Update from P2C file

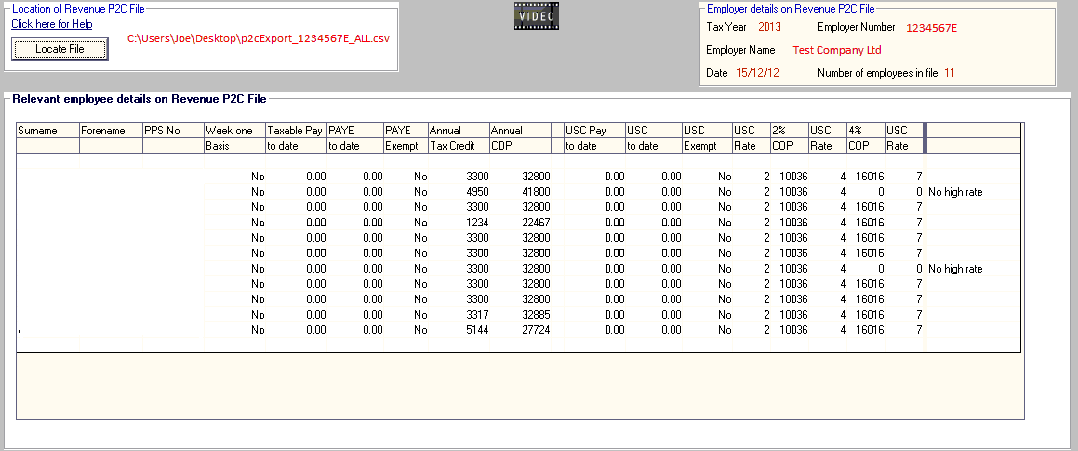

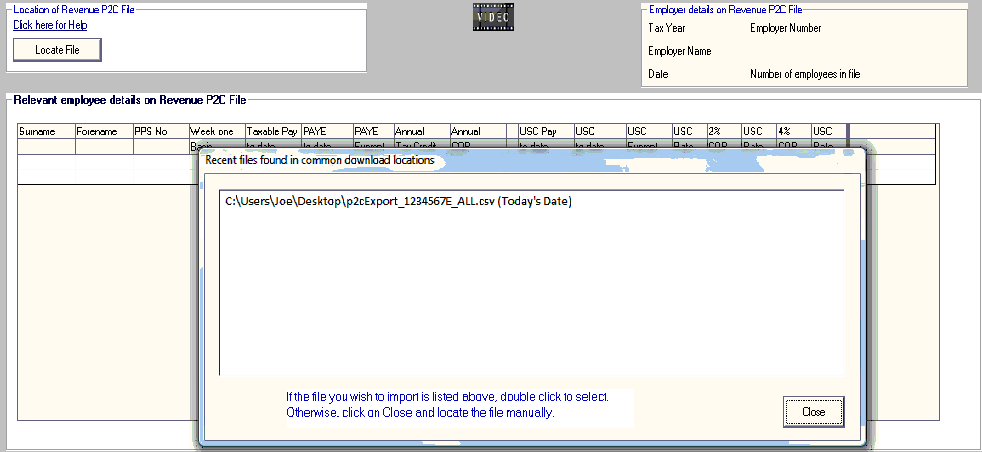

Ø Select the P2C file e.g. p2cExport_1234567E_ALL.csv or p2cExport_1234567E_AMD.csv

Ø Double Click on the file to open

Ø All contents of the P2C file are displayed on screen

Ø Click Print P2C details for a file copy of the contents of the P2C file

Ø Click Update to update all employee tax credit, SRCOP, USC COP and previous employment details.

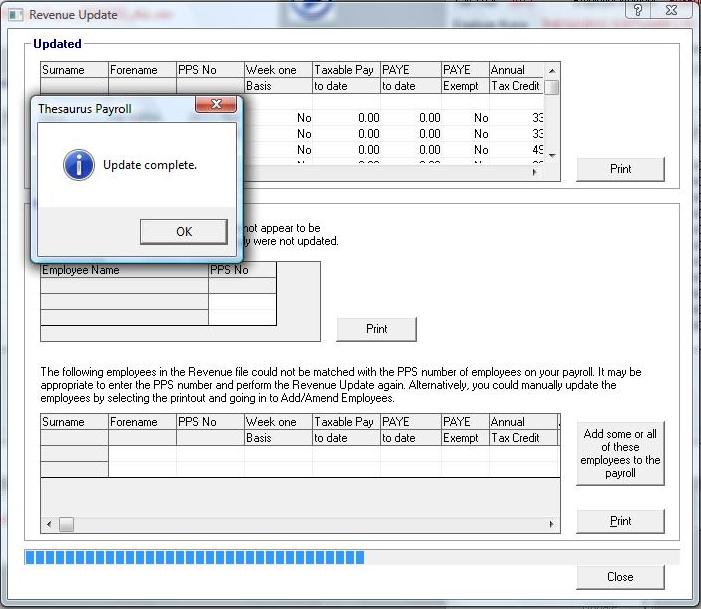

Ø A list of those employees who updated will be shown

Ø A list of those employees who are on file but were not included in the P2C file will be shown

Ø A list of those employees who are on the P2C file but not in Thesaurus Payroll Manager will be shown.

EMPLOYEES IN P2C FILE NOT SETUP IN THESAURUS PAYROLL MANAGER

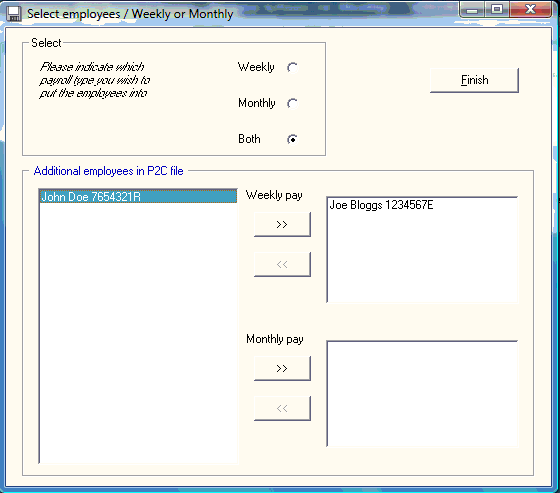

If there are employees in the P2C file which are not in Thesaurus Payroll Manager you will be given the list of these employees once you select to update from the P2C file.

At time of importing, Thesaurus will identify those employees for whom there is no record within the payroll and allow you to add some/ all of these employees to the payroll from the P2C file.

Ø Select "Add some or all of these employees to the payroll"

Ø The list of additional employees contained in the P2C file will be displayed.

Ø Select the pay frequency you wish to set the employees to

Ø The full listing of employees will transfer to the right list for addition

Ø Simply highlight an employee that you do not wish to setup and click the arrow to move them back to the left list removing them from the list of employees to be added.

Ø Click Finish

Ø The employees are now set up

Ø The payment method is set to cash and the PRSI Class to A1, you can change these settings in Add/Amend Employees if requires.

Should you wish to set some employees up under a different pay frequency simply repeat the P2C file import and the above process selecting the other pay frequency.

Need help? Support is available at 01 8352074 or thesauruspayrollsupport@brightsg.com.