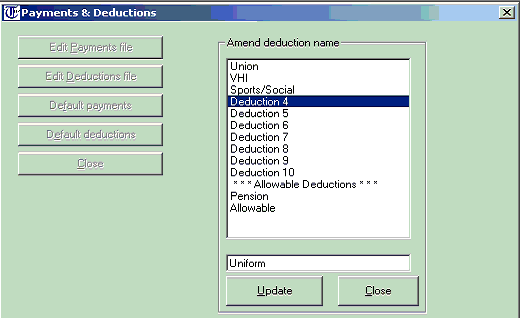

Deductions File

- Click Edit Deductions File

- Select Deduction 1

- Rename Deduction 1 to description required i.e. Union, VHI, Sports/Social etc.

- Click Update

- Repeat this step for all non allowable deductions

Need help? Support is available at 01 8352074 or thesauruspayrollsupport@brightsg.com.