Sep 2018

24

The Death of PAYE ‘P Forms’

The introduction of PAYE Modernisation is just months away, leaving employers bewildered and confused about what the new PAYE system will entail. Essentially, all of the current ‘P Forms’ - P30s, P35s, P60s, P45s and P46s - will be abolished, and in their place will be real time periodic submissions to Revenue. Employers will be required to send these submissions, known as Payroll Submission Requests (PSRs), to Revenue each time an employee is paid. In most cases, this means a file will be submitted either weekly or monthly.

As Revenue will be receiving file submissions each pay period, the annual P35 will no longer be required. In addition, this periodic file will eliminate the need for P30s.

The files being submitted each pay run will also have details of employees commencing and employees leaving. This will mean that P45s and P46s are no longer required to be completed by the employer.

At the end of a tax year, the individual taxpayer will be able to view and print their official certificate of earnings and deductions directly from the MyAccount portal on the Revenue website. This means that P60s should no longer be needed.

PAYE Modernisation with Payroll Software

PAYE Modernisation should not add to an employers workload. In fact, employer responsibilities will be greatly reduced. Payroll software will be able to seamlessly integrate into the Revenue system, enabling employers to make the periodic submission directly from the payroll software at the click of a button.

Thesaurus Software is at the forefront when it comes to PAYE Modernisation compliant payroll software. With two different payroll packages to choose from - Thesaurus Payroll Manager and BrightPay - customers will be guaranteed leading edge software and expertise. We have already experienced the introduction of a similar real time reporting system with our UK payroll software.

Book a demo today to find out just how easy PAYE Modernisation can be when using the right payroll software package.

Related Articles:

Sep 2018

21

BrightPay wins ‘Payroll Software of the Year’

BrightPay was announced the winner of ‘Payroll Software of the Year’ at this year’s AccountingWEB’s Software Excellence Awards.

The awards, which took place in London, are held by AccountingWEB - an online community for accounting and finance professionals in the UK. The winner is decided by a public vote, whereby members are asked to rate the software systems they use to determine the best products on the market.

It’s a great achievement for BrightPay to win the prestigious award, especially when you look at the number of larger software companies offering payroll in the UK. BrightPay also has a 99% customer satisfaction rate, and is used to process payroll for over 120,000 businesses across the UK and Ireland.

Marketing Manager at BrightPay, Karen Bennett says: “We’re delighted to win this award; it’s fantastic for BrightPay and our team to be recognised by our customers and the AccountingWEB members, and a massive thank you to everyone who voted for us.”

Paul Byrne, Managing Director, says: “It’s a real pleasure and honour to receive this award. It’s great to see such recognition for all the hard work we have put in. We work hard each year to improve the BrightPay experience for all of our customers, both in terms of the payroll software itself and the customer support that we offer.”

BrightPay in Ireland

In the Irish market, BrightPay is currently preparing for PAYE Modernisation, a real time reporting system that is being introduced on 1st January 2019. Essentially, employers will be required to report pay information to Revenue each pay period. This overhaul of the Irish PAYE system aims to ensure that employers and employees have the most accurate, up-to-date information relating to pay and tax deductions.

A similar system was introduced in the UK in 2013, which was seamlessly integrated into BrightPay UK payroll software. We have the relevant experience to ensure that PAYE Modernisation is just as streamlined in BrightPay Ireland. By switching to BrightPay Ireland, you can be assured that you have PAYE Modernisation compliant payroll software.

Book a demo today to see how BrightPay can help you with PAYE Modernisation.

Are you missing out on our newsletter? We will not be able to email you without you subscribing to our mailing list. You will be able to unsubscribe at anytime. Don’t miss out - subscribe today!

Related Articles:

- Which is really better - the existing PAYE system or PAYE Modernisation?

- Manually calculating payroll with PAYE Modernisation

- PAYE Modernisation: Frequently Asked Questions

- BrightPay Ireland - Customer Survey - The Results are in!

Sep 2018

18

Thesaurus Payroll Manager - Customer Survey Results

Opinions and feedback from our customers matter to us. We love to hear comments and suggestions from users in order to improve our customers’ experience. We recently conducted a customer survey to get an insight into what customers think about Thesaurus Payroll Manager and to find out what new features our customers want. We appreciate all the feedback received from this year’s survey and would like to say a massive thank you to everyone who took part.

The survey looked at customer satisfaction rates, software performance and customer support. We were delighted to discover that the customer satisfaction rate for our payroll software has remained at its exceptional 99%. The satisfaction rate for the customer support offered has also kept its 99% satisfaction rate.

One of the most common suggestions from this year’s survey was for the ability to reverse the payroll for individual employees rather than having to re-input the payroll for all employees. We are delighted to confirm that Thesaurus Payroll Manager 2019 will allow you to make corrections to previous pay periods for individual employees.

Thesaurus Connect

The survey also included some questions regarding our optional cloud add-on, Thesaurus Connect. With an overall satisfaction rate of 91%, customers rated Thesaurus Connect’s features highly, including the secure online backup (99%), payslip & P60 online accessibility (98%), HR document upload (98%), value/price (97%) and its ability to reduce payroll administration tasks (90%).

Watch this short video for an overview of how Thesaurus Connect can meet your payroll and HR needs.

PAYE Modernisation

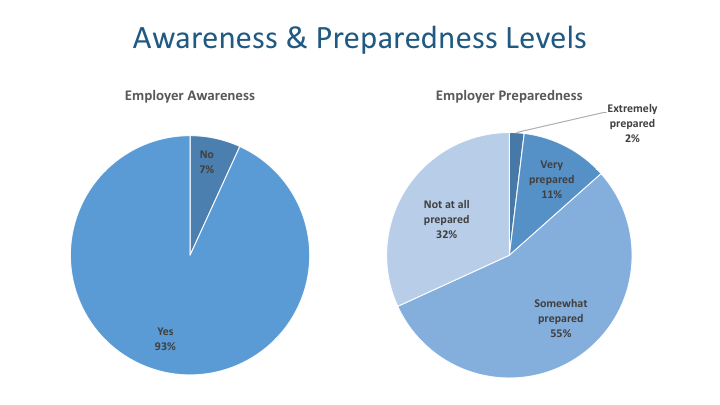

This year’s survey also looked at PAYE Modernisation. With the introduction of this new system just three months away, we were surprised to find out that almost 7% of employers said that they were not aware of the upcoming changes.

When looking at the question ‘Do you feel prepared for the introduction of PAYE Modernisation?’, the results were also quite worrying. Just 2% of employers said that they felt extremely prepared, while a massive 32% said they felt not at all prepared.

It is important that all employers understand the new PAYE changes being implemented. We are running a series of free PAYE Modernisation training webinars with a guest speaker from Revenue. Make sure to book your place now.

Alternatively, you can book an online PAYE Modernisation demo with Thesaurus Payroll Manager to find out what the software will look like in 2019.

Related Articles:

Sep 2018

14

Data Protection Commissioner teams up with Thesaurus Software for free GDPR webinar

The introduction of the General Data Protection Regulation (GDPR) in May brought with it new and more stringent rules around the security of personal data and how it is processed.

The new legislation places increased responsibilities on all those parties that process personal data. All organisations, regardless of size, have had to comply with the GDPR. As part of their preparation for the GDPR, employers were required to introduce or update existing policies regarding personal data held.

Free Webinar: GDPR 3 Months On! (20th September @ 11.00 am)

Thesaurus Software is hosting a free GDPR webinar this September where we will have a guest speaker from the Data Protection Commissioner’s office. The webinar will be CPD accredited and free to attend.

In this webinar, we will look at what’s new in GDPR, how it may affect your business and what we have learned from the GDPR three months after it’s introduction. We will also discuss how Thesaurus Software can help your organisation utilise the new data protection regulations for the benefit of you, your customers, suppliers and employees.

Webinar Speakers

Laura Murphy - Laura is an experienced Human Resource professional with unique global experience. She has worked in-house and in external consultancy roles for SMEs, international organisations and public sector bodies across the UK and Ireland.

Jennie Hussey - Jennie is an experienced Employment Law Advisor with a demonstrated history of working in the HR and payroll industry.

Guest Speaker: Graham Doyle - We are pleased that Graham Doyle, Head of Communications from the Data Protection Commissioners office will be joining us to discuss GDPR and the effect it is having on all businesses.

Places are limited - book your place now!

Related articles:

- GDPR Compliant Payroll Software

- What happens if I don’t comply with GDPR

- GDPR & Thesaurus Connect

- GDPR & The Future of Payroll

Thesaurus & BrightPay Newsletter - Are you missing out?

We will not be able to email you about webinar events, special offers, legislation changes, other group products and payroll related news without you subscribing to our newsletter. You will be able to unsubscribe at anytime. Don’t miss out - sign up to our newsletter today!

Sep 2018

3

The Existing PAYE System VS PAYE Modernisation: Which is really better?

The Irish PAYE system was first implemented back in 1960 with no major changes since its introduction. Ireland today is very different compared to what it was 58 years ago - so why should the PAYE system remain the same?

For the past few years, Revenue has been working on a much needed and well overdue facelift of the Irish PAYE system. The new system, known as PAYE Modernisation will replace existing PAYE processes from 1st January 2019. Many employers are left wondering what the difference is between the two systems, and more importantly, which system is really better?

Key Changes with PAYE Modernisation

With PAYE Modernisation, there will be no P30s every month or quarter and no P35s at the end of the tax year. In fact, all ‘P forms’ will be eliminated.

Instead, submissions will need to be sent to Revenue in real time, detailing employee pay and tax information. These will be known as Payroll Submission Requests (PSR), and will need to be submitted ‘on or before’ the date an employee is paid each pay period. In most cases, this means a file will be submitted either weekly or monthly.

Some employers are worried that this will massively add to an employer’s workload. Realistically however, the payroll process will require much less of an employers time. Payroll software will be integrated with Revenue so that for employers, the file will be automatically prepared and sent directly to Revenue at the click of a button.

The retrieval of tax credits will also be automated, which should ensure that the correct credits are being applied by employers. With payroll software, Revenue integration will enable employers to receive changes to an employees tax credits directly from Revenue and update it in the payroll software at the click of a button. This file will be known as a Revenue Payroll Notification (RPN).

Regardless of how frequently an employer will be required to send submissions to Revenue, the payment date will remain the same. There will be no change to the method that employers currently use to make the Revenue payment.

Find out what else the new system has to offer with Thesaurus Software’s free online PAYE Modernisation webinars.

PAYE Modernisation: Made Easier with Payroll Software

Although employers will still have the option to process their payroll manually, it will be very cumbersome and tedious, with the changes becoming more of a hindrance than beneficial.

Employers are advised to use PAYE Modernisation compliant payroll software so that the entire system will be smooth and integrated. With payroll software, employers will benefit from a reduced workload as a result of PAYE Modernisation, while making the payroll process much easier and streamlined.

Thesaurus Software is the number one payroll software provider in Ireland with two payroll packages to choose from - Thesaurus Payroll Manager and BrightPay.

Book a demo today to see how PAYE Modernisation will affect your business.

Related articles:

Aug 2018

20

Thesaurus Connect: The GDPR Survival Toolkit

Thesaurus Connect is tailored to help you overcome some of the key challenges GDPR presents when processing payroll. The payroll itself is still processed on Thesaurus Payroll Manager’s desktop application, however the payroll information is stored online on a secure cloud server. As the payroll information is stored online, it has allowed us to bring you even more benefits to help you with GDPR compliance.

Secure Cloud Backup

With the GDPR, it is important to keep a copy of payroll files safe in case of fire, theft, damaged computers or cyber attacks. Essentially Thesaurus Connect is a secure cloud backup, keeping employee’s payroll data safe and secure. A chronological history of all payroll backups will be maintained which can be downloaded and restored at any time.

Self-Service Remote Access

GDPR includes a recommendation to provide remote access to a secure system, which would provide employees with direct access to their personal data. With Thesaurus Connect, employees can be invited to their own password protected self-service portal. Employees can login to the portal 24/7 on any device, including PC’s, Macs, tablets and smartphones (essentially anywhere that they have access to an internet browser) or there is also an employee smartphone app where employees can login and get notifications directly to their device.

Password Protected Payslip Portal

With Thesaurus Connect, employees can access a payslip library where they can view and download all historic and current payslips. Employees can also access payroll documents such as P60s, HR documents such as their contract of employment, personal data held by their employer and past and scheduled leave.

Right to Rectification

The right to rectification of personal data held is an important employee right under the GDPR. With the employee self-service portal, employees can update their basic personal details such as their phone number and postal address.

Accurate Employee Records

Data controllers and data processors must ensure that the personal data held is relevant and up-to-date. As employees can update their basic personal details on Thesaurus Connect, this ensures that employers have access to the most accurate personal details for employees.

User Limitations and Restrictions

With the GDPR, data controllers must ensure that, by default, only personal data which is necessary for each specific purpose of the processing can be accessed. Therefore, payroll processors should only have access to the personal data that is strictly required for processing the payroll. This is referred to as data minimisation, or privacy by default. With Thesaurus Connect, users can be set up so that they only have access to the information needed to complete their specific responsibilities. For example, there may be a HR manager who should not have access to employee’s payroll data, or a payroll processor who should not have access to employee documents or employees marked as confidential.

Central Location for Employee Documents

Thesaurus Connect acts as an all in one central location to store all things employee related, including payroll, HR and other employment related documents. Employers have the ability to upload documents that apply to all employees (e.g. company handbook), documents that are unique to individual employees (e.g contract of employment), or even documents that are relevant to a particular department.

Secure Document Exchange

If you are a payroll bureau, you can invite your payroll clients to Thesaurus Connect to their own online employer dashboard. This is a secure portal for client communications, eliminating the need to send documents with sensitive personal information by email. Clients can view employee payslips as soon as they have been finalised, they can run their own payroll reports and view amounts due to Revenue. This offers an additional layer of GDPR protection for client’s payroll data.

Essentially, by introducing Thesaurus Connect in your business, you will be taking steps to be GDPR compliant. Book a demo today to have a look at Thesaurus Connect.

Related articles:

Jul 2018

11

Meet the experts behind PAYE Modernisation!

PAYE as you know it is changing - in just a few short months Revenue are revamping and modernising the existing PAYE system. This is called PAYE Modernisation. This new PAYE system will be very different. Instead of a monthly or quarterly P30, a submission containing pay information will need to be made to Revenue each time an employee is paid. This is known as a Payroll Submission Request, or a PSR.

By sending this information to Revenue in real time, it will enable employers to pay the correct amounts of deductions for every employee, also eliminating the need to submit a P35 at the end of the tax year. Overall, this will improve the accuracy, ease of understanding and transparency of the PAYE system for all stakeholders, including employers, employees and Revenue.

While PAYE Modernisation will bring many benefits, some employers are finding it difficult to fully understand the new system; When will payments need to be made to Revenue? Can corrections be made after the submission has been sent? What will happen when broadband is not available or very poor and weekly submissions have to be made?

Ask the Experts!

Every employer has concerns that they are unsure about. Thesaurus Software is giving you the chance to join the experts to ask them any queries you may have with free online PAYE Modernisation webinars.

Thesaurus Software has the expertise and understanding regarding PAYE Modernisation. We have already experienced the implementation of a similar real time reporting system in the UK, known as RTI. Thesaurus Software’s Managing Director, Paul Byrne, is a key stakeholder working with Revenue towards the design of this new PAYE system for Ireland.

For the webinars, Paul Byrne will be joined by guest speakers Sinead Sweeney, who is the PAYE Modernisation Change Manager for the Revenue Commissioners, and Sandra Clarke, Partner at BCC Accountants and a Council Member of the Irish Tax Institute.

Click here to register and find out more about Thesaurus Software’s upcoming PAYE Modernisation webinars.

Related articles:

Jul 2018

4

PAYE Modernisation: What you need to know

PAYE Modernisation - The Facts

PAYE Modernisation is a mandatory payroll requirement that will be introduced from the 1st of January 2019. It won’t change the way you calculate your PAYE information, it just means that you will need to send your data through to Revenue in real time. Employers should take steps to ensure their existing records are up-to-date and correct.

PAYE Modernisation Compliant Software

To comply with PAYE Modernisation you will need to utilise fully compliant payroll software. BrightPay is working directly with Revenue to ensure this new real time process is as easy as possible for our customers. BrightPay is a simple and easy to use payroll software that makes your payroll journey hassle free. With a 99% customer satisfaction rate and free customer support, BrightPay is the payroll solution to help you with PAYE Modernisation.

Free PAYE Modernisation Training

BrightPay has teamed up with Revenue as guest speakers to bring you free PAYE Modernisation training webinars throughout the year. All webinars are CPD accredited and free to attend. Our next webinar is PAYE Modernisation: Understanding and implementing the new legislation which takes place this September. Places are limited - book your place now to avoid disappointment.

Payroll bureau webinar | Employer webinar

PAYE Modernisation: Frequently Asked Questions

PAYE Modernisation or Real Time Reporting is probably the biggest overhaul of the PAYE system since PAYE was introduced back in 1960. Many employers are worried about this new system and how it will affect their payroll processing. Find out some of the most common questions people have asked about PAYE Modernisation.

Proposed Client Letter for PAYE Modernisation

Keeping your clients informed and up-to-date will be a key step to successfully transfer to the new PAYE Modernisation system. To assist our customers, we have created a template letter for payroll bureaus to send to their clients as an initial communication with regards to PAYE Modernisation. We will also have a sample letter of engagement available for payroll bureaus later this year.

Related Articles:

Jul 2018

2

GDPR and Payroll Processing: Do I need consent from my client’s employees?

Businesses must provide their employees with information on what happens to their data, for example sharing employee’s personal data with a payroll bureau who processes the payroll. Employee personal data can be stored and managed by a payroll bureau, bookkeeper or accountant for the sole benefit of correctly paying their wages, paying the correct tax and providing a payslip. All of this legitimately falls under the remit of the GDPR legislation.

Employee Consent

Many bureaus have expressed concern and confusion in relation to getting consent from client’s employees and securely distributing payslips. Payroll bureaus do not need to seek consent from individual employees that the payroll is processed for. However, the employer will need to inform their employees that they are sharing their personal information with a third party.

An employee cannot withdraw their consent for their personal data to be used as part of the payroll processing. It should be noted that bureaus should keep only the personal data that is strictly required for the purpose of the payroll. This is referred to as data minimisation or privacy by default.

GDPR Webinars

BrightPay is running free webinars to help you with what you need to know about GDPR. These webinars are free to attend for both payroll bureaus and employers. Places are limited - book your place now.

- Payroll Data & GDPR - What you need to know (4th July)

This webinar will look at the biggest areas of concern including emailing payslips, employee consent and your legal obligation. We will also look at some important steps to achieve GDPR compliance. Click here to book your place now.

- GDPR - 3 Months On (20th September)

This webinar will look at what have we learned from the GDPR 3 months on and how we can help your organisation utilise the new regulations for the benefit of you, your customers, suppliers and employees. This webinar will also include a guest speaker from the Data Protection Commissioners office. Click here to book your place now.

Related articles:

May 2018

2

GDPR - What do you need to know?

Free GDPR Webinars for Employers & Payroll Bureaus

Employers process large amounts of personal data, not least in relation to their customers and their own employees. Consequently, the GDPR will impact most if not all areas of the business and the impact it will have cannot be overstated. Join us for our free webinar where we will discuss what GDPR is, why employers need to take it seriously and how you can prepare for the 25th May deadline.

Employer Webinar | Bureau Webinar

How can Thesaurus Connect help with GDPR?

Under the GDPR legislation, where possible the controller should be able to provide self-service remote access to a secure system which would provide the data subject with direct access to his or her personal data. Thesaurus Connect is a self-service option which will give employees online remote access to view their payroll information 24/7.

Free Guide: GDPR & The Future of Payroll

The guide will uncover the ins and outs of the impact of GDPR on your payroll processing, highlighting the biggest areas of concern including emailing payslips, employee consent and your legal obligation.

Data Processor Agreement - Free Template

Whenever a data controller (e.g. a payroll bureau client) uses a data processor (e.g. payroll bureau) there needs to be a written contract in place. The contract is important so that both parties understand their responsibilities and liabilities. To assist our customers, we have created a template Data Protection Agreement which can be used by data processors as an addendum to any existing agreements.

Download Data Protection Agreement

GDPR Employee Privacy Policies

GDPR requires employers to give information to their workforce, setting out in particular the personal data (employee information) the employer holds about them, how it is used, and with whom the information is shared. The information required is more detailed than is currently required under existing data protection laws. Employers need to ensure that their employee privacy notices accurately reflect how they process employee data and are in line with GDPR requirements. GDPR compliant employee policies are available through the Bright Contracts software.

Thesaurus Newsletter - Are you missing out?

GDPR is changing how we communicate with you. After May 2018, we will not be able to email you about webinar events, special offers, legislation changes, other group products and payroll related news without you subscribing to our newsletter. You will be able to unsubscribe at any time. Don’t miss out - sign up to our newsletter today!