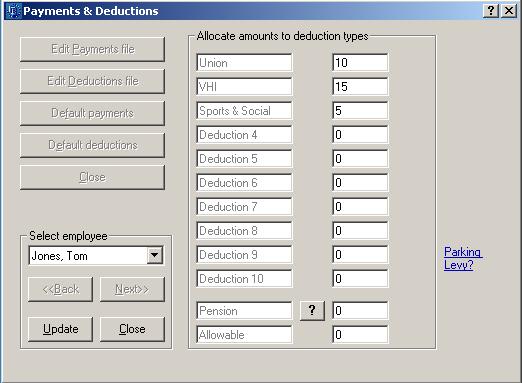

Default Deductions

- Click Default Deductions

- Choose the appropriate Employee from the drop down list

- Allocate unit amount for each deduction type

This is the static rate/figure which does not change from pay period to pay period. The payroll operator will simply enter the appropriate periodic multiplier to be applied to this rate when processing payroll. For example if the Deduction is for VHI then the periodical deduction will be entered as the Default Deduction, the payroll operator would then simply enter the number of deductions to make be it one for one week or two in the case of a holiday week.

- Click Update

- Repeat this step for ALL Employees i.e each default deduction is specific to each employee

Need help? Support is available at 01 8352074 or thesauruspayrollsupport@brightsg.com.