Oct 2018

10

Budget 2019 Employer Payroll Focus

Pay As You Earn (PAYE)

- There was no change to tax rates for 2019, the standard rate will remain at 20% and the higher rate at 40%.

- Standard Rate Cut Off Points (SRCOPs) will be increased by €750 from 1st January 2019.

Earned Income Tax Credit

The Earned Income Tax Credit will be increased by €200 from €1,150 to €1,350.

Home Carer Tax Credit

The Home Carer Tax Credit will be increased by €300 from €1,200 to €1,500.

Universal Social Charge (USC)

- Exemption threshold remains at €13,000

- 4.75% rate reduced to 4.5%

- 2% threshold increased by €502 from €19,372 to €19,874

- No change to 8% rate

For 2019, USC will apply at the following rates for those earning in excess of €13,000

| Rate Bands | Rate |

| Up to €12,012 | 0.5% |

| Next €7,862 | 2% |

| Next €50,170 | 4.5% |

| Balance | 8% |

Medical card holders and individuals aged 70 years and older whose aggregate income does not exceed €60,000 will pay a maximum rate of 2%.

The emergency rate of USC remains at 8%.

Non PAYE income in excess of €100,000 is subject to USC at 11%.

National Training Levy

The National Training Levy of 0.8% which is collected as part of the employer PRSI contribution will increase to fund further and higher education, the increases are as follows:

- 0.9% in 2019

- 1% in 2020

Pay Related Social Insurance (PRSI)

With the increase in the National Training Levy which is collected as part of the employer PRSI contribution, employer PRSI will increase as follows:

- 8.6% increased to 8.7%

- 10.85% increased to 10.95%

The weekly threshold for the higher rate of employer PRSI will be increased from €376 to €386.

The rates of PRSI for Class S will remain unchanged but the range of benefits available to Class S contributions will be extended to include Jobseeker’s Benefit in late 2019.

Benefit in Kind (BIK) - Electric Cars

The 0% rate of BIK introduced in Budget 2018 for electric vehicles provided by an employer to an employee has been extended until 2021 with a cap of €50,000 on the Original Market Value of the vehicle.

National Minimum Wage

The National Minimum Wage will increase from €9.55 to €9.80 per hour in respect of hours worked on or after 1st January 2019.

Social Welfare Payments

There will be a €5 increase in all weekly Social Welfare payments with effect from week commencing 25th March 2019. The maximum personal rate of Illness Benefit will be increased to €203 per week. Maternity Benefit and Paternity Benefit will be increased to €245 per week.

Paid Parental Leave

The Budget provides for 2 additional weeks paid parental leave per parent (paid by the DEASP) to be introduced in November 2019. The leave must be taken during the first year following the birth of a child.

Are you missing out on our newsletter? We will not be able to email you without you subscribing to our mailing list. You will be able to unsubscribe at anytime. Don’t miss out - subscribe today!

Oct 2018

8

Thesaurus Customer Update: October 2018

Free Webinar: PAYE Modernisation - 2 Months to Deadline

We have teamed up with Revenue & IPASS to bring you free CPD accredited webinars to help you prepare for PAYE Modernisation. With just over two months before PAYE Modernisation takes effect, these webinars will discuss how PAYE Modernisation will affect payroll processing and what is expected from you going forward. Both webinars are CPD accredited and free to attend. Places are limited.

- 25th October - Guest Speaker: IPASS - Register here

- 7th November - Guest Speaker: Revenue - Register here

Thesaurus Payroll Manager - Customer Survey Results

We would like to say a massive thank you to everyone who filled out our customer satisfaction survey last month. We were delighted to discover that the customer satisfaction rate for Thesaurus Payroll Manager has remained at its exceptional 99%. Our customer support team also boasts a 99% customer satisfaction rate.

Extended Customer Support Hours

To assist our customers with the transition to PAYE Modernisation, our customer support will have extended and Saturday opening hours from Monday 17th December until Saturday 16th February including early mornings and evenings.

View opening hours | Contact support

Thesaurus Software secures investment from Hg

We are very excited to announce that Thesaurus Software has secured investment from Hg, a specialist technology investor. This partnership benefits Thesaurus Software as we can access the experience and support of Hg and its network, whilst retaining voting control of the business. “It’s great to secure an investment from a firm who both knows our market and has the experience to help us develop the business.”

PAYE Modernisation checklist to ensure 100% compliance

It is important that all employers understand the upcoming changes to the Irish PAYE system. PAYE Modernisation will affect all employers and it will be important to ensure 100% compliance to avoid penalties and fines. Find out the key factors you need to consider when preparing for its introduction with our PAYE Modernisation checklist.

Budget 2019 - Employer Payroll Focus

Budget 2019 was announced on Tuesday October 9th 2018 . This is a summary of the measures that will have a direct effect on employers with regards to payroll.

Did you miss it? Important information regarding PAYE Modernisation

We recently sent out an email to all customers regarding PAYE Modernisation detailing a number of things you need to be aware of or to check in advance of January. Please be assured that our 2019 software will fully cater for the new system and that we aim to make it as seamless as possible for you.

View email | PAYE Modernisation demo

BrightPay wins ‘Payroll Software of the Year’

BrightPay was announced the winner of ‘Payroll Software of the Year’ at this year’s Software Excellence Awards. It’s a great achievement for BrightPay to win this prestigious award. The winner was decided by a public vote, whereby members are asked to rate the software systems they use to determine the best products on the market. BrightPay is created by Thesaurus Software, offering a more advanced and user-friendly alternative to Thesaurus Payroll Manager.

Thesaurus Connect: The GDPR Survival Toolkit

Thesaurus Connect is tailored to help you overcome some of the key challenges GDPR presents when processing payroll. The payroll itself is still processed on the Thesaurus Payroll Manager desktop application, however, the payroll information is stored online on a secure cloud server, allowing us to bring you even more benefits to help you with GDPR compliance.

Are you part of an association that needs help with PAYE Modernisation?

We are working with a number of associations that are helping their members with PAYE Modernisation. We are offering a free partnership platform to Irish associations where we can provide free PAYE Modernisation training and free training on our payroll software products. Our partnership platforms enable us to offer association members introductory discounts.

Are you missing out on the Thesaurus newsletter? We will not be able to email you without you subscribing to our mailing list. You will be able to unsubscribe at anytime. Don’t miss out - sign up to our newsletter today!

Oct 2018

2

Extended Customer Support Hours

To assist our customers with the transition to PAYE Modernisation, our customer support will have extended and Saturday opening hours from Monday 17th December until Saturday 16th February (excluding Christmas week).

We recently conducted a customer survey to determine when our customers are most likely to avail of extended hours. Based on the results of this survey, our opening hours for this period will be as follows:

- Monday to Thursday - 8 am to 7 pm

- Friday - 8 am to 6 pm

- Saturday - 9 am to 1 pm

Once live with our extended hours, we will continue to monitor demand for customer support and will change or extend hours if required. It is also important to note that we will not have a full complement of staff during these extended hours.

In addition to our telephone and email support, we will also have extensive on-screen and online support (including videos) to help you through all of the new features.

Our customer support team can be contacted at 01 8352074 or support@thesaurus.ie.

Sep 2018

24

The Death of PAYE ‘P Forms’

The introduction of PAYE Modernisation is just months away, leaving employers bewildered and confused about what the new PAYE system will entail. Essentially, all of the current ‘P Forms’ - P30s, P35s, P60s, P45s and P46s - will be abolished, and in their place will be real time periodic submissions to Revenue. Employers will be required to send these submissions, known as Payroll Submission Requests (PSRs), to Revenue each time an employee is paid. In most cases, this means a file will be submitted either weekly or monthly.

As Revenue will be receiving file submissions each pay period, the annual P35 will no longer be required. In addition, this periodic file will eliminate the need for P30s.

The files being submitted each pay run will also have details of employees commencing and employees leaving. This will mean that P45s and P46s are no longer required to be completed by the employer.

At the end of a tax year, the individual taxpayer will be able to view and print their official certificate of earnings and deductions directly from the MyAccount portal on the Revenue website. This means that P60s should no longer be needed.

PAYE Modernisation with Payroll Software

PAYE Modernisation should not add to an employers workload. In fact, employer responsibilities will be greatly reduced. Payroll software will be able to seamlessly integrate into the Revenue system, enabling employers to make the periodic submission directly from the payroll software at the click of a button.

Thesaurus Software is at the forefront when it comes to PAYE Modernisation compliant payroll software. With two different payroll packages to choose from - Thesaurus Payroll Manager and BrightPay - customers will be guaranteed leading edge software and expertise. We have already experienced the introduction of a similar real time reporting system with our UK payroll software.

Book a demo today to find out just how easy PAYE Modernisation can be when using the right payroll software package.

Related Articles:

Sep 2018

21

BrightPay wins ‘Payroll Software of the Year’

BrightPay was announced the winner of ‘Payroll Software of the Year’ at this year’s AccountingWEB’s Software Excellence Awards.

The awards, which took place in London, are held by AccountingWEB - an online community for accounting and finance professionals in the UK. The winner is decided by a public vote, whereby members are asked to rate the software systems they use to determine the best products on the market.

It’s a great achievement for BrightPay to win the prestigious award, especially when you look at the number of larger software companies offering payroll in the UK. BrightPay also has a 99% customer satisfaction rate, and is used to process payroll for over 120,000 businesses across the UK and Ireland.

Marketing Manager at BrightPay, Karen Bennett says: “We’re delighted to win this award; it’s fantastic for BrightPay and our team to be recognised by our customers and the AccountingWEB members, and a massive thank you to everyone who voted for us.”

Paul Byrne, Managing Director, says: “It’s a real pleasure and honour to receive this award. It’s great to see such recognition for all the hard work we have put in. We work hard each year to improve the BrightPay experience for all of our customers, both in terms of the payroll software itself and the customer support that we offer.”

BrightPay in Ireland

In the Irish market, BrightPay is currently preparing for PAYE Modernisation, a real time reporting system that is being introduced on 1st January 2019. Essentially, employers will be required to report pay information to Revenue each pay period. This overhaul of the Irish PAYE system aims to ensure that employers and employees have the most accurate, up-to-date information relating to pay and tax deductions.

A similar system was introduced in the UK in 2013, which was seamlessly integrated into BrightPay UK payroll software. We have the relevant experience to ensure that PAYE Modernisation is just as streamlined in BrightPay Ireland. By switching to BrightPay Ireland, you can be assured that you have PAYE Modernisation compliant payroll software.

Book a demo today to see how BrightPay can help you with PAYE Modernisation.

Are you missing out on our newsletter? We will not be able to email you without you subscribing to our mailing list. You will be able to unsubscribe at anytime. Don’t miss out - subscribe today!

Related Articles:

- Which is really better - the existing PAYE system or PAYE Modernisation?

- Manually calculating payroll with PAYE Modernisation

- PAYE Modernisation: Frequently Asked Questions

- BrightPay Ireland - Customer Survey - The Results are in!

Sep 2018

18

Thesaurus Payroll Manager - Customer Survey Results

Opinions and feedback from our customers matter to us. We love to hear comments and suggestions from users in order to improve our customers’ experience. We recently conducted a customer survey to get an insight into what customers think about Thesaurus Payroll Manager and to find out what new features our customers want. We appreciate all the feedback received from this year’s survey and would like to say a massive thank you to everyone who took part.

The survey looked at customer satisfaction rates, software performance and customer support. We were delighted to discover that the customer satisfaction rate for our payroll software has remained at its exceptional 99%. The satisfaction rate for the customer support offered has also kept its 99% satisfaction rate.

One of the most common suggestions from this year’s survey was for the ability to reverse the payroll for individual employees rather than having to re-input the payroll for all employees. We are delighted to confirm that Thesaurus Payroll Manager 2019 will allow you to make corrections to previous pay periods for individual employees.

Thesaurus Connect

The survey also included some questions regarding our optional cloud add-on, Thesaurus Connect. With an overall satisfaction rate of 91%, customers rated Thesaurus Connect’s features highly, including the secure online backup (99%), payslip & P60 online accessibility (98%), HR document upload (98%), value/price (97%) and its ability to reduce payroll administration tasks (90%).

Watch this short video for an overview of how Thesaurus Connect can meet your payroll and HR needs.

PAYE Modernisation

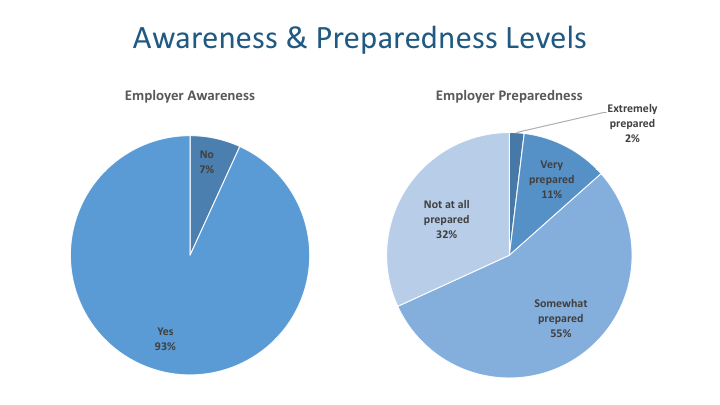

This year’s survey also looked at PAYE Modernisation. With the introduction of this new system just three months away, we were surprised to find out that almost 7% of employers said that they were not aware of the upcoming changes.

When looking at the question ‘Do you feel prepared for the introduction of PAYE Modernisation?’, the results were also quite worrying. Just 2% of employers said that they felt extremely prepared, while a massive 32% said they felt not at all prepared.

It is important that all employers understand the new PAYE changes being implemented. We are running a series of free PAYE Modernisation training webinars with a guest speaker from Revenue. Make sure to book your place now.

Alternatively, you can book an online PAYE Modernisation demo with Thesaurus Payroll Manager to find out what the software will look like in 2019.

Related Articles:

Sep 2018

14

Data Protection Commissioner teams up with Thesaurus Software for free GDPR webinar

The introduction of the General Data Protection Regulation (GDPR) in May brought with it new and more stringent rules around the security of personal data and how it is processed.

The new legislation places increased responsibilities on all those parties that process personal data. All organisations, regardless of size, have had to comply with the GDPR. As part of their preparation for the GDPR, employers were required to introduce or update existing policies regarding personal data held.

Free Webinar: GDPR 3 Months On! (20th September @ 11.00 am)

Thesaurus Software is hosting a free GDPR webinar this September where we will have a guest speaker from the Data Protection Commissioner’s office. The webinar will be CPD accredited and free to attend.

In this webinar, we will look at what’s new in GDPR, how it may affect your business and what we have learned from the GDPR three months after it’s introduction. We will also discuss how Thesaurus Software can help your organisation utilise the new data protection regulations for the benefit of you, your customers, suppliers and employees.

Webinar Speakers

Laura Murphy - Laura is an experienced Human Resource professional with unique global experience. She has worked in-house and in external consultancy roles for SMEs, international organisations and public sector bodies across the UK and Ireland.

Jennie Hussey - Jennie is an experienced Employment Law Advisor with a demonstrated history of working in the HR and payroll industry.

Guest Speaker: Graham Doyle - We are pleased that Graham Doyle, Head of Communications from the Data Protection Commissioners office will be joining us to discuss GDPR and the effect it is having on all businesses.

Places are limited - book your place now!

Related articles:

- GDPR Compliant Payroll Software

- What happens if I don’t comply with GDPR

- GDPR & Thesaurus Connect

- GDPR & The Future of Payroll

Thesaurus & BrightPay Newsletter - Are you missing out?

We will not be able to email you about webinar events, special offers, legislation changes, other group products and payroll related news without you subscribing to our newsletter. You will be able to unsubscribe at anytime. Don’t miss out - sign up to our newsletter today!

Sep 2018

12

National Minimum Wage - Increasing Jan 19

Currently, the national minimum wage is €9.55 per hour, which increased on 1st January 2018. The Low Pay Commission has recommended that the national minimum wage be increased by 25 cent to €9.80 per hour. The Government has accepted this recommendation and this increase is due to be introduced in January 2019.

This is the fifth increase of the national minimum wage since 2011. This increase could benefit up to 120,000 employees, increasing their hourly rate by 2.6%. An employee working 40 hours per week will see their gross pay increase by €10.00.

The new minimum hourly rates will be:

- Experienced adult worker – €9.80

- Under age 18 – €6.86

- In the first year after the date of first employment over age 18 - €7.84

- In the second year after the date of first employment over age 18 - €8.82

- In a course of training or study over age 18, undertaken in normal working hours-1st one third period: €7.35; 2nd one third period: €7.84; 3rd one third period: €8.82

The Taoiseach, Leo Varadkar said “this increase will put us in the top five in the world for our national minimum wage in cash terms and purchasing power.”

Related Articles:

- GDPR & Payroll Processing: Do I need consent from my client’s employees?

- PAYE Modernisation - List of Employees

- PAYE Modernisation: What you need to know

- What happens if I don’t comply with the GDPR ?

Are you missing out on our newsletter? We will not be able to email you without you subscribing to our mailing list. You will be able to unsubscribe at any time. Don’t miss out - subscribe today!

Sep 2018

11

Thesaurus Software secures investment from Hg

We are very excited to announce that Thesaurus Software has secured investment from Hg, a specialist technology investor.

Hg’s structured minority investment strategy, Transition Capital, will fund the investment.

Transition Capital offers privately-owned businesses an attractive alternative to a minority equity sale.

This partnership benefits Thesaurus Software as we can access the experience and support of Hg and its network, whilst retaining voting control of the business.

The Irish market continues to represent our core customer base where we expect to see further growth with the introduction of the PAYE modernisation legislation coming in January, 2019. We also launched into the UK market, just six years ago, where we’ve seen our UK customer base grow to an impressive 25,000 customers.

Our payroll software products; Thesaurus Payroll Manager and BrightPay Payroll will automate the tasks involved in the upcoming PAYE modernisation legislation. We have developed user friendly automation features to receive and send the required PAYE information to and from Revenue. Our aim is to target the many employers who are still processing their payroll on manual systems or spreadsheets. At Thesaurus Software, we believe our products offer key automation functionality that can save our customers time and money.

Paul Byrne, Managing Director said:

“Our aim is to establish ourselves as the leading provider of payroll and HR software systems in the UK and Ireland. The combination of Hg’s understanding of the market and our innovative products will help us achieve these goals.”

Hg has many years experience operating in the payroll and HR space. The investment and partnership will allow Thesaurus Software to leverage that expertise to continue to grow our market share in Ireland and the UK. It is fantastic to have a partner that shares our vision for the future and recognises the potential our products have. We’re excited for the future!!

Peter Miholich, Director, Hg, said:

“We have been really impressed by the dedication of the Thesaurus team to delivering great software and outstanding service to their customers. We look forward to partnering with Paul, Ross and the team to take Thesaurus Software to the next stage of its development, adding our experience and strong track-record of working with successful businesses in Accounting and Payroll software.”

About Thesaurus Software

Established in 1991, Thesaurus Software offers payroll, HR and accounting software products to Irish and UK businesses and accountants. We provide powerful software that is both cost effective and easy to use. Our suite of payroll and HR products save businesses a considerable amount of time by utilising automation and innovative technology. Currently, our products are used by over 120,000 (and counting) businesses across the UK and Ireland. We are a passionate team who strive on the excitement and challenge of continuous growth, improvement and development. Our plans for the future are big!

https://www.thesaurus.ie/

https://www.brightpay.ie/

About Hg

Hg is a sector expert investor, committed to helping build ambitious businesses across the technology, services and industrial technology space, primarily in Europe. Deeply resourced sector teams focus on specific sub-sectors and investment themes to identify companies occupying an established position within a niche, and which have the potential to grow faster than their market, create employment and become the leader in their industry. Hg’s dedicated operations innovation team provides practical support to management teams to help them realise their growth ambitions. Based in London and Munich, Hg has funds under management of over £10 billion serving some of the world’s leading institutional and private investors. For further details, please see www.hgcapital.com

Sep 2018

3

The Existing PAYE System VS PAYE Modernisation: Which is really better?

The Irish PAYE system was first implemented back in 1960 with no major changes since its introduction. Ireland today is very different compared to what it was 58 years ago - so why should the PAYE system remain the same?

For the past few years, Revenue has been working on a much needed and well overdue facelift of the Irish PAYE system. The new system, known as PAYE Modernisation will replace existing PAYE processes from 1st January 2019. Many employers are left wondering what the difference is between the two systems, and more importantly, which system is really better?

Key Changes with PAYE Modernisation

With PAYE Modernisation, there will be no P30s every month or quarter and no P35s at the end of the tax year. In fact, all ‘P forms’ will be eliminated.

Instead, submissions will need to be sent to Revenue in real time, detailing employee pay and tax information. These will be known as Payroll Submission Requests (PSR), and will need to be submitted ‘on or before’ the date an employee is paid each pay period. In most cases, this means a file will be submitted either weekly or monthly.

Some employers are worried that this will massively add to an employer’s workload. Realistically however, the payroll process will require much less of an employers time. Payroll software will be integrated with Revenue so that for employers, the file will be automatically prepared and sent directly to Revenue at the click of a button.

The retrieval of tax credits will also be automated, which should ensure that the correct credits are being applied by employers. With payroll software, Revenue integration will enable employers to receive changes to an employees tax credits directly from Revenue and update it in the payroll software at the click of a button. This file will be known as a Revenue Payroll Notification (RPN).

Regardless of how frequently an employer will be required to send submissions to Revenue, the payment date will remain the same. There will be no change to the method that employers currently use to make the Revenue payment.

Find out what else the new system has to offer with Thesaurus Software’s free online PAYE Modernisation webinars.

PAYE Modernisation: Made Easier with Payroll Software

Although employers will still have the option to process their payroll manually, it will be very cumbersome and tedious, with the changes becoming more of a hindrance than beneficial.

Employers are advised to use PAYE Modernisation compliant payroll software so that the entire system will be smooth and integrated. With payroll software, employers will benefit from a reduced workload as a result of PAYE Modernisation, while making the payroll process much easier and streamlined.

Thesaurus Software is the number one payroll software provider in Ireland with two payroll packages to choose from - Thesaurus Payroll Manager and BrightPay.

Book a demo today to see how PAYE Modernisation will affect your business.

Related articles: