Oct 2016

12

Budget 2017 Overview (for payroll)

No changes have been made to SRCOPs, tax credits or PRSI classes. Emergency basis will also remain unchanged.

USC (Universal Social Charge: No changes were made to the USC exemption threshold of €13,000. The 1%, 3% and 5.5% rates have been reduced by 0.5% to 0.5%, 2.5% and 5% respectively. There has been no change to the 8% rate of USC. In addition the Rate 2 COP has been increased from €18,668 to €18,772.

Medical card holders and individuals aged 70 years and over whose aggregate income does not exceed €60,000 will pay a maximum rate of 2.5%. The rate of 8% USC will continue to apply under the Emergency Basis.

Minimum Wage:

The National Minimum Wage will increase from €9.15 gross per working hour to €9.25 gross per working hour.

• Workers under age 18 will be entitled to €6.48 (currently €6.41) per working hour.

• Workers in the first year of employment over the age of 18 will be entitled to €7.40 (currently €7.32) per working hour. Workers in the second year of employment over the age of 18 will be entitled to €8.33 (currently €8.24) per working hour.

Minimum wage for trainees:

Employee aged over 18, in structured training during working hours:

• 1st one third of course will increase to €6.94 (currently €6.86),

• 2nd third of course will increase to €7.40 (currently €7.32) 3rd part of course €8.33 (currently €8.24).

PRD (Pension Related Deduction)

Budget 2017 did not make any change to the rates and thresholds for PRD.

However, the Financial Emergency Measures in the Public Interest Bill 2015 provides for the following changes:

• From 1st January 2017, the exemption threshold will increase from €26,083 to €28,750. 10% PRD will apply to earnings between €28,750 and €60,000, and 10.5% PRD will apply to any earnings in excess of €60,000.

PRSI

There were no changes to PRSI.

Sep 2016

11

Paternity Leave Benefits – Update from Revenue

In August Revenue issued guidance for the new Paternity Benefit which was introduced in respect of Births and Adoptions on or after 1st September, 2016.

Paternity Benefit will be liable for income tax but not PRSI or USC. All employees who pay their tax through the PAYE system will automatically have their annual tax credits and rate bands reduced by the amount of benefit paid. Employers and pension providers will be notified of the adjusted tax credits and cut-off points on their Employer Tax Credit certificates.

Paternity Benefit should not be included on Forms P45, P60 and P35L.

Paternity Benefit is payable at the minimum rate of €230 per week for two weeks and must be taken in one block. Although some employers can pay employees while on Paternity Leave, however this is not a requirement. In such cases, the Paternity Benefit should be paid to the employer. If you have any queries on the appropriate payments, please direct them to the Department of Social Protection.

Sep 2016

10

Jobs & Pensions Service – New Online Service for Employees

The Jobs & Pensions Service available from Monday 12th of September 2016 is a new online service for employees. Irish employees can register their new job (or private pension) with Revenue using the service.

The Jobs and Pensions service replaces the Form 12A, meaning employees must register their first job in Ireland using the service. After registering employment using the service a tax credit certificate will issue to both the employer (P2C) and employee.

The service can also be used by employees who are:

• changing jobs provided the previous job has been ceased on Revenue records, employees will be able to see when they log in if the previous job has been ceased

• starting a second job in addition to their main job

• starting to receive payments from a private pension

Access to the service is available in myAccount, employees must register to use the service.

Employers should:

• encourage new employees to register for myAccount

• provide new employees with the information required to register their new job (registration can be done in advance of the start date):

- tax registration number

- start date of the new job

- pay frequency

- staff number is one has been allocated

• no longer submit a P46 form where employees register their own job using the service

• continue to upload P45(3) as normal

• continue to issue P45s immediately on cessation of employment

• operate the emergency basis for PAYE & USC if a pay day occurs before receipt of either P45 or P2C

Further information on the service can be found in Revenue’s Employer Notice September 2016, which can be found here.

Dec 2015

1

Week 53: Irish Payroll

Are you due a week 53?

Employers are only due a week 53 if there are 53 pay dates in the tax year. This situation will arise for employers in 2015 where their pay date falls on a Thursday. This is due to the fact that their first pay date fell on Thursday 1st January and their last pay date falls on Thursday 31st December. Employers with any other pay date will not be due a week 53. The same principle applies for employers who run fortnightly payroll (they are only due a week 54 if there are 27 pay periods in the tax year).

Week 53 PAYE Deductions

Employers should apply employee’s tax credits and standard rate cut off points on a week 1 basis. This means employees will get the benefit of more than one year’s tax credits and cut off points. Where an employee is on an emergency basis then an emergency basis should continue to apply.

Week 53 USC Deduction

Employers should apply USC standard cut offs on a week 1 basis. This is a change from last year where there were no additional thresholds granted. If an employee is on an emergency basis then an emergency basis should continue to apply for week 53. If an employee is exempt from USC they will continue to be exempt in week 53.

Week 53 PRSI Deduction

There is no change to the way PRSI is calculated.

Oct 2015

27

Small Benefit Exemption Scheme - Increase in threshold

The Minister for Finance Michael Noonan is set to fast track an increase in the threshold for the Small Benefit Exemption Scheme. The current threshold is €250; this will double and will increase to €500. The last time the threshold was increased was in 2005 when it was increased from €100 to €250. The move is contained in the Finance Bill, published last week. The new rules were expected to be implemented from 1st January 2016 however, The Department of Finance say the change will be implemented in time for Christmas.

Under the Revenue Commissioner’s Approved Small Benefit Exemption Scheme employers can provide employees with a small benefit, this small benefit is not subject to PAYE, USC or PRSI.

The following rules apply:

• The benefit cannot be cash, cash payments are fully taxable

• Only one such benefit can be given to an employee in one tax year

• Where a benefit exceeds the threshold the full value of the benefit is subject to PAYE, USC & PRSI

• The benefit can not form part of a "salary sacrifice" scheme

The small benefit is traditionally given as a voucher often at Christmas, as mentioned above only one such benefit can be given to an employee in one tax year. Where more than one benefit is given in a tax year only the first benefit will qualify under the Small Benefit Exemption Scheme.

Full details of Finance Bill 2015 can be found on Revenue’s website

http://www.revenue.ie/en/practitioner/law/bills/finance-bill-2015/index.html

Oct 2015

15

Budget 2016 – Employer Payroll Focus

Tax Rates and Standard Rate Cut Off Points (SRCOPs)

There has been no change to tax rates or SRCOPs. The standard rate of tax will remain at 20% and the higher rate of tax will remain at 40%.

There has been no change to the SRCOP and Tax Credits on the Emergency Basis of tax.

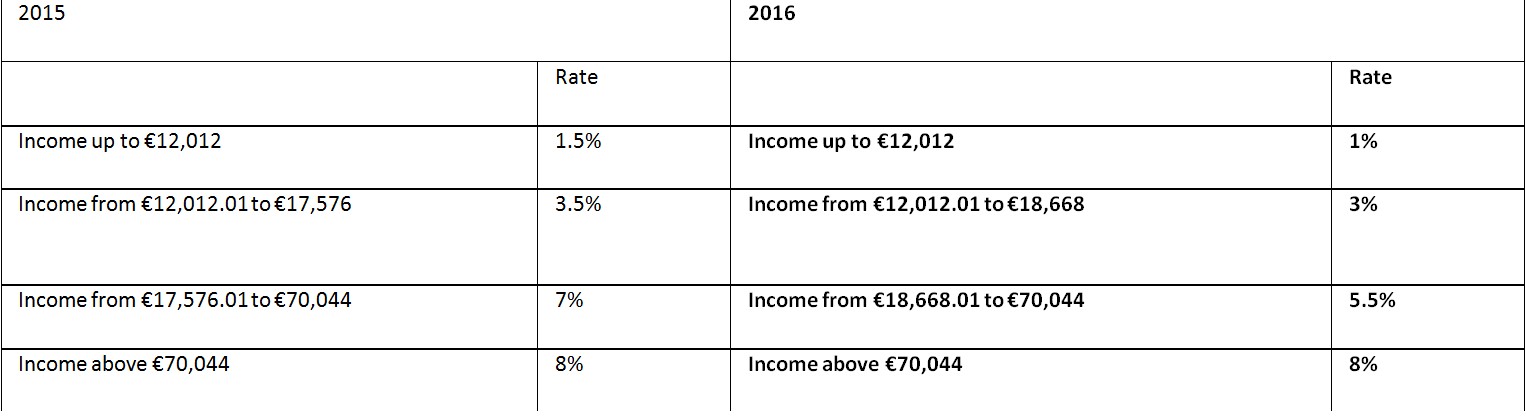

Universal Social Charge (USC)

The annual threshold for USC has been increased to €13,000 from €12,012.

Please note full medical card holders and individuals aged 70 and over whose aggregate income does not exceed €60,000 will pay a maximum rate of 3%.

The emergency rate of USC remains at 8%.

PRSI

Increase from €356.01 to €376.01 in the weekly threshold at which liability to employer’s PRSI increases from 8.5% to 10.75%.

A tapered PRSI credit has been introduced for employee PRSI; the PRSI credit will commence in respect of weekly income of €352.01 and will taper out as a weekly income reaches €424.

For earnings between €352.01 and €424, the maximum weekly PRSI credit of €12.00, is reduced by one-sixth of earnings in excess of €352.01.

Example:

Gross weekly earnings of €377

Maximum PRSI Credit €12

One-sixth of earnings in excess of €352.01

(€377-€352.01 = €24.99/6) (€4.17)

Reduced PRSI Credit €7.83

PRSI @ 4% €15.08

Less: Reduced PRSI Credit €7.83

Employee PRSI Weekly Liability €7.25

Jul 2015

1

PAYE Anytime

What is PAYE Anytime?

PAYE Anytime is the Revenues On-Line Service for employees. The service offers PAYE tax payers a secure way to manage their tax affairs online. PAYE Anytime is a self assessment system so employees are responsible for the information they provide.

You can register for PAYE Anytime by going to revenue.ie or by clicking on the below link.

https://www.ros.ie/selfservice/enterRegistrationDetails.faces

Fill in your personal details and a Revenue Pin will be posted to you.

What can you do on PAYE Anytime

• View your own tax records

• You can claim a wide range of tax credits

• You can use your profile to update your personal details; revenue can then use this information to suggest additional tax credits you may be entitled to

• You can claim a repayment for items such as health expenses (all receipts should be kept for a 6 year period)

• Request a P21 balancing statement (end of year review) for any of the last 4 years

• You can enter your bank account details so any refund due to you can be deposited directly to your bank account (revenue will not deduct money from your account if you have a tax liability)

• You can also declare additional income earned such as B.I.K’s and dividends

• If you are jointly accessed you can reallocate some of your tax credits or standard rate band between you and your spouse

• If you have multiple incomes you can reallocate your tax credits or standard rate band between your incomes

You don’t have to submit a paper claim when you submit transactions through PAYE Anytime. The service cannot be used by employees who submit a Form 11 or a Form 12 tax return to revenue on an annual basis.

PAYE Anytime now allows you to view your tax records from any computer or smart phone.

May 2015

22

IPASS - Annual Payroll Conference

IPASS (IRISH PAYROLL ASSOCIATION) held their annual payroll conference in Croke Park on the 21st May. Paul Byrne and Audrey Mooney from Thesaurus Software Limited attended the conference. They enjoyed meeting the other exhibitors, the delegates and listening to the guest speakers. The speakers included Lindsay Melvin the CEO of the Chartered Institute of Payroll Professionals (CIPP), John Kelly from the National Employment Rights Authority (NERA), representatives from Revenue and Department of Social Protection (DSP).

It was also an opportunity to show our payroll product BrightPay which is available for Irish and UK payroll. BrightPay is a simple but powerful payroll software package that makes managing payroll quick and easy. It is designed for small to medium sized businesses, accountants and other payroll bureau providers.

BrightPay Ireland can be downloaded from www.brightpay.ie

BrightPay UK can be downloaded from www.brightpay.co.uk

BrightPay installs as a trial version, which you can use licence free for 60 days at no cost.

Thank you and congratulations to Noelle Quinn and the IPASS team for another successful and enjoyable annual conference.

May 2015

21

Accrual of holidays during periods of long-term illness

Currently employees working in the private sector are not entitled to build up holidays whilst on sick leave - it is up to the discretion of the employer.

Under new laws about to take effect, private sector employees on long-term sick leave WILL be entitled to accrue annual leave.

The rule relating to the holiday accrual is contained within the Workplace Relations Bill, which makes sweeping changes and reforms to Irish Employment law. The new law will mean that employees will now be entitled to accrue holiday leave while off sick. (though they will have to use the holiday days within 15 months of accruing them.)

Traditionally in Ireland, by virtue of the Organisation of Working Time Act 1997, employees in Ireland don’t accrue annual leave in such circumstances. However, recent key decisions in the Court of Justice of the European Union (CJEU) have meant that the Irish approach was out of sync with European requirements. Minister of State for Business and Employment, Gerald Nash opened up discussions on including these amendments in the Workplace Relations Bill.

The Workplace Relations Bill has now passed both Houses of the Oireachtas and will be signed into law by the President in the coming weeks, with a commencement date of July 1st looking likely. However the holiday provisions will be commenced immediately following the signing by the President.

May 2015

11

Bike to Work Scheme extended for another 5 years

The Bike to Work tax break scheme is to be extended for another five years.

This allows commuters to get a bike worth up to €1,000 through their employer.

Anyone who availed of the Bike to Work scheme in 2009 is now entitled to get a second bike tax-free worth the same amount.

The bike to work is a salary sacrifice that is not liable to PAYE, PRSI or USC.

You can enter in the details of the bike to work into Thesaurus Payroll Manager using the following steps.

In Add/Amend Employee details, go to Deductions, and into the “Other allowable” section enter in the description Bike to work.

Enter in the amount to be deducted each week/month into the field and Update.

The amount entered in here, will be deducted every week or month depending on when you update your payroll.