Oct 2021

1

Thesaurus Customer Update: October 2021

Welcome to Thesaurus Software's October update. Our most important news this month include:

-

BrightPay and Relate Software join forces to create an accounting and payroll software champion

-

It’s time to go paperless & how an employee app can help

EWSS eligibility rules and rates for October

Revenue have announced that the Employment Wage Subsidy Scheme (EWSS) eligibility rules and rates will remain unchanged for the month of October 2021.

5 ways to boost the efficiency of your payroll process (for employers)

Join our upcoming webinar on 20th October where we discuss practical ways you can streamline payroll and HR processes within your business using cloud technology.

6 tips for payroll success while making a profit (for bureaus)

Join our upcoming webinar on 7th October where we discuss practical ways you can streamline payroll and HR processes in your practice using cloud technology while making a profit.

Set up Thesaurus Payroll Manager for multiple users

Each Thesaurus licence key can be installed and activated on up to 10 PCs. If shared access is required, the data location can be set to your server or cloud environment.

Let’s talk about family leave

Join our sister product Bright Contracts for their free webinar on 19th October about all things family leave related. From Maternity Leave to Parent’s Leave, Bright Contracts gives you all of the information about entitlements and pay that employers need to know.

A step closer to Sustainability

Earlier this year at Thesaurus Software we formed a ‘Green Team’ that will identify and implement opportunities that can improve the sustainability of our company. Follow us on our journey to keep up with our latest projects.

Sep 2021

1

Thesaurus Customer Update: September 2021

Welcome to Thesaurus Software's September update. Our most important news this month include:

-

Sick pay comes to Ireland: How does this affect employers and payroll processors?

-

Webinar on-demand: Employment Wage Subsidy Scheme (EWSS) Guest Speaker: Revenue

Employment Wage Subsidy Scheme (EWSS) changes in October

Join BrightPay for a free webinar on 30th September where we will be joined by representatives from the Revenue Commissioners to discuss upcoming changes to the Employment Wage Subsidy Scheme in October.

A video message from Paul, CEO of Thesaurus Software

Watch a short video where Paul talks about how our add-on product Thesaurus Connect can reduce your stress and perhaps even help improve your bottom line as an accountant.

Link your payroll data to the cloud

With Thesaurus Connect, you don't need to worry about manually backing up your payroll data. When you link an employer to Thesaurus Connect, it will be automatically synchronised to the cloud as you run your payroll or make any changes.

What happens if I don't submit Revenue's Employer Eligibility Review Form?

Failure to complete and submit the EWSS Eligibility Review Form that confirms the required reduction and related declaration will result in the suspension of payment of the EWSS claim and possible penalties.

Customer survey 2021 results

The results are in for Thesaurus Software’s annual customer survey. Our key findings include a 99.4% customer satisfaction rating, which is fantastic news! Some customer comments include:

“We are a very happy customer; we are a small company but extremely happy with the fantastic efforts of support during a world pandemic. I would consider this reliability when recommending you”.

“Your product is the best wage system for Irish employers since day one. It has made payroll so easy and efficient for employer and employee. It is unbeatable. Your Support people are accessible and always helpful. A wonderful team. Thanks for making my life so easy for more than 25 years”.

“Anytime I have had to phone Thesaurus the staff are so friendly and helpful and know their job so well. It's a complete pleasure to deal with them”.

Aug 2021

31

Customer Survey 2021 - the results are in!

We value our customers’ feedback and opinions as it allows us to improve and grow our business. We recently conducted an annual survey as it is a powerful indicator of overall success as a company as it captures the entire experience of using Thesaurus Payroll Manager, from the product features to the daily customer support to the live webinars and online documentation.

We are proud of the continued high marks and appreciate the thoughtful feedback from this year’s survey and would like to say a massive thank you to everyone who took part. The survey looked at customer satisfaction, software performance and customer support.

We’ve compiled the results of our latest survey and we wanted to share them with you.

The Results

As the survey was very comprehensive, we’re not going to share the results of each and every question. But we did want to share the main areas of focus and what you, our customers, have said.

- We asked: How satisfied are you with Thesaurus Payroll Manager?

- You said: Thesaurus Payroll Manager achieved a 99.4% customer satisfaction rate, which is fantastic news for everyone on the Thesaurus Software team.

- We asked: How would you rate the following Thesaurus Connect features?

- You said: The most highly rated Thesaurus Connect features included automatic cloud backup (98.9%), online employer dashboard (96.7%) and employee self-service portal & app (98.5%).

- We asked: How satisfied are you with Thesaurus Software's Customer Support?

- You said: The majority of customers rated our telephone support (99%), email support (99.5%), online help documentation (98.5%) and online video tutorials (98.9%) as excellent, very good or good, giving our customer support team an overall satisfaction rate of 99%.

- We asked: How would you rate Thesaurus Software’s handling of COVID-19?

- You said: 99.5% of customers answered that they found our handling of COVID-19 overall to be either excellent, very good or good - in particular, our free online COVID-19 webinars (99.6%), payroll upgrades (99.7%), online help and support (99.5%) and phone and email support (98.9%).

Customer Testimonials

We also received a number of customer testimonials from the survey - all of which will be added to the Thesaurus Software website in due course. Some of our favourite testimonials received include:

“We are a very happy customer; we are a small company but extremely happy with the fantastic efforts of support during a world pandemic. I would consider this reliability when recommending you”.

“Your product is the best wage system for Irish employers since day one. It has made payroll so easy and efficient for employer and employee. It is unbeatable. Your Support people are accessible and always helpful. A wonderful team. Thanks for making my life so easy for more than 25 years”.

“Anytime I have had to phone Thesaurus the staff are so friendly and helpful and know their job so well. It's a complete pleasure to deal with them”.

Get in touch

If you feel that you’re not using the full suite of Thesaurus Connect’s features to its fullest potential, you can book a free 15-minute online Thesaurus Connect demo.

Aug 2021

31

What happens if I don't submit Revenue’s Employer Eligibility Review Form?

The Irish government has extended the Employment Wage Subsidy Scheme (EWSS) until 31st December 2021. The scheme gives employers impacted by COVID-19, a subsidy per employee to help keep them in employment. On 9 July, Revenue published guidelines to highlight the changes to the EWSS applicable for the period from 1 July 2021. The main change made to the scheme was in relation to eligibility.

To assist employers in ensuring continued eligibility for the scheme, from 30th June 2021, all employers are required to complete and submit an online monthly EWSS Eligibility Review Form (ERF) through ROS by the 15th of each month. Companies claiming EWSS must fill out a monthly eligibility form, showing their revenue for 2021 remains at least 30% below the reference period in 2019 and a declaration to confirm that the information submitted is correct and accurate to the best of their knowledge. Failure to complete and submit the EWSS Eligibility Review Form that confirms the required reduction and related declaration will result in suspension of payment of EWSS claims.

Revenue has stated: “Where Revenue determines that an employer, at any time over the term of the scheme, claimed and received payment by applying accounting practices that are clearly not appropriate, or by deliberately misrepresenting the true financial situation of the business, it will be excluded from the EWSS in its entirety. No further claims will be accepted, and all subsidy paid and PRSI credit issued will be immediately repayable together with interest and penalties. The business may also face possible criminal prosecution.”

The government has paid nearly €4 billion to date in EWSS payments on top of the €2.9 billion paid under the earlier TWSS. Revenue have launched an investigation on companies that are suspected of overclaiming pandemic wage subsidies.

According to Revenue’s code of practice for audits and non-audit interventions, officials can make unannounced site visits, conduct profile interviews with business owners, carry out assurance checks, and initiate investigations. Please ensure you are submitting correct information to avoid any penalties.

Upcoming webinar

Join Thesaurus Software for a free webinar on 30th September where we will be joined by representatives from the Revenue Commissioners to discuss upcoming changes to the Employment Wage Subsidy Scheme in October and the Employer Eligibility Review Forms. There will also be a live Q&A session to answer any questions that you may have.

Limited Places Remaining – Click here to reserve your place.

Related articles:

Aug 2021

3

Thesaurus Customer Update: August 2021

Welcome to Thesaurus Software's August update. Our most important news this month include:

-

Watch On-Demand: EWSS Changes & The Return to Work

-

Going paperless: how an employee app can help

-

How Statutory Sick Pay will be calculated when introduced in 2022

EWSS Employer Eligibility Review Form

Revenue confirmed it has extended the deadline for the completion and submission of the EWSS Eligibility Review Form in respect of June 2021 to 15 August 2021. The eligibility review form in respect of July 2021 is also due to be submitted on the same date. Watch our webinar on-demand where we cover everything you need to know.

Statutory Sick Pay - Coming January 2022

Currently, there is no legal obligation for employers in Ireland to pay employees who are on sick leave, and it is up to the discretion of each employer. However, it will be mandatory for employers in Ireland to provide Statutory Sick Pay (SSP) for employees from January 2022.

Employee self-service app – A must-have tool for every business

Thesaurus Connect gives employees access to a user-friendly smartphone and tablet app that gives them access to their payslips, HR documents, annual leave calendar and much more. Self-service apps are becoming more popular as they benefit both the employer and employee.

Adopting a hybrid working model

The COVID-19 crisis has completely shifted the way we work and live with companies having to quickly adopt new initiatives and technologies to ensure employee safety whilst maintaining productivity. Join Bright Contracts for a free online webinar on the 25 August where our team of experts will discuss how hybrid working has changed the way we work and live and what this change means for your business.

Jul 2021

2

Thesaurus Customer Update: July 2021

Welcome to Thesaurus Software's July update. Our most important news this month include:

-

EWSS changes under Ireland’s Economic Recovery Plan

-

Managing the Annual Leave Backlog as the Country Reopens

-

Thesaurus Software’s new energy efficient office

Free Webinar: EWSS Changes & The Return to Work

The Employment Wage Subsidy Scheme (EWSS) has been extended until 30 December 2021. Join our upcoming webinar where we discuss the extension of the EWSS, including the new enhanced eligibility rules and what you need to know about returning to the workplace. The webinar takes place on 27 July at 10.30 am and is free to attend for all employers and payroll bureaus.

Revenue EWSS guidance is expected to be updated next week.

Bureau Branding in Thesaurus Connect

Bureaus have the ability to add their own firm branding to Thesaurus Connect, including the company name, company logo and contact details. The branding will be visible to clients on their self-service dashboard which will help enhance your client relationships.

Multiple Users in Thesaurus Connect

Employers have the option to add as many users as they wish to their Thesaurus Connect account at no additional cost. Invite managers or an external accountant as a standard user and set up user permissions for different access levels. For example, you can set up a department manager to manage employee leave, with no access to the payroll.

Automatic Enrolment Delayed until 2023

The introduction of automatic enrolment in Ireland will be delayed until at least 2023. When introduced, this will mean by law, that employers will have to enrol their employees in a workplace pension scheme.

Let’s Get Topical – The Vaccine Policy

One year on, the impact of COVID-19 on the employment landscape is hugely significant and has brought about many changes, especially the provisions of an employment contract. This is why Bright Contracts has been a saving grace for many employers as it regularly updates all contract and handbook content.

To get an insight into what Bright Contracts can do, you can watch our video and you can also download a trial version of the software first to get a look at the content and layout.

Thesaurus Software's Sustainability Journey

Here at Thesaurus Software we take environmental responsibility very seriously and are committed to developing our business towards ecological sustainability at both a company and an individual level. Thesaurus Software opened a new purpose-built office in May 2021. We have also recently established a passionate Green Team to educate, promote and inspire sustainability to our employees and our loyal customers.

Jun 2021

30

EWSS Changes and Ireland’s Economic Recovery Plan

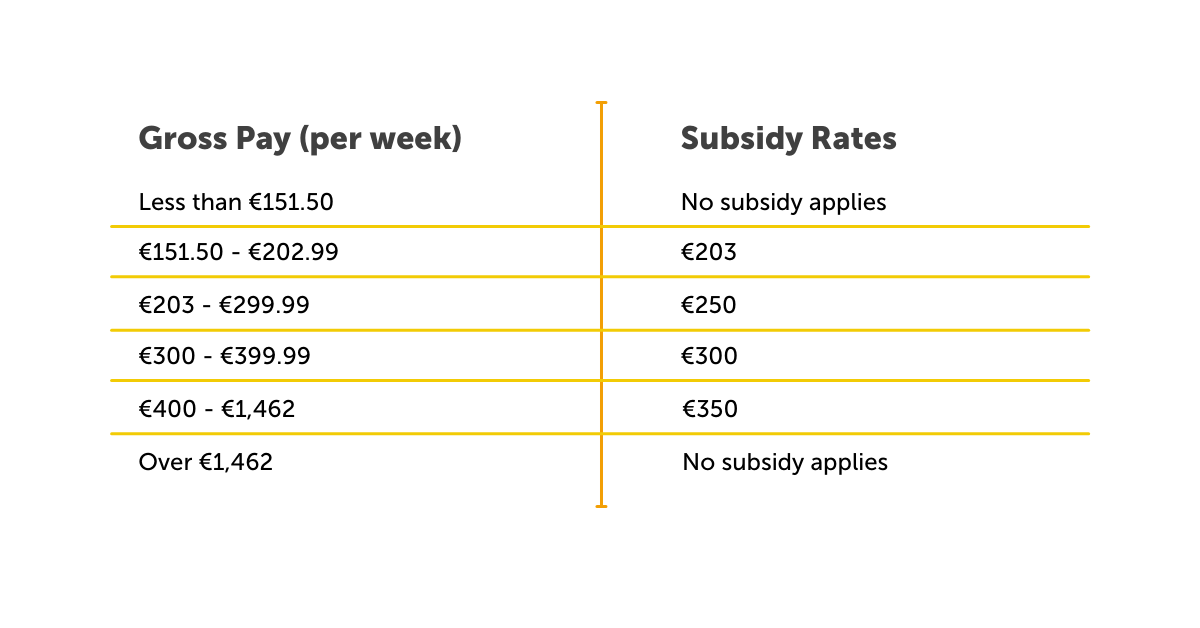

On the 1st of June 2021, the Government announced that the Employment Wage Subsidy Scheme (EWSS) would be extended until the 30th of December 2021 to support businesses as they continue to reopen and recover from the COVID-19 pandemic. The rates below will continue for July, August and September 2021.

A decision on the subsidy rates that will apply for October 2021 onwards, is expected to be announced toward the end of August or early September.

The Government have set out an economic recovery plan for Ireland with measures to help businesses who have experienced significant negative economic disruption due to COVID-19 with a minimum of a 30% decline in turnover or in customer orders. The period for this been extended from 6 months to 12 months under the new recovery plan. If you are unsure whether you are within the guidelines or need more clarity, please see further Revenue guidance.

Although the EWSS is a subsidy payable to employers only and will not impact employee payslips, the scheme must still be administered through the payroll. Employers must operate PAYE on all payments, including regular deduction of income tax, USC and employee PRSI from your employees’ pay. With Thesaurus Payroll Manager you can simply tick that 'you are registered for EWSS and this employee is being claimed for' when processing the payroll.

Remember, you must continue to review your eligibility status on the last day of every month to ensure you continue to meet the eligibility criteria. If you no longer qualify, you should de-register for EWSS with effect from the following day and untick the EWSS tickbox in the payroll software.

Want to find out more about the Employment Wage Subsidy Scheme? Register for our next webinar on 27th July where our panel of payroll and HR experts will answer any questions that you may have.

Related articles:

Jun 2021

1

Thesaurus Customer Update: June 2021

Welcome to Thesaurus Software's June update. Our most important news this month include:

-

Automatic enrolment delayed until 2023

-

How to use Thesaurus Payroll Manager when working remotely

-

Ransomware: How to protect your payroll data

Protect your payroll data from ransomware attacks

With the recent ransomware attack on the HSE still disrupting Irish health services, the subject of ransomware is on all our minds. Taking backups of your data is so important in order to quickly restore data to get back up and running as soon as possible. All data in Thesaurus Connect is stored securely within Microsoft Azure data stores, access to which have been tightly restricted to a limited set of servers and IP addresses.

Employment Wage Subsidy Scheme extended

The EWSS continues to be a requirement for many, with 43% of small businesses still availing of the scheme. Yesterday it was announced that the scheme would be extended until 31 December 2021 with a modification to widen eligibility. The enhanced rates of support and the reduced rate of Employers’ PRSI will remain in place until at least September.

How to manage the annual leave backlog as the country Reopens

A self-service system is the simplest way to manage your staff's annual leave – both from a HR and employee perspective. Give employees control to request annual leave, view leave taken and leave remaining all through an app on their smartphone or tablet.

30 days until TWSS Reconciliation deadline

Employers have until June 30th, 2021, to:

- Accept the reconciliation calculation issued by Revenue

- Make corrections to payslips if necessary, or

- Make an enquiry through MyEnquiries

How Cloud innovation can help simplify the payroll process

By introducing cloud innovation to your business, employers can work more efficiently by streamlining administrative processes and delegating manual tasks to employees. Download our free guide to find out more.

May 2021

31

Ransomware: How to keep your data safe

Unfortunately, we have all become way too familiar with certain concepts over the course of the past year. Concepts such as R number, variants etc. With the recent ransomware attack on the HSE still disrupting Irish health services, the subject of ransomware is on all our minds.

One of the important lessons that we can take from ransomware is how we should have backups to quickly restore data to get back up and running as soon as possible, if data was lost after a breach.

If you use Thesaurus Connect alongside our payroll software, you can be assured that you already have this covered.

All data in Thesaurus Connect is stored securely within Microsoft Azure data stores, access to which have been tightly restricted to a limited set of servers and IP addresses. These data stores are replicated across multiple data centres to protect against a major data loss event impacting a particular data centre. Furthermore, the data itself is encrypted and multiple versions of your employer data are retained as a further safeguard. All traffic into and out of Thesaurus Connect is encrypted using SSL and we undergo regular penetration testing to ensure our public-facing applications are secure and resilient.

This should provide some comfort for you if you are already using Thesaurus Connect.

If the payroll data on your own device is compromised, it should be worthless as many of the key fields (e.g. PPSN, names, bank details) are already encrypted within the software.

If you do not use Thesaurus Connect, please ensure that you keep regular external backups of your data. You might even consider using Thesaurus Connect for this. View the pricing model for Thesaurus Connect where users are billed on a monthly subscription, based on usage where you only pay for what you use.

There are many other Thesaurus Connect benefits that we would be delighted to show you on a free 15-minute demo. Book now.

Related Articles:

May 2021

26

Automatic enrolment delayed until 2023

The introduction of automatic enrolment in Ireland will be delayed until at least 2023. The scheme's purpose is for workers to supplement their state pension as a shocking 40% of private sectors workers rely solely on the state pension to fund their retirement. This will mean by law, that employers will have to enrol their employees in a workplace pension scheme. Auto enrolment was supposed to be introduced at the beginning of 2021. It’s now looking like it will be rolled out in 2023, but it could be extended yet again as the full details for auto enrolment are still being ironed out by the government.

How will auto enrolment work in Ireland?

During the phased roll out of auto enrolment, employees will be required to make initial minimum default pension contributions of 1.5% of their qualifying earnings, increasing by 1.5 percentage points every 3 years thereafter to a maximum contribution of 6% at the beginning of year 10.

Employers will be required to make matching (tax deductible) pension contributions on behalf of the employee at the specified contribution rate to help fund their retirement. This means that employees, employers and the State will each contribute to the member’s account.

What are the criteria?

Employees between the ages of 23 and 60 who earn €20,000 or more per annum (across all employments) will be automatically enrolled into a pension scheme with no waiting period. All employees outside of these criteria may opt in themselves. Mandatory auto enrolment requirements won’t apply to any employee who is already a member of a pension scheme, provided the scheme meets certain minimum standards. Automatic enrolment will be an earnings-related workplace savings system where employees will retain the freedom to opt out if they wish.

Can I prepare for auto enrolment?

It's important that employers understand what they need to do and prepare early. Employers should educate themselves on auto enrolment and familiarise themselves with the terminology. Businesses may need to think about one-off costs to set up an auto enrolment pension scheme, as well as the ongoing cost of paying money into the scheme and managing the process.

If you are a new business and employing staff for the first time after auto enrolment is introduced, your legal duties for automatic enrolment will begin on the day your first member of staff starts work. There will be guidance and support available to ensure that businesses comply with auto enrolment.

Will my payroll software cater for this?

If you’re fortunate enough to use a good payroll software then this will handle and automate the administrative duties for you. With Thesaurus Payroll Manager, there will be no additional charge for any of the auto enrolment features. All of this will be included as part of your payroll software package, which also includes free customer phone and email support.

At Thesaurus Software, we already experienced the rollout of auto enrolment in the UK, with our UK payroll product, BrightPay. Auto enrolment phased in at the beginning of October 2012, starting with the larger UK companies. Every company in the UK enrolled employees into a pension scheme by 1st February 2018. BrightPay UK introduced auto enrolment features which enabled users to automate and simplify the entire process, so we are already experts in the field and well prepared for the rollout in Ireland.

The extension of auto enrolment beyond 2023 looks very possible as the target market for auto enrolment is younger, lower-paid workers in sectors such as Wholesale and Retail Trade, Accommodation and Food Services, Construction and Industry. These sectors have been worst affected by the COVID-19 pandemic. Adding an extra cost to these employers and employees who have been living off the pandemic unemployment payment (PUP) for the past year, to suddenly start paying into a pension fund, seems unfair and unlikely.

To keep up with the latest payroll news, check out our new Bright website. There, you'll be able to register for any of our upcoming payroll webinars and download our payroll guides.

Related Articles:

.png)