Sep 2021

8

A spotlight on employee-led sustainability efforts

Earlier this year Thesaurus Software moved into our new energy-efficient offices in Duleek, Co. Meath. Employees have formed the 'Green Team', a company-wide committee tasked with identifying and implementing opportunities that can improve the sustainability of our company.

From the start the Green Team have demonstrated their enthusiasm for environmental sustainability and passion for sharing their knowledge. This is highlighted below in a number of projects they’ve undertaken:

Making the Garden Bloom:

While the initial focus was on the new purpose-built offices, the Green Team soon turned their attention to the green spaces outside. Inspired by their Earth Week guest, Dr Emma Reeves, a Senior Ecologist at the Forest, Environmental Research, & Services (FERS), the group was particularly keen to plant native, bee-friendly plants and trees that would help pollinators and further benefit biodiversity. The first planting phase has been completed with the group planning the layout of the garden and planting shrubs, flowers, and trees. In September, the second phase will begin, with the team planting Spring bulbs including hyacinths, tulips, and daffodils.

Single-Use Plastics Awareness Campaign:

On the 3rd of July, the Single-Use Plastics Directive came into effect for all EU member states. In Ireland, this means that certain single-use plastics such as straws and coffee cups have been banned from the Irish market. Supporting this initiative, the Green Team created an awareness campaign highlighting the use of plastic in the beauty industry and introduced a single-use plastics ban in the office. With 10 of the most commonly found single-use plastic items representing 70% of all marine litter, this is an important and useful step all employees can take.

Future projects:

The Green Team’s future plans are focused on tackling pollution and engaging with more employees at Thesaurus Software. In September, the company will take part in a clean-up at a local beach and will also develop a new project highlighting the unsustainable nature of fast fashion and what options are available to address it.

If you’re interested in keeping up to date with Thesaurus Software’s journey, sign up to our sustainability newsletter for future updates.

Sep 2021

1

Thesaurus Customer Update: September 2021

Welcome to Thesaurus Software's September update. Our most important news this month include:

-

Sick pay comes to Ireland: How does this affect employers and payroll processors?

-

Webinar on-demand: Employment Wage Subsidy Scheme (EWSS) Guest Speaker: Revenue

Employment Wage Subsidy Scheme (EWSS) changes in October

Join BrightPay for a free webinar on 30th September where we will be joined by representatives from the Revenue Commissioners to discuss upcoming changes to the Employment Wage Subsidy Scheme in October.

A video message from Paul, CEO of Thesaurus Software

Watch a short video where Paul talks about how our add-on product Thesaurus Connect can reduce your stress and perhaps even help improve your bottom line as an accountant.

Link your payroll data to the cloud

With Thesaurus Connect, you don't need to worry about manually backing up your payroll data. When you link an employer to Thesaurus Connect, it will be automatically synchronised to the cloud as you run your payroll or make any changes.

What happens if I don't submit Revenue's Employer Eligibility Review Form?

Failure to complete and submit the EWSS Eligibility Review Form that confirms the required reduction and related declaration will result in the suspension of payment of the EWSS claim and possible penalties.

Customer survey 2021 results

The results are in for Thesaurus Software’s annual customer survey. Our key findings include a 99.4% customer satisfaction rating, which is fantastic news! Some customer comments include:

“We are a very happy customer; we are a small company but extremely happy with the fantastic efforts of support during a world pandemic. I would consider this reliability when recommending you”.

“Your product is the best wage system for Irish employers since day one. It has made payroll so easy and efficient for employer and employee. It is unbeatable. Your Support people are accessible and always helpful. A wonderful team. Thanks for making my life so easy for more than 25 years”.

“Anytime I have had to phone Thesaurus the staff are so friendly and helpful and know their job so well. It's a complete pleasure to deal with them”.

Aug 2021

31

Customer Survey 2021 - the results are in!

We value our customers’ feedback and opinions as it allows us to improve and grow our business. We recently conducted an annual survey as it is a powerful indicator of overall success as a company as it captures the entire experience of using Thesaurus Payroll Manager, from the product features to the daily customer support to the live webinars and online documentation.

We are proud of the continued high marks and appreciate the thoughtful feedback from this year’s survey and would like to say a massive thank you to everyone who took part. The survey looked at customer satisfaction, software performance and customer support.

We’ve compiled the results of our latest survey and we wanted to share them with you.

The Results

As the survey was very comprehensive, we’re not going to share the results of each and every question. But we did want to share the main areas of focus and what you, our customers, have said.

- We asked: How satisfied are you with Thesaurus Payroll Manager?

- You said: Thesaurus Payroll Manager achieved a 99.4% customer satisfaction rate, which is fantastic news for everyone on the Thesaurus Software team.

- We asked: How would you rate the following Thesaurus Connect features?

- You said: The most highly rated Thesaurus Connect features included automatic cloud backup (98.9%), online employer dashboard (96.7%) and employee self-service portal & app (98.5%).

- We asked: How satisfied are you with Thesaurus Software's Customer Support?

- You said: The majority of customers rated our telephone support (99%), email support (99.5%), online help documentation (98.5%) and online video tutorials (98.9%) as excellent, very good or good, giving our customer support team an overall satisfaction rate of 99%.

- We asked: How would you rate Thesaurus Software’s handling of COVID-19?

- You said: 99.5% of customers answered that they found our handling of COVID-19 overall to be either excellent, very good or good - in particular, our free online COVID-19 webinars (99.6%), payroll upgrades (99.7%), online help and support (99.5%) and phone and email support (98.9%).

Customer Testimonials

We also received a number of customer testimonials from the survey - all of which will be added to the Thesaurus Software website in due course. Some of our favourite testimonials received include:

“We are a very happy customer; we are a small company but extremely happy with the fantastic efforts of support during a world pandemic. I would consider this reliability when recommending you”.

“Your product is the best wage system for Irish employers since day one. It has made payroll so easy and efficient for employer and employee. It is unbeatable. Your Support people are accessible and always helpful. A wonderful team. Thanks for making my life so easy for more than 25 years”.

“Anytime I have had to phone Thesaurus the staff are so friendly and helpful and know their job so well. It's a complete pleasure to deal with them”.

Get in touch

If you feel that you’re not using the full suite of Thesaurus Connect’s features to its fullest potential, you can book a free 15-minute online Thesaurus Connect demo.

Aug 2021

31

What happens if I don't submit Revenue’s Employer Eligibility Review Form?

The Irish government has extended the Employment Wage Subsidy Scheme (EWSS) until 31st December 2021. The scheme gives employers impacted by COVID-19, a subsidy per employee to help keep them in employment. On 9 July, Revenue published guidelines to highlight the changes to the EWSS applicable for the period from 1 July 2021. The main change made to the scheme was in relation to eligibility.

To assist employers in ensuring continued eligibility for the scheme, from 30th June 2021, all employers are required to complete and submit an online monthly EWSS Eligibility Review Form (ERF) through ROS by the 15th of each month. Companies claiming EWSS must fill out a monthly eligibility form, showing their revenue for 2021 remains at least 30% below the reference period in 2019 and a declaration to confirm that the information submitted is correct and accurate to the best of their knowledge. Failure to complete and submit the EWSS Eligibility Review Form that confirms the required reduction and related declaration will result in suspension of payment of EWSS claims.

Revenue has stated: “Where Revenue determines that an employer, at any time over the term of the scheme, claimed and received payment by applying accounting practices that are clearly not appropriate, or by deliberately misrepresenting the true financial situation of the business, it will be excluded from the EWSS in its entirety. No further claims will be accepted, and all subsidy paid and PRSI credit issued will be immediately repayable together with interest and penalties. The business may also face possible criminal prosecution.”

The government has paid nearly €4 billion to date in EWSS payments on top of the €2.9 billion paid under the earlier TWSS. Revenue have launched an investigation on companies that are suspected of overclaiming pandemic wage subsidies.

According to Revenue’s code of practice for audits and non-audit interventions, officials can make unannounced site visits, conduct profile interviews with business owners, carry out assurance checks, and initiate investigations. Please ensure you are submitting correct information to avoid any penalties.

Upcoming webinar

Join Thesaurus Software for a free webinar on 30th September where we will be joined by representatives from the Revenue Commissioners to discuss upcoming changes to the Employment Wage Subsidy Scheme in October and the Employer Eligibility Review Forms. There will also be a live Q&A session to answer any questions that you may have.

Limited Places Remaining – Click here to reserve your place.

Related articles:

Aug 2021

3

Thesaurus Customer Update: August 2021

Welcome to Thesaurus Software's August update. Our most important news this month include:

-

Watch On-Demand: EWSS Changes & The Return to Work

-

Going paperless: how an employee app can help

-

How Statutory Sick Pay will be calculated when introduced in 2022

EWSS Employer Eligibility Review Form

Revenue confirmed it has extended the deadline for the completion and submission of the EWSS Eligibility Review Form in respect of June 2021 to 15 August 2021. The eligibility review form in respect of July 2021 is also due to be submitted on the same date. Watch our webinar on-demand where we cover everything you need to know.

Statutory Sick Pay - Coming January 2022

Currently, there is no legal obligation for employers in Ireland to pay employees who are on sick leave, and it is up to the discretion of each employer. However, it will be mandatory for employers in Ireland to provide Statutory Sick Pay (SSP) for employees from January 2022.

Employee self-service app – A must-have tool for every business

Thesaurus Connect gives employees access to a user-friendly smartphone and tablet app that gives them access to their payslips, HR documents, annual leave calendar and much more. Self-service apps are becoming more popular as they benefit both the employer and employee.

Adopting a hybrid working model

The COVID-19 crisis has completely shifted the way we work and live with companies having to quickly adopt new initiatives and technologies to ensure employee safety whilst maintaining productivity. Join Bright Contracts for a free online webinar on the 25 August where our team of experts will discuss how hybrid working has changed the way we work and live and what this change means for your business.

Jul 2021

29

Revenue's EWSS Eligibility Review Form

The Finance (Covid-19 and Miscellaneous Provisions) Bill 2021 was published on 23 June and extended the Employee Wage Subsidy Scheme (EWSS) to 31 December 2021. On 9 July, Revenue published guidelines to highlight the changes to the EWSS applicable for the period from 1 July 2021. The main change made to the scheme was in relation to eligibility.

Businesses who started trading before 1 January 2019 must compare their level of trade for 2021 to the level of trade for 2019 to assess their eligibility for the scheme. This will allow businesses whose trade was severely impacted due to government restrictions in the first half of 2021 to trade at higher levels for the second half of 2021 compared to 2019 and still avail of the scheme, subject to meeting the scheme conditions.

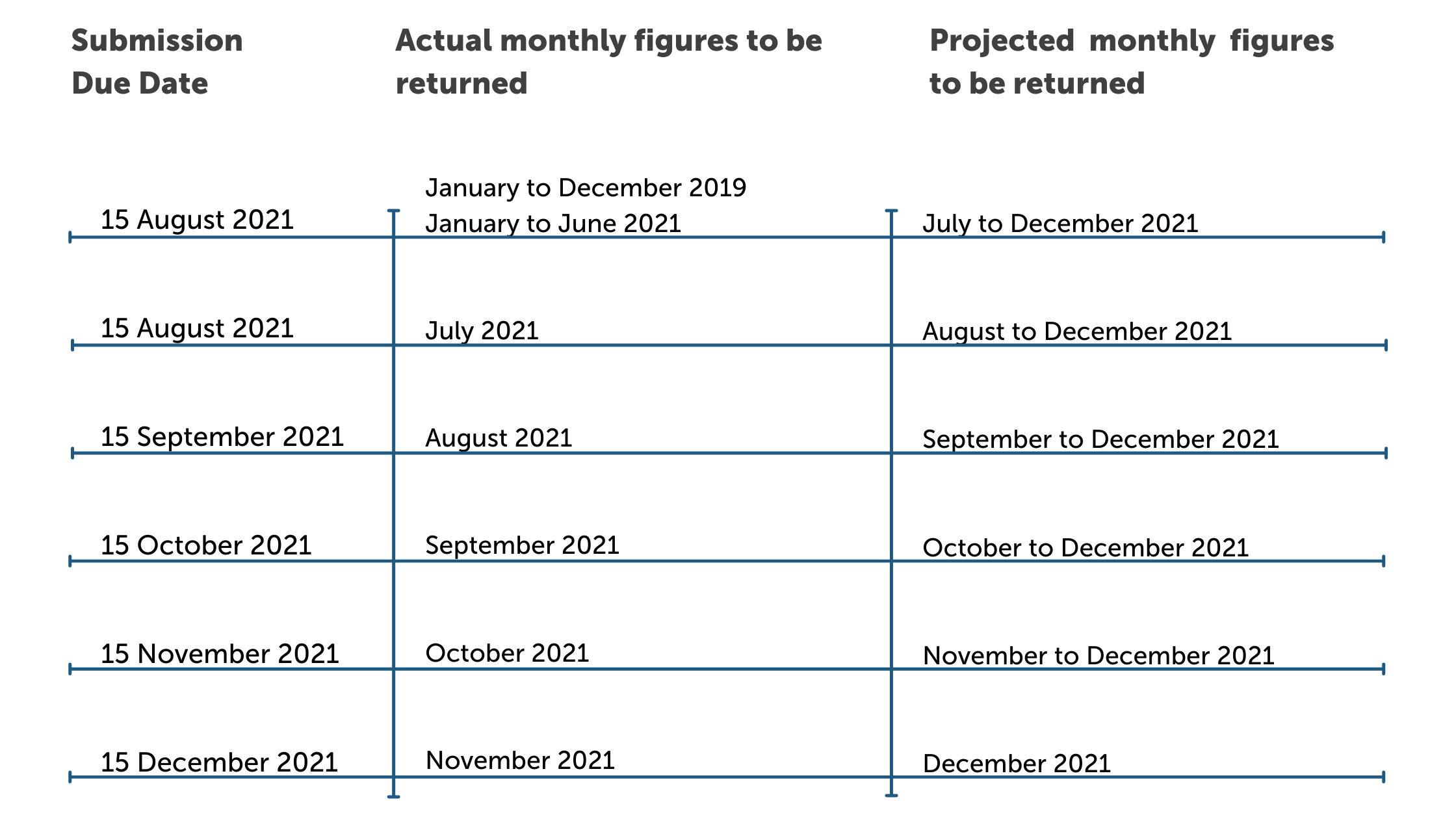

Employers must now submit monthly EWSS Eligibility Review Forms

To assist employers in ensuring continued eligibility for the scheme, from 30 June 2021, all employers will be required to complete and submit an online monthly EWSS Eligibility Review Form (ERF) through ROS. Revenue has extended the deadline for completing and submitting the EWSS Eligibility Review Form in respect of June 2021 to 15 August 2021. The eligibility review form in respect of July 2021 is also due to be submitted on the same date.

Through ROS, employers will need to provide details of actual monthly turnover or customer order values for 2019, together with the same detail for the first six months of 2021. They will also need to provide details of monthly projections for the remainder of 2021 i.e. July to December 2021.

On 15th of every subsequent month during the scheme operation, employers will need to provide details of the actual results for the previous month, together with reviewing the original projections provided to ensure they remain valid. This can be summarised as follows:

Timely submission of the electronic form will provide assurance to both employers and Revenue that subsequent EWSS claims are appropriate and in line with the terms of the scheme. This, in turn, will reduce the possibility of employers claiming EWSS amounts to which they are not entitled and having to repay those amounts to Revenue.

Childcare businesses continue to be eligible for the scheme with no reduction in turnover or orders required. However, there is a requirement for such businesses to register for EWSS through ROS prior to submitting payroll for paydates in respect of which subsidies are being claimed.

Employer Declaration

As part of the monthly submission, employers (or agents on their behalf) must sign a declaration that the information submitted is correct and accurate with best-estimate projections for future months. Failure to complete and submit the EWSS Eligibility Review Form that confirms the required reduction and related declaration will result in suspension of payment of EWSS claims.

Childcare businesses and businesses who commenced trading after 1 November 2019 will have to complete a declaration as part of the Employer Eligibility Review platform on ROS to confirm their exemption.

For more information you can read Revenue's Guidelines on eligibility for the Employment Wage Subsidy Scheme from 1 July 2021 document here.

Related articles:

Jul 2021

26

It’s time to go paperless & how an employee app can help

COVID-19 has accelerated the move to paperless systems for businesses all over the world. In retail we saw outlets curtailing the use of cash due to fear of spreading the virus; causing payment habits to evolve faster than ever. With more of us working remotely, the office has also seen rapid innovation and it has become crucial that businesses digitalise their paper forms. While some of us may have found the move to digital difficult at first, many of us are now used to it and can easily visualise a future where paper is no longer needed in the workplace. The pros of a paperless workplace far outweigh the cons and it has the ability to revolutionise the way we work.

The move to paperless is nothing new in the world of payroll processing. Going back to a time where payroll was done manually and without the help of software is unimaginable to most payroll processers. However, if you are still using paper anywhere in your workflow, it’s time to make the change.

Thesaurus Connect is a cloud add-on to our payroll software that can help you to digitalise payroll and HR processes, allowing you to cut down on your use of paper and even stop using it altogether. So how can Thesaurus Connect help you achieve this?

Thesaurus Connect digitalises the following tasks:

- Sharing documents with employees such as contracts of employment, staff handbooks etc.

- Distributing payslips to employees

- Annual leave management

What are the benefits of digitalizing payroll processes?

1. Your company can save money

Surveys have found that the average amount spent by businesses on printing is over €800 per employee. With 30% of print jobs not even being picked up from the printer and 50% of print jobs ending up in the bin within 24 hours, businesses are essentially throwing money away. A document such as a staff handbook can be as long as 100 pages. Say you have 40 employees, that adds up to 4000 pages and a lot of money being spent on paper and ink. Sharing the staff handbook through a cloud portal cuts out this cost altogether.

2. It is more convenient for you and your employees

With Thesaurus Connect, staff have the ability to access important documents through the employee self-service app on their phone. This means they no longer have to store physical documents that can often be lost or get thrown away. It also means that if you would like to update or change any of the information in the document, it is easy to do so. Once the document has been updated, employees will receive a push notification to let them know the newly updated document is ready to be viewed.

Sharing a document online with a few clicks of a mouse is far more convenient than having to print off, sort through and physically distribute reams of paper. It also doesn’t matter where an employee is; in the office, working from home, or even travelling abroad, everyone will have access to the document at the same time.

3. You can save yourself hours of time

Paper-based processes are notoriously slow and are more prone to error which can end up taking you hours to correct. One way you can save time with Thesaurus Connect is by digitalising your annual leave management processes. Instead of having employees submit paper forms, the employee can request leave wherever or whenever suits them; be it from their desk or even in their own time through the Thesaurus Connect mobile or tablet app.

Once a request for leave has been made, the relevant manager will receive a notification on their own Thesaurus Connect dashboard. From the dashboard, employers can either approve or deny the leave request. Through your dashboard, you can view a real-time, company-wide calendar where you can see which employees are on leave, when they are on leave and the type of leave, saving you hours of time when dealing with annual leave requests.

4. It improves accountability

Another great benefit of using Thesaurus Connect's online document sharing feature instead of paper is that it allows for accountability. From the employer dashboard, users have the ability to track who has read the documents which have been shared with them and who hasn’t. When it comes to managing annual leave through Thesaurus Connect, you can assign users to manage requests from specific employees. You also will have a record of who has requested leave, when, and who has dealt with the request.

5. It improves security

Employee documents, especially payslips, are highly confidential documents which contain sensitive personal information. It is the responsibility of the employer to ensure that the employees' information is kept safe and secure. If you are still sharing paper payslips with employees, you are leaving them at high risk of a data breach. In the Thesaurus Connect mobile app, employees will receive an email and a push notification when their latest payslip becomes available to be viewed or downloaded. From the app, employees can also view and download all historic payslips. Thesaurus Connect uses a design structure that maximises security. Each user will have their own login details and unique password. Thesaurus Connect utilises the Microsoft Azure platform, keeping the employee’s personal information secure.

6. It helps you stay ahead of the competition

Technology is always evolving and by not moving from manual paper processes to digital ones, you are at risk of being left behind by the competition. Companies are having to continuously innovate to keep up with customers' expectations and payroll is no different. The digital transformation has changed employees’ expectations. To attract and retain top talent, employers need to replace old manual processes with digital solutions. In a recent employee survey, 91% of employees said they want digital solutions and 88% think that technology is a vital part of the employee experience.

7. You are helping the environment

Lastly, the biggest advantage of going paperless is that you are helping to save the environment. By curtailing the use of paper in the workplace not only are you saving trees, but you are also helping to reduce pollution, save water and cut down on the use of fossil fuels which are used to make ink. Turning a single tree into 17 reams of paper releases around 110 lbs of C02 into the atmosphere. It has become the responsibility of businesses to cut down on carbon emissions and going paperless is the first step you can take.

It is becoming increasingly important for businesses to make more environmentally friendly choices. Thesaurus Software recently conducted a survey of our UK customers and over 70% of respondents said that they would like to make more environmentally friendly decisions for their business. From the same survey, 43% said that it was either extremely important or very important for them to choose suppliers who make a conscious effort to reduce the impact they have on the environment.

Read about our own sustainability efforts here.

Why not book a free online demo of Thesaurus Connect today and find out more about its benefits and how it can help your business go paperless.

Related articles:

Jul 2021

9

Preparing for Statutory Sick Pay to be introduced in Jan 2022

The Government is currently drafting the Sick Leave Bill 2021 which will make it mandatory for employers in Ireland to provide Statutory Sick Pay (SSP) for employees. The sick pay scheme aims to ensure that every worker in the private sector will have the security and peace of mind of knowing that if they fall ill and miss work, they will not lose out on a full day’s pay.

Currently, there is no legal obligation on employers in Ireland to pay employees who are on sick leave, and it is up to the discretion of each employer. At present, employees in companies who do not offer sick pay can apply for Illness Benefit after 3 days of illness. Different rates apply depending on the employee’s earnings - the maximum for those earning over €300 is €203 per week. COVID-19 had a particular impact on those employees in companies where sick pay was not provided and highlighted the fact that Ireland is one of just three remaining countries in the EU not to have introduced a Statutory Sick Pay Scheme.

See statement from Tánaiste, Leo Varadkar:

“Ireland is one of the few advanced countries in Europe not to have a mandatory sick pay scheme, and although about half employers do provide sick pay, we need to make sure that every worker, especially lower-paid workers in the private sector, have the security and peace of mind of knowing that if they fall ill and miss work, they won’t lose out on a full day’s pay. I believe this scheme can be one of the positive legacies of the pandemic as it will apply to illness of all forms and not just those related to COVID-19.”

The plan is to introduce SSP over a 4-year period commencing January 2022.

The initial plan is as follows:

- 2022 – 3 days covered

- 2023 – 5 days covered

- 2024 – 7 days covered

- 2025 – 10 days covered

The rate of pay will be calculated on 70% of the employee’s wages (subject to a daily maximum of €110). Employees will need to provide a medical certificate to qualify and they must be in that employment for a minimum period of 6 months before they can qualify.

The daily earnings threshold of €110 is based on 2019 mean weekly earnings of €786.33 and equates to an annual salary of €40,889.16. It can be revised over time by ministerial order in line with inflation and changing incomes.

Once entitlement to sick pay from their employer ends, employees who need to take more time off may qualify for Illness Benefit from the Department of Social Protection subject to PRSI contributions.

Employers will need to prepare for this new legislation and update Contracts of Employment and company policies accordingly. Check out our sister product, Bright Contracts, which can help you keep contracts of employment and staff handbooks up to date with changing legislation.

Please note that the above plan has not yet been legislated on and is subject to change.

Related articles:

Jul 2021

2

Thesaurus Customer Update: July 2021

Welcome to Thesaurus Software's July update. Our most important news this month include:

-

EWSS changes under Ireland’s Economic Recovery Plan

-

Managing the Annual Leave Backlog as the Country Reopens

-

Thesaurus Software’s new energy efficient office

Free Webinar: EWSS Changes & The Return to Work

The Employment Wage Subsidy Scheme (EWSS) has been extended until 30 December 2021. Join our upcoming webinar where we discuss the extension of the EWSS, including the new enhanced eligibility rules and what you need to know about returning to the workplace. The webinar takes place on 27 July at 10.30 am and is free to attend for all employers and payroll bureaus.

Revenue EWSS guidance is expected to be updated next week.

Bureau Branding in Thesaurus Connect

Bureaus have the ability to add their own firm branding to Thesaurus Connect, including the company name, company logo and contact details. The branding will be visible to clients on their self-service dashboard which will help enhance your client relationships.

Multiple Users in Thesaurus Connect

Employers have the option to add as many users as they wish to their Thesaurus Connect account at no additional cost. Invite managers or an external accountant as a standard user and set up user permissions for different access levels. For example, you can set up a department manager to manage employee leave, with no access to the payroll.

Automatic Enrolment Delayed until 2023

The introduction of automatic enrolment in Ireland will be delayed until at least 2023. When introduced, this will mean by law, that employers will have to enrol their employees in a workplace pension scheme.

Let’s Get Topical – The Vaccine Policy

One year on, the impact of COVID-19 on the employment landscape is hugely significant and has brought about many changes, especially the provisions of an employment contract. This is why Bright Contracts has been a saving grace for many employers as it regularly updates all contract and handbook content.

To get an insight into what Bright Contracts can do, you can watch our video and you can also download a trial version of the software first to get a look at the content and layout.

Thesaurus Software's Sustainability Journey

Here at Thesaurus Software we take environmental responsibility very seriously and are committed to developing our business towards ecological sustainability at both a company and an individual level. Thesaurus Software opened a new purpose-built office in May 2021. We have also recently established a passionate Green Team to educate, promote and inspire sustainability to our employees and our loyal customers.

Jun 2021

30

EWSS Changes and Ireland’s Economic Recovery Plan

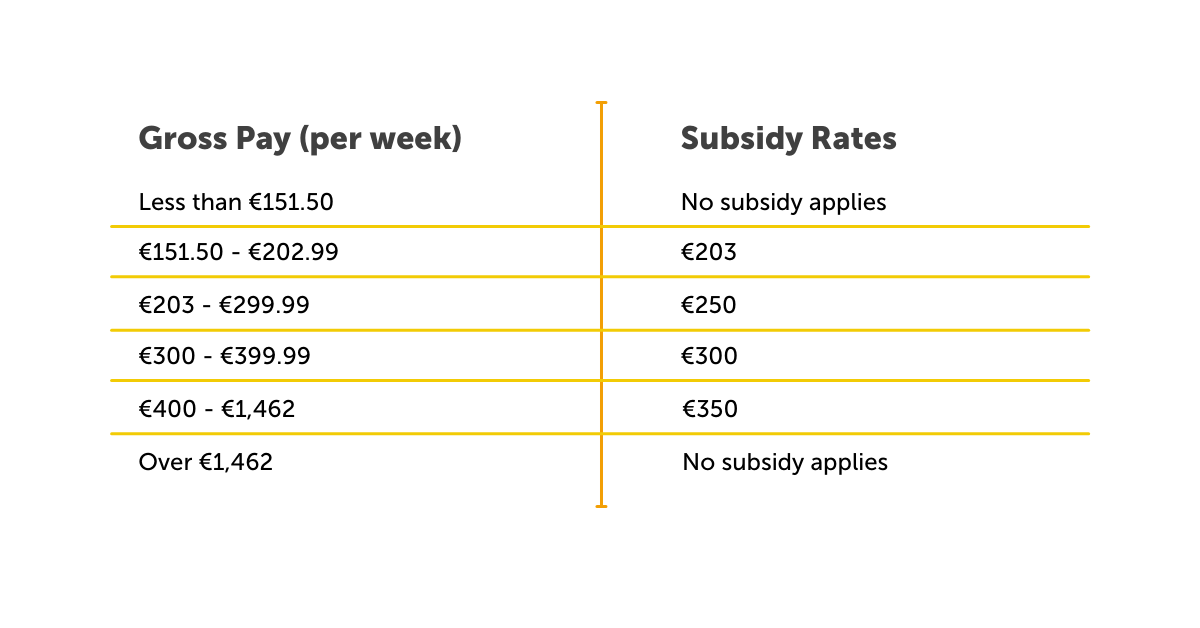

On the 1st of June 2021, the Government announced that the Employment Wage Subsidy Scheme (EWSS) would be extended until the 30th of December 2021 to support businesses as they continue to reopen and recover from the COVID-19 pandemic. The rates below will continue for July, August and September 2021.

A decision on the subsidy rates that will apply for October 2021 onwards, is expected to be announced toward the end of August or early September.

The Government have set out an economic recovery plan for Ireland with measures to help businesses who have experienced significant negative economic disruption due to COVID-19 with a minimum of a 30% decline in turnover or in customer orders. The period for this been extended from 6 months to 12 months under the new recovery plan. If you are unsure whether you are within the guidelines or need more clarity, please see further Revenue guidance.

Although the EWSS is a subsidy payable to employers only and will not impact employee payslips, the scheme must still be administered through the payroll. Employers must operate PAYE on all payments, including regular deduction of income tax, USC and employee PRSI from your employees’ pay. With Thesaurus Payroll Manager you can simply tick that 'you are registered for EWSS and this employee is being claimed for' when processing the payroll.

Remember, you must continue to review your eligibility status on the last day of every month to ensure you continue to meet the eligibility criteria. If you no longer qualify, you should de-register for EWSS with effect from the following day and untick the EWSS tickbox in the payroll software.

Want to find out more about the Employment Wage Subsidy Scheme? Register for our next webinar on 27th July where our panel of payroll and HR experts will answer any questions that you may have.

.png)