P30

Annual PAYE/USC/PRSI liability less than or equal to €28,800, and

be registered for at least one year with all P35’s filed.

To access this report go to Report > P30 details>

Ø Click P30 by week number OR P30 by date

P30 by week - The P30 by week calculates PAYE, USC & PRSI liability by week number.

P30 by date - The P30 by date calculates PAYE, USC & PRSI liability by pay date for both monthly and quarterly returns.

Ø Click Print

Ø If you wish to return the P30 through ROS - Go to www.ros.ie > Login > Select Online Return > P30

To access this report go to Report > P30 details>

Ø Select P30 by date

Ø Quarterly liability figures are stated at the bottom of the P30 by date report

Ø Click Print if required

Ø If you wish to return the P30 through ROS - Go to www.ros.ie > Login > Select Online Return > P30

Ø Select P30 Payment Records

Ø Enter amount paid

Ø Click Update

To access this utility go to Reports > P30 Details > P30 by Week Number/P30 by Date

Ø Click ROS.

Ø Select the Return Period i.e. Monthly/Quarterly.

Ø Choose the period start date e.g. 01/01/2013.

Ø The system will automatically populate the fields with the correct figures.

Ø Enter a contact name.

Ø Click Prepare File, the file will be saved to C:\ROS\P30 and will be named the PAYE Number - Year - Period e.g. 1234567E - 2013 - Month 1

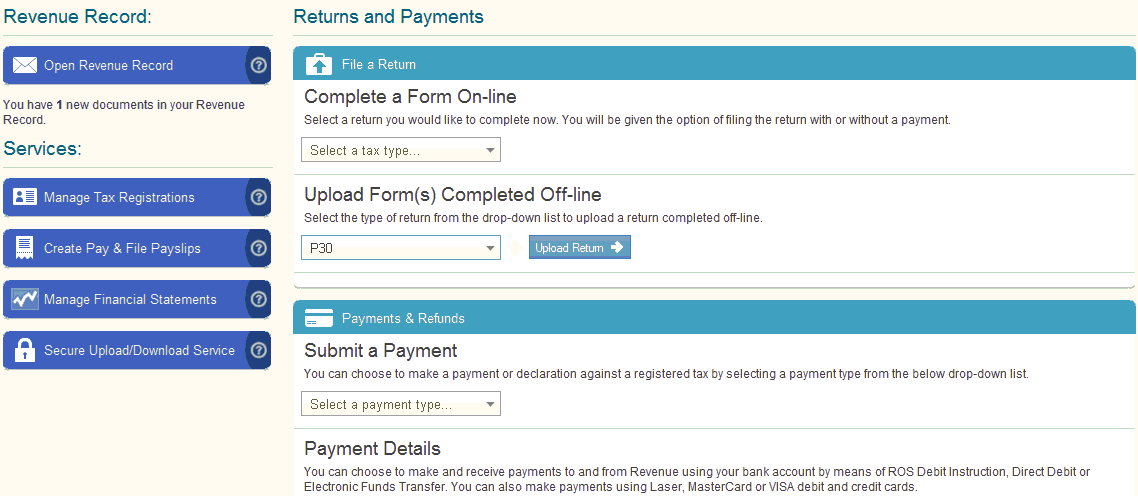

Ø Go to www.ros.ie > Login > Click Upload a file completed offline > Select P30 & follow the on screen instructions

To access this utility go to www.ros.ie > Select Login

Ø Click Login

Ø Select Certificate

Ø Enter Password

Ø Click Login

Ø Under My Services - Select Upload file completed offline

Ø Select P30

Ø Click Add file

Ø Select P30 file - e.g. 1234567E - 2013 - Month 1

Ø Click Add

Ø Select Certificate

Ø Enter Password

Ø Click Upload

Ø Confirm that P30 details are correct - Click Next

Ø Tick file return only to make a P30 return with NO payment - Use this option if you wish to return a P30 without payment or if you have NO payment to make.

Ø If you wish to make a return with a payment - Tick Payment type i.e. Laser card, RDI (ROS Debit Instruction)

Ø Confirm file upload by entering password

Ø Click Sign & Submit

Ø An acknowledgement of your P30 return will be sent to your ROS Inbox

Need help? Support is available at 01 8352074 or thesauruspayrollsupport@brightsg.com.