Sep 2017

27

What do you mean…. “Do I have a backup?”

One of the most common calls I get on the support line is from a distressed customer who tells me they have lost their payroll information. Reasons for the loss of this information are varied and could be anything from a laptop being stolen, a virus attacking the computer, holding files to ransom or fire or water damage to the computers in the office.

The first question I’ll ask on a call of this type will be “do you have a backup?”. Honestly, I can’t tell you the number of people that say “No” to this. People are also mistakenly under the impression that we have a copy of their payroll data. Unfortunately this is never the case, we do not have access to the employer’s payroll information so this can add to the customer's stress levels as you can imagine!

We would always stress the importance of taking a backup of your payroll information. You would have your computers and office equipment insured against anything happening so why would you not do the same for your data? Think of your backup as your information’s insurance policy, after all it is almost irreplaceable or at the very least a major inconvenience to try and rebuild your payroll.

In a lot of cases, the call to our customer support line comes too late for us to be of any real assistance and the only advice we have to give is to start over and process payroll from the beginning again.

We never think anything like this will happen to us, but take it from me, it does, so go ahead and take out that insurance policy and backup before it is too late!

The following links will guide you to taking a backup in your software or book a demo of Thesaurus Connect our latest cloud add on that offers an automated online backup feature :

BrightPay UK: https://www.brightpay.co.uk/docs/17-18/backing-up-restoring-your-payroll/

BrightPay Ireland: https://www.brightpay.ie/docs/2017/backing-up-restoring-data-files/backing-up-your-payroll-data/

Thesaurus Payroll Manager: https://www.thesaurus.ie/docs/2017/processing-payroll/backup-data-files/

Jul 2017

3

Revenue moves to PAYE Modernisation / Real Time Reporting

Following the announcement in last October’s Budget 2016, Revenue entered a consultation on the modernisation of the PAYE system.

Revenue’s proposal is that employers will report pay, tax and other deductions at the same time as they process and finalise their payroll. Similar to Real Time Information (RTI) in the UK, details of employees starting or leaving employment will be reported on the date of commencement/cessation and will eliminate the filing of P30, P35 and P45 forms.

Although, many businesses across Ireland have broadly welcomed the forthcoming introduction, some smaller businesses have expressed concern about the additional administrative burden due to poor internet access and the additional hours it may involve. Many businesses will be a risk as they have not invested in payroll software where they calculate their payroll manually.

Last April Revenue disclosed that it received 77 submissions to the consultation which represented a broad range of interests, both from large and small companies. For larger employers, the transition will be relatively straightforward, but Revenue is looking at alternatives to accommodate smaller employers, in particular, those who may still process their payroll manually.

IBEC state that while most of its members welcome the change, it is important that the system is flexible. A professional services group also warned that the work involved for employers to prepare for the implementation of PAYE modernisation / Real Time Reporting (RTR) should not be underestimated.

Thesaurus Software / BrightPay Ireland already has the experience and expertise in developing the same real time features and functions for our UK customers. We are already collaborating with Revenue to ensure the transition for our customers to Real Time Reporting (RTR) / PAYE modernisation is smooth, user-friendly and ready for implementation in January 2019.

For further information, Revenue have provided the following link:

http://www.revenue.ie/en/corporate/consultations-and-submissions/paye-modernisation/index.aspx

Interested in finding out more about PAYE Modernisation? Register now for our free PAYE Modernisation webinar. Click here to find out more.

May 2017

27

PAYE Modernisation - an update

What is PAYE Modernisation?

From 1st January 2019, whenever Irish employers pay their employees, a file must be submitted (electronically) to Revenue containing details of these payments. The contents of this file will be similar to the details currently submitted in the annual P35, however, unlike the annual P35, this file must be submitted each pay period. Therefore, in most cases, the submission will be made either weekly or monthly.

This real time information will enable Revenue to ensure that employees are receiving their correct credits and cut off points. This in turn should mean that the incidence of year end over/underpayments of income tax will be substantially reduced.

Employees will also be able to log on to their Revenue account and, among other things, view the information that the employer has submitted in respect of them.

What direct effect will this have on employers?

In the main, this should be good for employers. Most of the “P” forms (P45s, P46s, P60s and P35s) will be no more as the new periodic file will supersede them.

Payroll software will automatically submit the periodic file to Revenue without the need to physically upload a file on the ROS website. In addition, payroll software will get automatically updated with employee credits and cut off points, again without the need to check for and download P2C files from the ROS website.

The correct treatment of illness benefit should also be facilitated by the new system, eliminating the guesswork and complication involved in the current system.

So, all in all, PAYE modernisation should represent a positive change for employers.

What are the possible downsides for employers?

For most employers there should be no downside, in fact the whole payroll process will be somewhat easier, thanks mainly to payroll software interacting directly with Revenue’s systems.

For those employers who do things after the fact e.g. they pay employees an amount and then sort it out later by working things backwards with the software (net to gross), the transition to PAYE modernisation could be somewhat problematic.

Submission of the periodic file will be required in or around the pay date and late submissions may lead to Revenue intervention. Submission of correction files will be accommodated by the new system, however constant correction submissions may also lead to Revenue intervention and possible interest and penalties. Therefore submission of “best guess” periodic files, followed later by correction files, to reflect what was actually paid, will not be advisable.

These employers need to regularise their business processes so as to ensure that the payroll they process is done so in real time, either by using payroll software or by using their accountants or payroll bureaux on a more timely basis.

This change in mindset is perhaps the largest single challenge facing PAYE modernisation.

Thesaurus Software and PAYE Modernisation

Thesaurus Software is already collaborating with Revenue through the payroll software representative body, the PSDA (Payroll Software Developers Association), to help ensure that the final version of PAYE Modernisation is workable and ready for implementation by 2019.

Our experience in developing similar functionality in the UK means that our development team have the expertise and experience to create the best solution for our Irish customers.

In keeping with our pricing culture, there will be no additional charge for the new functionality.

Interested in finding out more about PAYE Modernisation? Register now for our free PAYE Modernisation webinar. Click here to find out more.

May 2017

23

Thesaurus Payroll Manager to discontinue Windows XP support

The technology that Thesaurus Payroll Manager utilises will be updated and improved from January 2018. As a result of this improvement, Thesaurus Payroll Manager will no longer be able to run on Windows XP operating systems. This technological enhancement brings many performance, reliability and security improvements, while also opening up new possibilities for our development team to add further functionality. Users will not notice any obvious difference using Thesaurus Payroll Manager 2018 compared to previous versions as all the changes are operating in the background.

Microsoft discontinued support for Windows XP in April 2014. This means that Microsoft are no longer releasing upgrades for these systems. Although Windows XP machines may still work normally, it does mean that these PCs are more vulnerable to security risks and viruses.

If you are still using Windows XP, you should consider upgrading to a newer PC or operating system. Due to the greater security risks, more and more programmes and applications are discontinuing support for Windows XP. Internet Explorer 8 is also no longer supported. If your Windows XP PC is connected to the Internet and you use Internet Explorer 8 to surf the web, you might be exposing your PC to additional threats.

These security threats became a reality for many Windows XP users in recent weeks with more than 200,000 organisations becoming victims of the widespread ransomware attack, WannaCry. This cyber attack affected organisations across the globe, including hospitals, banks and government agencies. The majority of these victims were using outdated or older Windows operating systems, such as Windows XP and Windows Vista.

While we do apologise for any inconvenience this change may cause, it is the best decision for our customers’ security and user experience.

Useful links:

May 2017

15

Protect your payroll data against Ransomware

Ransomware, like the name suggests, is when your files are held for ransom. It is a type of malware that essentially takes over a computer and prevents users from accessing their data until such time as a ransom is paid. The ransomware encrypts data on the computer using an encryption key that only the attacker knows. If you want to decrypt them, you have to pay. If the ransom isn’t paid, the data is often lost forever.

A ransomware attack, also known as WannaCry or WeCrypt, recently spread across the globe and is believed to have affected over 200,000 organisations. The cyber-attack struck banks, hospitals and government agencies in more than 150 countries, exploiting known vulnerabilities in Microsoft operating systems.

How to protect against a ransomware attack?

- Think before you click – It is important to look for malicious email messages that are often concealed as emails from companies or people you regularly interact with online. It is important to avoid clicking on links or opening attachments in those messages, since they could unleash malware. However, unlike many other malicious programs, WannaCry has the ability to move around a network by itself. Once the virus is inside an organisation, it will hunt down vulnerable machines and infect them too.

- Keep software up to date – Users should ensure that security updates are installed on their computer as soon as they are released. Last month, the NSA revealed software vulnerabilities in a Windows Server component which allows files to spread within corporate networks. Since then, Microsoft has released software patches for the security holes. Anyone who applied this patch more than likely was not affected by WannaCry. However, not everyone has installed these updates and so these users are susceptible to an attack. It is also important to note that the vulnerability does not exist within Windows 10, but is present in all versions of Windows prior to that, dating back to Windows XP. Support for Windows XP was discontinued in 2014, and so if you are using XP it is recommended to upgrade to a more secure system. It is important to keep all software packages up to date to maximise protection against attacks.

- Keep backups of data files – Users should regularly back up their data, which will make it possible to restore files without paying a ransom. This can be done by saving files to a USB key, external server or a cloud sharing facility such as Dropbox or Google Drive. Individual software packages may also offer a backup facility, enabling you to automatically back up sensitive data, for example Thesaurus Cloud allows users to easily backup payroll data.

How can Thesaurus Cloud help?

Thesaurus Cloud is an optional add-on to your payroll software that allows employers to automatically and securely backup payroll data to a highly secure cloud server, ensuring that you will never lose your payroll data if you are the victim of an attack.

You may decide that you only want to use Thesaurus Cloud for payroll backups, however, the features listed below can also be availed of.

With Thesaurus Cloud, employers can invite their employees to their own self-service portal. Employees can login to their own personal account, be it on their PC, tablet or smartphone, where they can view payroll documents relevant to them, with a full history of payslips and P60s. Employees can also request annual leave and view annual leave remaining through their portal.

Furthermore, Thesaurus Cloud provides users with an annual leave management facility and a document upload facility, where all information is stored within the same location. With the document upload, employers can upload employee contracts & staff handbooks, training manuals, employment documents and much more, which can be accessed by employers and employees on any device.

Find out more about Thesaurus Cloud with an online demo.

Mar 2017

31

Important Information for Employers - Changes to Civil Service Travel Rates

Where employees use their own private cars or motorcycles for business purposes, reimbursement in respect of allowable motoring expenses can be effected by way of flat-rate mileage allowances.

There are two types of mileage allowance schemes which are acceptable for tax purposes if an employee bears all the motoring expenses:

- The prevailing schedule of Civil Service rates; or

- Any other schedule with rates not greater than the Civil Service rates

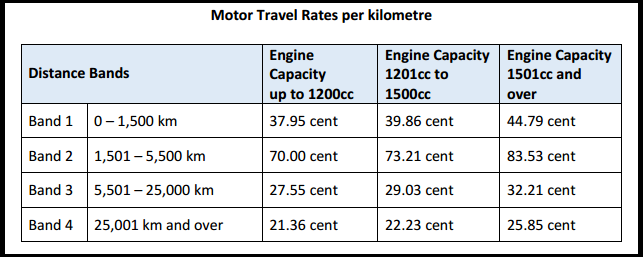

The Department of Public Expenditure and Reform has recently published circulars with new Civil Service Travel Rates, the revised rates are effective from 1st April 2017. The distance bands have increased from two to four with a lower recoupment rate for the first 1,500 kilometres.

Business travel carried out between 1st January and 31st March 2017 will not be affected by these new bands and rates, business travel to date from 1st January 2017 will count towards the cumulative business travel for the year.

Motor Travel Rates - Effective from 1st April 2017

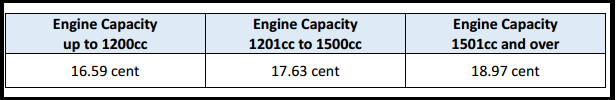

Reduced Motor Travel Rates per kilometre

The reduced rates are payable to Civil Service employees who undertake a journey associated with their job but not solely related to the performance of their duties, such as:

- Attendance at confined promotion competitions

- Attendance at approved courses of education

- Attendance at courses or conferences

- Return visits home at weekends during a period of temporary transfer

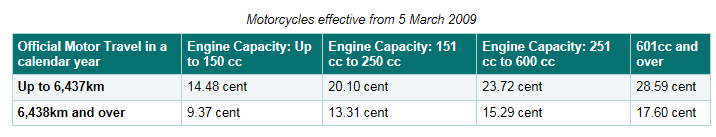

The Motor Travel Rates for motorcycles and bicycles remain unchanged as follows:

Motorcycle:

Bicycle: 8 cent per km

Please note, there are changes to subsistence rates which are also effective from 1st April 2017.

Please click here for the circular on Motor Travel Rates, and here for the circular on Subsistence

Mar 2017

29

Auto enrolment for Ireland?

The current Minister for Social Protection, Leo Varadkar, has, on a number of occasions, mentioned his desire to introduce auto enrolment in Ireland.

This will be a welcome and necessary development as it is unlikely that the current levels of state pension will be sustainable in the medium to long term.

The UK is nearing the end of its auto enrolment roll out and there are, I believe, a number of lessons learnt.

On the face of it, the requirement to enrol an employee into a pension scheme (based on age and earnings), to make deductions/contributions and to allow for opting out, would all appear very straightforward. Not so! Employer guidance extends to many hundreds of pages and the rules are unnecessarily complex.

My first suggestion is to keep it simple. If the minister has his way, auto enrolment may commence around about the same time as Revenue’s Smart PAYE project. This will be a lot to take on board at the one time, particularly if the UK’s auto enrolment rules are anything to go by. Examples of how to make it simpler - link everything to pay date (not pay period) and forego the requirement to apportion.

Next, I would suggest that a common filing standard is adopted at the outset for both enrolments and contributions. This was attempted in the UK, without success. The main problem was the pension companies and their differing systems. Ideally an all encompassing file specification would be mandated and the pension companies would just have to accept. Plus there would need to be common business rules for the various fields in the specification. Lessons learnt here from the SEPA roll out which resulted in similar looking files for the various banks but with very different business rules!

Postponement is a handy feature in the UK system but it does complicate things further. If everything else can be made simple and seamless, then postponement may not be required. Hand in hand with this would be the suggestion that all employees are enrolled no matter what their earnings are and no matter how temporary their employments are for. They would still have the ability to opt out.

Also, the creation of a government backed master trust (similar to NEST in the UK) would further obviate the need for postponement as postponement is generally used to get a pension scheme set up.

In relation to opting out, the opt out window should be linked to the actual pay date of first deduction rather than the auto enrolment date (which itself has many potential definitions) or scheme join date.

Employee communications is another big part of the whole process. The UK communications have evolved and simplified over the last few years and their present format would be fine for Ireland.

Finally, the actual calculation of the pension deduction/contribution should be based on all (taxable) earnings. The UK rules limit the calculation to a portion of the earnings, further increasing its complexity.

The above are my main suggestions and stem from our involvement with the UK system through our UK payroll software, BrightPay, where we have ongoing engagement with employers, accountants, professional bodies, HMRC, the Pensions Regulator, NEST, IFAs and the various pension providers.

Feedback welcome at paul@thesaurus.ie

Feb 2017

14

2016 P35 Deadline

Employers – the P35 deadline is fast approaching, the deadline is February 15th. (Or 46 days after the cessation of the business) Failure to make a P35 return by this date may result in a fine.

The deadline for an employer who pays and files electronically via Revenue Online Services (ROS) is extended to the 23rd of February.

To view our online documentation for preparing and submitting your P35 to ROS via Thesaurus Payroll Manager or BrightPay please click on the links below:

Thesaurus Payroll Manager:

https://www.thesaurus.ie/docs/2016/year-end/preparing-the-ros-p35-file/

https://www.thesaurus.ie/docs/2016/year-end/submitting-the-ros-p35/

BrightPay:

https://www.brightpay.ie/docs/2016/year-end/preparing-a-p35-ros-file/

https://www.brightpay.ie/docs/2016/year-end/submitting-a-p35-to-ros/

Nov 2016

29

DSP Christmas Bonus

A Christmas Bonus will be paid out to all eligible welfare and pension recipients along with their normal weekly payment during the week beginning November 28th 2016.

Anyone getting monthly payments will get any bonus due in their December payment.

An 85% 2016 Christmas Bonus for Social Welfare and Pensions was confirmed in Budget 2017 back in October. The Christmas Bonus is 85% of your normal payment (including any payments for qualified adults or children) with a minimum payment of €20.

About 1.3 million people will benefit from the Christmas Bonus (almost 890,000 recipients and an estimated 400,000 dependents). Around €225 million will be paid out. It will be useful for all the extra expenses at Christmas time.

The DSP Christmas Bonus is a non taxable payment. To keep record of it through your payroll you can add it as a non taxable addition.

Nov 2016

17

PAYE Modernisation

Revenue propose to roll out real time reporting of PAYE from 1st January 2019.

This means that payroll software will submit data (much akin to the annual P35) to Revenue each pay period.

The technology behind this may pose some challenges, not least for Revenue who will need to handle significant volume. Most payroll software companies will be able to adapt, assuming that file specifications, test environments etc. are provided to them in good time by Revenue.

The core issue is the possible expectation that the periodic payroll data transmission should be sent to Revenue “on or before” each pay date. This is the position in the UK where RTI (real time information) has been in place for a number of years. The “on or before” requirement has caused problems and HMRC had to relax their requirements (and penalties regime) in the initial year or so.

“On or before” represents a seismic shift for bureaus and employers alike and a much better alternative might be the submission of monthly returns. This is where the monthly P30 is enhanced to include all the P35 fields.

Automatic retrieval of P2C data would be a nice feature of PAYE modernisation and hopefully this will be included as part of the overall package.

The consultation document can be found at http://www.revenue.ie/en/spotlights/paye-modernisation.html

Submissions are invited up to 12th December 2016.

Interested in finding out more about PAYE Modernisation? Register now for our free PAYE Modernisation webinar. Click here to find out more.