Oct 2016

20

JobBridge scheme coming to an end

The controversial JobBridge scheme, brought in in 2011 as an initiative to help the unemployed get work experience, will be wound down from this Friday, Minister for Social Protection, Leo Varadkar has announced.

The minister said that those on the scheme currently would be able to finish their internship but that a new scheme will take place of the scheme going forward. The new employment scheme will be introduced for jobseekers in late 2017.

The new scheme will likely have employers making some form of contribution for being included in the scheme which will reduce the possibility of exploitation of the scheme and the new scheme will see jobseekers earning at least the minimum wage.

Some jobseekers on the JobBridge scheme were felt to have been exploited by some companies and that along with the small top-up payment of just €52 per week, led to heavy criticism from the beginning by certain groups and political parties.

A report launched by Indecon International Research Economists found that the scheme had been successful in helping people return to the job market. Over 10,500 interns who had gone through the JobBridge scheme took part in a survey for the report. In total, 64.2% of people who had gone through the scheme were now employed. In terms of intern satisfaction, the responses varied under different aspects. However, over half of those surveyed were dissatisfied with the value of the JobBridge top up payment, and three out of 10 didn’t believe the scheme met their expectations.

Oct 2016

20

New Childcare Subsidy Scheme

As part of Budget 2017, a new €35m Single Affordable Child Care Subsidy Scheme will be introduced in September 2017. It is designed to provide parental means-tested subsidies, towards the cost of childcare for children aged six months to 15 years and universal subsidies of up to €80 a month or €900 a year for all children aged between six months and three years. This scheme will replace the existing subsidy schemes – including the Community Childcare Subvention Programme, After-School Child Care Scheme and the Childcare Education and Training Support Programme. As a result, all families, no matter what their income levels, will be entitled to as much as €900 a year, if the child is in 40 hours per week of childcare. The payment will apply on a pro-rata basis of a State subsidy of 50 cent an hour of childcare and will be paid directly to the childcare provider. International research confirms that access to high quality and affordable childcare is particularly important and beneficial for children from lower income families.

In addition to the childcare package, €86m extra has been provided in respect of the full year costs of the extended Early Childhood Care and Education Scheme (ECCE), the free pre-school scheme, and the roll out of the Access and Inclusion Model, or AIM, to enable children with disabilities to participate in pre-school education.

Oct 2016

12

Budget 2017 Overview (for payroll)

No changes have been made to SRCOPs, tax credits or PRSI classes. Emergency basis will also remain unchanged.

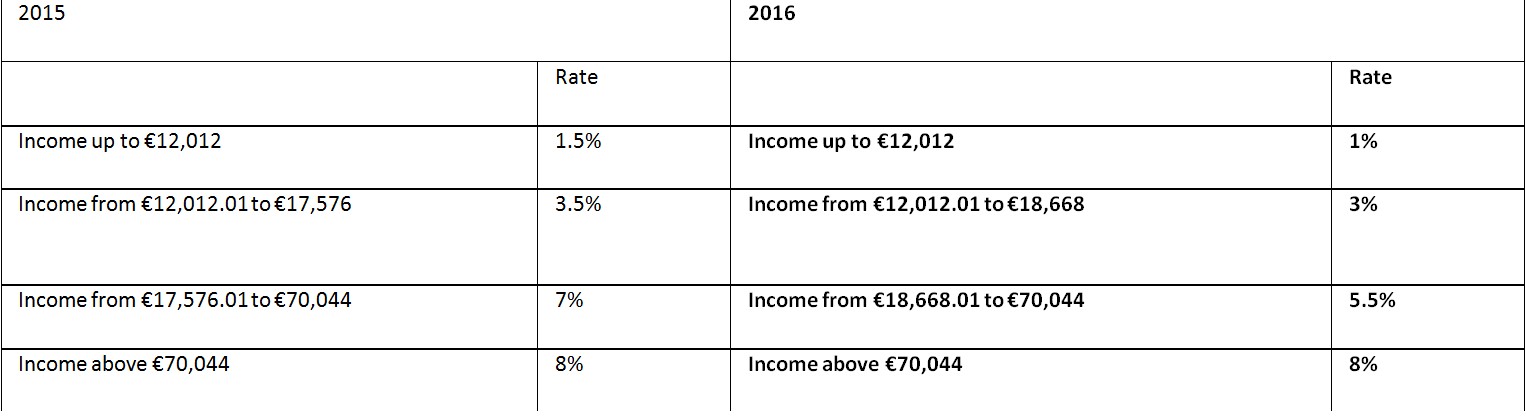

USC (Universal Social Charge: No changes were made to the USC exemption threshold of €13,000. The 1%, 3% and 5.5% rates have been reduced by 0.5% to 0.5%, 2.5% and 5% respectively. There has been no change to the 8% rate of USC. In addition the Rate 2 COP has been increased from €18,668 to €18,772.

Medical card holders and individuals aged 70 years and over whose aggregate income does not exceed €60,000 will pay a maximum rate of 2.5%. The rate of 8% USC will continue to apply under the Emergency Basis.

Minimum Wage:

The National Minimum Wage will increase from €9.15 gross per working hour to €9.25 gross per working hour.

• Workers under age 18 will be entitled to €6.48 (currently €6.41) per working hour.

• Workers in the first year of employment over the age of 18 will be entitled to €7.40 (currently €7.32) per working hour. Workers in the second year of employment over the age of 18 will be entitled to €8.33 (currently €8.24) per working hour.

Minimum wage for trainees:

Employee aged over 18, in structured training during working hours:

• 1st one third of course will increase to €6.94 (currently €6.86),

• 2nd third of course will increase to €7.40 (currently €7.32) 3rd part of course €8.33 (currently €8.24).

PRD (Pension Related Deduction)

Budget 2017 did not make any change to the rates and thresholds for PRD.

However, the Financial Emergency Measures in the Public Interest Bill 2015 provides for the following changes:

• From 1st January 2017, the exemption threshold will increase from €26,083 to €28,750. 10% PRD will apply to earnings between €28,750 and €60,000, and 10.5% PRD will apply to any earnings in excess of €60,000.

PRSI

There were no changes to PRSI.

Sep 2016

11

Paternity Leave Benefits – Update from Revenue

In August Revenue issued guidance for the new Paternity Benefit which was introduced in respect of Births and Adoptions on or after 1st September, 2016.

Paternity Benefit will be liable for income tax but not PRSI or USC. All employees who pay their tax through the PAYE system will automatically have their annual tax credits and rate bands reduced by the amount of benefit paid. Employers and pension providers will be notified of the adjusted tax credits and cut-off points on their Employer Tax Credit certificates.

Paternity Benefit should not be included on Forms P45, P60 and P35L.

Paternity Benefit is payable at the minimum rate of €230 per week for two weeks and must be taken in one block. Although some employers can pay employees while on Paternity Leave, however this is not a requirement. In such cases, the Paternity Benefit should be paid to the employer. If you have any queries on the appropriate payments, please direct them to the Department of Social Protection.

Sep 2016

10

Jobs & Pensions Service – New Online Service for Employees

The Jobs & Pensions Service available from Monday 12th of September 2016 is a new online service for employees. Irish employees can register their new job (or private pension) with Revenue using the service.

The Jobs and Pensions service replaces the Form 12A, meaning employees must register their first job in Ireland using the service. After registering employment using the service a tax credit certificate will issue to both the employer (P2C) and employee.

The service can also be used by employees who are:

• changing jobs provided the previous job has been ceased on Revenue records, employees will be able to see when they log in if the previous job has been ceased

• starting a second job in addition to their main job

• starting to receive payments from a private pension

Access to the service is available in myAccount, employees must register to use the service.

Employers should:

• encourage new employees to register for myAccount

• provide new employees with the information required to register their new job (registration can be done in advance of the start date):

- tax registration number

- start date of the new job

- pay frequency

- staff number is one has been allocated

• no longer submit a P46 form where employees register their own job using the service

• continue to upload P45(3) as normal

• continue to issue P45s immediately on cessation of employment

• operate the emergency basis for PAYE & USC if a pay day occurs before receipt of either P45 or P2C

Further information on the service can be found in Revenue’s Employer Notice September 2016, which can be found here.

Jun 2016

20

Equality for working Dads with new Paternity Leave

Over the next number of weeks we are going to look at Working Time Protected Leave legislation in Ireland, this legislation is in place to protect employees and includes leave such as; Maternity Leave, Paternity Leave, Adoption Leave, Carer’s Leave, Parental Leave & Force Majeure Leave. Today we will start with Paternity Leave.

In last year’s budget, the Fine Gael-Labour coalition had agreed to legislate to allow for fathers/partners to take two weeks’ paid paternal leave. The legislation will allow fathers to take the leave at any stage within 26 weeks of the birth or placement of the child in adoption situations.

The new legislation is due to come into force in September this year and when it does it will mean that for the first time in history, the role of fathers in postnatal care will be formally recognized on our little island. From September, every employer in Ireland must offer new fathers/partners two weeks’ paternity leave following the birth of a child. The state will pay fathers €460 for the leave, which is in line with current maternity pay. However, as with the Maternity pay, employers are under no obligation to pay the father while they are out on Paternity Leave. Remember to update your company handbook to include a policy for the new Paternity Leave when it does come in.

Great though it is to finally have some leave in place for fathers, we still have a long way to go before reaching the dizzy heights of paternity leave Scandinavian-style, where the model is usually one of paid parental leave to be shared between both parents, with some non-transferable months. In Sweden for example, parents can take up to sixteen months of leave, paid up to 80% of salary (with a cap of €4,000 per month). Our closest neighbours in the UK allow 2 weeks paid Paternity Leave but have also introduced “Shared Parental Leave” of up to 52 weeks after the birth/placement of a child which can be shared between both parents. Ireland, generally comes bottom of the European table in terms of family leave, so Paternity Leave, even at just 2 weeks is very welcome.

Jan 2016

1

New Irish national minimum wage rate takes effect from 1 January 2016

The new hourly rate represents an increase of 50c on the previous figure and is the second increase to the minimum wage since 2011. Alongside the hourly pay increase, employer PRSI thresholds are being adjusted from 1 January to ensure that an increased PRSI burden does not fall on minimum wage employers.

- Experienced adult worker €9.15 per hour (was €8.65 )

- Over 19 and in 2nd year of first job €8.24 (was €7.79)

- Over 18 and in first year of first job €7.32 ( was €6.92)

- Aged under 18 €6.41 (was €6.06)

Minimum Wage for Trainees:

Employee aged over 18, in structured training during working hours

- 1st one third of course €6.86 (was €6.49 )

- 2nd third of course €7.32 (was €6.92 )

- 3rd part of course €8.24 (was €7.79)

Dec 2015

1

Week 53: Irish Payroll

Are you due a week 53?

Employers are only due a week 53 if there are 53 pay dates in the tax year. This situation will arise for employers in 2015 where their pay date falls on a Thursday. This is due to the fact that their first pay date fell on Thursday 1st January and their last pay date falls on Thursday 31st December. Employers with any other pay date will not be due a week 53. The same principle applies for employers who run fortnightly payroll (they are only due a week 54 if there are 27 pay periods in the tax year).

Week 53 PAYE Deductions

Employers should apply employee’s tax credits and standard rate cut off points on a week 1 basis. This means employees will get the benefit of more than one year’s tax credits and cut off points. Where an employee is on an emergency basis then an emergency basis should continue to apply.

Week 53 USC Deduction

Employers should apply USC standard cut offs on a week 1 basis. This is a change from last year where there were no additional thresholds granted. If an employee is on an emergency basis then an emergency basis should continue to apply for week 53. If an employee is exempt from USC they will continue to be exempt in week 53.

Week 53 PRSI Deduction

There is no change to the way PRSI is calculated.

Oct 2015

27

Small Benefit Exemption Scheme - Increase in threshold

The Minister for Finance Michael Noonan is set to fast track an increase in the threshold for the Small Benefit Exemption Scheme. The current threshold is €250; this will double and will increase to €500. The last time the threshold was increased was in 2005 when it was increased from €100 to €250. The move is contained in the Finance Bill, published last week. The new rules were expected to be implemented from 1st January 2016 however, The Department of Finance say the change will be implemented in time for Christmas.

Under the Revenue Commissioner’s Approved Small Benefit Exemption Scheme employers can provide employees with a small benefit, this small benefit is not subject to PAYE, USC or PRSI.

The following rules apply:

• The benefit cannot be cash, cash payments are fully taxable

• Only one such benefit can be given to an employee in one tax year

• Where a benefit exceeds the threshold the full value of the benefit is subject to PAYE, USC & PRSI

• The benefit can not form part of a "salary sacrifice" scheme

The small benefit is traditionally given as a voucher often at Christmas, as mentioned above only one such benefit can be given to an employee in one tax year. Where more than one benefit is given in a tax year only the first benefit will qualify under the Small Benefit Exemption Scheme.

Full details of Finance Bill 2015 can be found on Revenue’s website

http://www.revenue.ie/en/practitioner/law/bills/finance-bill-2015/index.html

Oct 2015

15

Budget 2016 – Employer Payroll Focus

Tax Rates and Standard Rate Cut Off Points (SRCOPs)

There has been no change to tax rates or SRCOPs. The standard rate of tax will remain at 20% and the higher rate of tax will remain at 40%.

There has been no change to the SRCOP and Tax Credits on the Emergency Basis of tax.

Universal Social Charge (USC)

The annual threshold for USC has been increased to €13,000 from €12,012.

Please note full medical card holders and individuals aged 70 and over whose aggregate income does not exceed €60,000 will pay a maximum rate of 3%.

The emergency rate of USC remains at 8%.

PRSI

Increase from €356.01 to €376.01 in the weekly threshold at which liability to employer’s PRSI increases from 8.5% to 10.75%.

A tapered PRSI credit has been introduced for employee PRSI; the PRSI credit will commence in respect of weekly income of €352.01 and will taper out as a weekly income reaches €424.

For earnings between €352.01 and €424, the maximum weekly PRSI credit of €12.00, is reduced by one-sixth of earnings in excess of €352.01.

Example:

Gross weekly earnings of €377

Maximum PRSI Credit €12

One-sixth of earnings in excess of €352.01

(€377-€352.01 = €24.99/6) (€4.17)

Reduced PRSI Credit €7.83

PRSI @ 4% €15.08

Less: Reduced PRSI Credit €7.83

Employee PRSI Weekly Liability €7.25