Nov 2021

30

4 mistakes to avoid when running payroll

Thesaurus Payroll Manager's optional add-on product, Thesaurus Connect, unlocks powerful cloud features that help improve your payroll processes. Below, we outline 4 mistakes that you should be avoiding when running payroll, and what solutions both Thesaurus Payroll Manager and Thesaurus Connect can offer to ensure that your business is safe and secure using the latest technology.

1. Failing to back up your payroll data

It is highly recommended that you always keep a back-up of your payroll data. Using a cloud platform such as Thesaurus Connect or an external device to back up data is the safest option to ensure you never lose valuable information, should something happen to your computer.

2. Complicated annual leave process

Do you need an easy-to-use leave management tool? With Thesaurus Connect, employees can request annual leave through their own self-service portal. Once approved, the leave will be automatically synchronised to the payroll software on the desktop.

3. Inefficiency and human error

Your efficiency when running payroll will depend greatly on the level of automation used. Automation cuts down on the repetition of uncomplicated tasks. Thesaurus Software's automation includes payments platform Modulr to help reduce the risk of errors.

4. Not complying with GDPR

Using GDPR compliant payroll software means you and your employees can rest assured that all personal data is stored and managed in a safe and secure manner. Click here to find out how Thesaurus Connect is helping with GDPR.

Watch this short video for an overview of how your business can benefit from Thesaurus Connect.

Related articles

- Sharing a hybrid working policy with employees

- Budget 2022 - An Employer Payroll Focus

- Webinar on-demand: Connecting Payroll & Payments with Modulr

Nov 2021

29

Your payroll resolutions for the new year

New year’s resolutions can divide people into two camps. Those who love to start the new year with a clean slate and fresh goals, and those who’ve lost all optimism and scoff at their naivety. Understandably, there are cynics. Changing your behaviour is hard and more often than not, these resolutions fail. The resolutions most likely to fail are those that are too vague with no clear path on how to achieve them.

If you’re setting resolutions for your business or job this year, then break them up into manageable and uncomplicated steps. You’ve likely heard of SMART goals – specific, measurable, achievable, realistic, and time limited. If you’re looking to improve your business, for example, the payroll service you offer, then using this established tool is how you can go about it. Rather than simply saying “I want to make my payroll services better for clients” or “I want to reduce the time I spend on payroll”, decide on specific goals which will help you achieve this.

Achieving payroll goals for 2022

1. Provide an employee app for your clients

This one is a specific, easily achievable goal that can help you provide a better payroll service to your clients. Employee apps have risen in use in recent years and are popular among employers and employees alike. Thesaurus Connect, the cloud add-on to Thesaurus Payroll Manager, includes one and your clients will immediately gain extra value from it. Their employees can book their annual leave through the employee app, view confidential documents, and use it to view their payslips. From a marketing perspective, an employee app can also have multiple benefits. The extra value if offers can encourage customer loyalty, and its frequent use by clients and their employees can increase awareness of your business.

2. Offer clients instant access to reports

Similar to the goal above, this is a simple and achievable step that you can take to improve your payroll services. By using Thesaurus Connect, you can offer your clients access to payroll reports whenever they like. This can be more convenient for your clients and can reduce the amount of back-and-forth communication between you and the client.

Once you finalise payroll on Thesaurus Payroll Manager, the report will automatically become available for the client to view via their Thesaurus Connect self-service portal. Your clients will also be able to use the portal to access a number of preprogramed reports, as well as any other payroll reports which have been set up and saved on the payroll application.

3. Spend less time on manual entry

By setting this goal you can reduce the overall time you spend on delivering your payroll services. How can you go about this? First, decide where you want to reduce manual entry. For example, how you pay employees is a good place to start. By using a payroll software which is integrated with a payments platform, you can send wages on behalf of your client to their employees instantly. This means you no longer need to spend time creating bank files. To learn more about the integration with Modulr, click here.

4. Review your GDPR compliance

It’s always advisable to review your compliance with GDPR and ensure you’re keeping your client’s payroll data secure. By keeping on top of this, you can assure clients that security is a priority for your practice. Make sure the data you collect is the minimum amount required and remember to provide your clients and their employees access to their personal information. Again, an employee app can help with this. Using Thesaurus Connect, employees can view and update their personal information, whenever they like.

Discover more:

Now that you’ve decided on what steps you can take to improve your payroll services, make sure you have the right payroll software and employee app to support you. Book a demo today to discover more about Thesaurus Connect.

To keep up with the latest payroll news, check out our new Bright website. There, you'll be able to register for any of our upcoming payroll webinars and download our payroll guides.

Nov 2021

22

Christmas bonuses and One4All gift cards: your festive payroll guide covered

It’s coming close to the end-of-year madness, and as payroll processors you’re likely to be particularly busy in the lead-up to Christmas. Between managing the annual leave requests, Christmas bonuses, and holiday pay, there are a quite a few payroll tasks to sort out. To help you with this, we’ve put together a few key points to remember if you’re processing the payroll this Christmas.

Christmas Bonuses:

A Christmas bonus can put a smile on every employee’s face and can be the perfect way to say ‘thank you’ for all the hard work done during a difficult year. However, it’s important you don’t get caught out on tax implications.

Under Revenue’s Small Business Exemption Scheme, employers can gift employees and directors a small benefit of up to €500 in value, tax free, each year. Certain guidelines must be followed:

- This benefit cannot be in cash.

- Only one such benefit can be given to an employee in one tax year. Only the first one qualifies for tax free status, even if you do not offer the full €500.

With this tax-free benefit, you have the potential to save up to €653.65 in tax per employee as the total cost of a net €500 gift paid through payroll is €1,153.65. Remember though, if a benefit exceeds €500 in value, the full value of that benefit is subject to tax.

In order to qualify for the small benefit exemption, it is important that gift cards are not given to employees as a salary sacrifice. This means you cannot fund the bonus from a deduction of your employee’s salary. The rewards must be invoiced and paid external to payroll.

Vouchers:

- Tax-free vouchers are a popular way of gifting a Christmas bonus to employees.

- Tax-free vouchers can be used only to purchase goods or services.

- The tax-free vouchers must be purchased from the business bank account or credit card.

- Employees or directors cannot purchase a voucher themselves and seek reimbursement for it.

One4all gift cards are commonly used as they allow employees to choose a gift from over 11,000 retailers. They also don’t charge over administration, service, or delivery.

If you’re a Thesaurus Payroll Manager customer, you can purchase One4all gift cards through the software. The software's integration with One4all allows you to easily purchase the cards, and more importantly, it can keep track of your purchases. This ensures that you’ll be notified if you attempt to purchase more than one gift card for an employee in any one tax year. Click the link to discover more about how the integration between Thesaurus Payroll Manager and One4All works.

Please note: to use the One4All feature on Thesaurus Payroll Manager you must have upgraded to the latest version of the software.

When to pay employees in December:

It’s common for many businesses to have a different payroll date in December. Often, employees will be paid earlier in December so they can cover their holiday expenses and because many businesses are closed at the end of the month.

It's likely only your monthly paid employees will be affected by this. If you plan to pay employees early, make sure you give yourself enough time to process the payroll in advance. Give your employees notice of the change in pay date and enough time that they can submit their expenses if they have any. Remember to make provisions to ensure that you report your employees’ pay to Revenue on or before the pay date.

Managing annual leave requests:

Christmas can be a very busy time for many businesses, and it may also be a time when employees are most looking to take annual leave. While you need to ensure you have enough employees working to cover this busy period, you should also look to be as fair as possible.

It’s recommended that you have a clear policy on holiday requests. Most often, a “first-come, first-served” approach is used. This provides a fair and transparent method for all employees. One way of achieving this is by using an employee app. Thesaurus Connect, a cloud add-on to Thesaurus Payroll Manager, includes an employee self-service platform which can be accessed online or through the Thesaurus Connect employee app. The app gives employees access to a self-service portal that they can use to request leave at any time. Once a request has been made, the employer or their manager, will be notified of it. When a request has been made it is time stamped, allowing you to see the order in which they come in. The employee will then be notified if the request has been accepted or rejected. Thesaurus Connect also includes a company-wide calendar for the employer to view so that you can ensure that there is adequate staffing before approving an annual leave request.

Discover more

Interested in learning more about annual leave management on Thesaurus Connect? Book a free online demo here for a detailed walkthrough of everything Thesaurus Connect has to offer you and your business.

Related Articles:

Nov 2021

1

Thesaurus Customer Update: November 2021

Welcome to Thesaurus Software's November update. Our most important news this month include:

-

Report calls for pension age increase

-

Budget 2022 - Employer Payroll Focus

-

Payroll App – What your employees can and cannot see

New: Pay Employees through Thesaurus Payroll Manager

Thesaurus Payroll Manager is excited to introduce our latest integration with the payments platform, Modulr. This integration will give you a fast, secure and easy way to pay employees through the software without the need to create bank files. Join our free webinar to find out how it works.

What to Include in a Hybrid Working Policy

Having hybrid working policies and agreements in place is essential when returning employees to the office and agreeing on a split between working remotely and working in the office. Book a demo of Bright Contracts to see how they can help your business today.

Reward your employees with a One4all gift card

With Halloween officially over for another year, it’s time to start preparing for the festive season, in particular, how you would like to reward your employees. Did you know, you can purchase One4all gift cards for employees through Thesaurus Payroll Manager?! Employers can give a gift card of up to €500 tax-free to employees.

Next Generation Payroll Trends for Accountants

In today’s world, payroll can (and should) be profitable for accountants. Join our upcoming webinar where we explore various ways that accountants can automate payroll processes and become more efficient.

The App that Every Business should be using

Give employees more control with Thesaurus Connect’s employee self-service app. Employees can view their payslips and HR documents, request annual leave and view their leave balance taken and remaining and can even update their personal details. Book a free 15-minute demo to find out more.

The Year that was: 2021 in Review

2021 was a year of both personal and business challenges. COVID-19 changed life as we knew it and resulted in a lot of changes being made worldwide. New policies were introduced, people's places of work changed as well as a number of other adjustments.

Join Bright Contracts for a look back at 2021 where we detail all the employment law changes that were made and a look forward as to what the year 2022 will bring.

Oct 2021

28

New Feature: Introducing direct payments through Thesaurus Payroll Manager

Thesaurus Software have partnered up with payment platform Modulr to give payroll processors a fast, secure and easy way to pay employees directly through Thesaurus Payroll Manager. Up until now, when you wanted to pay employees through credit transfer, you needed to create a bank file that would then need to be uploaded to your online banking account. This can be quite a manual process that is prone to human error. This new method of paying employees cuts down on admin work and eliminates manual entry errors, saving you time.

To use this new integration, first ensure you have created a Modulr Account. You will also need to download a mobile app called Authy which you will use to authenticate user logins and payments. The Authy app is a second layer of security that will help protect your account from hackers or data breaches.

How does Thesaurus Payroll Manager’s new direct payments feature work?

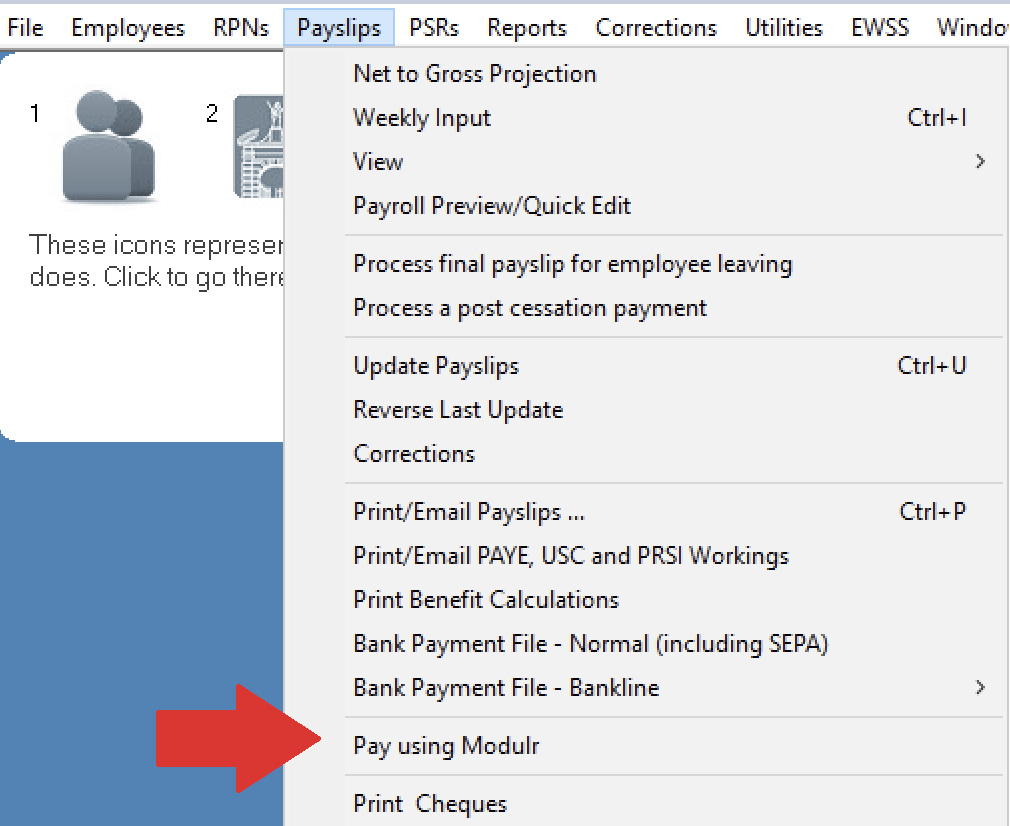

1. Once you have updated payslips for a pay period as you normally would, under the payslips tab choose pay using Modulr.

2. A box will then appear on screen asking you to log into your Modulr account.

3. Once you have entered your details, you will authenticate your login through the Authy app on your mobile device.

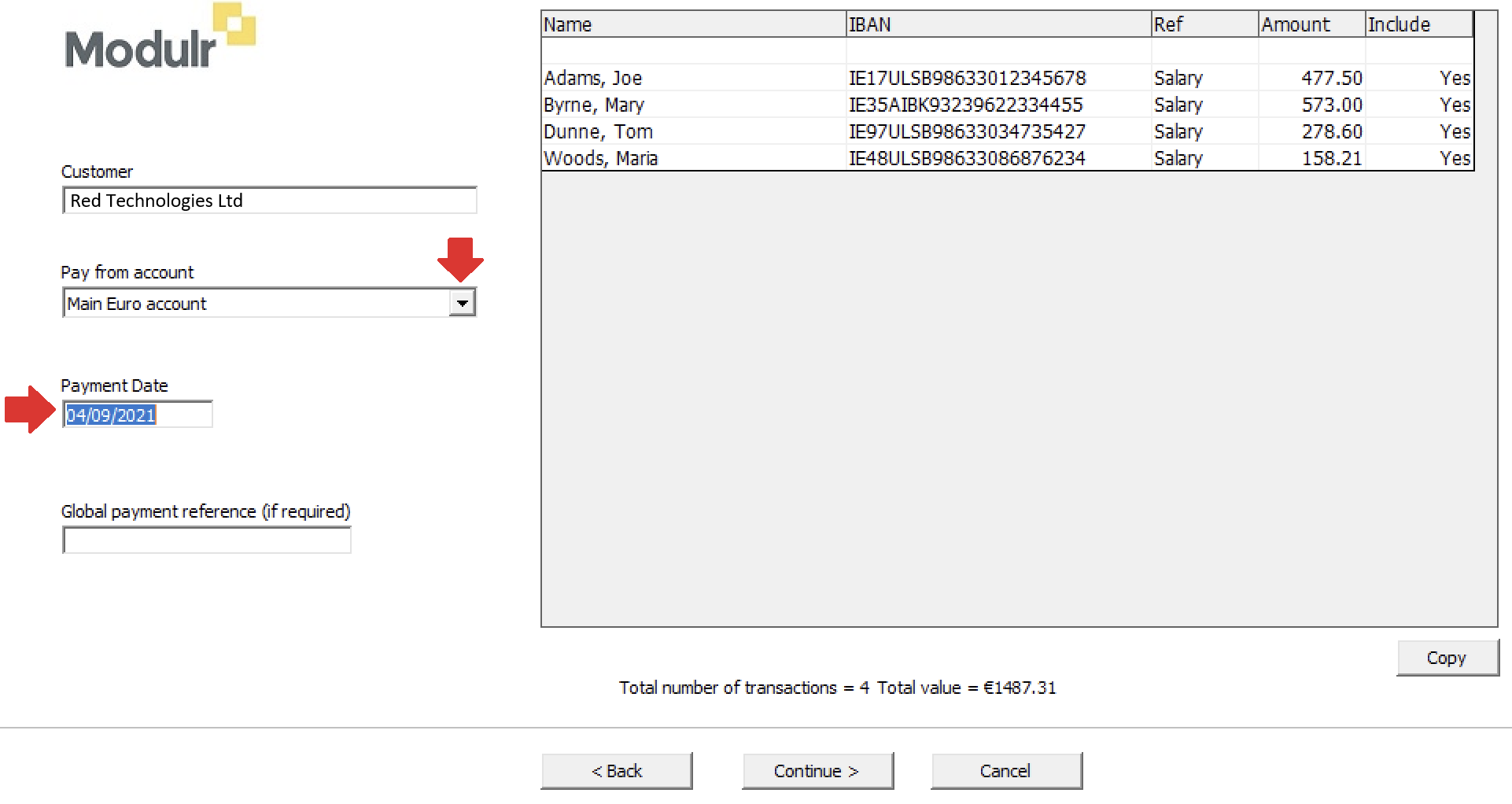

4. Once set up, your payroll information in Thesaurus Payroll Manager will automatically synchronise with your Modulr account. In the pop up, any employees whose payment method is set to credit transfer will be listed along with their IBAN and the amount they are to be paid for that period, a reference can also be added here.

5. Next, simply select the account you would like to make the payment from and choose a payment date.

6. After clicking continue, you will be shown a summary of your payment request submission. Once you have reviewed the payment request you can click “Send to Modulr.”

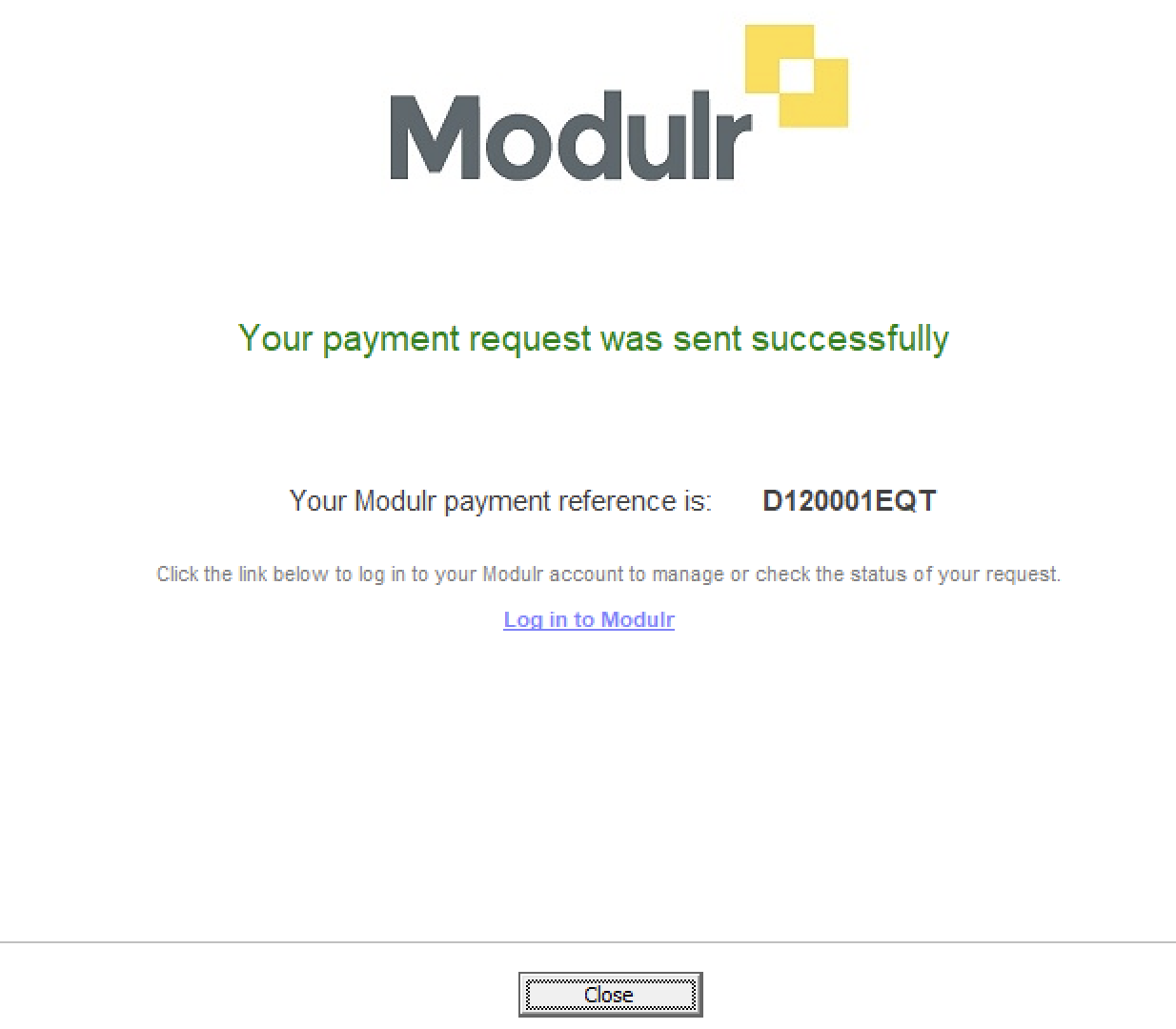

7. You will need to authenticate the submission by once again using your Authy app. The following screen will be displayed to let you know that the transfer has been successful:

8. The final step is for the authorised person to log in to their Modulr account and approve the payment request submission. This may be the payroll processor themself or if you are processing payroll for a client then this task can be assigned to the client, giving them control by allowing them to give the final approval on the payment of employees.

For more detailed instructions on how to use Modulr with Thesaurus Payroll Manager, view our help guide.

What are the benefits of using Thesaurus Payroll Manager’s Modulr integration to pay employees?

Improved workflow and less chance of errors

Paying employees directly through Thesaurus Payroll Manager using our new integration with Modulr means that you can save yourself time by cutting down on admin work and eliminating the risk of manual entry errors.

Secure payments and peace of mind

Encrypted communication between parties and authentication using your mobile means payments made through Modulr are secure and fully traceable, giving you peace of mind.

More flexibility with same day payments

Thesaurus Payroll Manager and Modulr’s integration allows you to pay employees using SEPA (Single Euro Payments Area). With SEPA, if you authorise the payments before 2 PM the money will land in employees’ bank accounts that same day. If the payments aren’t authorised until after 2 PM then it will go through the next business day. This quick turnaround means that you have the flexibility to change payments up until the day before or even the morning of pay day.

Register for one of our free webinars where we will discuss how our new integration can benefit your business.

Webinar for Accountants Webinar for Employers

Oct 2021

13

Budget 2022 - An Employer Payroll Focus

Income Tax

There is no change to tax rates for 2022, the standard rate will remain at 20% and the higher rate at 40%.

- The Standard Rate Cut Off Point (SRCOP) has been increased by €1,500

- The Personal Tax Credit increased by €50 from €1,650 to €1,700

- The Employee Tax Credit increased by €50 from €1,650 to €1,700

- The Earned Income Credit increased by €50 from €1,650 to €1,700

Universal Social Charge (USC)

- Exemption threshold remains at €13,000

- There are no changes to the rates of USC

- The 2% USC rate band has increased by €608, from €20,687 to €21,295

USC Rates & Bands 2022

- €0 – €12,012 @ 0.5%

- €12,013 – €21,295 @ 2%

- €21,296 – €70,044 @ 4.5%

- €70,045 + @ 8%

Medical card holders and individuals aged 70 years and older whose aggregate income does not exceed €60,000 will continue to pay a maximum rate of 2%.

The emergency rate of USC remains at 8%.

Non-PAYE income in excess of €100,000 will continue to be subject to USC at 11%.

Employment Wage Subsidy Scheme

The Employment Wage Subsidy Scheme (EWSS) will continue until the end of April 2022 in a graduated form.

- The current rates will remain for October and November 2021

- Employers availing of EWSS on December 31st 2021 will continue to be eligible until April 30th 2022, assuming they meet the eligibility criteria which will continue to be a 30% reduction in turnover/customer orders in 2021 compared to 2019

- EWSS will close to new employers from January 1st 2022

- For December, January and February a two-rate structure will apply as follows:

Level of subsidy the employer will receive is per paid employee

| Employee Gross Weekly Wages | Subsidy Payable |

| Less than €151.50 | Nil |

| From €151.50 to €202.99 | €151.50 |

| From €203 to €1,462 | €203 |

| More than €1462 | Nil |

- For March and April 2022, a flat rate subsidy of €100 will apply

- The reduced rate of employer’s PRSI will no longer apply for the final two months of the scheme

National Minimum Wage

The National Minimum Wage will increase by 30 cent from €10.20 to €10.50 per hour from January 1st 2022.

Pay Related Social Insurance (PRSI)

The weekly threshold for the higher rate of employer PRSI will increase to €410 from €398, this is in line with the increase in the National Minimum Wage.

Parent’s Leave

Parent’s leave has been increased by two weeks, this brings it up to seven weeks from July 2022.

VAT

The reduced rate of 9% VAT for the tourism and hospitality sector will continue to apply until the end of August 2022.

Social Welfare Payments

There will be a €5 increase in all weekly Social Welfare payments with effect from January 2022. The maximum personal rate of Illness Benefit will be increased to €208 per week. Maternity Benefit, Parent’s Benefit and Paternity Benefit will be increased to €250 per week.

Remote Working

Where an employer does not pay the e-working allowance (€3.20 per day) to an e-worker, employees will be able to claim tax relief on 30% of the cost of vouched expenses for heat, light and broadband in respect of the days worked from home.

Extension of BIK Exemption for Electric Vehicles

The BIK exemption for battery electric vehicles will be extended out to 2025 with a tapering effect on the vehicle value. This measure will take effect from 2023. For BIK purposes, the original market value of an electric vehicle will be reduced by €35,000 for 2023, €24,000 for 2024 and €10,000 for 2025.

Related articles:

Oct 2021

11

Sharing a hybrid working policy with employees

While it is great to now have the option of returning to the office, it doesn’t necessarily mean that everyone will want to, not on a full-time basis at least. Experiencing the longer lie-ins, no commute, and an overall better work-life balance, employers and employees alike have enjoyed the benefits of remote working. However, each employee is different and along with the benefits of working from home comes challenges such as employees feeling isolated and unmotivated. Phase II of the Remote Working during COVID-19 National Survey conducted in Ireland in October 2020 found that 94% of respondents would like to work remotely for at least part of their working week. Because of this, many businesses have adopted a hybrid working model, with many more set to do so in the coming months.

What is hybrid working and do employees have the right to request it?

In Ireland, hybrid working falls under remote working and may sometimes be referred to as e-working or flexible working. A hybrid working model is when an employee works part of their time in the workplace provided by their employer and part of their time from home or anywhere else other than the normal place of work. In Ireland, employees have the right to request that they work this way. However, currently there is no legal framework around how such a request should be made and how it should be handled by employers. The legislation giving employees the right to request remote working is expected to be published at the end of the year.

As an employer, you may already have experience with employees working from home and the advantages it can bring. You also may have already decided that you would like to adopt a hybrid working model into your workplace. If this is the case, a Hybrid Working Policy document should be created so that all staff are aware of how the new arrangement will operate.

What information should be included in a Hybrid Working Policy?

The rules and limitations surrounding the company’s hybrid working policy should be clearly outlined in the Hybrid Working Policy, including:

- Are there any roles within the company which may not be suitable for remote working

- Will employees need to follow a hybrid working schedule

- Are there certain tasks which you, as an employer, would prefer to be taken care of in the office rather than at home (or vice versa)

- While working remotely, is the employee allowed to work anywhere or are there limitations. Examples of this may be that the employee must stay in the country or cannot work in public settings due to cybersecurity concerns

- What hours should an employee be working. Are there set working hours, when should they take breaks and what is the maximum number of hours they should be working each day

The policy should include details of how staff will be managed and supported as they work from separate locations, including:

- How should employees communicate with managers and colleagues and what should be done to ensure effective and fair communication

- How should new staff be onboarded

- How will employees’ performance will be managed

- How will employees’ health, safety and wellbeing be maintained

Guidelines for remote working should be clearly defined, including:

- What equipment is suitable for remote working and how will the equipment be provided

- What are the insurance requirements for the employer and the employee

- Details of a home risk assessment

- How cyber security will be maintained

How should a Hybrid Working Policy be shared with employees?

Once you have put together a Hybrid Working Policy, what is the best way to share it with employees? When sharing the policy with employees, you may want to share it with all or multiple employees at the same time. As employees may be working from different locations, it’s likely not possible to physically hand out the document to each employee.

You could email the policy to employees. However, emails are not always an effective way of getting your employees' attention. In a 2019 survey, 34% of respondents said that they sometimes ignore HR emails from their employer, while 5.7% even said that they always ignore HR emails. The reason for this may be that employees are simply overwhelmed by the number of emails they receive at work.

A better way of getting employees to read your new Hybrid Working Policy is by sharing it with them through an app on their smartphones. Thesaurus Connect is a cloud add-on to Thesaurus’ payroll software which includes an employee app which can be used to take care of a number of HR tasks. With Thesaurus Connect, employers will have access to their own employer dashboard from where they can upload employee documents to be shared with employees through the employee app. Employers can share documents with individual employees, multiple employees or all employees if they wish to do so. This means employees can easily access all their documents in one place, be it their individual contract of employment or company-wide documents. Since the documents are available on the employees' phones, it also means they can be accessed anytime, anywhere.

When a document is shared with employees this way, each employee will receive a push notification on their mobile to notify them that the document has become available for them to view. With push notifications, because users can instantly read the alert on their device, they are less likely to ignore it like they may do with an email. Furthermore, employers can track who has and who has not read each document and so you can give them a nudge if needs be.

Reviewing and updating your Hybrid Working Policy

As hybrid working is still a relatively new concept for many employers, the policy should be reviewed regularly. Employers may want to make changes to the policy as the needs of the business and employees change. The updated policy can be quickly reshared on Thesaurus Connect, and employees, are once again alerted to it by push notification.

As well as sharing documents, you can also easily share payslips with employees using Thesaurus Connect. Other HR functions of Thesaurus Connect which are done using the employee app are annual leave management and updating employee information. To learn more about the many benefits of Thesaurus Connect and how they can improve your business and ease the transition to hybrid working, book a free online demo today.

Related articles:

Oct 2021

5

Report calls for pension reform

On the 17th September, a new report, Population Aging and the Public Finances in Ireland, was published by Minister for Finance, Paschal Donohoe. It highlighted the need for significant structural reforms to address the aging population, longer life expectancy, and the associated age-related expenditure. It found that current revenue increases will not be sufficient and suggested that policy reforms such as linking the Stage Pension Age to life expectancy will be required.

What are the report’s findings?

At the moment, two major factors are contributing to a worrying financial situation for the state and for those most vulnerable in our society. One, people are living longer. Life expectancy is expected to grow by three and a half years between 2019 and 2050. Two, similar to other developed countries, the birth rate is expected to fall. Such developments will have a substantial impact on the age-profile of Ireland’s population. It is predicted that 8% of people in Ireland will be aged 80 or over in 2050, up from 3% in 2019. This means that there will be fewer people of a working age generating the necessary funds to support an older population.

As a result of the aging population, the report expects the GDP (Gross domestic product) to slow relative to current growth rates and that the associated costs of an older population will be €17 billion higher than in 2019, in today’s terms. A slowdown in output growth will impact government revenue which in turn will create considerable pressure to fund this increase in demographically sensitive expenditure such as the state pension. It states, that without reforms, this will push the public finances onto “an unsustainable path”.

Proposed policy reform:

It is proposed that the most important reform to tackle the estimated cost of an aging population is to increase the State Pension Age (SPA), aligning it with the increased life-expectancy. However, in December of last year, the Social Welfare Act 2020 was signed into law preventing the previous plans to increase the SPA from 66 to 67 in 2021 and to 68 in 2028. The report estimates that the cost of keeping the SPA at 66 will be €50 billion over the long term.

This publication is part of the Finance Department’s submission to the Commision on Pensions which was set up in November 2020 in order to examine sustainability and eligibility issues in respect to the State Pension and the Social Insurance Fund.

The Pensions Commision only recently submitted their report to Minister for Social Protection Heather Humphreys in early September. It is understood, but not yet confirmed, that the report recommends that the SPA rise in quarterly increments to 67 between 2028 and 2031, before gradually increasing to 68 by 2039.

What about auto enrolment?

The report published by the Minister of Finance included no mention of auto enrolment. Looking at the UK, auto enrolment was introduced in 2012 to address similar issues facing Ireland; lack of retirement savings, increasing life expectancy, and the long-term repercussions that this would have on their State Benefits system. The Pensions Act 2008 requires all UK employers to offer workplace pension schemes and to automatically enrol eligible workers into the scheme.

In February of this year, it was announced that the proposed auto enrolment scheme in Ireland would be delayed yet again, until at least 2023. The auto enrolment scheme would see workers automatically enrolled into a pension scheme, with contributions made by the employer, the employee, and the state. The most recent figures from 2019 showed that only 30% of all employees are making regular contributions to their pensions and the gross income point at which most employees make a pension contribution is between €40,000 and €45,000. The COVID-19 pandemic exacerbated the issue, creating a growing divide between who are saving for retirement and who cannot.

Auto enrolment is undoubtedly necessary to address serious vulnerabilities in Ireland’s existing pension model. Cróna Clohisey, the Public Policy Lead with Chartered Accountants Ireland, previously spoke in March 2021, on how the SPA should not be changed without parallel reform to private pensions. Commenting on the issue, she said “Introducing auto-enrolment is the obvious answer to what is now a huge problem. This scheme will incentivise people to save and that in turn will reduce the reliance on the state pension”.

To learn about auto enrolment and how Thesaurus Payroll Manager will cater for it speak to a member of our team today.

Oct 2021

1

Thesaurus Customer Update: October 2021

Welcome to Thesaurus Software's October update. Our most important news this month include:

-

BrightPay and Relate Software join forces to create an accounting and payroll software champion

-

It’s time to go paperless & how an employee app can help

EWSS eligibility rules and rates for October

Revenue have announced that the Employment Wage Subsidy Scheme (EWSS) eligibility rules and rates will remain unchanged for the month of October 2021.

5 ways to boost the efficiency of your payroll process (for employers)

Join our upcoming webinar on 20th October where we discuss practical ways you can streamline payroll and HR processes within your business using cloud technology.

6 tips for payroll success while making a profit (for bureaus)

Join our upcoming webinar on 7th October where we discuss practical ways you can streamline payroll and HR processes in your practice using cloud technology while making a profit.

Set up Thesaurus Payroll Manager for multiple users

Each Thesaurus licence key can be installed and activated on up to 10 PCs. If shared access is required, the data location can be set to your server or cloud environment.

Let’s talk about family leave

Join our sister product Bright Contracts for their free webinar on 19th October about all things family leave related. From Maternity Leave to Parent’s Leave, Bright Contracts gives you all of the information about entitlements and pay that employers need to know.

A step closer to Sustainability

Earlier this year at Thesaurus Software we formed a ‘Green Team’ that will identify and implement opportunities that can improve the sustainability of our company. Follow us on our journey to keep up with our latest projects.

Sep 2021

28

BrightPay joins forces with Relate Software to create an accounting and payroll software champion

We are delighted to announce that BrightPay has joined forces with Relate Software, a leader in post-accounting, practice management, and bookkeeping software. The partnership will aim to create a software champion, serving payroll and accounting bureau and SMEs across Ireland and the UK.

Owned by Thesaurus Software, BrightPay is a modern payroll and HR software which takes care of every aspect of running your payroll, from entering employee and payment details to creating payslips and sending real-time payroll submissions. The software has been designed from the ground up to be clear and simple, and yet no compromise has been made on payroll features.

Likewise, Relate is dedicated to building innovative and focused products designed specifically for the accounting profession. Its offering includes Surf products, a cloud native product suite of bookkeeping, post-accounting, and practice management software. Relate is an industry-leader in Ireland and has been building software for over 25 years.

By partnering with Relate and combining products and strengths from both businesses, we can provide a greater offering to our customers, with scope and backing for further innovation and development. This is an exciting moment in BrightPay’s journey to delivering a one stop solution for businesses and accountancy firms. Together we will aim to provide a best-in-class software suite with a clear value proposition to drive efficiency and reduce errors, all with increased flexibility from working with a cloud offering.

For more information, please see the press release and customer FAQs.