Oct 2021

13

Budget 2022 - An Employer Payroll Focus

Income Tax

There is no change to tax rates for 2022, the standard rate will remain at 20% and the higher rate at 40%.

- The Standard Rate Cut Off Point (SRCOP) has been increased by €1,500

- The Personal Tax Credit increased by €50 from €1,650 to €1,700

- The Employee Tax Credit increased by €50 from €1,650 to €1,700

- The Earned Income Credit increased by €50 from €1,650 to €1,700

Universal Social Charge (USC)

- Exemption threshold remains at €13,000

- There are no changes to the rates of USC

- The 2% USC rate band has increased by €608, from €20,687 to €21,295

USC Rates & Bands 2022

- €0 – €12,012 @ 0.5%

- €12,013 – €21,295 @ 2%

- €21,296 – €70,044 @ 4.5%

- €70,045 + @ 8%

Medical card holders and individuals aged 70 years and older whose aggregate income does not exceed €60,000 will continue to pay a maximum rate of 2%.

The emergency rate of USC remains at 8%.

Non-PAYE income in excess of €100,000 will continue to be subject to USC at 11%.

Employment Wage Subsidy Scheme

The Employment Wage Subsidy Scheme (EWSS) will continue until the end of April 2022 in a graduated form.

- The current rates will remain for October and November 2021

- Employers availing of EWSS on December 31st 2021 will continue to be eligible until April 30th 2022, assuming they meet the eligibility criteria which will continue to be a 30% reduction in turnover/customer orders in 2021 compared to 2019

- EWSS will close to new employers from January 1st 2022

- For December, January and February a two-rate structure will apply as follows:

Level of subsidy the employer will receive is per paid employee

| Employee Gross Weekly Wages | Subsidy Payable |

| Less than €151.50 | Nil |

| From €151.50 to €202.99 | €151.50 |

| From €203 to €1,462 | €203 |

| More than €1462 | Nil |

- For March and April 2022, a flat rate subsidy of €100 will apply

- The reduced rate of employer’s PRSI will no longer apply for the final two months of the scheme

National Minimum Wage

The National Minimum Wage will increase by 30 cent from €10.20 to €10.50 per hour from January 1st 2022.

Pay Related Social Insurance (PRSI)

The weekly threshold for the higher rate of employer PRSI will increase to €410 from €398, this is in line with the increase in the National Minimum Wage.

Parent’s Leave

Parent’s leave has been increased by two weeks, this brings it up to seven weeks from July 2022.

VAT

The reduced rate of 9% VAT for the tourism and hospitality sector will continue to apply until the end of August 2022.

Social Welfare Payments

There will be a €5 increase in all weekly Social Welfare payments with effect from January 2022. The maximum personal rate of Illness Benefit will be increased to €208 per week. Maternity Benefit, Parent’s Benefit and Paternity Benefit will be increased to €250 per week.

Remote Working

Where an employer does not pay the e-working allowance (€3.20 per day) to an e-worker, employees will be able to claim tax relief on 30% of the cost of vouched expenses for heat, light and broadband in respect of the days worked from home.

Extension of BIK Exemption for Electric Vehicles

The BIK exemption for battery electric vehicles will be extended out to 2025 with a tapering effect on the vehicle value. This measure will take effect from 2023. For BIK purposes, the original market value of an electric vehicle will be reduced by €35,000 for 2023, €24,000 for 2024 and €10,000 for 2025.

Related articles:

Jul 2021

29

Revenue's EWSS Eligibility Review Form

The Finance (Covid-19 and Miscellaneous Provisions) Bill 2021 was published on 23 June and extended the Employee Wage Subsidy Scheme (EWSS) to 31 December 2021. On 9 July, Revenue published guidelines to highlight the changes to the EWSS applicable for the period from 1 July 2021. The main change made to the scheme was in relation to eligibility.

Businesses who started trading before 1 January 2019 must compare their level of trade for 2021 to the level of trade for 2019 to assess their eligibility for the scheme. This will allow businesses whose trade was severely impacted due to government restrictions in the first half of 2021 to trade at higher levels for the second half of 2021 compared to 2019 and still avail of the scheme, subject to meeting the scheme conditions.

Employers must now submit monthly EWSS Eligibility Review Forms

To assist employers in ensuring continued eligibility for the scheme, from 30 June 2021, all employers will be required to complete and submit an online monthly EWSS Eligibility Review Form (ERF) through ROS. Revenue has extended the deadline for completing and submitting the EWSS Eligibility Review Form in respect of June 2021 to 15 August 2021. The eligibility review form in respect of July 2021 is also due to be submitted on the same date.

Through ROS, employers will need to provide details of actual monthly turnover or customer order values for 2019, together with the same detail for the first six months of 2021. They will also need to provide details of monthly projections for the remainder of 2021 i.e. July to December 2021.

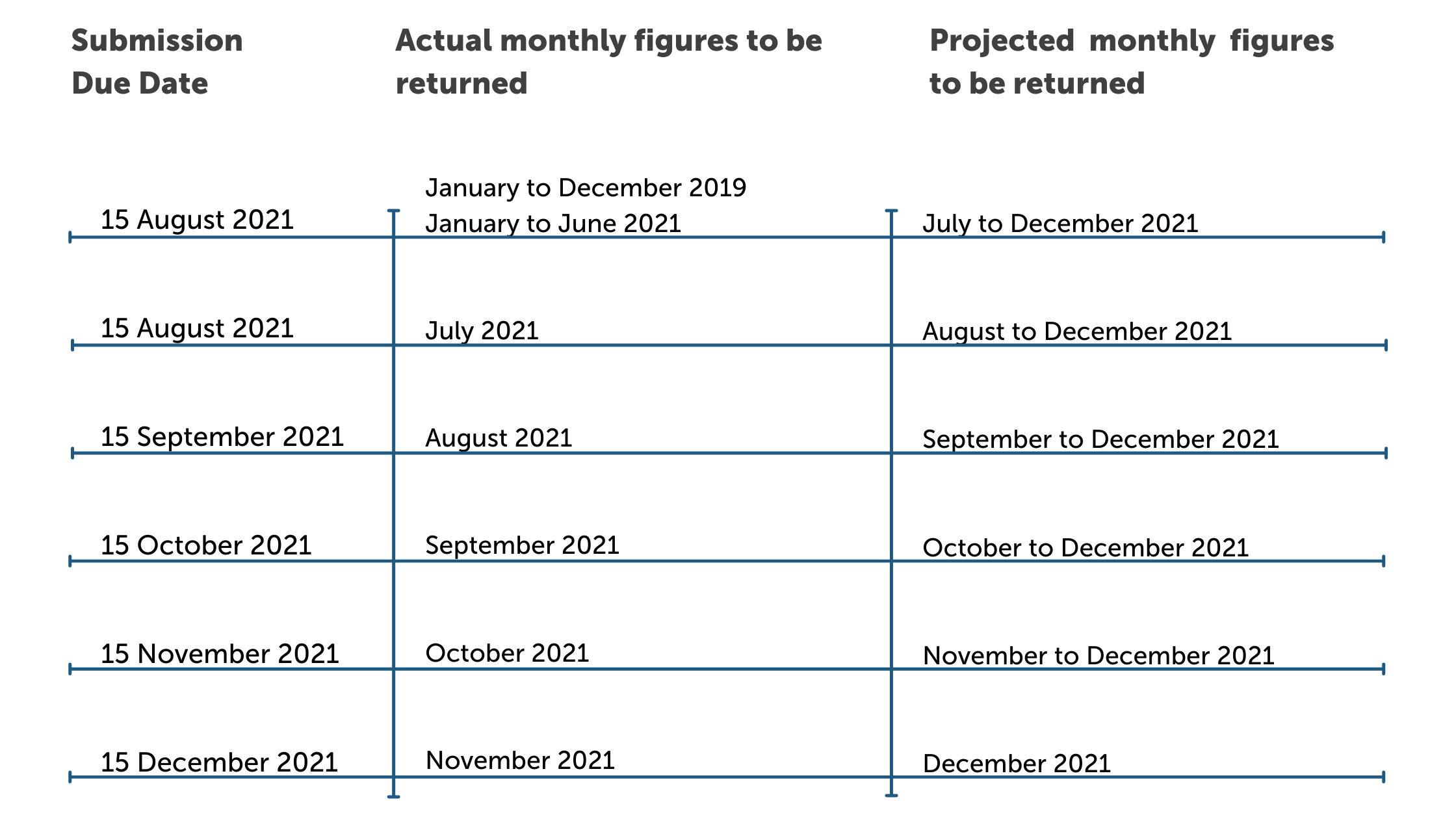

On 15th of every subsequent month during the scheme operation, employers will need to provide details of the actual results for the previous month, together with reviewing the original projections provided to ensure they remain valid. This can be summarised as follows:

Timely submission of the electronic form will provide assurance to both employers and Revenue that subsequent EWSS claims are appropriate and in line with the terms of the scheme. This, in turn, will reduce the possibility of employers claiming EWSS amounts to which they are not entitled and having to repay those amounts to Revenue.

Childcare businesses continue to be eligible for the scheme with no reduction in turnover or orders required. However, there is a requirement for such businesses to register for EWSS through ROS prior to submitting payroll for paydates in respect of which subsidies are being claimed.

Employer Declaration

As part of the monthly submission, employers (or agents on their behalf) must sign a declaration that the information submitted is correct and accurate with best-estimate projections for future months. Failure to complete and submit the EWSS Eligibility Review Form that confirms the required reduction and related declaration will result in suspension of payment of EWSS claims.

Childcare businesses and businesses who commenced trading after 1 November 2019 will have to complete a declaration as part of the Employer Eligibility Review platform on ROS to confirm their exemption.

For more information you can read Revenue's Guidelines on eligibility for the Employment Wage Subsidy Scheme from 1 July 2021 document here.

Related articles:

Nov 2020

13

Free webinar - Wage Subsidy Scheme with Revenue

We have teamed up with Revenue to bring you a free webinar where we discuss everything you need to know about TWSS reconciliation and the Employment Wage Subsidy Scheme (EWSS).

Wage Subsidy Scheme with Revenue

10.30am | 19th November

The Employment Wage Subsidy Scheme (EWSS) gives employers impacted by COVID-19 a subsidy payable per employee to help keep them in employment. This scheme has replaced the Temporary Wage Subsidy Scheme (TWSS) from 1 September 2020 and will run until 31 March 2021.

Employment Wage Subsidy Scheme | Guest: Revenue

What you’ll learn:

- What is TWSS Reconciliation

- The Key Points of the Employment Wage Subsidy Scheme

- Employer & Employee Eligibility Criteria

- Operating Payroll & Processing of Subsidy Claims

- Operating EWSS with BrightPay & Thesaurus Payroll Manager

- Q&A Panel Discussion

Hear from Payroll Experts

Q&A Panel:

- Paul Byrne, Managing Director at Thesaurus Software?

- Audrey Mooney, Customer Support Manager at Thesaurus Software?

- Laura Murphy, HR Manager & Employment Law Expert at Thesaurus Software?

From the Revenue Commissioners:

- Karen Byrne,?Assistant Principal (Personal Division)

- Siobhán?Gilbourne,?Higher Executive Officer (Personal Division)

- Gearóid Murphy,?Principal Officer (Personal Division)

- Anne Dullea, Principal Officer (Medium Enterprises Division) & business owner of the EWSS?

- Laura Glancy, Assistant Principal (Personal Taxes, Policy and Legislation Division)

Even if you can’t make it, register now and we’ll send you a recording.

Related Articles:

Thesaurus COVID-19 Resource Hub

Blog: Customer update October 2020

On-demand COVID-19 Webinars

Oct 2020

15

Budget 2021: Employer Payroll Focus

Here are the main points from Budget 2021, as delivered by Minister for Finance Paschal Donohoe.

Pay As You Earn (PAYE)

There is no change to tax rates for 2021, the standard rate will remain at 20% and the higher rate at 40%.

In addition, there is no change to Standard Rate Cut Off Points (SRCOPs).

Earned Income Tax Credit

The Earned Income Tax Credit will be increased by €150 from €1,500 to €1,650 to bring it in line with the PAYE tax credit.

Dependent Relative Tax Credit

The Dependent Relative Tax Credit will be increased by €175 from €70 to €245 to support families with caring responsibilities.

Universal Social Charge (USC)

- Exemption threshold remains at €13,000

- 2% threshold increased by €203 from €20,484 to €20,687

- Due to the increase to the 2% threshold, the income chargeable at 4.5% reduces from €49,560 to €49,357

- There are no changes to the rates of USC

For 2021, USC will apply at the following rates for those earning in excess of €13,000

| Rate Bands | Rate |

| Up to €12,012 | 0.5% |

| Next €8,675 | 2% |

| Next €49,357 | 4.5% |

| Balance | 8% |

Medical card holders and individuals aged 70 years and older whose aggregate income does not exceed €60,000 will pay a maximum rate of 2%.

The emergency rate of USC remains at 8%.

Non-PAYE income in excess of €100,000 is subject to USC at 11%.

National Minimum Wage

The National Minimum Wage will increase by 10 cent from €10.10 to €10.20 per hour from January 1st 2021.

Pay Related Social Insurance (PRSI)

The weekly threshold for the higher rate of employer PRSI will increase to €398 from €395, this is in line with the increase in the National Minimum Wage.

State Pension Age

The age to qualify for the State Pension will remain at 66 for 2021, it was due to increase to 67.

Illness Benefit

The ‘waiting days’ for Illness Benefit will reduce from 6 days to 3 days for all new claims from the end of February 2021.

Parent’s Leave

Parent’s Benefit has been increased by three weeks, this brings it up to five weeks. The leave must be taken during the first year following the birth of a child.

Wage Subsidy Scheme

The Employment Wage Subsidy Scheme (EWSS) is due to continue until 31st March 2021, a wage subsidy scheme in some form is expected to be in place until the end of 2021.

Warehousing of Tax Liabilities

The tax debt warehousing scheme will be expanded to include repayments of the Temporary Wage Subsidy Scheme (TWSS) owed by employers.

Covid Restrictions Support Scheme (CRSS)

A new scheme was introduced for businesses impacted by Covid-19 restrictions, it will provide support for businesses that have had to close because of Covid-19. The scheme is operational from October 13th until March 31st 2021.

The payment will be calculated as a percentage of the business’s average weekly VAT exclusive turnover in 2019 subject to a maximum payment of €5,000 per week. The first payments are expected to be made in Mid-November.

VAT

The 13.5% rate of VAT for the tourism and hospitality sector will be reduced to 9% from November 1st 2020, the reduced rate will remain in place until December 31st 2021.

For the latest payroll updates, don’t miss our next free webinar where we are joined by Revenue.

Webinar: Wage Subsidy Scheme with Revenue

10.30am | 19th November

Webinar Agenda

- TWSS Reconciliation

- Employment Wage Subsidy Scheme - Key Points

- Employer & Employee Eligibility Criteria

- Operation of Payroll & Processing of Subsidy Claims

- Operating EWSS with BrightPay & Thesaurus Payroll Manager

- Q&A Panel Discussion

If you are unable to attend the webinar at the specified time, simply register and we will send you the recording afterwards.

Related Articles:

BrightPay COVID-19 Resource Hub

Blog: Customer update October 2020

On-demand COVID-19 Webinars

Oct 2019

22

Parent’s Leave & Benefit Bill... Some paid leave is on the way for all new parents!

The Government is working on a range of changes to help parents spend more quality time with their children. Last week, they published the new Parent's Leave and Benefit Bill 2019. This Bill is expected to be enacted on or before 1st November 2019.

So what is this….?

The new Parent’s Leave & Benefit Bill introduces the concept of paid parent's leave for employees for the first time in Ireland. Originally called the ‘Parental Leave & Benefit Bill’, this has had a name change to the Parent’s Leave & Benefit bill to clearly differentiate parent's leave from parental leave (which is a separate entitlement!).

What’s included in the new Bill?

- Parents will be able to take two weeks paid parents leave for any child born / adopted on or after 1st November 2019. The leave must be used before the child’s first birthday. In the case of multiple births, a parent will only be able to claim parents leave once.

- It is available to both parents and it can be taken as a continuous period of two weeks or in two separate one week blocks.

- An employee needs to give their employer six weeks' notice of when they want to take the leave, stating the expected start date and the duration.

- Employers are allowed postpone the parent's leave in situations where taking the leave would have a substantial adverse effect on the operation of the employer's business. Employers however cannot postpone the leave for more than 12 weeks.

- Parents receive a statutory payment of €245 per week (they need the necessary PRSI contributions to qualify!).

The Bill does not require employers to pay employees while on parent's leave. It will be up to each employer to decide if they want to top-up an employee's parent's benefit and, if so, by how much. The advice would be to be consistent with approaches taken on the other family leave types.

Company policies should be reviewed and updated to reflect the changes being introduced. This will help you prepare for any increase in staff requests. Make sure you keep your paperwork & record keeping in order.

Want to find out more? Register for our free employment law webinar.

Feb 2019

22

Employment (Miscellaneous Provisions) Act 2018

The Minister for Employment Affairs and Social Protection, Regina Doherty has confirmed the new Employment Bill, which has been in the pipeline now for a number of years, will come into force on the 4th March. The Bill is being introduced to ‘improve the security of working hours for employees on insecure contracts and those working variable hours’, common in (but not exclusive to) service industries such as hospitality, tourism and retail. These industries often rely on flexibility in the employment contract and therefore the introduction of this new Bill will require them to take note.

The new Act makes certain breaches a criminal offence; where the employer does not comply with the new obligations in the Bill to provide the required information within one month, can lead to criminal prosecution. Fines on conviction could be up to €5,000 or imprisonment of up to twelve months or both. Directors, managers, secretaries or other officers of a company can be individually liable, i.e. be prosecuted individually for offences.

- In summary, the new Act will:

- Prohibit the use of Zero Hour contracts, save for exceptional circumstances

- Obligate employers to notify new employees of five core terms of employment in writing within five days of commencing employment

- Create a new entitlement to ‘Banded Hours’ contracts

- Provide for minimum payments to employees who are required to be available to work but are not actually called to work

The Act also introduces an anti-penalisation provision whereby an employer may not penalize an employee for exercising their rights under the 1994 Terms of Employment Act. An employee who is penalized can be awarded compensation of such amounts as the WRC considers just but will not exceed four weeks remuneration.

The new Act will bring significant changes for Irish employers and employees and according to Minister Regina Doherty; the Act is a “once-in-a-generation reform of our labour market.”

Please visit Brightcontracts.ie for more information on the new Employment Bill which has been in the pipeline now for a number of years and is to be enacted on 4th March 2019.

Related Articles:

How to avoid PAYE Modernisation mistakes

Back to Basics - Disciplinary Steps and Sanctions

Thesaurus Payroll Software | BrightPay Payroll Software | Bright Contracts

Feb 2019

19

What are “banded hours”?

The Employment Act 2018 creates a new right for employees whose employment contract does not accurately reflect the reality of the hours they work on a consistent basis. After a reference period of 12 months, employees will be able to request in writing to be placed in a band of hours that better reflect their average weekly hours worked. In response, employers are obliged to place the employee in the appropriate band and should do so within four weeks of receiving the employee’s request.

The appropriate band is determined by the employer on the basis of the average number of hours worked by the employee per week during the reference period.

The appropriate bands are laid down in law as set out in the below table.

| Band A: | 3 to 6 hours |

| Band B: | 6 to 11 hours |

| Band C: | 11 to 16 hours |

| Band D: | 16 to 21 hours |

| Band E: | 21 to 26 hours |

| Band F: | 26 to 31 hours |

| Band G: | 31 to 36 hours |

| Band H: | over 36 hours |

An employer may refuse to place an employee in a band in one of the following circumstances:

- Where there is no evidence to support the employee’s claim

- Where there have been significant adverse changes to the business during or after the reference period

- Due to exceptional circumstances, an emergency or unforeseeable circumstances beyond the employer’s control

- Where the average hours worked by the employee were affected by a temporary situation that no longer exists

In determining the 12 month reference period, a continuous period of employment immediately before the legislation is to be enacted on 4th March 2019 will be reckonable towards the 12 month reference period. Please visit Brightcontracts.ie for more information on the new Employment Bill which has been in the pipeline now for a number of years.

The Bill is being introduced to ‘improve the security of working hours for employees on insecure contracts and those working variable hours’, common in (but not exclusive to) service industries such as hospitality, tourism and retail. These industries often rely on flexibility in the employment contract and therefore the introduction of this new Bill will require them to take note.

To keep up with the latest payroll news, check out our new Bright website. There, you'll be able to register for any of our upcoming payroll webinars and download our payroll guides.

BrightPay Payroll Software | Thesaurus Payroll Manager | Bright Contracts

Nov 2017

24

Premature births & maternity benefit

From 1st October 2017, the period for which Maternity Benefit is paid has been extended in cases where a baby is born prematurely. A premature birth is described as one at less than 37 weeks’ gestation. It is estimated that every year in Ireland approximately 4,500 babies are born prematurely.

Currently, under the Maternity Protection Acts 1994 and 2004, a mother is entitled to 26 weeks’ maternity leave and 16 weeks’ unpaid leave. Maternity leave normally starts two weeks before the babies expected due date or on the date of the birth of the child should it be earlier.

Under the new amendment, where a child is born prematurely the mother’s paid maternity leave will be extended by the equivalent of the duration between the actual date of birth of the premature baby and the date when the maternity leave was expected to start. For example, where a baby is born in the 30th week of gestation the mother would have an additional entitlement of approximately 7 weeks of maternity leave and benefit i.e. from the date of birth in the 30th week to the two weeks before the expected date of confinement. This additional period will be added onto the mother’s normal entitlement to 26 weeks of maternity leave and benefit, where the mother meets the ordinary qualifying criteria.

Mothers of preterm babies are advised to contact the Department of Employment Affairs and Social Protection (DEASP), email maternityben@welfare.ie, to arrange the additional payment.

Babies surviving from the earliest gestations, such as 23 weeks, can spend months in a neonatal unit in hospital, by the time a premature baby gets to go home, a mother’s maternity leave can almost be used up. This new change has been heralded as a positive step in supporting parents during a difficult time.

Related Articles

Nov 2017

13

Maternity Leave & Benefit Extended for Mothers of Premature Babies

Paid maternity leave has been extended in cases where a baby is born prematurely.

Up until now, mothers in Ireland were entitled to 26 weeks maternity leave with 16 weeks additional unpaid leave which must be taken immediately after the end of the maternity leave.

This meant that for some mothers of premature babies, their leave could be almost used up by the time they get their baby home from hospital.

However under the new arrangements, mothers of premature babies will be entitled to an additional period of paid maternity leave.

From 1st October 2017, the period for which Maternity Benefit is paid is being extended in cases when a baby is born prematurely. The benefit will extend for the duration between the actual birth date of the premature baby to the date when the maternity leave was expected to commence. This will extend the existing 26 weeks of paid maternity leave, so that mothers of premature babies can give their children the care and attention that they need.

This change will benefit nearly 4,500 women annually.

You can view more information about Maternity Benefit on the Department of Employment Affairs and Social Protection’s website.

Oct 2017

2

Are you ready for PAYE Modernisation?

To raise awareness about forthcoming PAYE Modernisation in 2019, Revenue has commenced its awareness campaign by releasing an information leaflet “PAYE Modernisation – Are You Ready”.

This leaflet highlights the vital steps for new and existing employers to undertake in advance of 1st January 2019, in order to succeed in the imminent taxation system revolution.

The key idea behind PAYE Modernisation is that all communication between employer and Revenue will happen in “real time”. In order to effectively overcome the upcoming challenges, employers are being encouraged to focus on the quality and accuracy of the data they provide to Revenue.

In preparation for PAYE Modernisation, employers are advised to follow several easy steps to guarantee its overall success when it does come into effect in 2019:

- Register as an employer (for new employers)

- Verify the PPSN provided by employees (e.g. check it against a Public Services Card, P45 or other Revenue or DSP correspondence) and where the employee does not hold a PPSN, they should contact the DSP to apply for one.

- Register all employees with Revenue (i.e. P45(3) or P46 where the employee has no P45). Where the new employee has not worked in Ireland before, the employee must register the employment online using the Jobs and Pension service available in myAccount. The Jobs and Pension service can also be used by employees who are changing from one employment to another. Once the employment has been registered, Revenue will issue a tax credit certificate.

- Issue a P45 when an employee ceases employment and submit it to Revenue.

- Ensure an up-to-date tax credit certificate has been received for each employee. The leaflet outlines the basis of tax which should be applied on the first payday of a new tax year in the event that an up-to-date tax credit certificate for that year is not received.

- Ensure a complete PAYE, PRSI and USC record for each employee is held at the end of the tax year.

At Thesaurus Software & BrightPay, we have always strived to deliver excellence in customer service and professional expertise in both Irish and UK payroll. We widely welcome the upcoming PAYE changes. As Paul Byrne, director of Thesaurus Software Ltd, stated during the Revenue's public consultation process held in December 2016:

“Whatever system is adopted, it is important that it represents a step forward for all parties. We are already committed to not charging our customers for the additional development involved. In addition, we are considering making a free version of our software available for micro employers, those with one or two employees.”

Related articles