Sep 2013

23

PAYROLL TAX TIP – SEPTEMBER 2013

Employees do you know when your employer pays or partly pays medical insurance on your behalf you do not get Tax Relief at Source (TRS)?

When you pay your own medical insurance premium you automatically receive tax relief at the standard rate of tax, currently 20%. When your employer pays or partly pays medical insurance on your behalf you will not have been allowed Tax Relief at Source. The good news is you are entitled to the relief when your employer has paid the medical insurance on your behalf but you have to claim the relief due from Revenue.

Individual Paying Medical Insurance:

| Gross Premium | €1,000 |

| Tax Relief at Source: | €200 |

| Cost to Individual: | €800 |

Employer Paying Medical Insurance:

| Gross Premium | €1,000 |

| Tax Relief at source (employer pays this to Revenue through Tax Return) | €200 |

| Benefit in Kind | €1,000 |

Using the example above although the employer has only paid €800 to the medical insurance provider the employee will pay benefit in kind of €1,000.

If your employer pays or partly pays your medical insurance you should contact your local tax office to ensure you are receiving the tax relief.

Details can also be found in the help file for Thesaurus Payroll Manager and BrightPay.

Sep 2013

9

Not registered for LPT? - then no Tax refund!

Revenue are now getting tough with those who had failed to file a property return, and officials will not issue refunds to them.

Those who have not filed a property return will not be in a position to reclaim tax refunds for Medical expenses and tuition fees etc..

A spokeswoman for the Revenue said it will eventually issue refunds to those who have yet to register for the property tax, but it will first deduct the tax due from the refund amount.

In general, in advance of issuing a refund, a taxpayer's record will be reviewed to ensure no outstanding liability exists. Where a liability exists, an offset will be made before the refund will be issued.

Sep 2013

6

Kite Flying prior to Irish Budget

A new report presented to Social Welfare Minister Joan Burton recommends the PRSI rate for self employed and proprietary directors should go up from current rate of 4% to 5.5% to fund extra social benefits for those who work for themselves.

The higher PRSI rate would be used to fund the paying of long-term illness and disability benefits for the self employed, which are not available to those who work for themselves at the moment.

However, the higher PRSI payment that the advisory group recommends for all the self-employed to pay for disability benefits, is set to be opposed by business group ISME The report also states that it would provide a safety net for those who want to start a business.

The cabinet has approved publication of the report, however it remains unclear if the recommendations will form part of next month's budget.

Aug 2013

23

Employer’s Checklist for NERA Inspections

Below you will find a handy employer’s checklist for a NERA (National Employment Rights Authority) inspection:

1. Do you have your employer’s registration number with the Revenue Commissioners?

2. Have you a list of all your employees together with their PPS numbers and addresses?

3. Have you the dates of commencement of employment for all employees? (And dates of termination if applicable?)

4. Have you given all your employees a written statement of terms and conditions of employment?

5. Have you the employees’ job classification?

6. Have you a record of their annual leave and public holidays taken by each employee?

7. Have you a record of hours worked for all employees?

8. Have you a record of all payroll details?

9. Can you prove that you provide your employees with a written statement of pay?

10. Have you a record or register of all employees under the age of 18?

11. Have you employment permits where applicable?

12. Have you filled out the template letter details that you will receive from NERA advising you of the inspection?

Bright Contracts – Employment contracts and handbooks

BrightPay – Payroll Software

Aug 2013

19

Can Employees Be Paid Less Than The Minimum Wage?

The National Minimum Wage Act, 2000 states that the NMW is €8.65 per hour, there are some exceptions to this.

Where employees are under the age of 18 or within the first 2 years after the date of their first employment over the age of 18, the rate is €6.06 per hour

In the first 2 years after the date of first employment over the age of 18, the rate is €6.92 per hour in the first year and €7.79 per hour in the second year

Or

Where a trainee is doing a course which complies with S.I. No. 99 of 2000 for the 1st one third of the period the rate is €6.49 per hour, the 2nd one third the rate is €6.92 per hour, and the 3rd one third the rate is €7.79 per hour.

S.I. No 99 of 2000 is the Statutory Instrument which forms part of the National Minimum Wage Act, 2000

For the protection of both employees and employers a Contract of Employment, which is now a legal requirement, should be given to each employee as this will state clearly what is expected of both sides and will minimise or hopefully prevent issues arising that lead to ill feeling or disputes in the workplace.

Bright Contracts – Employment contracts and handbooks

BrightPay – Payroll Software

Jul 2013

31

Bike to Work scheme - an incentive that works!

Cycling has become one of the biggest growing trends in Ireland when it comes to commuting to and from work and also exercising.

It is a prime example of how well an incentive scheme can work, as the bike to work scheme has transformed cycling in Ireland.

As we all know, cycling is a great form of exercise and by cycling to work, you'll make sure you stay active and get good exercise every day without using up any more of your valuable time.

The bike to work initiative gives you the opportunity to sacrifice part of your salary in return for a bicycle and/or accessories. Under the scheme you don’t pay income tax, PRSI or Universal Social Charge of the price of the bicycle and/or accessories so you can save between 31% and 52% on the normal price (depending on your marginal tax rate).

Participating in the bike to work scheme couldn't be easier;

The employer simply pays for the bike and equipment up to the value of €1,000, and off you go. Your Employer will inform you how the payment will work exactly, whether they buy the bike outright or it operates under a "salary sacrifice" arrangement, but either way you save on tax! Simply set up an Allowable Deduction on Thesaurus Payroll Manager / Bright Pay to accommodate for the salary sacrifice.

The scheme is flexible in so far as your employer doesn't have to specifically notify the Revenue Commissioners that you're availing of the scheme and there are no Government forms to fill out. However, your employer does have to maintain the normal records such as invoices and payment details associated with buying the bike.

Introduced on 1st January 2009, this tax incentive scheme was designed to encourage more people to get on their bikes and cycle to work. And given the obvious rise of the number of cyclists on our roads, it’s easy to see that this incentive is definitely working.

You can find out more at http://www.revenue.ie/en/tax/it/leaflets/benefit-in-kind/faqs/cycle-work.html#cycle1

Bright Contracts – Employment contracts and handbooks

BrightPay – Payroll Software

Dec 2012

19

Submitting your P35 using ROS

We have included a video to help you with submitting your P35 using Revenue Online Service.

This video can be accessed by clicking on the video icon in the ROS P35 screen in the software.

You can also view the video here.

Dec 2012

10

2012 Payroll Year-End Upgrade Now Available

The 2012 payroll year-end upgrade is now available!

2012 P60

New for 2012 we have added the function to email P60s to your employees directly from your payroll software, similar to the email payslip option that we introduced in the initial release of the 2012 payroll. PAYE regulation states that P60s must be 'made available' to employees, Revenue have confirmed that an email copy of the P60 is an acceptable method of issuing P60s to employees.

If you wish to print your P60s this option is still available, as Revenue are no longer supplying P60 stationery, Revenue allows the printing of the P60 to blank A4 paper which is facilitated within the payroll.

You need only give one copy of the P60 to each employee.

ROS P35

ROS will accept the submission of the correct 2012 format P35 from 24th November.

If your P35 file contains negative USC figures for any of your employees then you must wait until 28th January 2013 to submit your P35. If you attempt to submit your P35 prior to this date ROS will give you an error message. To check if this is the reason for the failed ROS submission then simply go to the year-end menu and view the P35 spreadsheet to check if any of your employees has a total negative USC figure.

Our ROS P35 feature will include video help offering a step by step guide to creating and submitting your ROS P35. This video will be available from the start of January.

How to upgrade your 2012 payroll software

You should have received the upgrade message on launching the payroll software in the last week, if you have not received this message then simply go to the 'Help' menu and select 'Check for updates' to see if you are on the latest version. We have also sent you a reminder email.

Once you see the upgrade message, you should upgrade. Upgrading will only take a couple of minutes. If you have installed your payroll software to somewhere other than the default location, this other location will be stated in the upgrade message. Make a note of this location as you will be asked for it during the upgrade procedure.

Dec 2012

10

New Payroll Software, BrightPay Launches in 2013 Alongside Thesaurus Payroll Manager

Thesaurus Payroll Manager

Thesaurus Payroll Manager is one of the leading payroll software programs available on the Irish market and is the choice of 55,000 employers. As we constantly strive to improve and continue as market leaders we welcome your feedback and queries which are key to our improvement plans for Thesaurus Payroll Manager in the years ahead!

BrightPay - 2013 Launch

During 2013 we will release a brand new second payroll option, BrightPay, satisfying every whim of the end user, written to evolve into the future in line with operating systems and legislative obstacles faced by employers. This software will mirror the dynamics and power of UK BrightPay, www.brightpay.co.uk, which we launched in 2011.

BrightPay will be feature rich and more powerful than Thesaurus Payroll Manager.

Which to use?

We do understand that many users will prefer to stick with what they know so we are committed to offering both payroll solutions, Thesaurus Payroll Manager and BrightPay, for the years ahead.

Every customer will have the choice to use either Thesaurus Payroll Manager or BrightPay (or both) - the price will be the same!

Any customer who has purchased a 2013 Thesaurus Payroll Manager license can avail of a free BrightPay license for 2013, to receive your free license simply email brightpay@thesaurussoftware.com to register your request, remember to quote your 2013 Thesaurus Invoice number.

Dec 2012

10

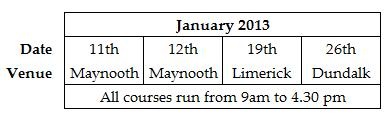

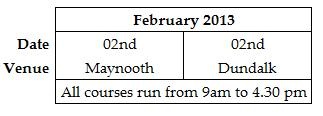

2013 Computerised Payroll Training

In association with our training partner, Oiliúna, computerised payroll training courses are now open for bookings for the months of January and February 2013.

Simply click here to download thebooking form for complete booking information.

Alternatively, should you wish to contact a trainer in your area our network of trainer details are available at http://www.thesaurus.ie/Training.aspx

Bright Contracts – Employment contracts and handbooks

BrightPay – Payroll Software