Sep 2018

21

BrightPay wins ‘Payroll Software of the Year’

BrightPay was announced the winner of ‘Payroll Software of the Year’ at this year’s AccountingWEB’s Software Excellence Awards.

The awards, which took place in London, are held by AccountingWEB - an online community for accounting and finance professionals in the UK. The winner is decided by a public vote, whereby members are asked to rate the software systems they use to determine the best products on the market.

It’s a great achievement for BrightPay to win the prestigious award, especially when you look at the number of larger software companies offering payroll in the UK. BrightPay also has a 99% customer satisfaction rate, and is used to process payroll for over 120,000 businesses across the UK and Ireland.

Marketing Manager at BrightPay, Karen Bennett says: “We’re delighted to win this award; it’s fantastic for BrightPay and our team to be recognised by our customers and the AccountingWEB members, and a massive thank you to everyone who voted for us.”

Paul Byrne, Managing Director, says: “It’s a real pleasure and honour to receive this award. It’s great to see such recognition for all the hard work we have put in. We work hard each year to improve the BrightPay experience for all of our customers, both in terms of the payroll software itself and the customer support that we offer.”

BrightPay in Ireland

In the Irish market, BrightPay is currently preparing for PAYE Modernisation, a real time reporting system that is being introduced on 1st January 2019. Essentially, employers will be required to report pay information to Revenue each pay period. This overhaul of the Irish PAYE system aims to ensure that employers and employees have the most accurate, up-to-date information relating to pay and tax deductions.

A similar system was introduced in the UK in 2013, which was seamlessly integrated into BrightPay UK payroll software. We have the relevant experience to ensure that PAYE Modernisation is just as streamlined in BrightPay Ireland. By switching to BrightPay Ireland, you can be assured that you have PAYE Modernisation compliant payroll software.

Book a demo today to see how BrightPay can help you with PAYE Modernisation.

Are you missing out on our newsletter? We will not be able to email you without you subscribing to our mailing list. You will be able to unsubscribe at anytime. Don’t miss out - subscribe today!

Related Articles:

- Which is really better - the existing PAYE system or PAYE Modernisation?

- Manually calculating payroll with PAYE Modernisation

- PAYE Modernisation: Frequently Asked Questions

- BrightPay Ireland - Customer Survey - The Results are in!

Sep 2018

18

Thesaurus Payroll Manager - Customer Survey Results

Opinions and feedback from our customers matter to us. We love to hear comments and suggestions from users in order to improve our customers’ experience. We recently conducted a customer survey to get an insight into what customers think about Thesaurus Payroll Manager and to find out what new features our customers want. We appreciate all the feedback received from this year’s survey and would like to say a massive thank you to everyone who took part.

The survey looked at customer satisfaction rates, software performance and customer support. We were delighted to discover that the customer satisfaction rate for our payroll software has remained at its exceptional 99%. The satisfaction rate for the customer support offered has also kept its 99% satisfaction rate.

One of the most common suggestions from this year’s survey was for the ability to reverse the payroll for individual employees rather than having to re-input the payroll for all employees. We are delighted to confirm that Thesaurus Payroll Manager 2019 will allow you to make corrections to previous pay periods for individual employees.

Thesaurus Connect

The survey also included some questions regarding our optional cloud add-on, Thesaurus Connect. With an overall satisfaction rate of 91%, customers rated Thesaurus Connect’s features highly, including the secure online backup (99%), payslip & P60 online accessibility (98%), HR document upload (98%), value/price (97%) and its ability to reduce payroll administration tasks (90%).

Watch this short video for an overview of how Thesaurus Connect can meet your payroll and HR needs.

PAYE Modernisation

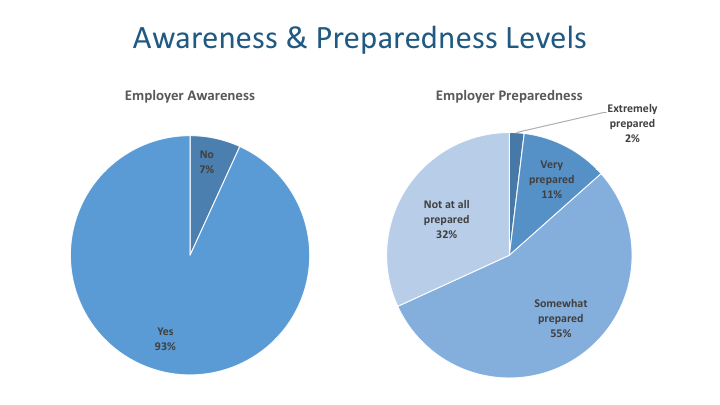

This year’s survey also looked at PAYE Modernisation. With the introduction of this new system just three months away, we were surprised to find out that almost 7% of employers said that they were not aware of the upcoming changes.

When looking at the question ‘Do you feel prepared for the introduction of PAYE Modernisation?’, the results were also quite worrying. Just 2% of employers said that they felt extremely prepared, while a massive 32% said they felt not at all prepared.

It is important that all employers understand the new PAYE changes being implemented. We are running a series of free PAYE Modernisation training webinars with a guest speaker from Revenue. Make sure to book your place now.

Alternatively, you can book an online PAYE Modernisation demo with Thesaurus Payroll Manager to find out what the software will look like in 2019.

Related Articles:

Jun 2018

22

PAYE Modernisation - List of Employees

In preparation for PAYE Modernisation, Revenue will soon be asking employers to send a list of their employees through Revenue's Online Services (ROS). This list will ensure that both Revenue and employer records are accurate and up to date.

The list must include:

- employees who are currently in your employment (including directors)

- employees on long term leave such as maternity leave or sick leave

- pensioners in receipt of payments

- seasonal or temporary employees for whom you have not completed the P45 process

- employees on a career break for whom you have not issued a P45

- employees for whom you have received a PAYE Exclusion Order

Employees who are currently on a career break and have been issued with a P45 are not to be included.

Before you send your list, please ensure you have:

- entered a PPS Number for all employees

- issued a P45 to any employees that have left your employment

- submitted P45 Part 3/P46 for any employees that have commenced employment

- entered the employer address, this can be entered/amended by going to File > Amend Company Details

You can create the 'List of Employees' file within Thesaurus Payroll Manager by selecting ROS > List of employees.

Please note, to ensure the return includes all new employees only prepare the return when all new employees have been included in a pay run.

Are you missing out on our newsletter?

We will not be able to email you without you subscribing to our mailing list. You will be able to unsubscribe at anytime. Don’t miss out - sign up to our newsletter today!

Jun 2018

8

What happens if I don’t comply with GDPR ?

The amount of data currently being processed by businesses was unforeseeable way back in the 1990’s when the current Data Protection Regulation was drawn up. Officials recognised that the current rules just weren’t sufficient to handle the current digital era. An updated reform was agreed and GDPR was born.

From May 25th, the GDPR legislation was enforced by data regulators across Europe. As this deadline is passed, it is important to note that every business that stores and manages personal data will be affected by this change.

To help you with your GDPR preparation we’ve compiled a list of some of the most common questions that we get asked:

What is personal data?

Personal data is anything that allows a person to be identified. Some examples would be; name, address, IP address or photo.

What happens if I don’t comply with the GDPR?

One of the most talked about elements of the GDPR is the consequences for non-compliance. Companies that fail to comply can face fines of up to £20 million or 4% of turnover (whichever is greater).

Will the GDPR affect my business?

In short, yes. GDPR will affect every individual and organisation that holds or processes personal data from any individual in the EU.

Can I still email payslips?

Emailing payslips is still perfectly acceptable under the GDPR. However, it is important to consider the security of the payslip. Payroll software, like BrightPay & Thesaurus, will encrypt payslips and automatically delete payslips that are sent from our servers.

How can BrightPay/ Thesaurus help?

Data Protection has always been a priority for BrightPay & Thesaurus. Like all companies, we’ve had to review how we handle data in preparation for the GDPR. Here is a list of resources we’ve put together to aid you on the voyage to becoming compliant with the GDPR:

1. Free GDPR webinars for payroll bureaus and employers

Join us for our free webinar where we will discuss what GDPR is and why employers need to take it seriously.

2. BrightPay & Thesaurus Connect

The GDPR states that where possible individuals should have access to a secure, self-service remote system which would provide direct access to their personal data. BrightPay Connect is a self-service option which will give employees online remote access to view their payroll information at any time.

3. Free GDPR and The Future of Payroll guide

This guide will specifically look at the impact of GDPR on your payroll processing and highlight the biggest areas of concern. We will walk through some important steps to achieve GDPR compliance.

4. Free template: Data Processor Agreement

Whenever a data controller (e.g. a payroll bureau client) uses a data processor (e.g. payroll bureau) there needs to be a written contract in place. The contract is important so that both parties understand their responsibilities and liabilities.

BrightPay Newsletter - Are you missing out?

GDPR is changing how we communicate with you. From May 2018, we will not be able to email you about webinar events, special offers, legislation changes, other group products and payroll related news without you subscribing to our newsletter. You will be able to unsubscribe at any time. Don’t miss out - sign up to our newsletter today!

Related Articles:

- Thesaurus - June 2018 customer update.

- GDPR: What you need to know.

- Real-time reporting to become part of payroll processing.

Thesaurus Payroll Software | BrightPay Payroll Software.

May 2018

22

Thesaurus Software - We don't just do payroll

As one of Ireland’s largest payroll software providers, we have a lot of customers using our payroll software, but did you know that we have a number of other HR, payroll and accounts software packages available?

Thesaurus Payroll Manager

Payroll Manager is a payroll software market leader in Ireland. Having been tried, tested and evolved for over two decades, our customers use Payroll Manager to pay hundreds of thousands of employees every month. If you want a mature and reliable payroll software solution with a proven track record and a national support network, look no further!

BrightPay

BrightPay is a payroll software which is future-proof, having been programmed using modern technology, it allows the user to process and run payroll effortlessly no matter how large or complicated it may be. Having a feature-rich interface allowing the user to customise reports, set up unlimited pay rates, additions and deductions, the options are endless making the weekly/monthly pay-run a breeze!

Thesaurus Connect

Thesaurus Connect is a powerful add-on to the payroll software which enables secure automatic backups of your payroll data to the cloud. The web based self-service dashboard for employers and their employees is an invaluable tool for those employers looking to put their best foot forward in terms of GDPR readiness and compliance.

Bright Contracts

This HR software allows the user to manage and create professional Contracts of Employment for their workers, and also includes an Employee Privacy Policy in line with the new data protection legislation, GDPR. It also has a customisable Staff/Company Handbook with all the legislative and best practice policies and procedures that are recommended for any business with staff. In addition, the software also provides a wealth of online support documentation, such as template HR letters, checklists, guidelines, etc.

Thesaurus Accounts

Thesaurus Accounts is a robust bookkeeping and accounts package that has stood the test of time. Designed by bookkeepers and accountants, it is the choice of thousands of Irish companies. It looks after all of the prime books of entry right through to trial balance and management accounts.

Related Articles:

Apr 2018

19

Real time reporting to become part of payroll processing

In less than a year the current PAYE system is going to change remarkably with the introduction of real time reporting known as PAYE Modernisation. The current payroll system hasn’t been modified since it was first introduced in the 60’s.

The main objective of PAYE Modernisation is to enable clear communication between Revenue and those who are processing payroll. This change will affect most, if not all businesses across Ireland.

Some of the common questions people have asked about PAYE Modernisation are:

- What do I have to do differently for PAYE Modernisation?

PAYE Modernisation will mean that people processing payroll will now how to submit a file to Revenue every pay period as opposed to the current annual ‘P’ forms. Payroll Software will make this a hassle free process, ensuring employers can easily comply with PAYE Modernisation.

- Will PAYE Modernisation be complicated?

PAYE Modernisation will likely cause a significant burden to employers, particularly small employers that do not currently utilise payroll software. BrightPay and Thesaurus Software will be fully equipped to make PAYE Modernisation a seamless process for payroll processors. Our developers have already implemented a similar real time reporting process for our UK payroll software.

- What will PAYE Modernisation cost my business?

As reports will need to be submitted to Revenue every pay period a lot of businesses will be relying on payroll software to do this for them. If you do not have payroll software in place, now is the time to think about purchasing. Luckily, low cost payroll software, like BrightPay and Thesaurus payroll will seamlessly handle PAYE Modernisation.

- Will PAYE Modernisation take up a lot of my time?

For companies still processing payroll manually, PAYE Modernisation will likely impose a significant time burden. For employers utilising payroll software like BrightPay and Thesaurus Software, administrative tasks will be significantly simplified. PAYE Modernisation reports required by Revenue can be sent easily from within the software. Also, the introduction of PAYE Modernisation has meant the elimination of the time consuming annual ‘P’ forms.

Free PAYE Modernisation Webinars

If there is something you’re still unsure of relating to PAYE Modernisation, we have teamed up with Revenue to bring you free online training webinars. These webinars are designed for employers and payroll bureaus to discuss what PAYE Modernisation will mean for your business and to help you prepare for the transition to the new system. You can sign up to our newsletter to get an invitation to our next PAYE Modernisation webinar.

Thesaurus & BrightPay Newsletter

GDPR is changing how we communicate with you. After May 2018, we will not be able to email you about webinar events, special offers, legislation changes, other group products and payroll related news without you subscribing to our newsletter. You will be able to unsubscribe at anytime. Don’t miss out - sign up to our newsletter today!

Thesaurus Payroll Software | BrightPay Payroll Software

Related Articles:

Mar 2018

5

Less than 3 months to go: Are you prepared for GDPR?

The EU’s General Data Protection Regulation (GDPR) will be implemented in Ireland in May 2018 with the aim of protecting all EU citizens from privacy and data breaches in an increasingly data driven world.

Unfortunately, many employers do not realise that 25th May 2018 is a deadline as opposed to a start date. It is important that all employers are ready and GDPR compliant by this date, with potential fines for breaches as high as €20 million or 4% of global turnover.

All employers process large amounts of personal data, especially when it comes to their customers and their employees. Consequently, the GDPR will impact most if not all areas of the business and the impact it will have cannot be overstated.

Organisations need to act now to prepare for the potential changes to their systems and procedures. The introduction of GDPR is just three months away, and by now all businesses should be taking action.

As part of our own preparation, we need your help. After 25th May 2018, we will not be able to email you about webinar events, special offers, legislation changes, payroll related news and other group products without you subscribing to our mailing list. You will be able to unsubscribe at anytime.

Don’t miss out - sign up to our newsletter today!

Free Webinar: GDPR for your Payroll Bureau

BrightPay by Thesaurus Software is hosting a free webinar on 8th March to help payroll bureaus prepare for GDPR. In this webinar, we will peel back the legislation to outline clearly:

- What is GDPR and why is it being implemented?

- Why employers need to take it seriously

- How it will impact payroll bureaus

- How to prepare for GDPR

- How we are working to help you

Places are limited - book your place now!

Jan 2018

22

How will PAYE Modernisation affect your payroll bureau? Only 10 Places Left!!!

Revenue are joining Thesaurus Software for a series of free, CPD accredited webinars detailing what you need to know about PAYE Modernisation.

How will PAYE Modernisation affect your payroll bureau?

There are just 10 places left for our next webinar which takes place this Thursday! With almost 1,000 accountants and payroll bureaus already registered, this is your last chance to register.

Agenda

- An introduction to PAYE Modernisation including recent changes

- What direct effect will this have on employers?

- What direct effect will this have on employees?

- What are the possible downsides for employers?

- Revenue’s delivery schedule

- The role out of PAYE Modernisation in the UK

- Processing manually or using payroll software?

- The letter of engagement

- How will PAYE Modernisation affect your payroll service

- Communicating these changes to your clients.

Don’t miss out - book your place now!!

Payroll Bureaus: Getting Ready for PAYE Modernisation

The next webinar in the series takes place in March where there will be a key focus on what payroll bureaus need to do to prepare for PAYE Modernisation.

Subscribe to our Newsletter

We have lots more webinars scheduled over the coming months. Don’t miss out - make sure to sign up to our newsletter today! You will have the option to unsubscribe at any time.

Thesaurus Payroll Manager | BrightPay Payroll Software

Related Articles:

Nov 2017

14

PAYE Modernisation – What do these changes mean for you?

The existing PAYE (Pay As You Earn) system was introduced nearly sixty years ago ensuring that correct deductions are made relating to pay and tax.

From 1st January 2019, this system for PAYE will undergo a long overdue update, but don’t worry, this update will benefit all involved – including employers and employees.

Employers –

PAYE Modernisation will change how employers report their payroll information to Revenue. Every time an employee is paid a file will need to be submitted (electronically) to Revenue, consisting of all details of employee payments, deductions and leaver information. The contents will be similar to the current annual P35, but this file will be submitted every pay period (weekly, monthly, fortnightly, etc.).

The update will also allow employers to submit a new employee’s information before they commence employment with them. PAYE Modernisation / Real Time Reporting (RTR) will result in a reduction in the occurrence of year end over/underpayments of tax.

This new Revenue reporting system is anticipated to be fully integrated into payroll software. Fortunately, it is envisaged that the workload will not increase as a result of PAYE Modernisation.

Employees –

An online statement will be sent before the start of the new tax year which will detail the employee’s tax credits and standard cut-off point (SRCOP). This will be based on estimated income and details available to Revenue.

Employees will be encouraged to make any adjustments to this online statement, including any claims for additional entitlements. This differs from the current system where an employee is required to wait until the end of the tax year to apply for any refund as a result of overpayment of taxes or to find out if there are amounts due to Revenue as a result of underpayment of taxes.

P60s will be abolished, employees will instead have access to their pay and tax record online, this will be updated on an ongoing basis throughout the year as they are paid. This will enable Revenue to carry out periodic reviews to identify if employees are utilising their tax credits and SRCOP to the maximum effect (e.g. where an employee has 2 employments) and, where applicable, employees will be prompted to reallocate tax credits and SRCOP.

Related articles

- PAYE Modernisation - Are You Ready For January 2019?

- Revenue moves to PAYE Modernisation

- Auto Enrolment Planned for Ireland by 2021

- 2018 and Beyond

Oct 2017

10

Thesaurus Payroll Manager - Customer Survey - The Results are in!

Opinions and feedback from our customers matter to us. We love to hear comments and suggestions from users in order to improve the customer experience. Last month we conducted a customer survey to get an insight into what customers think about Thesaurus Payroll Manager and find out what new features our customers want.

The survey also looked at customer satisfaction rates, software performance and customer support. We were delighted to discover that Thesaurus Payroll Manager has a 99.6% customer satisfaction rate. Customers are also highly satisfied with our customer support team, with a satisfaction rate of 99.5%. Many customers agree that BrightPay saves them time (99.4%) and offers good value for money (99.6%).

Surprisingly, 43% of customers were not aware that Thesaurus Payroll Manager includes integration with One4all. This new feature was added last year and enables employers to seamlessly purchase One4all gift cards for employees.

The survey also looked at awareness of PAYE Modernisation. Nine out of ten accountants, bookkeepers and payroll bureaus said that they were aware of this new PAYE system, which will be effective from 1st January 2019. Meanwhile, one in five employers were unaware of this upcoming change. Thesaurus recently hosted a number of free PAYE Modernisation webinars, with a guest speaker from Revenue. The webinars incorporated everything you need to know about PAYE Modernisation. Watch the PAYE Modernisation training session on demand.

Customer Testimonials

We also received a number of customer testimonials from the survey - all of which will be added to the Thesaurus website in due course. Some of our favourite testimonials received include:

- "We have used Thesaurus for our payroll since 2001. Over the last 17 years our general accounting software has been changed 3 times but we have never found a better payroll system or had a reason for wanting to change..."

- "I found the support I was given by Thesaurus to be of the highest quality, with the empathy shown by Thesaurus employees to be extraordinary."

- "I have used Thesaurus Payroll in a number of companies and I found it much easier to use than any other payroll software I have encountered. It has always provided updates and changes required quickly without fuss. The newest addition, Thesaurus Connect has made life easy for me. Payslips automatically sent out to employees and the facility for them to view and print payslips as required has freed up a lot of management time for other duties."

- "The support staff are brilliant, they answer questions in everyday language and are committed to staying with you until you have a total understanding of the query."

- "Thesaurus Payroll Manager is the most cost effective change we have made to our business. From the standard paying wages to being able to email payslips, work out holiday entitlement and much more, this software package is worth its weight in gold. Saving us time and money. I wouldn't be without it."

Prize Winners

As a thank you for taking part in the survey, we are giving away four €50 One4all vouchers. We are delighted to announce that the winners are:

- John Ganly - Blanchardstown Amalgamated Sports Ltd

- Geraldine Grennan - PJ Grennan Ltd

- Elaine Donnelly - Irish Theatre Institute

- Eugene O'Donovan - SME Finance

The Thesaurus team will be in contact with the winners shortly.

We appreciate all the feedback received from this year’s survey and would like to say a massive thank you to everyone who took part.