Aug 2020

13

The Employment Wage Subsidy Scheme - Important Update

The Employment Wage Subsidy Scheme (EWSS) will replace the Temporary Wage Subsidy Scheme (TWSS) from September 1st 2020. Revenue are currently working through the finer details of the scheme. Below is some information to help you understand the scheme and to help prepare for it should you choose to avail of it.

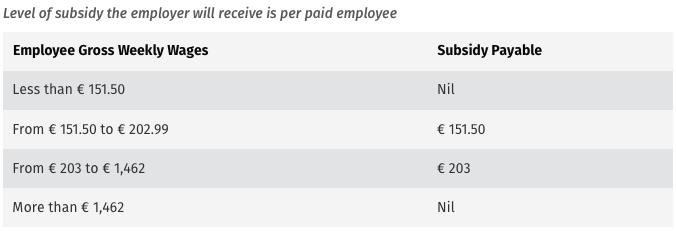

The scheme provides a flat-rate subsidy to qualifying employers based on the number of paid and eligible employees on the employer’s payroll. The scheme is expected to operate until 31st March 2021.

- It is important to note that TWSS will cease on August 31st 2020.

- Employers wishing to avail of EWSS must register for it via ROS. Revenue are planning to have the registration facility available from August 19th.

- Employers must hold up to date tax clearance to register for the scheme and to receive the subsidy payments.

- Employers must be able to demonstrate that their turnover or customer orders between July 1st and December 31st 2020 are expected to suffer at least a 30% reduction as a result of Covid-19. Further information on the qualifying criteria can be found here.

- Registered childcare providers can avail of the EWSS without the requirement to meet the 30% reduction in turnover or customer orders.

- Employers must review their eligibility status on the last day of every month to ensure they continue to meet the eligibility criteria, if they no longer qualify they should deregister for EWSS with effect from the following day (1st of the month)

- Proprietary directors were due to be excluded from the scheme. It is now expected that they will be included where they retain ‘ordinary’ employees on the payroll.

Subsidy Payment:

- The subsidy will be paid to employers monthly after the return due date (14th of the following month).

- Any changes made to payroll submissions after the return due date will not be processed for subsidy payments.

Please note, gross pay includes notional pay and is before any deductions for pension, salary sacrifice etc

Payroll:

- Employers will be required to pay employees in the normal manner i.e. calculating and deducting Income Tax, USC and employee PRSI through payroll.

- EWSS is a subsidy paid to an employer. It will not show on payslips or in myAccount.

Employer PRSI:

A 0.5% rate of employers PRSI will continue to apply for employments that are eligible for the subsidy. This is expected to work as follows:

- PRSI will be calculated as normal via payroll e.g. on PRSI class A1.

- Revenue will calculate a PRSI credit by calculating the difference between the rate on the normal class and the 0.5%.

- The credit will show on the Statement of Account to reduce the employer’s liability to Revenue.

July/August 2020

TWSS and EWSS will run in parallel from 1st July to 31st August. Employees already on TWSS must remain on TWSS until the end of August. Employers wishing to operate the scheme from July 1st i.e. for employees not eligible for TWSS, should process the payroll for these employees in the normal manner and Revenue will review these cases at a later date and refund the subsidy due.

Revenue plan to cater for this via myEnquiries. This will require employers to provide Revenue with the employee details etc. Payment should be made to employers in September.

Publication

A list of employers availing of EWSS will be published in January 2021 and April 2021 to www.revenue.ie.

Software Upgrades (to cater for EWSS)

We plan to release upgrades for Thesaurus Payroll Manager and BrightPay in the week commencing 24th August. Revenue are still fine tuning the details of the scheme and how it will interact with PAYE Modernisation. Therefore, unfortunately, we will be unable to release upgrades any earlier than this.

Apr 2020

28

Temporary Wage Subsidy Scheme - Operational Phase

The Temporary Wage Subsidy Scheme enters the operational phase on 4th May 2020.

In the operational phase, Revenue will provide all employers with details of the maximum subsidy and maximum top up for all employees currently on a J9 PRSI class and for any employees who might be placed on a J9 class during the remainder of the scheme.

This Revenue instruction will be in the form of a file (TWSS file) downloaded from ROS. It will not be an automatic download through the software but instead will require you to log in to your ROS account and download the file there. It will operate in much the same way as you would have downloaded P2C files in the past. The software will then import this file and update the subsidies of all J9 employees automatically.

This TWSS file will be available in ROS from 4th May and we will be releasing an upgrade to our software on the same day to cater for importing the TWSS file.

As the 4th May is a bank holiday, our support lines will be open on 5th May but we have plenty of on screen help and would ask that you only contact support if absolutely necessary.

This should be a one time download as the figures in the downloaded file will be based on payroll submissions made for January and February.

To ensure that you will be able to download the file, it is important that you know your ROS login certificate password and you should ensure that you have this to hand.

For your information, a preview of the relevant ROS screens can be viewed here.

Dec 2019

16

Thesaurus Payroll Manager 2020 is now available for download

Click here to download Thesaurus Payroll Manager 2020

Please note, with our new licensing model there is only one download which covers both Standard and Bureau customers.

Thesaurus Payroll Manager offers a 60 day free trial from the date of installation. This free trial is fully featured with complete functionality. The software can be licensed at any time during the trial period.

We have prepared a help sheet to guide you through the set up.

2020 Thesaurus Payroll Manager caters for all relevant budget changes and includes improved PAYE Modernisation functionality.

Thesaurus Payroll Manager 2020 licenses can be purchased by clicking here.

Year End 2019

Under PAYE Modernisation, employers no longer file a return with Revenue at year end or provide a year end statement to employees.

To access frequently asked questions on year end, click here.

Thesaurus Connect 2020

Thesaurus Connect is an optional add-on that provides automated backup of your payroll data to the cloud and a powerful web-based self-service dashboard for employers and employees.

Connect is billed at the end of each calendar month based on your total number of active employees in that month. Payments for Connect are automatically taken using the payment details you set up in your Thesaurus Account. There is no contract.

Christmas 2019

The management and staff of Thesaurus Software Ltd would like to thank you for your valued custom in 2019 and to take this opportunity to wish you a Merry Christmas and a prosperous New Year.

Our office will be closed on the 24th, 25th and 26th of December, it will re-open on the 27th of December; it will also be closed on the 1st of January.

Dec 2019

3

The evolution of the payroll bureau

If you are an accountant working in practice, you may know that I was once one of you, before I escaped to the leafy suburbs of IT.

While in practice, part of my income came from providing a payroll bureau service.

This came with its challenges as I was tied to it, it wasn't very profitable and not all of my payroll clients understood that I actually needed to have the employees' hours before I could do the payroll.

I would send them their payslips with a summary report, reminded them when to pay Revenue and, in return, they would grudgingly pay my fees.

That was twenty years ago. A lot has happened since then, the two main things being technology and PAYE Modernisation.

I wish that PAYE Modernisation had been around in my time. I could really have used it to convince some of my less conscientious clients to change their ways or else. The "or else" being the big stick of Revenue fines.

Technology has enabled a lot of things. The arrival of the smart phone, cloud services and increased internet speeds have been transformative.

In my practice days, I had one client who considered themselves at the forefront of technology. They would have been blown away seeing the way their employees could now receive their payslips on their smart phone and all the other cool things e.g. holiday requests, a document portal and so on. Mind you, if I was still practising and had that same client, I think that these are things they would expect.

That same client would also expect to be able to log on to their own portal and get whatever payroll information they wanted 24/7.

What we are starting to see now is that this type of client is becoming more of a thing. A large part of the driving force for this is their increasingly youthful workforce. Millennials grow up with a smart phone attached to them and they want as much of their life on it as possible.

Another feature that I wish had been around in my time is getting clients to effectively update their own payroll. What I mean by this is that instead of the various ways they would send the hours (word documents, emails, scraps of paper), they would now log in to their portal, update the hours and these would flow seamlessly in to the payroll. Plus everything would be logged and time stamped, so they couldn't blame me if an employee was overpaid or not paid at all.

All of the above would have certainly transformed my basic payroll service of 20 years ago and forged a client base less likely to defect to some new accountant trending on social media.

The clients would still be getting the same attention as always but the "value added" would be enormous. They get to look much more modern with their employees, which can help with attracting and retaining employees. They also gain access to a HR tool with which they can manage holidays, roll out documents and ensure that employee contact information is always current. The vast majority of small/micro employers have nothing like this.

In the UK, this value added payroll service is more common than it is here and I have asked accountants there what they charge. As you can imagine it varies quite a bit and will depend on the type and size of business, but I have heard rates as high as £10 per payslip for higher net worth clients with the average closer to £5.

This type of pricing would certainly have catapulted my small bureau service in to one of my more profitable activities as the cost of all this technology can be as little as 8c per employee per month.

Paul Byrne fca

Recommended reading:

Thesaurus Connect for Payroll Bureaus & Accountants

Dec 2018

12

Thesaurus Payroll Manager 2019 is now available

Click here to download Standard Version

Click here to download Bureau Version

2019 Thesaurus Payroll Manager caters for all relevant budget changes and for PAYE Modernisation.

There is comprehensive online help and videos accessible through the software and available on our website. You should find this help useful in light of the new PAYE system.

What you should do now is install the software by clicking on the relevant link above and following the on screen instructions. We have prepared a helpsheet to guide you though the installation and setup.

Install your ROS digital cert as per the helpsheet instructions. 'How to' videos are also included. Please note that if you are a tax agent and have a TAIN associated with your digital cert, the cert must be installed as an agent cert and NOT as an employer cert. Revenue's help line for ROS digital cert issues is 01 7383699.

After installing your cert, retrieve your employees' RPNs by clicking on the RPN icon. You will then be able to ensure that Revenue has sent you the correct credits and cut offs for all of your employees. Any employees not returned by Revenue are placed on emergency tax.

Year End 2018

To access the 2018 end of year guide, click here

Christmas 2018

The management and staff of Thesaurus Software Ltd would like to thank you for your valued custom in 2018 and to take this opportunity to wish you a Happy Christmas and a prosperous New Year.

Our office will be closed on the 24th, 25th and 26th of December, it will re-open on the 27th of December; it will also be closed on the 1st of January.

Dec 2017

17

2018 Thesaurus Payroll Manager is now available

Click here to download Standard Version

Click here to download Bureau Version

We have prepared a help sheet to guide you through the set up.

2018 Thesaurus Payroll Manager caters for all relevant budget changes and a host of new features.

Many of the new features have been prompted by PAYE Modernisation, which will be effective from 1st January 2019, and by GDPR. Further information on PAYE Modernisation can be found here

The main new features are as follows:

- More priority to the P2C download process, a log of all P2C imports and reminders when P2Cs have not been imported

- Direct emailing of the Payroll Preview, Payroll Summary and P30 reports from within the software

- Emailing of a single PDF document containing all employee payslips for a pay period

- List of Employees ROS file, Revenue will request this towards the latter half of 2018

- Automated password retrieval facility

- Greater file encryption

- The bureau version also includes a "late payrolls" feature

Please note, from 1st January 2018, Revenue will tax Illness Benefit by adjusting an employee's tax credits and cut off points. As a result of this change there will be more frequent P2Cs issued for employees.

Employee Gift Cards

Thesaurus Payroll Manager continues to offer gift card integration with One4All. Orders are delivered in a plain envelope, addressed to the employer, with all gift cards enclosed. The deadline for orders and payments to ensure delivery in time for Christmas is Wednesday 20th December at 12 p.m.

Find out more about gift cards, the tax advantages and payroll integration here

Year End 2017

To access the 2017 end of year guide, click here

Register here for our free webinar 'Year End Process - Thesaurus Payroll Manager' which will be presented on January 23rd 2018.

Christmas 2017

The management and staff of Thesaurus Software Ltd would like to thank you for your valued custom in 2017 and to take this opportunity to wish you a Happy Christmas and a prosperous New Year.

Our office will be closed on the 25th and 26th of December, it will re-open on the 27th of December; it will also be closed on the 1st of January.

Nov 2017

10

2018 and Beyond

With GDPR kicking in next May and PAYE Modernisation going live in January 2019, accountants and other bureau payroll providers will have a lot to contend with.

PAYE Modernisation will involve major process changes for many of your clients (just to ensure that a file is submitted to Revenue on or before the payroll date). Ensuring that payrolls are processed using the most up to date tax credits and cut off point information is also an essential part of the new system.

Because Illness Benefit becomes taxable through the P2C file from January 2018, ensuring that you use the most recent P2Cs will become a must before each and every pay run from as soon as January 2018.

We have been busy making updates to Thesaurus Payroll Manager 2018 to better prepare you for all of the above changes. Here is a quick outline of the software changes that we have made for 2018. These changes are in addition to those which cater for Budget 2018.

GDPR

Password retrieval is now an automated process which will require a recovery email address for each payroll client.

We have added a bit more file encryption so that you will be better protected if your system is compromised, your laptop is stolen or a memory stick goes missing.

You may be aware that our recent year end upgrade includes a feature whereby backup files can be securely sent to our support staff, should it be required to help with a support query.

Optionally, our cloud add on, Thesaurus Connect, will enable you to backup securely to a secure European Azure server and restore securely from that server to your payroll. Thesaurus Connect will also provide you with the added benefit of giving your clients and their employees direct access to their personal data, ensuring transparency and assisting with Data Subject Requests.

PAYE Modernisation and Illness Benefit Changes

Thesaurus Payroll Manager 2018 gives much more priority to the P2C download process, also keeping a log of all imports and reminding you when P2Cs have not been imported.

To prepare you for the new reality, where payrolls will be required to be processed in real time, we have included a “Late Payrolls” button to help identify those payrolls that are falling behind. This will be particularly useful where you have hundreds of payroll clients.

Knowing that your own processes will probably need to be more streamlined with real time submissions, we have added (and will continue to add) automated client emailing from within the software. Our initial 2018 release will include this for the payroll preview report. It will also include emailing of a single pdf document containing all payslips, the emailing of the P30 and emailing of the payroll summary report. It should be noted that these emails are transmitted securely through our Thesaurus servers and do not require third party software. This is the same system that our payslip emailing currently uses.

Towards the latter half of 2018, Revenue will ask you to submit a list of employees for each employer through ROS. The ability to prepare this file is in our initial 2018 release. The file is required by Revenue for data alignment. Their aim is to have knowledge of the correct employment details for as many employees as possible when PAYE Modernisation goes live.

At Thesaurus Software we plan to help you with PAYE Modernisation as much as we can. We have already been through these changes in the UK and can use this experience to help address issues before they arise.

We will bring you further updates throughout 2018, in many cases via free webinars (which will also help with your structured CPD requirements). Register for our next free webinars here.

We will begin testing the new real time systems with Revenue from April 2018 and we’ll keep you appraised of our progress.

Finally, we have included a few more importers should any of your clients (or colleagues) choose to move from other payroll software.

Related articles

May 2017

27

PAYE Modernisation - an update

What is PAYE Modernisation?

From 1st January 2019, whenever Irish employers pay their employees, a file must be submitted (electronically) to Revenue containing details of these payments. The contents of this file will be similar to the details currently submitted in the annual P35, however, unlike the annual P35, this file must be submitted each pay period. Therefore, in most cases, the submission will be made either weekly or monthly.

This real time information will enable Revenue to ensure that employees are receiving their correct credits and cut off points. This in turn should mean that the incidence of year end over/underpayments of income tax will be substantially reduced.

Employees will also be able to log on to their Revenue account and, among other things, view the information that the employer has submitted in respect of them.

What direct effect will this have on employers?

In the main, this should be good for employers. Most of the “P” forms (P45s, P46s, P60s and P35s) will be no more as the new periodic file will supersede them.

Payroll software will automatically submit the periodic file to Revenue without the need to physically upload a file on the ROS website. In addition, payroll software will get automatically updated with employee credits and cut off points, again without the need to check for and download P2C files from the ROS website.

The correct treatment of illness benefit should also be facilitated by the new system, eliminating the guesswork and complication involved in the current system.

So, all in all, PAYE modernisation should represent a positive change for employers.

What are the possible downsides for employers?

For most employers there should be no downside, in fact the whole payroll process will be somewhat easier, thanks mainly to payroll software interacting directly with Revenue’s systems.

For those employers who do things after the fact e.g. they pay employees an amount and then sort it out later by working things backwards with the software (net to gross), the transition to PAYE modernisation could be somewhat problematic.

Submission of the periodic file will be required in or around the pay date and late submissions may lead to Revenue intervention. Submission of correction files will be accommodated by the new system, however constant correction submissions may also lead to Revenue intervention and possible interest and penalties. Therefore submission of “best guess” periodic files, followed later by correction files, to reflect what was actually paid, will not be advisable.

These employers need to regularise their business processes so as to ensure that the payroll they process is done so in real time, either by using payroll software or by using their accountants or payroll bureaux on a more timely basis.

This change in mindset is perhaps the largest single challenge facing PAYE modernisation.

Thesaurus Software and PAYE Modernisation

Thesaurus Software is already collaborating with Revenue through the payroll software representative body, the PSDA (Payroll Software Developers Association), to help ensure that the final version of PAYE Modernisation is workable and ready for implementation by 2019.

Our experience in developing similar functionality in the UK means that our development team have the expertise and experience to create the best solution for our Irish customers.

In keeping with our pricing culture, there will be no additional charge for the new functionality.

Interested in finding out more about PAYE Modernisation? Register now for our free PAYE Modernisation webinar. Click here to find out more.

Mar 2017

29

Auto enrolment for Ireland?

The current Minister for Social Protection, Leo Varadkar, has, on a number of occasions, mentioned his desire to introduce auto enrolment in Ireland.

This will be a welcome and necessary development as it is unlikely that the current levels of state pension will be sustainable in the medium to long term.

The UK is nearing the end of its auto enrolment roll out and there are, I believe, a number of lessons learnt.

On the face of it, the requirement to enrol an employee into a pension scheme (based on age and earnings), to make deductions/contributions and to allow for opting out, would all appear very straightforward. Not so! Employer guidance extends to many hundreds of pages and the rules are unnecessarily complex.

My first suggestion is to keep it simple. If the minister has his way, auto enrolment may commence around about the same time as Revenue’s Smart PAYE project. This will be a lot to take on board at the one time, particularly if the UK’s auto enrolment rules are anything to go by. Examples of how to make it simpler - link everything to pay date (not pay period) and forego the requirement to apportion.

Next, I would suggest that a common filing standard is adopted at the outset for both enrolments and contributions. This was attempted in the UK, without success. The main problem was the pension companies and their differing systems. Ideally an all encompassing file specification would be mandated and the pension companies would just have to accept. Plus there would need to be common business rules for the various fields in the specification. Lessons learnt here from the SEPA roll out which resulted in similar looking files for the various banks but with very different business rules!

Postponement is a handy feature in the UK system but it does complicate things further. If everything else can be made simple and seamless, then postponement may not be required. Hand in hand with this would be the suggestion that all employees are enrolled no matter what their earnings are and no matter how temporary their employments are for. They would still have the ability to opt out.

Also, the creation of a government backed master trust (similar to NEST in the UK) would further obviate the need for postponement as postponement is generally used to get a pension scheme set up.

In relation to opting out, the opt out window should be linked to the actual pay date of first deduction rather than the auto enrolment date (which itself has many potential definitions) or scheme join date.

Employee communications is another big part of the whole process. The UK communications have evolved and simplified over the last few years and their present format would be fine for Ireland.

Finally, the actual calculation of the pension deduction/contribution should be based on all (taxable) earnings. The UK rules limit the calculation to a portion of the earnings, further increasing its complexity.

The above are my main suggestions and stem from our involvement with the UK system through our UK payroll software, BrightPay, where we have ongoing engagement with employers, accountants, professional bodies, HMRC, the Pensions Regulator, NEST, IFAs and the various pension providers.

Feedback welcome at paul@thesaurus.ie

Nov 2016

17

PAYE Modernisation

Revenue propose to roll out real time reporting of PAYE from 1st January 2019.

This means that payroll software will submit data (much akin to the annual P35) to Revenue each pay period.

The technology behind this may pose some challenges, not least for Revenue who will need to handle significant volume. Most payroll software companies will be able to adapt, assuming that file specifications, test environments etc. are provided to them in good time by Revenue.

The core issue is the possible expectation that the periodic payroll data transmission should be sent to Revenue “on or before” each pay date. This is the position in the UK where RTI (real time information) has been in place for a number of years. The “on or before” requirement has caused problems and HMRC had to relax their requirements (and penalties regime) in the initial year or so.

“On or before” represents a seismic shift for bureaus and employers alike and a much better alternative might be the submission of monthly returns. This is where the monthly P30 is enhanced to include all the P35 fields.

Automatic retrieval of P2C data would be a nice feature of PAYE modernisation and hopefully this will be included as part of the overall package.

The consultation document can be found at http://www.revenue.ie/en/spotlights/paye-modernisation.html

Submissions are invited up to 12th December 2016.

Interested in finding out more about PAYE Modernisation? Register now for our free PAYE Modernisation webinar. Click here to find out more.