May 2014

1

Eircodes - the new postcodes for Ireland

Every address in Ireland will receive its unique Eircode in Spring 2015.

"The Eircodes will help the public, businesses and public bodies to locate every individual address in the State. Eircodes will bring many benefits to the daily lives of people, householders and businesses. Currently, around 35% of addresses - mainly in rural areas - do not have a unique name or number in their address. With Eircodes, delivery of services and goods will be much easier and quicker to these addresses." - www.eircode.ie

When people receive their Eircode next year, they will not need to change their address. They will just add the Eircode whenever it is needed or useful, so it will be very easy to start using it straight away.

Each Eircode has seven-characters that are unique to each mailing address. The seven characters are divided into two parts – a Routing Key and a Unique Identifier.

For businesses, some of the main things to consider are:

- Stationery, customer forms, websites and other places where your address is shown. Perhaps, plan print stocks of existing stationery items accordingly in the run up to Eircode Launch Date in Spring 2015.

- If you use a software package in your business, you will need to check with its supplier as to their plans for when and how they intend to incorporate Eircodes into the package.

- Some staff training may be needed especially if your systems or processes have changed somewhat to take advantage of Eircodes.

Our software offerings will all be updated to include an extra address field for eircodes and will incorporate all the required validation logic.

Feb 2014

14

What might be coming down the tracks for Irish employers

Here is an article that recently appeared in the online version of Business & Finance and that should be of interest to all Irish employers.

http://businessandfinance.com/whats-coming-down-the-track-for-irish-employers/?ref

Jan 2014

22

Will Ireland ever follow the UK lead and adopt auto enrolment?

Thankfully, we are living longer! This, however, presents a huge challenge for any country’s retirement strategy. Back in 1950, there were 7.2 people aged 20–64 for every person of 65 or over in the OECD countries. This is projected to reduce to 1.8 by 2050. The math is stark. To fund a state pension which pays modern day equivalents to people retiring at 65 will soon become an impossible task. Apart from increasing the already huge tax burden to pay for pensions, there are really only two ways of addressing the problem. One, the retirement age needs to increase and, two, people will need to have private pensions or other incomes to supplement their state pension.

Auto Enrolment addresses the latter. It imposes a legal obligation on employers to enrol their employees in pension schemes and to contribute to these pensions. A deduction is made from the employee’s pay plus the employer contributes as well. Auto Enrolment began in the UK for very large employers in 2012 and is being rolled out to include all employers by 2017. The combined minimum deduction and contribution of 2% is designed to ease employees and employers into the concept but this combined level rises to 8% by 2018.

It should be noted that employee participation is optional. The employer must enrol them but they may subsequently opt out. Therefore, employees who feel that they are otherwise covered (e.g. through rental property and/or other investments) do not have to partake in Auto Enrolment.

The various rules surrounding Auto Enrolment and the structures that need to be put in place are numerous and represent a major undertaking for government, employers and pension companies.

Auto Enrolment (or similar) is an absolute necessity and it is somewhat surprising that Irish plans in this regard are not more advanced.

Dec 2013

4

What's new in 2014

Thesaurus Payroll Manager 2014 is now available. Click here to download.

2014 Budget Changes to cater for:

- Reduced rate of 4.25% employer’s PRSI to revert to 8.5% (affecting PRSI classes A0 and AX)

- Full year application of LPT (local property tax)

- Illness benefit waiting days increased to six from three meaning that employers will not have to adjust for tax until waiting days have elapsed

- Minor changes to BIK mileage bands

- PRD (pension levy) lower rate reduced from 5% to 2.5%

SEPA

As more banks become SEPA ready, the roll out of payroll software upgrades for these banks will be targeted to those customers affected, so, when preparing a SEPA file, the software will see if a specific upgrade is available for that bank.

As more banks become SEPA ready, the roll out of payroll software upgrades for these banks will be targeted to those customers affected, so, when preparing a SEPA file, the software will see if a specific upgrade is available for that bank.

Other users will not be inconvenienced by these targeted upgrades.

AIB, Danskebank, ABN Amro and Bank of America are currently catered for within Thesaurus Payroll Manager. Permanent TSB, Ulster Bank and Bank of Ireland are planned this month or 1st January at the latest. The remaining banks will follow as they become SEPA ready and we have successfully processed test files with them.

Cleaner graphics

This takes advantage of the fact that only 0.5% of users are now using 800 x 600 resolution and, for those that are, scroll bars will appear for the larger forms.

The “restore down” button at the top right of the main form previously forced users to keep the program in a maximised state. This button will now allow a user to show the program on part of their screen only. So, for example, you might have a spread sheet showing on your screen alongside the payroll. Some payroll sections will still take over the full screen e.g. payslip print to screen.

General improvements to the software upgrade process and many more 'under the hood' enhancements.

Sep 2013

24

What our customers say!

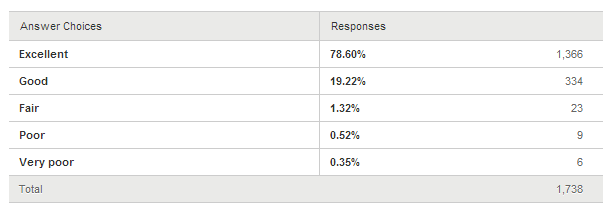

In a recent customer survey, 97.82% of respondents ranked the quality of our customer support as Excellent or Good.

This customer support covers our payroll software (Thesaurus Payroll Manager and BrightPay), our employment contracts software (Bright Contracts) and our accounts software (Solutions Plus) and is free to all registered users.

While the excellent/good percentage achieved would be way ahead of industry standards, we hope to reduce the 2.18% who ranked our support as fair or poor!

Aug 2013

12

LPT and the Revenue slam dunk

The introduction of Local Property Tax (LPT) in last year’s budget provoked much outrage and opposition. Marches, public meetings and demonstrations were staged in many parts of the country to protest against the new tax. One of the more popular suggestions was to boycott LPT but all of this noise and bluster was in vain as the measures introduced by the tacticians in Revenue were decisive in ensuring almost total compliance.

When planning the implementation of LPT, Revenue paid particular attention to the payment option “deduction at source”. Although only 5% of compliant taxpayers would eventually opt for this particular payment method, the crucial issue was that nearly all non-compliant taxpayers would be caught in this net. “Deduction at source” in the main refers to deduction from salaries or pensions.

The consultation process between Revenue, the payroll software companies and their representative body PSDA (Payroll Software Developers Association) was detailed and ensured that the mechanics of the LPT deduction in payroll was clear and simple. One of the main reasons that the start date was deferred until 1st July was to ensure the readiness of both Revenue and the payroll software companies for the new deduction.

Just this week, Revenue is preparing to issue P2Cs to employers containing updated LPT amounts. Many of the amounts will be enforcement estimates. Employers will not be able to tell the difference between normal LPT and enforcement LPT. The employers receiving these P2Cs have no choice but to comply, otherwise they will become liable themselves in much the same way as if they failed to deduct PAYE or PRSI.

No matter how militant an employer might be against LPT, it is unlikely that they will risk becoming liable for it on behalf of their employees.

All of the anti LPT campaigners advocating non-compliance really had no chance from the outset when pitted against the Revenue strategists.

Bright Contracts – Employment contracts and handbooks

BrightPay – Payroll Software

Jul 2013

29

The Payroll Software Choice - Thesaurus Payroll Manager or BrightPay

In January 2013, we launched our new payroll software, BrightPay. The rollout of BrightPay was met with a very positive response, particularly from those users who switched to avail of its added functionality.

We understand the comfort of sticking with what you know. Therefore we will continue to offer Thesaurus Payroll Manager for the foreseeable future – it is not being phased out!

BrightPay is built using modern technology, offering some immediate benefits:

- The user interface is very clean, simple and fluid. With full control over every pixel on the screen, we have put extra attention into how it looks and feels. BrightPay optimally fills your screen no matter what size display you use. All in all, it makes for a much better experience.

- By re-architecting the software from the ground up, we were able to design it with many advanced payroll features in mind, including:

- The ability to roll back one or more employees to any period, from any period.

- Very flexible reporting that allows you to build the exact report you want.

- Live payroll calculation previews which update as you type.

- The ability to add unlimited payments, rates, additions, deductions, BIK, etc. on a payslip.

- An interactive calendar for entering annual leave, sick leave, parenting leave, etc.

- Support for employees in multiple departments.

- Support for opening multiple employer files simultaneously.

- Future-proof for more upcoming features and integrations.

We encourage you to download BrightPay and have a look. If you wish to switch from Thesaurus Payroll Manager to BrightPay we would advise doing so at the start of a tax year, as it allows for an easier transition (with full import support) than a mid-year switch.

Remember if you hold a Thesaurus Payroll Manager licence you can avail of a BrightPay licence for the same tax year free of charge.

Bright Contracts – Employment contracts and handbooks

BrightPay – Payroll Software

Jul 2013

29

Foreign Currency Transactions - an area where you could save money

If you are paying any of your employees (or suppliers) in sterling or another non-euro currency, then you are probably experiencing higher banking fees and less competitive exchange rates than you should be. This is an area where you can reduce costs if you investigate alternative options to the conventional bank plus gain time with faster transfer options.

One alternative provider to your bank is TransferMate, who offer an impressive fast, efficient and cost effective service. We have been highly impressed with their service. Estimate the savings you can make by using their “savings calculator” at www.transfermate.com.

Bright Contracts – Employment contracts and handbooks

BrightPay – Payroll Software

Jul 2013

29

2013 SFA Awards

We told you in December how, much to our delight, we had been shortlisted as a finalist in the 2013 SFA Awards, “Innovator of the Year” category directly resulting from our innovation in software development. This was in no small part attributable to our new dynamic software, BrightPay and Bright Contracts.

The final winner of the category was Megazyme, who were also announced as the overall winner of the awards.

Megazyme is a biotechnology company which employs 34 people and is involved in the development of analytical test kits and reagents for the agricultural, food, wine, dairy and biotechnology industries.

We extend our congratulations and good wishes for their continued success.

Bright Contracts – Employment contracts and handbooks

BrightPay – Payroll Software

Jul 2013

29

Recent Customer Survey

We are constantly working towards improving the entire customer experience from customer support to improved functionality of the software. We would like to thank you for the time taken to complete our online survey and we will use your feedback to improve our service to you.

An iPad mini was up for grabs for taking part and the winner of this was Margaret Sullivan of Shellfish De La Mer Ltd.

Bright Contracts – Employment contracts and handbooks

BrightPay – Payroll Software