Oct 2013

11

LOCAL PROPERTY TAX (LPT) 2014

LPT 2013 (half year charge) is still quite topical but LPT 2014 (full year charge) is fast approaching!!!

The liability date for LPT 2014 is the 1st November 2013 - if you own a residential property on the 1st November 2013 you are liable for LPT 2014.

Key Dates for LPT 2014

- 1st January – 31st December 2014

Phased payments e.g. deduction at source from salary will continue

- 1st January 2014

If paying in full by cash, payment must be made by 1st January 2014

- 15th January – 15th December 2014

Direct Debits will continue

- 21st March 2014

Single Debit Authority payment deducted

Payment method for 2014:

If you paid your 2013 LPT liability by a phased payment method e.g. deduction at source, direct debit this payment method will automatically apply for 2014 and subsequent years. There is no requirement to notify Revenue of your payment method for 2014 unless you wish to select a different payment method.

If you chose a different payment method in 2013 e.g. Credit/Debit Card, you must confirm your payment method for 2014 by:

- 7th November 2013 (by paper)

- 27th November 2013 (on-line)

In the case of Credit/Debit Card Payments, the full amount will be charged to the card on the day you select this payment method for paying your 2014 LPT liability. This would mean the latest date for paying using this method would be the 27th November 2013.

Full details can be found on Revenue’s website

Oct 2013

7

Making the Most of Tax Reliefs and Credits

There are a wide range of benefits that Irish taxpayers can claim for:

Medical Expenses: Tax relief granted at standard rate of 20%- that’s €10 back for every €50 for doctors and consultants’ fees and prescribed medicines. Relief can also be claimed for a number of other less obvious items, for example - the cost of special diabetic or celiac food products subject to a letter from your doctor.

College Fees: Tax relief is available on fees paid for qualifying third-level courses with the relief applied at a rate of 20% - excluding examination fees, registration fees and administration fees. The first €2,500 of any fees paid in 2013 do not qualify – effectively this means that tax relief will only be available for families with more than one child attending college.

Flat Rate Expenses: People working in certain occupations, such as nurses for example, are entitled to a fixed rate expense allowance to cover the costs of uniform. Flat rate expenses can be deducted from your income before it is taxed. For example nurses who are required to provide and launder their own uniforms are granted a deduction of €733 while shop assistants are entitled to a deduction of €121 and airline cabin crew are granted €64.00.

Disappearing Reliefs: You have 4 years to make your tax relief claim. This means the earliest year for which you can claim is 2009 even if the relief in question has been abolished.

Relief for Service Charges ceased from January 1 2012 but can still be claimed for 2009, 2010 and 2011. A maximum annual spend of €400 on domestic service charges, including waste, water and sewage is eligible for tax relief at 20%.

Relief on Trade Union subscriptions were abolished in 2011 however you can still claim back to 2009 up to a maximum of €350 per annum.

Rent Relief is to be abolished completely by 2018.

Oct 2013

4

CPA Ireland – Practitioners’ Conference 2013

CPA Ireland held their Practitioners Conference in Carton House Friday 20th & Saturday 21st September 2013. Laura Murphy and Audrey Mooney from Thesaurus Software attended the conference. Laura and Audrey enjoyed meeting existing Thesaurus Payroll Manger and Solutions Plus customers – getting their feedback and comments.

It was also an opportunity to show Bright Contracts and our new payroll product BrightPay.

- Bright Contracts is an innovative software package that has everything you need to create and manage your staff handbook and and employment contracts.

- BrightPay is simple to use yet powerful and flexible, it will be offered alongside Thesaurus Payroll Manager giving customers a choice of payroll products.

Laura Murphy (left) and Audrey Mooney at the recent CPA conference

Oct 2013

4

Cheque no more

The National Payment Plan (NPP), announced by Finance Minister Noonan in April, aims to reduce cheque usage in Ireland to EU levels by 2015, a reduction of nearly 66%.

Cheques would be classed as being one of the more expensive methods of payment, as each bank has their own individual processing charge for cheques, up to .30c each and then there is the compulsory Government Stamp Duty of .50c on each cheque also. So before the cheque is even written, it has cost the issuer upwards of .65c.

In the world of payroll, cheques are not very common, for cost reasons more than anything but also with the increase and popularity of electronic pay systems like online banking and credit transfer, writing cheques is more cumbersome and timely.

With changing consumer habits; the Single European Payment Area (SEPA) enforcement, credit transfer payment methods, and a government drive to cut costs by implementing the National Payment Plan, does this mean cheque books will soon be consigned to the history books??

To read more about the NPP, please check out; http://www.centralbank.ie/paycurr/paysys/documents/national%20payments%20plan%20-%20final%20version.pdf

Sep 2013

29

How to manage sickness absence

Managing sick leave can be a challenge for every employer. It is essential that businesses find the balance between supporting those employees who are genuinely sick and minimising unnecessary absences in order to reduce costs. Costs can include:

- Loss of productivity

- Employing temporary cover

- Paying other employees additional overtime costs

The 2011 IBEC Guide to Managing Absence found that over 11 million days are lost to absence in Ireland every year, costing businesses €1.5 billion or €818 per employee. The report also found that employees missed 5.98 days on average, an absence rate of 2.6%.

Managing Absences

Absence levels can be addressed by taking some simple steps:

- Sickness Policy: there should be a policy in place that clearly sets out the procedure that will be followed by both employees and management in cases of absence through illness. The policy should be clearly communicated and consistently implemented. The default company handbook in Bright Contracts contains such a policy.

- Record, Monitor & Measure: monitoring and measuring enable employers to identify trends and recognise points at which absence levels need to be further investigated.

Return to Work Interviews: these are informal meetings between a line manager and an employee on the first day the employee returns to work. Return to work interviews are consistently rated as one of the most effective methods of managing absenteeism levels and it is recommended that they should be included in all sickness absence policies.

Bright Contracts – Employment contracts and handbooks.

BrightPay – Payroll Software

Sep 2013

24

What our customers say!

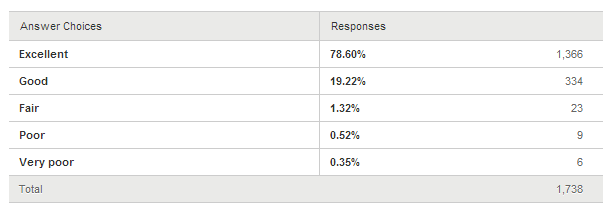

In a recent customer survey, 97.82% of respondents ranked the quality of our customer support as Excellent or Good.

This customer support covers our payroll software (Thesaurus Payroll Manager and BrightPay), our employment contracts software (Bright Contracts) and our accounts software (Solutions Plus) and is free to all registered users.

While the excellent/good percentage achieved would be way ahead of industry standards, we hope to reduce the 2.18% who ranked our support as fair or poor!

Sep 2013

23

PAYROLL TAX TIP – SEPTEMBER 2013

Employees do you know when your employer pays or partly pays medical insurance on your behalf you do not get Tax Relief at Source (TRS)?

When you pay your own medical insurance premium you automatically receive tax relief at the standard rate of tax, currently 20%. When your employer pays or partly pays medical insurance on your behalf you will not have been allowed Tax Relief at Source. The good news is you are entitled to the relief when your employer has paid the medical insurance on your behalf but you have to claim the relief due from Revenue.

Individual Paying Medical Insurance:

| Gross Premium | €1,000 |

| Tax Relief at Source: | €200 |

| Cost to Individual: | €800 |

Employer Paying Medical Insurance:

| Gross Premium | €1,000 |

| Tax Relief at source (employer pays this to Revenue through Tax Return) | €200 |

| Benefit in Kind | €1,000 |

Using the example above although the employer has only paid €800 to the medical insurance provider the employee will pay benefit in kind of €1,000.

If your employer pays or partly pays your medical insurance you should contact your local tax office to ensure you are receiving the tax relief.

Details can also be found in the help file for Thesaurus Payroll Manager and BrightPay.

Sep 2013

12

FREE BUSINESS EVENT FOR IRISH SMEs – TAKING CARE OF BUSINESS

Very few things in life are free so why not avail of a free event to help your business. If you own or manage a small business or are thinking of starting your own business you should visit www.takingcareofbusiness.ie to register as places are limited.

Attendees will:

- Meet with representatives from a number of State Offices & Agencies

- Get information & advice

- Find out ways to save your business money

- Receive support to help you in your business

Speakers on the day will include representatives from National Employment Rights Authority, Companies Registration Office, Department of Social Protection, Enterprise Ireland, Revenue as well as many others. Please see the eflyer for full details - https://www.takingcareofbusiness.ie/eflyer.pdf

Free Admission

Printworks Conference Centre, Dublin Castle

22nd October 2013 8.30am to 2.30pm

Initiative of the Department of Jobs, Enterprise & Innovation

Sep 2013

9

Not registered for LPT? - then no Tax refund!

Revenue are now getting tough with those who had failed to file a property return, and officials will not issue refunds to them.

Those who have not filed a property return will not be in a position to reclaim tax refunds for Medical expenses and tuition fees etc..

A spokeswoman for the Revenue said it will eventually issue refunds to those who have yet to register for the property tax, but it will first deduct the tax due from the refund amount.

In general, in advance of issuing a refund, a taxpayer's record will be reviewed to ensure no outstanding liability exists. Where a liability exists, an offset will be made before the refund will be issued.

Sep 2013

6

Kite Flying prior to Irish Budget

A new report presented to Social Welfare Minister Joan Burton recommends the PRSI rate for self employed and proprietary directors should go up from current rate of 4% to 5.5% to fund extra social benefits for those who work for themselves.

The higher PRSI rate would be used to fund the paying of long-term illness and disability benefits for the self employed, which are not available to those who work for themselves at the moment.

However, the higher PRSI payment that the advisory group recommends for all the self-employed to pay for disability benefits, is set to be opposed by business group ISME The report also states that it would provide a safety net for those who want to start a business.

The cabinet has approved publication of the report, however it remains unclear if the recommendations will form part of next month's budget.