Oct 2013

4

Cheque no more

The National Payment Plan (NPP), announced by Finance Minister Noonan in April, aims to reduce cheque usage in Ireland to EU levels by 2015, a reduction of nearly 66%.

Cheques would be classed as being one of the more expensive methods of payment, as each bank has their own individual processing charge for cheques, up to .30c each and then there is the compulsory Government Stamp Duty of .50c on each cheque also. So before the cheque is even written, it has cost the issuer upwards of .65c.

In the world of payroll, cheques are not very common, for cost reasons more than anything but also with the increase and popularity of electronic pay systems like online banking and credit transfer, writing cheques is more cumbersome and timely.

With changing consumer habits; the Single European Payment Area (SEPA) enforcement, credit transfer payment methods, and a government drive to cut costs by implementing the National Payment Plan, does this mean cheque books will soon be consigned to the history books??

To read more about the NPP, please check out; http://www.centralbank.ie/paycurr/paysys/documents/national%20payments%20plan%20-%20final%20version.pdf

Sep 2013

24

What our customers say!

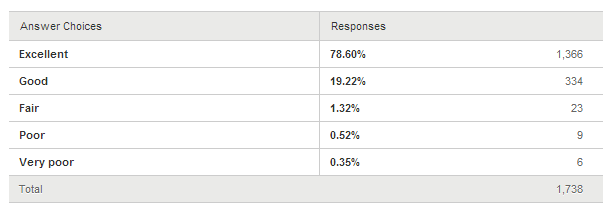

In a recent customer survey, 97.82% of respondents ranked the quality of our customer support as Excellent or Good.

This customer support covers our payroll software (Thesaurus Payroll Manager and BrightPay), our employment contracts software (Bright Contracts) and our accounts software (Solutions Plus) and is free to all registered users.

While the excellent/good percentage achieved would be way ahead of industry standards, we hope to reduce the 2.18% who ranked our support as fair or poor!

Aug 2013

31

New Layout for Irish P30 & P35 returns

With the recent introduction of the Local Property Tax, the helpline at Thesaurus Software HQ has been busy answering queries relating to it.

One of those queries has been to do with the filing of the monthly/quarterly P30.

If an employer, registered with ROS, has been creating the P30 on the Thesaurus Payroll Manager and then uploading it to ROS, there has not been any issue. However an employer trying to submit an online P30 on ROS itself is running into issues arising from where to enter the LPT.

The P30 had been showing fields for the PAYE & USC and then also for PRSI but nowhere was it showing a field for the LPT.

Revenue rectified this problem recently by changing the format of the online P30 and P35 so that the LPT and the USC fields are now separate from the PAYE.

Please see Revenue e-brief 35/13 for more information - http://www.revenue.ie/en/practitioner/ebrief/2013/no-352013.html

Aug 2013

28

Irish Payroll Tax Tip - August 2013

EMPLOYERS, DID YOU KNOW THAT YOU CAN PROVIDE EMPLOYEES WITH EQUIPMENT SUCH AS COMPUTERS, PRINTERS, SCANNERS, FAX MACHINES, OFFICE FURNITURE ETC TO WORK FROM HOME WITHOUT A BENEFIT IN KIND CHARGE.

Where the provision of such equipment is for business use, a benefit in kind charge will not arise in respect of incidental private use.

eWorking:

eWorking is regarded as a method of working using information and communication technology in which work carried out is not bound to any particular location.

Ways of eWorking include:

-

Working at home on a full time or part time basis

-

Working some of the time at home and the remainder of the time in the office

-

Working while on the move, with infrequent or occasional visits to the office

eWorking involves:

-

Working for substantial periods outside the employer’s premises

-

Logging onto the employer’s computer remotely

-

Sending & receiving email, data or files remotely

-

Developing ideas, products and services remotely

eWorkers will incur additional costs in the performance of their duties in their home e.g. electricity & heating costs. In addition to providing the necessary equipment an employer can pay these employees up to €3.20 per day without deducting PAYE, PRSI or USC. If the actual expense incurred by eWorking employees is higher the employer can reimburse the employee provided they have the backup documentation, records should always be kept.

Details can be found on Revenue’s website http://www.revenue.ie/en/tax/it/leaflets/it69.html

If you have any queries please email: audrey@thesaurussoftware.com/audrey@brightpay.ie

Bright Contracts – Employment contracts and handbooks

BrightPay – Payroll Software

Aug 2013

14

SEPA – WHAT YOU AS AN EMPLOYER NEED TO KNOW ABOUT SEPA

EMTS Credit Transfers V SEPA Credit Transfers

EMTS Credit Transfer Files require Bank Sort Codes and Bank Account Numbers.

SEPA Credit Transfer Files require Bank Identifier Codes (BIC’s) and International Bank Account Numbers (IBAN’s). Thesaurus Payroll Manager converts existing Bank Sort Codes and Bank Account Numbers to BIC’s and IBAN’s, users only need to obtain BIC and IBAN details for employees who require payment into Non Irish Bank Accounts.

With an EMTS Credit Transfer file the value date is the payment date, e.g. employees getting paid on the 16th of August the value date is the 16th of August. The file is uploaded with the value date of the 16th of August and the bank ensures employees are paid on that date.

With a SEPA Credit Transfer file users are required to enter a “Debit Date”, this is one business banking day prior to the day the funds are received. When paying employees on the 16th of August the Debit Date on the file needs to be the 15th of August and the file must be uploaded on or before the 15th of August.

Another big change, with SEPA Credit Transfer Files funds are required to be in your account one day earlier i.e. on the “Debit Date”. The bank will secure funds on the “Debit Date” so there must be cleared funds in the account. If there aren’t cleared funds in the account on the “Debit Date” you will be required to lodge funds to the account and resubmit the file.

Aug 2013

12

LPT and the Revenue slam dunk

The introduction of Local Property Tax (LPT) in last year’s budget provoked much outrage and opposition. Marches, public meetings and demonstrations were staged in many parts of the country to protest against the new tax. One of the more popular suggestions was to boycott LPT but all of this noise and bluster was in vain as the measures introduced by the tacticians in Revenue were decisive in ensuring almost total compliance.

When planning the implementation of LPT, Revenue paid particular attention to the payment option “deduction at source”. Although only 5% of compliant taxpayers would eventually opt for this particular payment method, the crucial issue was that nearly all non-compliant taxpayers would be caught in this net. “Deduction at source” in the main refers to deduction from salaries or pensions.

The consultation process between Revenue, the payroll software companies and their representative body PSDA (Payroll Software Developers Association) was detailed and ensured that the mechanics of the LPT deduction in payroll was clear and simple. One of the main reasons that the start date was deferred until 1st July was to ensure the readiness of both Revenue and the payroll software companies for the new deduction.

Just this week, Revenue is preparing to issue P2Cs to employers containing updated LPT amounts. Many of the amounts will be enforcement estimates. Employers will not be able to tell the difference between normal LPT and enforcement LPT. The employers receiving these P2Cs have no choice but to comply, otherwise they will become liable themselves in much the same way as if they failed to deduct PAYE or PRSI.

No matter how militant an employer might be against LPT, it is unlikely that they will risk becoming liable for it on behalf of their employees.

All of the anti LPT campaigners advocating non-compliance really had no chance from the outset when pitted against the Revenue strategists.

Bright Contracts – Employment contracts and handbooks

BrightPay – Payroll Software

Jul 2013

31

Bike to Work scheme - an incentive that works!

Cycling has become one of the biggest growing trends in Ireland when it comes to commuting to and from work and also exercising.

It is a prime example of how well an incentive scheme can work, as the bike to work scheme has transformed cycling in Ireland.

As we all know, cycling is a great form of exercise and by cycling to work, you'll make sure you stay active and get good exercise every day without using up any more of your valuable time.

The bike to work initiative gives you the opportunity to sacrifice part of your salary in return for a bicycle and/or accessories. Under the scheme you don’t pay income tax, PRSI or Universal Social Charge of the price of the bicycle and/or accessories so you can save between 31% and 52% on the normal price (depending on your marginal tax rate).

Participating in the bike to work scheme couldn't be easier;

The employer simply pays for the bike and equipment up to the value of €1,000, and off you go. Your Employer will inform you how the payment will work exactly, whether they buy the bike outright or it operates under a "salary sacrifice" arrangement, but either way you save on tax! Simply set up an Allowable Deduction on Thesaurus Payroll Manager / Bright Pay to accommodate for the salary sacrifice.

The scheme is flexible in so far as your employer doesn't have to specifically notify the Revenue Commissioners that you're availing of the scheme and there are no Government forms to fill out. However, your employer does have to maintain the normal records such as invoices and payment details associated with buying the bike.

Introduced on 1st January 2009, this tax incentive scheme was designed to encourage more people to get on their bikes and cycle to work. And given the obvious rise of the number of cyclists on our roads, it’s easy to see that this incentive is definitely working.

You can find out more at http://www.revenue.ie/en/tax/it/leaflets/benefit-in-kind/faqs/cycle-work.html#cycle1

Bright Contracts – Employment contracts and handbooks

BrightPay – Payroll Software

Jul 2013

29

The Payroll Software Choice - Thesaurus Payroll Manager or BrightPay

In January 2013, we launched our new payroll software, BrightPay. The rollout of BrightPay was met with a very positive response, particularly from those users who switched to avail of its added functionality.

We understand the comfort of sticking with what you know. Therefore we will continue to offer Thesaurus Payroll Manager for the foreseeable future – it is not being phased out!

BrightPay is built using modern technology, offering some immediate benefits:

- The user interface is very clean, simple and fluid. With full control over every pixel on the screen, we have put extra attention into how it looks and feels. BrightPay optimally fills your screen no matter what size display you use. All in all, it makes for a much better experience.

- By re-architecting the software from the ground up, we were able to design it with many advanced payroll features in mind, including:

- The ability to roll back one or more employees to any period, from any period.

- Very flexible reporting that allows you to build the exact report you want.

- Live payroll calculation previews which update as you type.

- The ability to add unlimited payments, rates, additions, deductions, BIK, etc. on a payslip.

- An interactive calendar for entering annual leave, sick leave, parenting leave, etc.

- Support for employees in multiple departments.

- Support for opening multiple employer files simultaneously.

- Future-proof for more upcoming features and integrations.

We encourage you to download BrightPay and have a look. If you wish to switch from Thesaurus Payroll Manager to BrightPay we would advise doing so at the start of a tax year, as it allows for an easier transition (with full import support) than a mid-year switch.

Remember if you hold a Thesaurus Payroll Manager licence you can avail of a BrightPay licence for the same tax year free of charge.

Bright Contracts – Employment contracts and handbooks

BrightPay – Payroll Software

Jul 2013

29

Recent Customer Survey

We are constantly working towards improving the entire customer experience from customer support to improved functionality of the software. We would like to thank you for the time taken to complete our online survey and we will use your feedback to improve our service to you.

An iPad mini was up for grabs for taking part and the winner of this was Margaret Sullivan of Shellfish De La Mer Ltd.

Bright Contracts – Employment contracts and handbooks

BrightPay – Payroll Software

Jul 2013

29

Real Time Information (RTI) - the UK experience so far

From April 2013, the UK has experienced a major change in the way employers report PAYE to HMRC. Employers now report their payroll information to HMRC in real time, on or before every payday. This is akin to a P35 being submitted weekly, fortnightly or monthly by UK employers .

Having such up to date information means that HMRC can issue accurate and timely instructions to employers thereby ensuring that an employee’s tax position at any time is correct i.e. there are less under or overpayments of tax. It will also help ensure the success of the new universal credit system whereby six working-age benefits will be merged into one.

There has been a number of teething problems with the new system, which is only to be expected given the scale of the change but various actions taken by HMRC prior to the live date have ensured that the transition has gone relatively smoothly. These actions included a pilot program, consultations with employer groups, consultations with software companies, various workshops and an overall general helpfulness on the part of the relevant HMRC staff.

It is understood that the Irish Revenue is a very interested spectator!

Bright Contracts – Employment contracts and handbooks

BrightPay – Payroll Software