to workers' rights to be introduced over the coming years. Other changes we are set to see for employees is the introduction of statutory sick pay and automatic enrolment onto pension schemes.

Subscribe to our newsletter to keep up to date on legislation changes, webinar events, special offers and other payroll related news.

Related articles:

May 2022

6

How to integrate payroll and HR

In a Censuswide survey of 251 HR and payroll managers, 76% of businesses admitted to failing to pay their employees correctly or on time on one or more occasion. In the 2019 survey it was also revealed that, on average, employees had been paid incorrectly or late four times in the previous twelve months. This failure can sour employee relations and employees may feel they are unable to trust their employers.

Successful businesses are built on relationships and when there is a breakdown of trust, relationships are damaged, and your business may suffer consequently. When a concern arises for an employee, it is often the HR department that they first turn to – including questions and issues to do with pay. Whether or not you think that payroll should be the responsibility of HR personnel, businesses can benefit from integrating the two functions.

Thesaurus Connect is the cloud extension to payroll software, Thesaurus Payroll Manager, that can streamline payroll and HR processes; meaning less work for employers and more peace of mind that your employees’ pay will be accurate. Thesaurus Connect can also help improve communication between you and your employees. Effective communication within organisations has become more important than ever since the COVID-19 outbreak forced many of us to work remotely.

Thesaurus Connect gives you access to an online employer portal from which you can manage employees in many ways. An unlimited number of users can be added, meaning the portal can be accessed safely and securely by any colleagues you wish to allow access. Listed below are eight features of Thesaurus Connect and how these features can benefit employers, HR departments and payroll processers.

1. Payroll Records - Instantly access your employees’ payslips and payroll documents, run your own payroll reports, and view amounts due to Revenue anywhere, any time, through your secure online portal.

2. Employee Self-Service - Invite your employees to an online self-service portal and employee app where they can access their payslip library, request annual leave, access HR documents and update personal contact details. Find out more. Employees can download the employee app on their smartphone or tablet; giving them instant access to their payroll information on the go. The employee app is available to download for free on any Android or iOS device.

3. Employee Records - Employers and managers can keep track of their employees’ basic personal details, which can be updated by employees. This ensures that you have the most accurate and up-to-date details on file for your employees.

4. Employee Calendar - The real-time employee calendar allows you and your colleagues to see, at a glance, who is on leave, when, and whether they are on annual leave, unpaid leave, parenting leave or sick leave.

5. Leave Management - Employees can submit holiday requests with a few simple clicks. Managers will be notified of the request and can view the holiday calendar online before approving, ensuring that you always have sufficient cover.

6. Secure Cloud Storage - When it comes to payroll, data security is extremely important. Payroll information is stored on Microsoft Azure, which is one of the most secure ways to store data.

7. Company Messaging - Whether it is an important memo, the company newsletter, or details of a staff party, the notification system will transform internal communications. All employees can be kept up to date on what is happening in the workplace, regardless of where they are located.

8. HR Documents & Resources - You can share documents and resources with individuals, teams or the whole company at the touch of a button. Track who has viewed circulated documents and who has not.

Book a Thesaurus Connect demo today to learn more about these features and how they can benefit your business.

Apr 2022

5

Auto Enrolment Update: Everything you need to know

Automatic Enrolment in Ireland is a subject which has been in discussion for over 25 years now. In 2017, the matter was brought to the forefront again with our Taoiseach at the time, Leo Varadkar, announcing that the scheme would begin in 2021. However, as we all know, delays caused by COVID-19 meant that this didn’t happen as planned. One year later, we are in a much better place and thankfully, details on the planned state pensions Auto Enrolment scheme were announced on the 29th of March 2022.

What is Auto Enrolment?

Auto Enrolment is being brought in to ensure that those working in the private sector have an income for their retirement, beyond the state pension. The scheme will be phased in over the next ten years. The system is to be set up by 2023 and employee enrolments into the scheme will begin in 2024. All employees aged between 23 and 60, earning over €20,000 a year and who are not already in an occupational pension scheme, will be automatically enrolled. While participation in the scheme will be voluntary, workers will have to opt-out of the scheme rather than opt-in. It is hoped that this model will encourage workers to remain in the scheme.

How much will go towards employees’ pension?

The employee, the employer, and the state will all make contributions towards the employee’s pension pot. Employees’ pension savings will be matched on a one-for-one basis by the employer, up to a maximum of €80,000 of earnings. The state will provide a top up of €1 for every €3 saved by the worker. This means that for every €3 saved by the employee, a further contribution of €4 will be made by the employer and the state combined.

Pension contribution example

| Employee Contribution | Employer Contribution | State Contribution |

| €3 | €3 | €1 |

Employer and employee pension contributions will be calculated as a percentage of the employee’s income. Rates will start at 1.5% and will increase every three years by 1.5%, until they eventually reach 6% by year 10 (2034).

Pension contribution rates

| Years | Contribution rate |

| 2024 - 2026 | 1.5% |

| 2027 - 2029 | 3% |

| 2030 - 2033 | 4.5% |

| 2034 onwards | 6% |

What does the new Automatic Enrolment scheme mean for payroll processers?

When the scheme is first rolled out in 2024, it will mean a few additional steps in the payroll process. Those processing payroll must ensure that all eligible employees have been enrolled into one of the four retirement saving funds that employees will have to choose from. For employees who do not express a preference for any fund, they should be enrolled into the default fund. After 6 months of participation, employees will have the choice to opt-out or suspend participation. When a person chooses to opt out, they can receive a refund of their contributions. Once opted out, the employee will need to be re-enrolled after two years.

Will there be changes in my payroll software?

Your payroll software provider will have ample time to implement these changes into the software and should be ready to go by 2024. At Thesaurus Payroll Manager, Auto Enrolment is something that we have had programmed into our UK payroll software, BrightPay UK, since the scheme was introduced in the UK in 2012. Thanks to this experience, we already have the knowledge of how Auto Enrolment in the software should work. Our aim, as is with our UK payroll product, will be to make the Auto Enrolment process as simple for the user as possible by automating the process.

Related articles:

Mar 2022

28

Thesaurus Software and AccountancyManager join forces

It has been an exciting six months since Thesaurus Software merged with Relate Software to become Bright Software Group or “Bright”, as we are now known. Things haven’t slowed down since and we are delighted to announce that Bright has now acquired AccountancyManager, the UK’s leading onboarding and practice management software. The cloud-based software slots in nicely with Bright’s payroll, HR, bookkeeping and post-accounting software products. This is an exciting opportunity for the individual brands to exploit our operational synergies and develop the best products to serve payroll bureaus, accountancy firms and SMEs across the UK and Ireland.

Click here to find out more about Bright.

Who are AccountancyManager?

AccountancyManager (AM) is an award-winning practice management software that shares the same ultimate goal as Bright; to improve accountants’ day-to-day activities by automating time-consuming tasks, helping them to achieve a better work/life balance and grow their businesses. Founded in 2017 by James Byrne and Alex Hawke, AccountancyManager quickly grew and today is used by thousands of accountants and bookkeepers across the UK and Ireland.

A Bright future for AccountancyManager

James Byrne, co-founder of AM will continue as a shareholder in the combined group and will remain involved with the business as an advisor to the combined board. Kevin McCallum, CEO of AM, will become Chief Operating Officer of the new, combined group as well as continuing to manage AM, working closely with Bright CEO, Paul Byrne.

Here’s what Kevin McCallum, incoming COO of Bright, has to say about the merger: “AccountancyManager joining Bright makes so much sense for many reasons, but for me, the shared values and customer-centric approach are the most compelling. I’m excited to be joining Paul and the wider Bright team in building out the scope and scale of our business and supporting more and more accountants and their clients.”

By partnering with AccountancyManager and combining products and strengths from both businesses, Bright can provide a greater offering to our customers, with scope and backing for further innovation and development. This is an exciting moment in Bright’s journey to delivering a one-stop solution for businesses and accountancy firms. Together we will aim to provide a best-in-class software suite with a clear value proposition to drive efficiency and reduce errors, all with increased flexibility from working with a cloud offering.

Related articles:

Feb 2022

22

How Thesaurus Payroll Manager customers can benefit from using Surf Accounts

Up until now, when you needed to transfer payroll data from Thesaurus Payroll Manager to your bookkeeping software it meant having to export your payroll journal and upload it to your accounting package. Thanks to our new integration with accounting software, Surf Accounts, this is no longer the case.

Thesaurus Payroll Manager users can now benefit from an improved workflow and increased efficiency when they use cloud-based accounting software, Surf Accounts alongside their payroll software.

Who are Surf Accounts?

In September 2021 Thesaurus Software joined forces with Relate Software, combining our strengths to form a payroll and accounting software powerhouse. Since then, we’ve been working hard to ensure existing customers from both sides can benefit from this merger without compromising the software they are accustomed to.

Surf Accounts allows you to access and update your accounts anytime, anywhere with an internet connection.

Other key features of the software include:

- Invoice management

- Online payments

- Bank reconciliation

- A Surf Accounts mobile app

- Customer Relationship Management system

- Customised reporting

Read more about Surf Accounts features.

How does the integration between Thesaurus Payroll Manager and Surf Accounts work?

Thesaurus Payroll Manager will create a payroll journal file that is unique to Surf Accounts, meaning that all your payroll figures will appear in the correct location in your general ledger in Surf Accounts. This means no more exporting and importing files or double entering figures.

Learn more about the Thesaurus Payroll Manager and Surf Accounts integration.

How it works:

- Sign into your Surf Accounts profile in the 'Utilities' section of the Thesaurus Payroll Manager dashboard.

- Once signed in, you can now proceed with your nominal ledger mapping, where you map your payroll data items to your relevant Surf Account's nominal account codes. This only needs to be set up once.

- Once that's finished, simply post the journal to submit your payroll journal to Surf Accounts.

This new integration can help eliminate the need to enter data separately into both systems. This can also help to reduce the chance of errors being made. All in all, the new integration will save you time and allow you to be more confident about the accuracy of your data. To learn more about how Surf Accounts works, book a free demo of the bookkeeping software today.

Jan 2022

28

New EWSS Update: Changes from 1st February

On the 21st January 2022, Minister for Finance Paschal Donohoe announced changes to Employment Wage Subsidy Scheme (EWSS) subsidy rates from 1st February.

Due to the COVID-19 restrictions which were brought in last December, the enhanced rates of the EWSS were extended for all businesses for December 2021 and January 2022. As well as this, the scheme was reopened in December for certain businesses who were previously registered for the EWSS and experienced a reduction in turnover as a direct effect of these new restrictions. With these restrictions now lifted from 21st January, many businesses have returned to normal, and the EWSS rates are now changing in line with this.

Changes to the EWSS from 1st February

From 1st February we will begin to see a gradual reduction in subsidy rates up until the scheme ends for all businesses in May. The EWSS rates which businesses are eligible to receive will depend on whether or not they were one of the businesses that were directly impacted by the COVID-19 regulations which were introduced in December.

The reduced rate of employer’s PRSI of 0.5% will continue to apply to wages paid before 1 March 2022 in relation to those who are eligible for the subsidy payment. The full rate of employers’ PRSI will be reinstated with effect from 1 March 2022 for all businesses.

Rates from 1st February for businesses directly impacted

For businesses that were directly impacted by the COVID-19 regulations that were introduced in December 2021, they will continue to receive the enhanced EWSS rates for the month of February, as outlined in the table below. For the month of March, the EWSS rates will revert to the original two-rate subsidy of €151.50 for employees with a gross weekly wage of between €151.50 to €202.99 and €203 for employees with a gross weekly wage of between €203 and €1461.99. For the months of April and May, businesses will receive a flat rate of €100 per employee. The scheme will eventually end for these businesses on 31st May 2022.

| Employee gross weekly wage | February 2022 | March 2022 | April 2022 | May 2022 |

| Less than €151.50 | Nil | Nil | Nil | Nil |

| €151.50 to €202.99 | €203 | €151.50 | €100 | €100 |

| €203 - €299.99 | €250 | €203 | €100 | €100 |

| €300 - €399.99 | €300 | €203 | €100 | €100 |

| €400 - €1,462 | €350 | €203 | €100 | €100 |

| Over €1,462 | Nil | Nil | Nil | Nil |

Rates from 1st February for other businesses

For businesses that were not directly impacted by the COVID-19 regulations that were introduced in December 2021, the enhanced subsidy rate will end on 31st January, and they will receive the two-rate subsidy for the month of February. For the months of March and April, these businesses will receive a flat rate of €100 per employee. The scheme will then end for these businesses on 30th April 2022.

| Employee gross weekly wage | February 2022 | March 2022 | April 2022 |

| Less than €151.50 | Nil | Nil | Nil |

| €151.50 to €202.99 | €151.50 | €100 | €100 |

| €203 - €1462 | €203 | €100 | €100 |

| Over €1462 | Nil | Nil | Nil |

Note: Revenue are working on updating their systems to cater for these changes. A Thesaurus Payroll Manager upgrade will also be released in line with these new changes.

EWSS Webinar

On February 4th, Thesaurus Software will be holding a free online webinar where we will be joined by representatives from Revenue to discuss recent EWSS changes and the updated guidance for employers. We will also have a questions and answers section at the end of the webinar where we will answer any questions you may have regarding the scheme.

Dec 2021

15

How to avoid employees carrying over their annual leave into the new year

For most employers in Ireland, their annual leave year runs from January to December and an employee’s annual leave entitlements will depend on how much they’ve worked that year. As we get closer to the end of 2021, you may notice some employees who still have days or maybe even weeks left to take. Depending on what type of business you’re in, this could be a real headache to deal with. For example, if you are in retail, giving employees time off at Christmas could be impractical.

Some employees may ask if they can carry over their leftover leave into 2022. According to Citizen’s Information, annual leave should be taken within the leave year it was earned. Whether or not an employee can carry over annual leave entitlements will depend on the policy you have in place. Some employers will agree to allow employees to carry over untaken annual leave within 6 months of the relevant leave date, while others may allow employees to carry over leave even further. It is important to note, if an employee is on extended sick leave, then legally, they are allowed to carry over any unused leave for up to 15 months after the end of the year it was earned.

While in most cases allowing an employee to carry over annual leave shouldn’t be a problem, it can become impractical, especially when you have a lot of employees wanting to do so. Making sure your employees take their annual leave within the year it was earned can help avoid employee burnout as it encourages them to take more regular breaks. It also prevents employees saving up their annual leave and using it all in one go which could result in your business being short staffed for a long period.

Whatever you decide, it is important that you have an annual leave policy in place which clearly outlines whether employees can carry over leave from one year to the next. If you would rather a “use it or lose it” policy where employees must take their leave within the year it was earned, then it is important that you carefully track employees’ leave taken and remaining. Doing this will help you avoid having employees on leave, when you may need them most.

If you would like a ready-made annual leave policy which you can tailor to your own needs, visit our sister company Bright Contracts to find out more, or book a free online demo with a member of their team today.

How can I keep track of employees’ annual leave?

If you have a lot of employees, it can be difficult to keep track of everyone’s annual leave. Luckily, your payroll software can help. Thesaurus Payroll Manager used alongside our optional cloud add-on Thesaurus Connect has an annual leave management feature which allows employers and employees to keep track of annual leave taken and remaining.

1. View a company-wide calendar of employees’ past and scheduled leave

When you open up Thesaurus Connect’s employer dashboard, from the calendar tab, you can view a company-wide calendar which shows all your employees past and scheduled leave. The calendar makes it easier for you when you need to decide whether or not you will approve an employee’s request for time off.

2. Let employees request leave through their phone

Thesaurus Connect also includes an employee smartphone app which the employee can use to request leave. From the app the employee simply selects the days which they would like off, the type of leave (paid or un-paid) and the times (e.g. a half day). Employees can request leave anytime, anywhere, even on the go. Once a leave request is approved the calendar on the employer dashboard is automatically updated.

3. Let employees know how much leave they have remaining without having to ask you

Another great feature of the Thesaurus Connect’s employee app is that when an employee opens the app, they can see how much leave they have used so far that year and the amount of leave they have remaining. When an employee can easily keep track of the amount of leave they have used it means they will be less likely to have leave left over by the end of the year.

While some employees will still need an extra nudge to remind them to take their full annual leave entitlements before the end of the year, Thesaurus Connect can greatly help payroll processers in keeping track of who has leave left to take. This can help avoid employees carrying over annual leave days and having too many employees requesting to take leave at the end of the year.

To learn more about how Thesaurus Connect can help you manage your employee’s annual leave, why not book a free online demo today.

Related articles:

Oct 2021

28

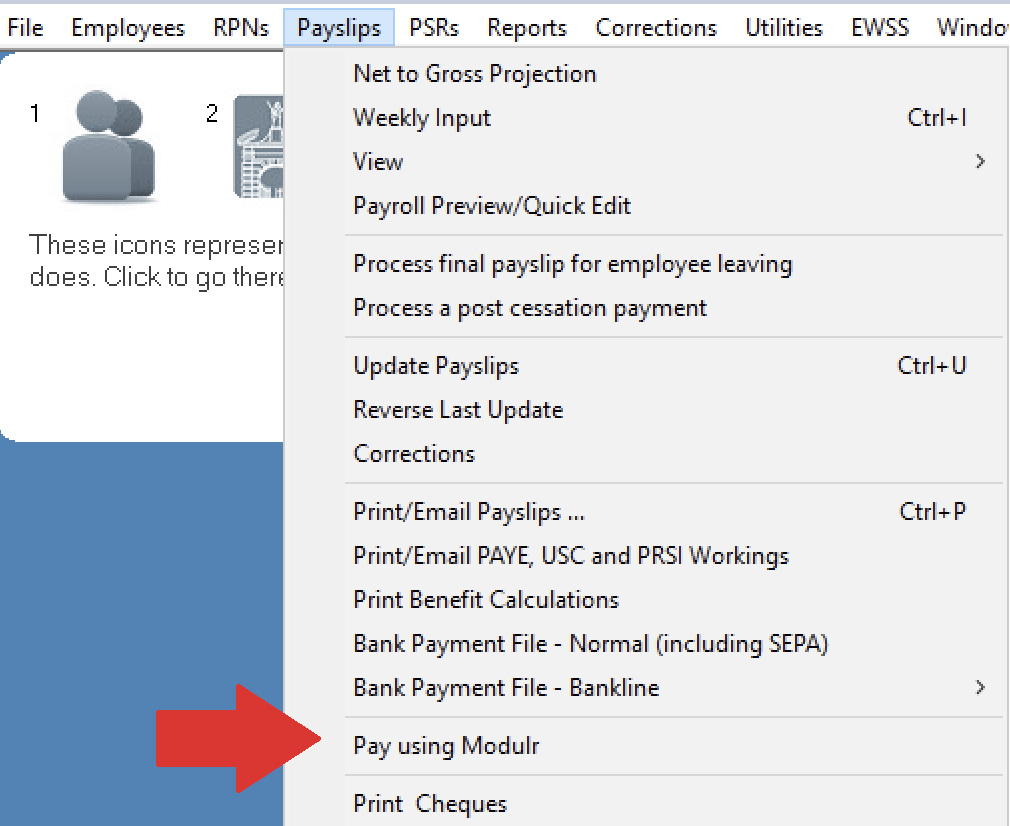

New Feature: Introducing direct payments through Thesaurus Payroll Manager

Thesaurus Software have partnered up with payment platform Modulr to give payroll processors a fast, secure and easy way to pay employees directly through Thesaurus Payroll Manager. Up until now, when you wanted to pay employees through credit transfer, you needed to create a bank file that would then need to be uploaded to your online banking account. This can be quite a manual process that is prone to human error. This new method of paying employees cuts down on admin work and eliminates manual entry errors, saving you time.

To use this new integration, first ensure you have created a Modulr Account. You will also need to download a mobile app called Authy which you will use to authenticate user logins and payments. The Authy app is a second layer of security that will help protect your account from hackers or data breaches.

How does Thesaurus Payroll Manager’s new direct payments feature work?

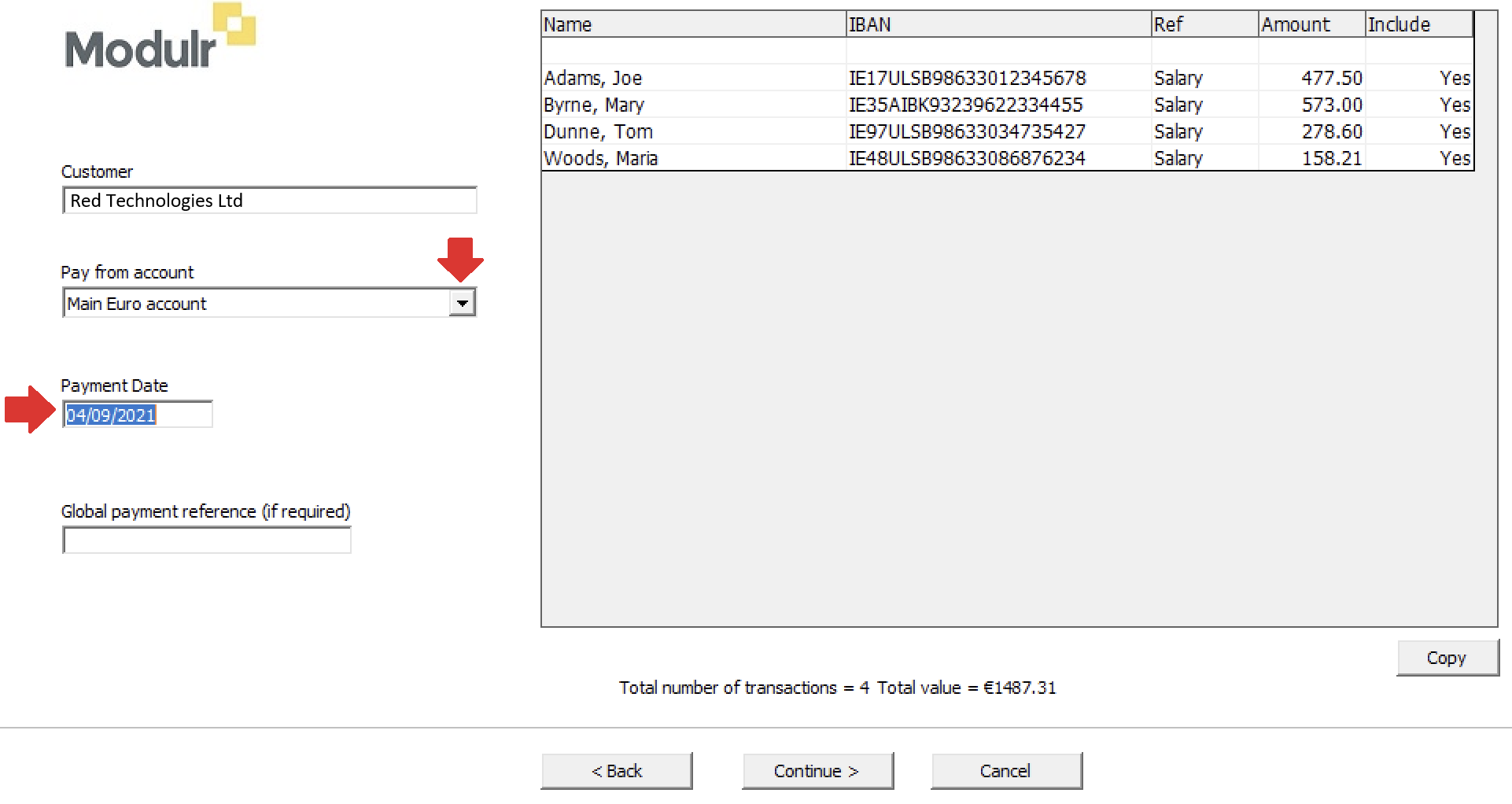

1. Once you have updated payslips for a pay period as you normally would, under the payslips tab choose pay using Modulr.

2. A box will then appear on screen asking you to log into your Modulr account.

3. Once you have entered your details, you will authenticate your login through the Authy app on your mobile device.

4. Once set up, your payroll information in Thesaurus Payroll Manager will automatically synchronise with your Modulr account. In the pop up, any employees whose payment method is set to credit transfer will be listed along with their IBAN and the amount they are to be paid for that period, a reference can also be added here.

5. Next, simply select the account you would like to make the payment from and choose a payment date.

6. After clicking continue, you will be shown a summary of your payment request submission. Once you have reviewed the payment request you can click “Send to Modulr.”

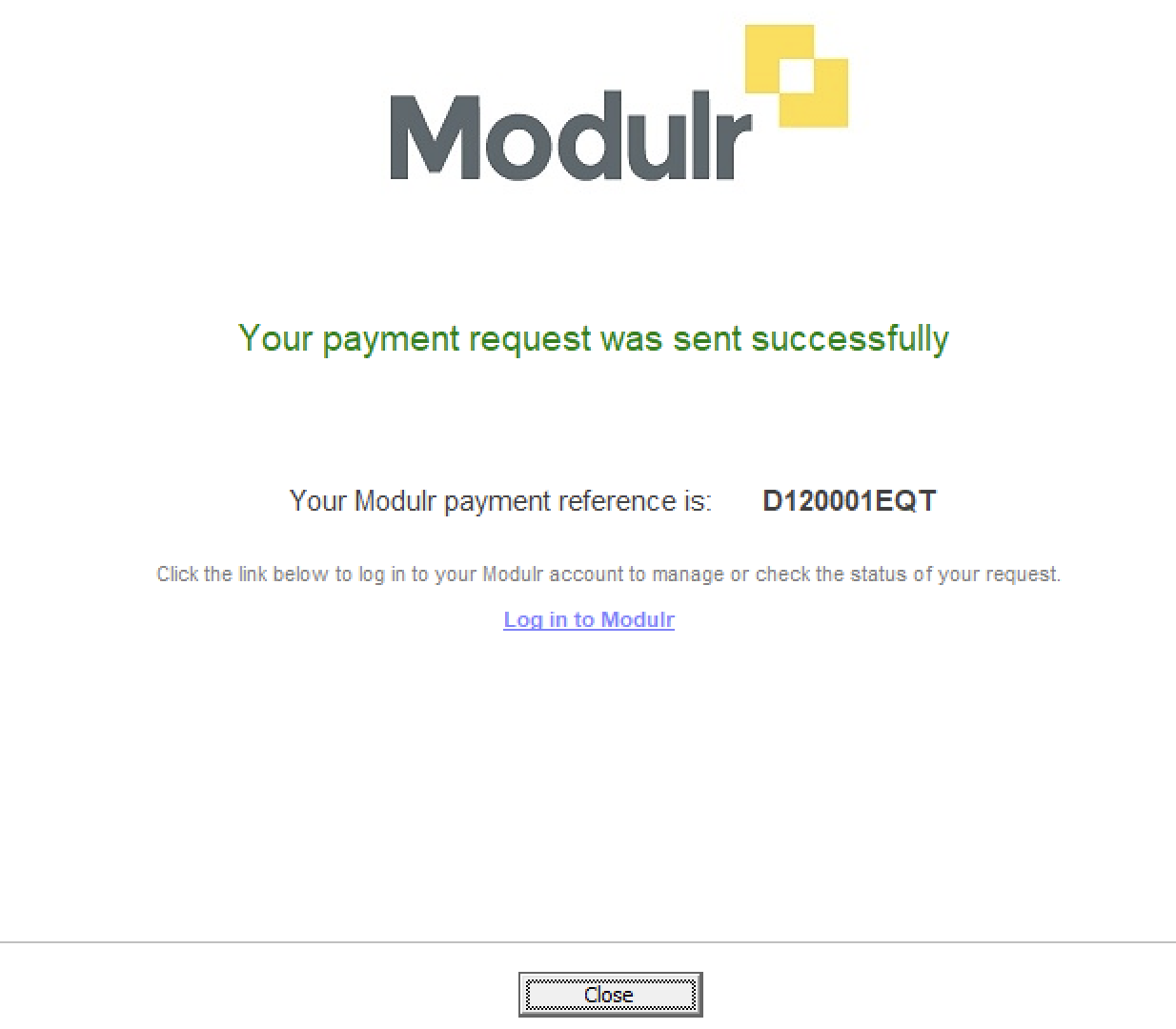

7. You will need to authenticate the submission by once again using your Authy app. The following screen will be displayed to let you know that the transfer has been successful:

8. The final step is for the authorised person to log in to their Modulr account and approve the payment request submission. This may be the payroll processor themself or if you are processing payroll for a client then this task can be assigned to the client, giving them control by allowing them to give the final approval on the payment of employees.

For more detailed instructions on how to use Modulr with Thesaurus Payroll Manager, view our help guide.

What are the benefits of using Thesaurus Payroll Manager’s Modulr integration to pay employees?

Improved workflow and less chance of errors

Paying employees directly through Thesaurus Payroll Manager using our new integration with Modulr means that you can save yourself time by cutting down on admin work and eliminating the risk of manual entry errors.

Secure payments and peace of mind

Encrypted communication between parties and authentication using your mobile means payments made through Modulr are secure and fully traceable, giving you peace of mind.

More flexibility with same day payments

Thesaurus Payroll Manager and Modulr’s integration allows you to pay employees using SEPA (Single Euro Payments Area). With SEPA, if you authorise the payments before 2 PM the money will land in employees’ bank accounts that same day. If the payments aren’t authorised until after 2 PM then it will go through the next business day. This quick turnaround means that you have the flexibility to change payments up until the day before or even the morning of pay day.

Register for one of our free webinars where we will discuss how our new integration can benefit your business.

Webinar for Accountants Webinar for Employers