Nov 2017

2

Auto Enrolment Planned for Ireland by 2021

Taoiseach Leo Varadkar said that the Government will publish a five year roadmap for pension reform before the end of the year. This will include the introduction of an auto-enrolment pension scheme for private sector workers, two-thirds of whom currently have no occupational pension to supplement their state pension. The first payments are expected to be made into new individually held funds by 2021.

He said the government would “work closely and consult with employers” in designing the new scheme. The Minister for Employment & Social Protection Regina Doherty, said that there will be no discrimination in the new auto-enrolment pension scheme proposed by Taoiseach Leo Varadkar.

“You can’t discriminate somebody that’s earning 20 grand to somebody that’s earning 40 grand,” said Minister Regina Doherty.

“But it’s always going to be based on the percentage, so whatever percentage you put in, the employer will put in a percentage and the State will put in a percentage, and we have to work out the details as to what that percentage will be.”

Related articles

Nov 2017

1

10% pay rise for Construction Sector under new Sectoral Employment Order

A Sectoral Employment Order (SEO) for the general construction industry has been signed into law by the Minister for State at the Department of Business, Enterprise and Innovation, Pat Breen.

Effective from 19th October 2017, the order provides for mandatory terms and conditions in the construction sector, including pay, pensions and sick leave. In finalising the Order, the Labour Court received submissions from the Construction Industry Federation (CIF), UNITE the Union, the Irish Congress of Trade Unions and the Trustees of the Construction Workers Pension Scheme.

Who does the Order affect?

The Order applies to employers in the construction sector, regardless of whether or not they are CIF members. The sector is defined to include both “Building Firms” and “Civil Engineering Firms”, examples will include companies involved in; construction, reconstruction, alteration, repair, painting and decorating. It is estimated that the new Order will apply to approximately 50,000 workers. Notably electricians and plumbers are not included.

Hourly Rates

The new minimum hourly pay rates are:

- New Entrant Workers: €13.77

- Category 1 Workers (General Operatives with more than 1 years’ experience: €17.04

- Category 2 Workers (Skilled General Operatives): €18.36

- Craft Workers (Includes: Bricklayers, Carpenters, Plasterers): €18.93

- Apprentices

- Year 1: 33.3% of Craft Rate

- Year 2: 50% of Craft Rate

- Year 3: 75% of Craft Rate

- Year 4: 90% of Craft Rate

These new rates are approximately 10% higher than they had been under the previous Registered Employment Agreement (REA).

Unsocial Hours

The following unsocial hours payments will now apply:

- Monday to Friday, normal finish time to midnight: time and a half

- Monday to Friday, midnight to normal starting time: double time

- Saturday, first four hours from normal starting time: time and a half. All subsequent hours until midnight: double time

- Sunday, all hours worked: double time

- Public holidays, all hours worked: double time plus an additional day’s leave

Pension Scheme and Sick Pay Scheme

The Order provides that employers must provide pension benefits with no less favourable terms than those in the Construction Workers Pension Scheme (CWPS). The Order also provides for a mandatory sick pay scheme, in recognition of the health and safety risks posed to industry workers.

Dispute Resolution

The Order includes a new dispute resolution procedure. No strike or lock-out is allowed unless and until all stated dispute resolution procedures have been exhausted.

Where to from here?

The Order is a significant development for those in the general construction industry. Employers will need to review their payment practices to ensure that they comply with the new requirements.

To keep up with the latest payroll news, check out our new Bright website. There, you'll be able to register for any of our upcoming payroll webinars and download our payroll guides.

To book a free online demo of Bright Contracts click here

To download your free trial of Bright Contracts click here

Oct 2017

25

Making an Employee Redundant

A redundancy situation can often arise in the following situations:

- an employee’s job ceases to exist

- the employer ceases to carry on the business

- the requirement for employees has diminished

- an employee is not skilled for work that is to be done

In the event of a redundancy, employees are covered under Redundancy Payments Acts 1967-2014, if they meet the following requirements:

- aged 16 or over

- have at least 2 years continuous service (104 weeks)

- are a full-time employee insurable under PRSI class A, or PRSI Class J for a part-time employee

How to calculate Statutory Redundancy Pay

Statutory Redundancy is payable at a rate of:

- 2 weeks’ pay for each year of service. If the period of employment is not an exact number of years, the excess days are credited as a portion of a year

- plus one week’s pay

The term ‘pay’ refers to the employee’s current normal gross weekly pay, including average regular overtime and benefits in kind. The above, however, is based on a maximum earnings limit of €600 per week (before PAYE, PRSI & USC).

An employer may also choose to pay a redundancy payment above the statutory minimum. In such circumstances, the statutory payment element will be tax free but some of the lump sum payment may be taxable.

To keep up with the latest payroll news, check out our new Bright website. There, you'll be able to register for any of our upcoming payroll webinars and download our payroll guides.

Oct 2017

19

Customer Update

Free Webinar: What you NEED to know about PAYE Modernisation

PAYE Modernisation is probably the biggest overhaul of the PAYE system since PAYE itself was introduced back in 1960. It will have wide ranging effects on all employers. Register now for our free webinar to find out what you need to know about PAYE Modernisation. Speakers include Paul Byrne (Thesaurus Software) & Sinead Sweeney (Revenue)

CPD Webinar: GDPR for your Payroll Bureau (Bureaus Only)

Data protection and how personal data is managed is changing forever. On 25 May 2018 the new General Data Protection Regulation (GDPR) will come into force. The GDPR is a European privacy regulation replacing all existing data protection regulations. Register now for our free, CPD accredited webinar to find out how this new legislation will affect your payroll bureau.

"What do you mean... Do I have a backup?” - A day in the life of Customer Support

One of the most common calls on the support line is from a distressed customer who tells us they have lost their payroll information. Reasons for the loss of this information are varied and could be anything from a laptop being stolen, a virus attacking the computer or fire or water damage to the computers in the office.

Thesaurus Connect - Try for Free

We are giving customers one free Thesaurus Connect 2017 licence. With Thesaurus Connect, employers can login to their own personal employer dashboard where they can access employee payslips, payroll reports and a company wide calendar. It also includes a self-service portal for employees to view payslips and request annual leave.

Redeem your free licence / Book a demo

New Automatic Enrolment Pension System to be in place by 2021?

Brian Hayes MEP has called on Minister for Social Protection, Regina Doherty to start work on the introduction of an automatic enrolment pension system, whereby all Irish private sector employees would be automatically enrolled into a pension scheme.

Thesaurus Customer Survey: The Results are in!

In our recent survey, we were delighted to discover that Thesaurus has a 99.6% customer satisfaction rate. Customers are also highly satisfied with our customer support team, with a satisfaction rate of 99.5%.

Oct 2017

11

Budget 2018 - Employer Payroll Focus

Pay As You Earn (PAYE)

- There was no change to tax rates for 2018, the standard rate will remain at 20% and the higher rate at 40%.

- Standard Rate Cut Off Points (SRCOPs) will be increased by €750 from 1st January 2018.

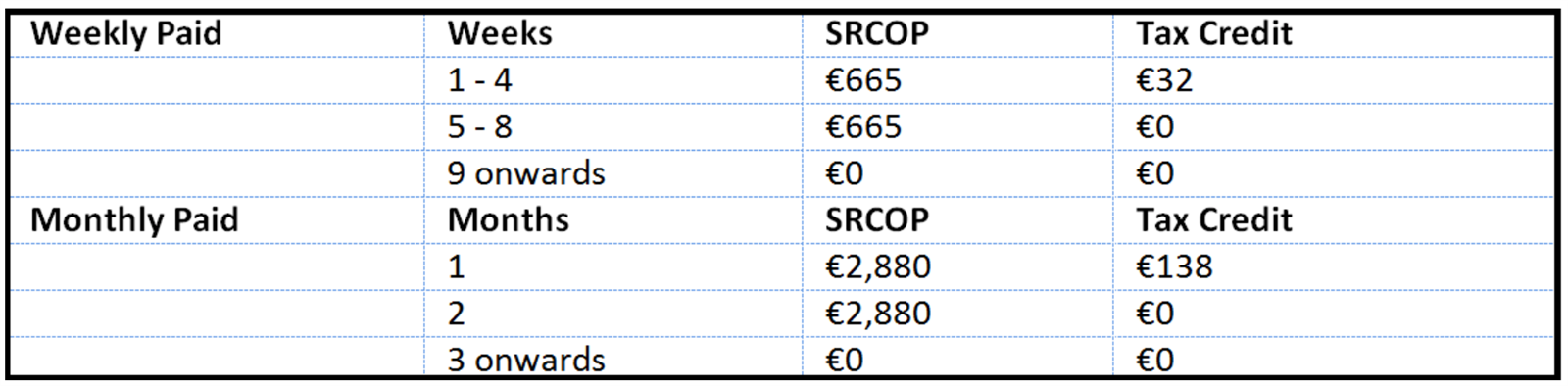

Emergency Basis of PAYE

Employee provides PPS Number:

Where an employee does not provide their PPS Number the higher rate of 40% tax applies to all earnings.

Earned Income Tax Credit

The Earned Income Tax Credit will be increased by €200 from €950 to €1,150.

Home Carer Tax Credit

The Home Carer Tax Credit will be increased from €1,100 to €1,200.

Universal Social Charge (USC)

- Exemption threshold remains at €13,000

- 2.5% rate reduced to 2%, threshold for this rate increased from €18,772 to €19,372

- 5% rate reduced by 0.25% to 4.75%

- No change to 8% rate

Medical card holders and individuals aged 70 years and older whose aggregate income does not exceed €60,000 will pay a maximum rate of 2%.

The emergency rate of USC remains at 8%.

PRSI & USC

The Minister outlined his intention to establish a working group in 2018 to carry out a review of the possible integration of PRSI and USC.

National Training Levy

The National Training Levy of 0.7% which is currently collected as part of the employer PRSI contribution will increase to fund further and higher education, the increases are as follows:

- 0.8% in 2018

- 0.9% in 2019

- 1% in 2020

Pay Related Social Insurance (PRSI)

There were no changes to general PRSI thresholds or employee PRSI announced in the Budget. However, as the National Training Levy is increasing and it is collected as part of the employer PRSI contribution, employer PRSI will increase as follows:

- 8.5% increased to 8.6%

- 10.75% increased to 10.85%

Benefit in Kind (BIK) - Electric Cars

A 0% rate of BIK will apply to electric vehicles provided by an employer to an employee in 2018 which is available for private use. Electricity used by the employee in the workplace to charge the car will also be exempt from BIK.

PAYE Modernisation

PAYE Modernisation will be effective from 1st January 2019. Budget 2018 has allocated €50 million for a project to enhance Revenue's IT capacity and to ensure employer compliance.

National Minimum Wage

The National Minimum Wage will increase from €9.25 to €9.55 per hour in respect of hours worked on or after 1st January 2018.

- Workers under age 18 will be entitled to €6.69 per working hour

- Workers in their first year of employment over the age of 18 will be entitled to €7.64 per working hour

- Workers in their second year of employment over the age of 18 will be entitled to €8.60 per working hour

Social Welfare Payments

There will be a €5 increase in all weekly Social Welfare payments with effect from 26th March 2018. The maximum personal rate of Illness Benefit will be increased to €198 per week. Maternity Benefit and Paternity Benefit will be increased to €240 per week.

Oct 2017

10

Thesaurus Payroll Manager - Customer Survey - The Results are in!

Opinions and feedback from our customers matter to us. We love to hear comments and suggestions from users in order to improve the customer experience. Last month we conducted a customer survey to get an insight into what customers think about Thesaurus Payroll Manager and find out what new features our customers want.

The survey also looked at customer satisfaction rates, software performance and customer support. We were delighted to discover that Thesaurus Payroll Manager has a 99.6% customer satisfaction rate. Customers are also highly satisfied with our customer support team, with a satisfaction rate of 99.5%. Many customers agree that BrightPay saves them time (99.4%) and offers good value for money (99.6%).

Surprisingly, 43% of customers were not aware that Thesaurus Payroll Manager includes integration with One4all. This new feature was added last year and enables employers to seamlessly purchase One4all gift cards for employees.

The survey also looked at awareness of PAYE Modernisation. Nine out of ten accountants, bookkeepers and payroll bureaus said that they were aware of this new PAYE system, which will be effective from 1st January 2019. Meanwhile, one in five employers were unaware of this upcoming change. Thesaurus recently hosted a number of free PAYE Modernisation webinars, with a guest speaker from Revenue. The webinars incorporated everything you need to know about PAYE Modernisation. Watch the PAYE Modernisation training session on demand.

Customer Testimonials

We also received a number of customer testimonials from the survey - all of which will be added to the Thesaurus website in due course. Some of our favourite testimonials received include:

- "We have used Thesaurus for our payroll since 2001. Over the last 17 years our general accounting software has been changed 3 times but we have never found a better payroll system or had a reason for wanting to change..."

- "I found the support I was given by Thesaurus to be of the highest quality, with the empathy shown by Thesaurus employees to be extraordinary."

- "I have used Thesaurus Payroll in a number of companies and I found it much easier to use than any other payroll software I have encountered. It has always provided updates and changes required quickly without fuss. The newest addition, Thesaurus Connect has made life easy for me. Payslips automatically sent out to employees and the facility for them to view and print payslips as required has freed up a lot of management time for other duties."

- "The support staff are brilliant, they answer questions in everyday language and are committed to staying with you until you have a total understanding of the query."

- "Thesaurus Payroll Manager is the most cost effective change we have made to our business. From the standard paying wages to being able to email payslips, work out holiday entitlement and much more, this software package is worth its weight in gold. Saving us time and money. I wouldn't be without it."

Prize Winners

As a thank you for taking part in the survey, we are giving away four €50 One4all vouchers. We are delighted to announce that the winners are:

- John Ganly - Blanchardstown Amalgamated Sports Ltd

- Geraldine Grennan - PJ Grennan Ltd

- Elaine Donnelly - Irish Theatre Institute

- Eugene O'Donovan - SME Finance

The Thesaurus team will be in contact with the winners shortly.

We appreciate all the feedback received from this year’s survey and would like to say a massive thank you to everyone who took part.

Useful Links

Oct 2017

2

Are you ready for PAYE Modernisation?

To raise awareness about forthcoming PAYE Modernisation in 2019, Revenue has commenced its awareness campaign by releasing an information leaflet “PAYE Modernisation – Are You Ready”.

This leaflet highlights the vital steps for new and existing employers to undertake in advance of 1st January 2019, in order to succeed in the imminent taxation system revolution.

The key idea behind PAYE Modernisation is that all communication between employer and Revenue will happen in “real time”. In order to effectively overcome the upcoming challenges, employers are being encouraged to focus on the quality and accuracy of the data they provide to Revenue.

In preparation for PAYE Modernisation, employers are advised to follow several easy steps to guarantee its overall success when it does come into effect in 2019:

- Register as an employer (for new employers)

- Verify the PPSN provided by employees (e.g. check it against a Public Services Card, P45 or other Revenue or DSP correspondence) and where the employee does not hold a PPSN, they should contact the DSP to apply for one.

- Register all employees with Revenue (i.e. P45(3) or P46 where the employee has no P45). Where the new employee has not worked in Ireland before, the employee must register the employment online using the Jobs and Pension service available in myAccount. The Jobs and Pension service can also be used by employees who are changing from one employment to another. Once the employment has been registered, Revenue will issue a tax credit certificate.

- Issue a P45 when an employee ceases employment and submit it to Revenue.

- Ensure an up-to-date tax credit certificate has been received for each employee. The leaflet outlines the basis of tax which should be applied on the first payday of a new tax year in the event that an up-to-date tax credit certificate for that year is not received.

- Ensure a complete PAYE, PRSI and USC record for each employee is held at the end of the tax year.

At Thesaurus Software & BrightPay, we have always strived to deliver excellence in customer service and professional expertise in both Irish and UK payroll. We widely welcome the upcoming PAYE changes. As Paul Byrne, director of Thesaurus Software Ltd, stated during the Revenue's public consultation process held in December 2016:

“Whatever system is adopted, it is important that it represents a step forward for all parties. We are already committed to not charging our customers for the additional development involved. In addition, we are considering making a free version of our software available for micro employers, those with one or two employees.”

Related articles

Sep 2017

27

What do you mean…. “Do I have a backup?”

One of the most common calls I get on the support line is from a distressed customer who tells me they have lost their payroll information. Reasons for the loss of this information are varied and could be anything from a laptop being stolen, a virus attacking the computer, holding files to ransom or fire or water damage to the computers in the office.

The first question I’ll ask on a call of this type will be “do you have a backup?”. Honestly, I can’t tell you the number of people that say “No” to this. People are also mistakenly under the impression that we have a copy of their payroll data. Unfortunately this is never the case, we do not have access to the employer’s payroll information so this can add to the customer's stress levels as you can imagine!

We would always stress the importance of taking a backup of your payroll information. You would have your computers and office equipment insured against anything happening so why would you not do the same for your data? Think of your backup as your information’s insurance policy, after all it is almost irreplaceable or at the very least a major inconvenience to try and rebuild your payroll.

In a lot of cases, the call to our customer support line comes too late for us to be of any real assistance and the only advice we have to give is to start over and process payroll from the beginning again.

We never think anything like this will happen to us, but take it from me, it does, so go ahead and take out that insurance policy and backup before it is too late!

The following links will guide you to taking a backup in your software or book a demo of Thesaurus Connect our latest cloud add on that offers an automated online backup feature :

BrightPay UK: https://www.brightpay.co.uk/docs/17-18/backing-up-restoring-your-payroll/

BrightPay Ireland: https://www.brightpay.ie/docs/2017/backing-up-restoring-data-files/backing-up-your-payroll-data/

Thesaurus Payroll Manager: https://www.thesaurus.ie/docs/2017/processing-payroll/backup-data-files/

Sep 2017

26

New Automatic Enrolment Pension System to be in place by 2021?

With better living standards and expanding economy, it is without doubt that Irish people are now living longer and we have a much healthier society. At the same time, we need to face the fact that with the Irish population inevitably getting older, there is the prospect that senior citizens will have to stay in employment long after they have passed retirement age. It is therefore absolutely vital to address the funding of the Irish pension system now if we want our pensioners to be well-protected in the future.

To tackle this issue, Brian Hayes MEP has called on Minister for Social Protection Regina Doherty to start work on the introduction of an automatic enrolment pension system, whereby all Irish private sector employees would be automatically enrolled into a pension scheme. As Mr Hayes stated, "a road map needs to be put in place for the introduction of an auto-enrolment system for all Irish businesses. The Cabinet needs to make it a priority to ensure that auto-enrolment is put into Irish Law by 2021. This is something that can be done through cross-party agreement."

In 2012, the UK introduced an automatic enrolment system which is working well and providing long-term sustainability. Automatic enrolment systems have also been introduced in Australia and New Zealand, and similar systems exist in the Netherlands, Sweden and Denmark. These countries are recognised as world leaders in pensions.

Mr Hayes has suggested that Ireland should create its own system, whereby every employee will be automatically enrolled into a pension scheme, into which they should contribute at least 1 per cent of their monthly salary, to be matched by their employer.

Mr Hayes also added, “In Ireland we are far too dependent on our state pension system. We have a very low take up of workplace pension schemes. Less than 40% of Irish workers are covered by a workplace pension scheme. The best way to deal with both of these problems is through an auto-enrolment system which reduces dependency on the state system and ensures people have additional pension pots built up.”

A recent global study called the ‘Melbourne Mercer Global Pension Index’ has stated that Ireland's pension system is good but has serious sustainability problems into the future. Elsewhere, Mercer's report found that Ireland will increasingly struggle to afford the provision of a guaranteed pension for everyone, if the current pension system isn’t addressed.

Sep 2017

22

Public Holiday Pay Entitlement

There can often be some confusion surrounding an employee's entitlement to pay for a public holiday particularly where the employee may be part-time or the public holiday falls on a day that the employee does not normally work.

It is also worth noting that not every bank holiday is a public holiday though in most cases they coincide. Good Friday is a bank holiday but it is not a public holiday. The following dates are the official public holidays in Ireland.

- New Year's Day (1 January)

- St. Patrick's Day (17 March)

- Easter Monday

- First Monday in May, June, August

- Last Monday in October

- Christmas Day (25 December)

- St. Stephen's Day (26 December)

Employees who qualify for public holiday benefit will be entitled to one of the following:

- A paid day off on the public holiday

- An additional day of annual leave

- An additional day's pay

- A paid day off within a month of the public holiday

So, who is entitled to a payment?

- Part-time employees qualify for public holiday entitlement if they have worked at least 40 hours in the 5 weeks ending the day before the public holiday.

- Full time employees are not required to have worked up a minimum number of hours.

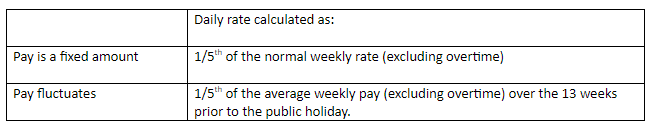

How to calculate the amount to be paid?

If the public holiday falls on a day which the employee would normally work:

- Full-time employees are entitled to one of the above four options at the employer’s discretion.

- Part-time employees have the same entitlement, so where the employee’s pay is a fixed amount the normal daily rate can be used. If the pay varies, the daily rate should be calculated over the 13 weeks immediately before the public holiday in question.

If the public holiday falls on a day which the employee does not normally work:

Further information can be found at Organisation of Working Time Act 1997.