Aug 2019

7

Save the trees: Instant Access to Payroll Data without any paper trail

We don’t get paychecks anymore, do we? The concept has been banished to TV shows set in the 1960s, where we see a down-on-their-luck salesman contemplate their paper cheque with sad resignation.

Outside of these cultural portrayals, we’ve all moved along to bank transfers. And yet, there’s still one hangover from the era of manual, paper led payroll: the payslip.

Many of us, despite receiving our pay electronically, will receive a paper payslip detailing precisely how much we’ve earned and the taxes we’ve paid. Often these slips will clutter on the employee’s desk, unsecured and aimless.

But how much can you innovate with the old fashioned payslip, anyhow? Quite a bit, actually. This resource heavy, old school process can be taken entirely online. All employee payslips can be securely stored and instantly accessible on Thesaurus Connect.

From here, individual employees can also access their HR documents such as their contract of employment through a personal self-service portal as and when they need it. That’s less legwork for you and a simple, well-organised process for the employee.

This can completely replace the more labour intensive process you have now. Payslips can be set up by the user to be automatically available on Thesaurus Connect with an email notification to employees, eliminating the need to email them or print it out to hand out, one-by-one manually.

But, of course, employers should still have the choice to do it their way. The business can always email, download or print payslips from Thesaurus Payroll Manager. Whichever way the client would prefer is fine, but it remains seamless for you, the accountant.

It’s all about what’s most comfortable. With 24/7 access to employee payslips and other payroll reports, missing payslips and confusion will be consigned to the past. No more manual processes, no more unnecessary legwork -- just the information when you need it, in one location, accessible from anywhere for the accountant, employer and employee.

And with Thesaurus Connect, the self-service process empowers the employee beyond payslips. The self-service portal is a powerful, multi-purpose cloud tool.

Employees can access their own personal leave calendar, request annual leave, view and change their contact information, access payslips and other payroll and employment-related documents. Clients can even give managers access to approve leave for their department and restrict access the other sensitive payroll information such as employee salaries. It’s payroll software with integrated cloud automation that’s about so much more than just pay.

Book a Thesaurus Connect demo today to see just how much time cloud automation and integration can save you.

Jul 2019

23

Using intelligent automation to streamline the payroll process

There’s a part in Joseph Heller’s classic novel Catch-22 where the character asks a military officer: “What do you do when it rains?" The captain answers the question frankly. "I get wet.” The captain’s resignation and simple acceptance echo the accountant’s attitude to admin. What else is there to do when processing payroll? Same as getting wet in the rain, payroll processing comes assigned with a burdensome bureaucracy.

Or does it? There are a lot of boxes to be ticked in the accounting profession. There are laws, statutes, regulations, each adding another bit of work to your already busy schedule. Indeed, the profession will never be without its share of bureaucracy and admin. But payroll doesn’t have to mean legwork and elbow grease. By using intelligent automation and the right system, you can cut out many of the repetitive (and plain tedious aspects) of payroll processing. Repetition becomes a thing of the past, too.

With Thesaurus Connect it couldn’t be simpler. Payroll reports are automatically synced to the online employer dashboard where users can log in and view payroll information from anywhere. This includes payslips, periodic reporting, P60s, and P45s.

But perhaps for payroll bureaus the most critical way you can reduce the admin burden is by devolving it, so it’s not all on you. Using the password protected self-service portal, your clients and their employees can login online to view their payroll data. For routine tasks, clients can help themselves. The more mundane aspects of payroll processing hum along in the background while you focus on the important stuff. All while maintaining complete control over the entire process.

So what do you do when it rains? You don’t have to get wet - and if you’re a payroll bureau, there’s a more straightforward, smarter way ahead. Admin doesn’t need to be a by-word for payroll, with Thesaurus Connect it can be a profitable, low touch service.

Book a demo today to find out how Thesaurus Connect can streamline your payroll processing.

Jul 2019

11

Save Time with Thesaurus Connect

Time is one of the most valuable assets to any company. We all get overwhelmed with our workload from time to time, Thesaurus Connect can permanently minimise this happening to you. It’s always nice to tick off your to-do list one by one with no interruption. Thesaurus Connect can help you achieve this and save you TIME.

Traceability. Everything on Thesaurus Connect can be traced, from annual leave requests to documents that have been viewed. All holiday requests approved or rejected, are listed on the dashboard of your Thesaurus Connect. This also includes sick days and unpaid leave for all employees. Any documents that are uploaded by the employer can be viewed by the relevant employee. The activity log allows the employer to view who has read each document with a time stamp. Employees can request to change any personal information on Thesaurus Connect, the new information is logged on the notification section which makes it quick and easy for the employer to view and change. All the above contributes to the employer being completely GDPR compliant.

Independence. Thesaurus Connect gives the employee independence when it comes to managing their personal information and payslips. They have secure access to their own payslips from any location with the use of the free App. They can download and print recent and past payslips without having to request them from the Payroll department. They also have secure access to their own personal information and can request to change any personal details on file at any time. Every employee can view their own profile from work or in the comfort of their own home.

Mobility. Thesaurus Connect give both the employer and employee the option of mobility. Both the employer and employee dashboard can be accessed from any PC or desktop once the username and password are entered correctly. It also allows the back-up to be restored on any PC once Thesaurus Payroll Manager is installed, this feature comes in particularly handy if the PC or laptop the employer has previously been working on crashes or is damaged. If for any reason an employee needs to apply for annual leave or access any payslip, this can all be done from a remote location once logged onto their own Thesaurus Connect.

Efficient. Thesaurus Connect is extremely efficient. It allows the employer to carry out everyday tasks with ease. Once the employer data is synchronised from Thesaurus Payroll Manager it immediately appears on the Thesaurus Connect dashboard. Once the employer has finalised the payroll for that pay period it can be synchronised and backed-up immediately. It also streamlines the new employee process allowing the new employee to view their Contract of Employment and Employee handbook online while also eliminating the old-style paperwork usually passed from employer to employee.

Watch our short employer video below which explains how Thesaurus Connect can streamline the workload in the payroll department. Move into the cloud where everything is completed with ease.

Jul 2019

11

Auto Enrolment: More payroll changes on the way

The government has announced major changes to the pensions system in Ireland, including State, private and public service pensions, which aims to address Ireland’s significant retirement savings gap.

The Taoiseach confirmed that the Government's key goals are to "create a fairer and simpler contributory pension system where a person's pension outcome reflects their social insurance contributions, and in parallel, create a new and necessary culture of personal retirement saving in Ireland".

From 2020, a new State pension system will come into place based on a ‘total contributions approach’ (TCA) where a person’s lifetime contribution will more closely match the benefit they receive. Under TCA, a person's contributory pension will be proportionate to the contributions they make, with fair regard for periods of child rearing, full time caring, and periods in receipt of social protection payments.

Although the State pension will be reformed and will remain at the core of the pension system in Ireland, a new retirement savings system is still needed to supplement the State pension.

Minister Regina Doherty said: “It is increasingly evident that most Irish workers are not saving enough, or indeed at all, for their retirement years. Many people will be faced with a serious reduction in their living standards when they retire – a fall in income they clearly do not want.”

This new 'Automatic Enrolment' retirement savings system will be introduced from 2022 to support and encourage personal savings provision. It is intended that employee savings in this scheme will be supported by employer and State contributions.

Under this system, workers will be ‘automatically enrolled’ into a workplace pension scheme with the option to opt-out, should they choose to do so. However, looking at the international experience of similar systems, for example in the UK, once enrolled, workers tend to remain in the scheme.

Automatic enrolment is a natural extension of the payroll process, making more sense for employers to process the majority of these duties within their payroll software. At BrightPay, we have experienced the rollout of auto enrolment in the UK first hand, where we introduced auto enrolment features which enabled users to automate and simplify the entire process.

Thesaurus Payroll Manager will be able to seamlessly cater for Auto Enrolment without any additional costs to the software, and also includes free phone and email support.

Jun 2019

25

PAYE Modernisation: The good, the bad and the ugly

Latest Revenue figures for PAYE Modernisation show that 161,000 employers have successfully submitted over 2 million payroll submissions in respect of over 2.6 million employees.

Although the new system has proved very successful overall, the first four months of the new real time payroll reporting system also faced some recurring issues with payroll submissions. Here are the 10 most common errors seen by Revenue:

- Employers mistakenly sending the payroll data to Revenue more than once.

- Employers incorrectly creating duplicate employments for the same employee.

- Payroll submissions, or parts of payroll submissions, failing the validation process.

- Employers ceasing employment for employees in error by incorrectly including cessation dates in payroll submissions.

- Employers failing to apply the most up-to-date Revenue Payroll Notification (RPN) when running payroll.

- Employees being taxed on the emergency tax basis where an RPN is available.

- Incorrect operation of emergency tax e.g. employee reported with emergency tax, but no tax deducted by the employer.

- ‘Gross Pay’ shown as less than ‘Pay for Income Tax’ and/or ‘Pay for USC’.

- No USC deducted where the employee is not USC exempt, and similarly, USC deducted where the employee is USC exempt.

- Employers paying their tax liability twice in error e.g. by setting up both a ROS Debit Instruction and Variable Direct Debit for the same payment period.

Where errors arise, employers should immediately rectify them to ensure that they are not included in future payrolls. Early action also reduces the possibility of a Revenue intervention. Revenue will continue to assist any employer who is experiencing genuine difficulty in complying with the new PAYE requirements. However, it is important to remember that employers who fail to engage with Revenue or who persistently breach the PAYE Regulations are liable to a €4,000 penalty per offence.

It is in every employer’s interest to ensure that the data submitted to Revenue is accurate and in line with the employee’s payslip record, especially now that employees have access to their pay and tax details through their myAccount. Any discrepancies between payroll details on an employee’s payslip and those reported to Revenue could result in employees seeking clarification from their employer.

Jun 2019

18

5 ways Connect can help your business

In case you haven’t already heard, Thesaurus Connect is our exciting new add-on to Thesaurus Payroll Manager that introduces powerful new features such as a free self-service app for employees and a web based self-service dashboard for employers. It also includes a secure and user-friendly way to backup and restore your payroll data on your PC to and from the cloud.

- Security – Never lose your payroll data again. With Connect, you can safely and securely backup your payroll data to the cloud. Thesaurus Connect maintains a chronological history of your backups. You can restore or download any of the backups to your PC at any time. You can restore a backup onto your existing PC, or you can simply download a backup onto a new computer.

- Productivity – Save time and man hours. Connect takes the hassle out of managing your HR duties. Track, approve and analyse your Leave Calendar anytime, anywhere. Issue, track & store employee documents and distribute them at the click of a mouse. The employee app allows your employees to view and download their own payslips, request leave and update their personal details without taking up their manager’s time.

- Connectivity – Stay connected 24/7. Have instant access to all your vital payroll & HR information. You can access your employees annual leave calendars, upload documents for your employees, see your Revenue reports and much, much more.

- Compliance – Don’t risk a €5,000 fine or a jail sentence! With the advent of GDPR, PAYE Modernisation and the recent changes in employment contract law, Connect is the best tool to help you stay compliant and up to date.

- Peace of Mind – Thesaurus Connect is hosted by Microsoft Azure. It's fully encrypted, totally secure and completely GDPR compliant.

Jun 2019

11

Top 6 Thesaurus Connect FAQ’s answered

1. What is the Cloud?

The cloud refers to software and services that run on the Internet, instead of locally on your computer. Cloud services can be accessed through a Web browser like Firefox or Google Chrome, and some companies (including Thesaurus!) offer dedicated mobile apps.

2. How do I do a back up to Connect?

To back up your employer file to Thesaurus Connect at any time, simply synchronise your Thesaurus Payroll Manager data to Thesaurus Connect. This can be done by:

- Selecting Process Icon No. 9 or 'Connect > Synchronise Employer', followed by 'Click here to synchronise (upload) employer data'.

3. Can I still use my old back up system?

Of Course! There’s no limit to how many back ups of your data that you can do.

4. Is it safe?

Absolutely. All communication between Thesaurus Payroll Manager on your PC and the Thesaurus Connect servers is carried out on a safe channel with maximum security. As you or your employees browse the online dashboards, we use various methods to protect against things like data injection, authentication hacking, cross site scripting, exposure flaws, request forgery, and the many other types of vulnerabilities.

Thesaurus Connect is powered using the latest web technologies and hosted on Microsoft Azure for ultimate performance, reliability and scalability.

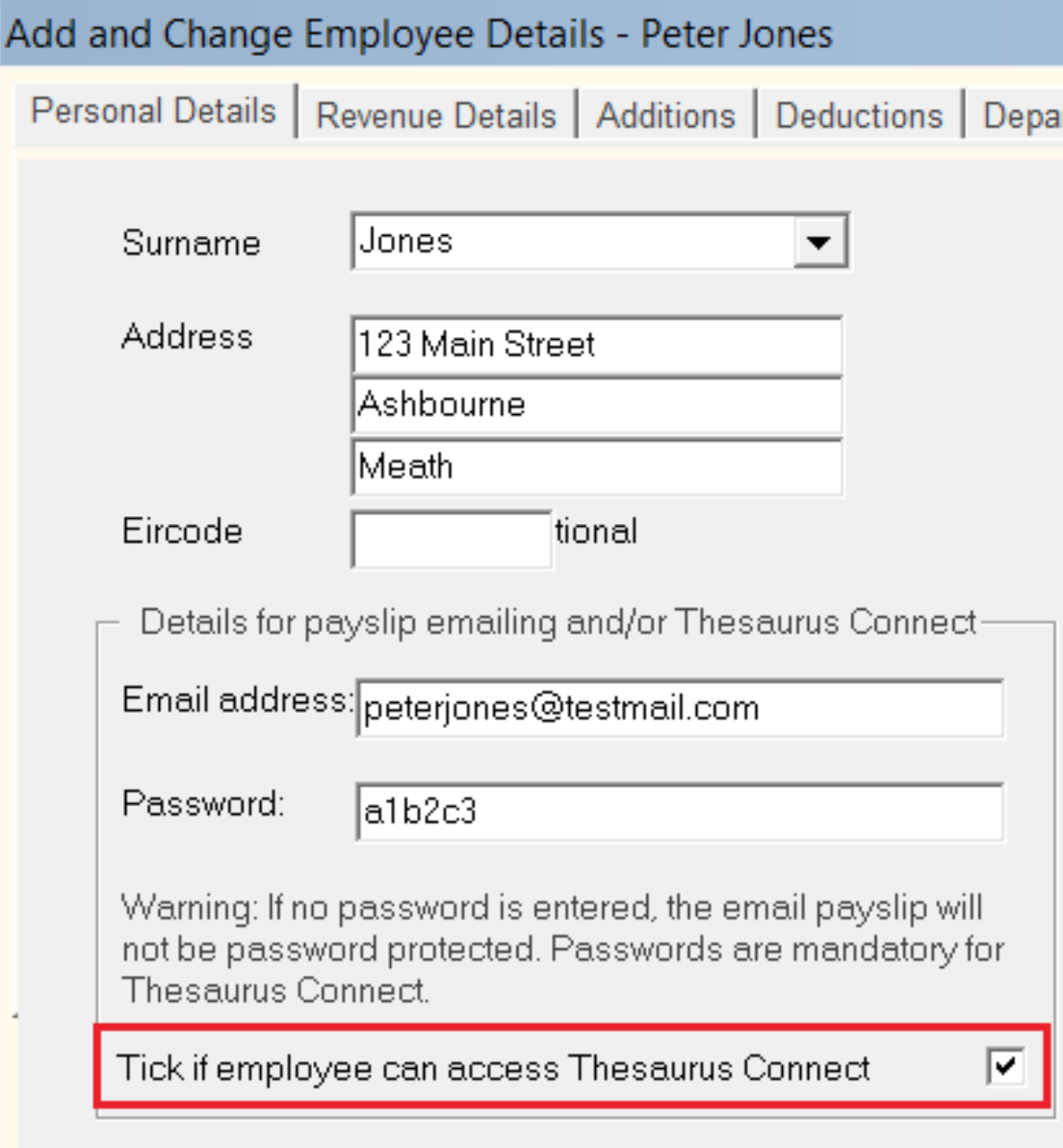

5. How do I allow my employees to access Connect?

- Within your Thesaurus Payroll Manager software, open the company you require.

- Go to 'Add/Amend Employees' and select the employee from the drop down menu.

- Under Personal Details, enter the employee's email address and a password of choice within 'Details for payslip emailing and/or Thesaurus Connect'.

- Tick to indicate the employee is to have access to Thesaurus Connect:

- Click 'Update' on completion.

- Now synchronise your employer to Thesaurus Connect for your changes to take effect via Process Icon No. 9 or 'Connect > Synchronise Employer'.

You are now ready to send invitation emails to your employees.

6. Does it matter how big or small my business is?

No, Connect has so many different features, from the secure back up to the ability to upload and distribute documents that all employers big or small will find it a must have tool for their business, now and in the future.

Jun 2019

5

Thesaurus Customer Update: June 2019

PAYE Modernisation Update: Payroll and tax details now available to employees in myAccount

With real time reporting now in place for employers, Revenue has turned their focus to the benefits of this new system for employees. Since the 15th of May, all employees can now view their payroll details, as reported by their employer, through myAccount. Employers should be aware that employees can now view any discrepancies between payroll details on an employee’s payslip and those reported to Revenue.

Read more | Revenue help guide

5 ways Thesaurus Connect can help your business

Thesaurus Connect introduces powerful new features such as a free self-service app for employees and a web based self-service dashboard for employers. It also includes a secure and user-friendly way to backup and restore your payroll data on your PC to and from the cloud. Discover five ways that Thesaurus Connect can help your business.

New User Management Interface for Connect

Our new User Management feature for Thesaurus Connect makes it more seamless and quicker for users to be set up or amended. It offers the option to select permissions for multiple employers at one time for a standard user. There is also a new permission to allow standard users to connect and synchronise employers from BrightPay to Connect and a new feature to mark an employer as confidential.

Top 6 Thesaurus Connect FAQs answered

From the concept of cloud in general to getting your employees up and running on their smartphone app, we have answered a wide range of questions about Thesaurus Connect. Here are the top six most common questions we get asked.

From the support desk: A mistake has been made on the payroll. How can this be corrected?

Corrections must always be dealt with on the basis of 'follow the money'. This means that if an employee has been underpaid/overpaid in a previous pay period, the correction of the underpayment/overpayment should be made in the next payroll run you perform. Where an employee, however, has physically received a payment amount which differs to the amount shown in the payroll, this will require a 'correction submission' to be made to Revenue in order to rectify the error. Information on correcting a payment can be found here.

More FAQs | Online Documentation | Video Tutorials

GDPR: 1 Year On

It’s been one year since the introduction of the GDPR, and employers and accountants are reviewing their systems, processes and procedures on an ongoing basis to ensure they are doing their best to avoid hefty non-compliance penalties. Find out how Thesaurus Connect can help you overcome some of the key challenges GDPR presents when processing payroll.

Jun 2019

4

New User Management Interface for Thesaurus Connect

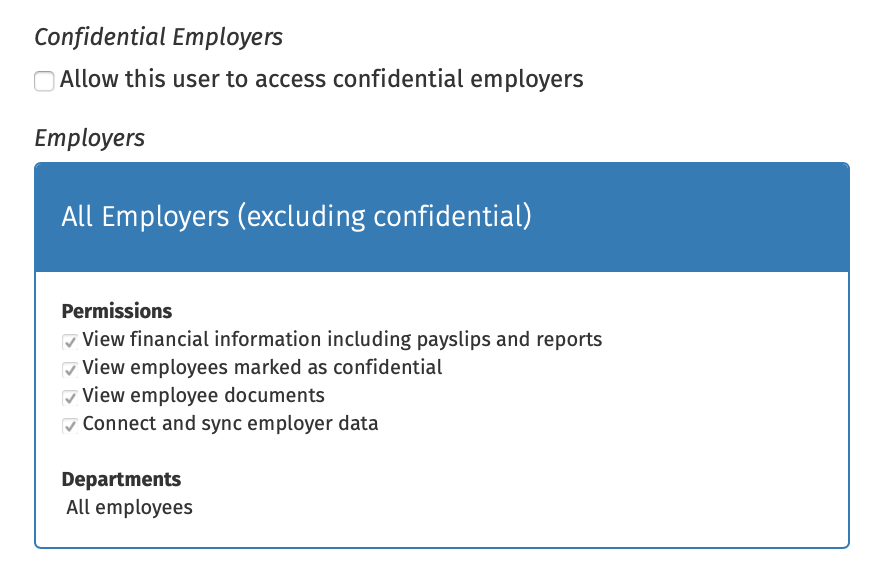

Our new User Management feature for Thesaurus Connect makes it more seamless and quicker for users to be set up or amended. It offers the option to select permissions for multiple employers at one time for a standard user. There is also a new permission to allow standard users to connect and synchronise employers from Thesaurus to Connect and a new feature to mark an employer as confidential.

Types of Users for Connect

- An administrator has full control over a Thesaurus Connect account, with the ability to edit account settings, add other users, redeem purchase codes, connect employers and manage all employer and employee information and processes.

- A standard user typically has access to just one employer in your Thesaurus Connect account, although they can be granted access to multiple employers if required. A standard user can view employer (and associated employees) information with various levels of restrictions and permissions.

User Permissions & Confidential Employers

As before, standard users can be set up so that they are restricted by department, so that they can only see information pertaining to employees that are associated with a particular department. They can also be restricted from accessing certain information, such as the ability to:

- View financial information including payslips and reports

- View employees marked as confidential

- View employee documents

- NEW: Connect and synchronise employer data

- Approve employee self-service requests

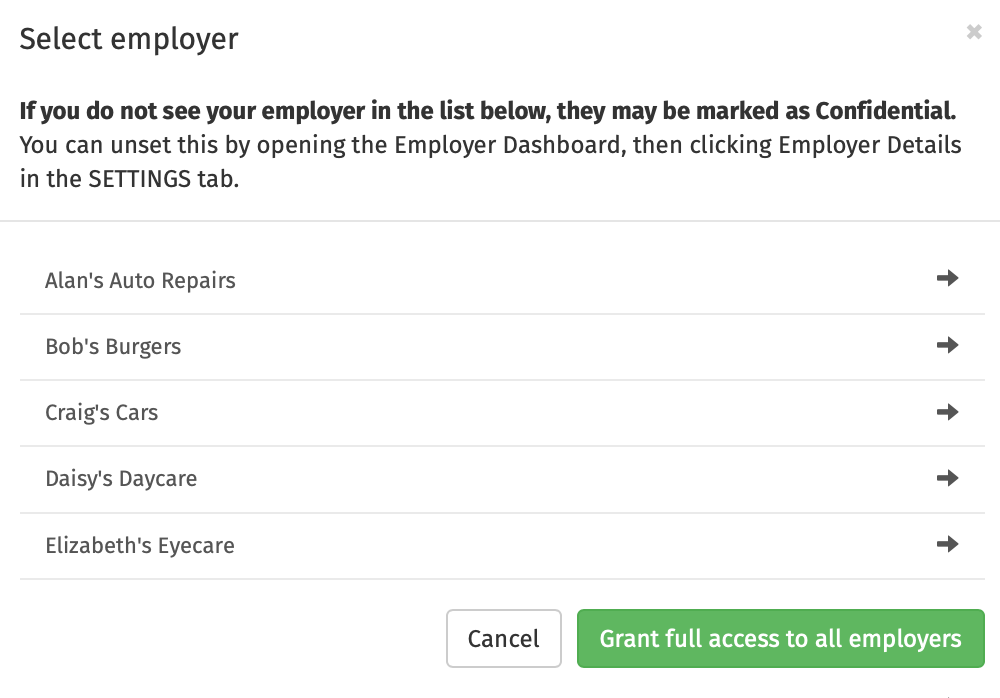

You now also have the option to grant a standard user access to all current employers, along with any new employers linked to the Connect account. Simply select ‘Grant Full Access to all Employers’ and select the permissions you wish to be applied to the user, including the new permission to Connect and Sync employer data.

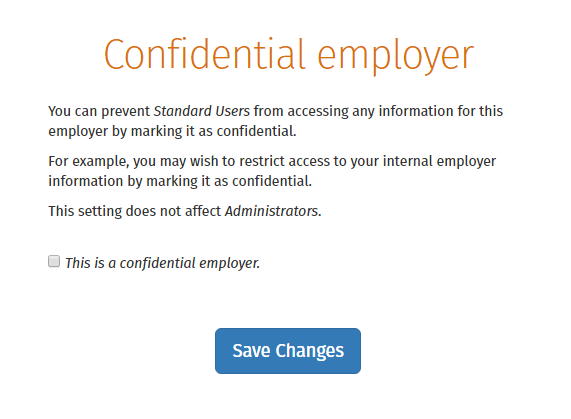

If required, an employer in Connect can be marked as confidential under the settings tab on the employer’s dashboard and only administrators on the Connect account will be able to view this employer. Standard users can only access confidential employers if they are given permission to do so.

May 2019

21

PAYE Modernisation Update: Payroll and tax details now available to employees in myAccount

PAYE Modernisation is now in full force with the majority of employers having seamlessly transitioned to the new reporting system. From January until the end of April this year, some 161,000 employers have successfully submitted over 2 million payroll submissions in respect of over 2.6 million employees.

With real time reporting now in place for employers, Revenue has turned their focus to the benefits of this new system for employees. Since the 15th of May, all employees can now view their payroll details, as reported by their employer, through their myAccount. Further improved services through myAccount will also follow later in the year.

Employers should be aware that employees can now view any discrepancies between payroll details on an employee’s payslip and those reported to Revenue. It is therefore very much in every employer’s interest to ensure that the data submitted to Revenue is accurate and in line with the employee’s payslip record.

For more information about employee pay and tax details in myAccount, visit Revenue’s new PAYE Modernisation for Employees helpguide.