Employer Receives Illness Benefit Payment

If you do not know how much Illness Benefit the employee is receiving then you must make a best estimate and deduct PAYE from it in the week it is due to the employee. The below fields must be used in order to allocate the correct PAYE treatment to the Illness Benefit.

- No payment is made for the first 6 days of Illness or for any Sunday during the Ill period.

- The normal weekly rate of Illness benefit is €188.00, or €31.33 per day.

- Employees will receive the 6 day payment even if they normally work 5 days.

- Employer reduces the employees salary by the Illness Benefit they are receiving so he is merely topping up the employee salary to their normal periodical salary.

Illness Benefit must still be recorded as a DSP payment using the dedicated Illness Benefit tab to facilitate the figures being reported to Revenue accurately and the appropriate tax treatment to apply.

- Employee instructs DSP to make payment directly to their employer.

- Employer receives the DSP Illness Benefit of €188.00 per week.

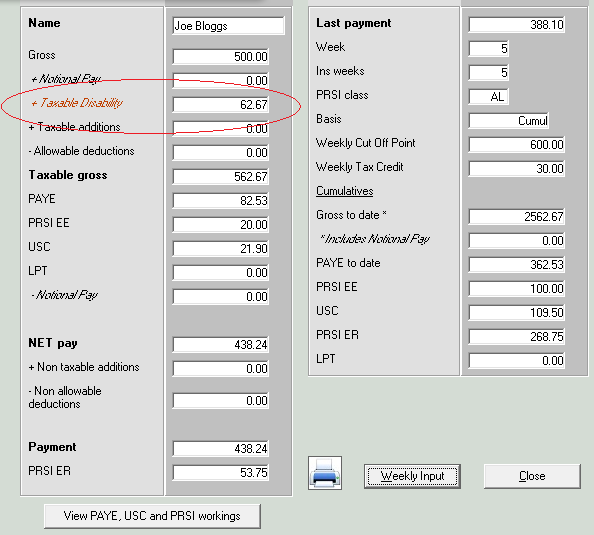

- The employer must collect the tax on the Illness Benefit that the employee is receiving from DSP and record that he has taxed the Illness Benefit. This portion of the employees pay must be treated correctly, subject to PAYE but free from USC and PRSI.

PAYE 500.00 @ 20% €100.00

Less Tax Credit - € 30.00

PAYE payable € 70.00

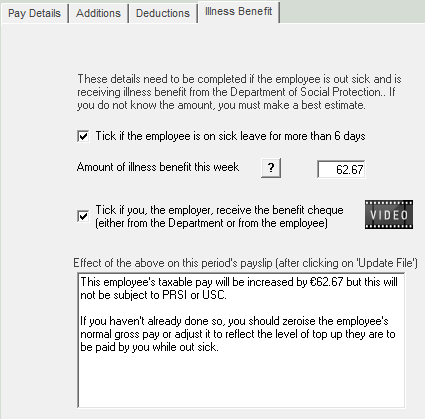

To tax the Illness Benefit in Thesaurus Payroll Manager

Payslips> Weekly/Monthly Input> Select the employee

Reduce the employees paid hours or basic pay in accordance with the company sick pay scheme.

Select the Illness Benefit tab

Indicate that "... the employee is on sick leave for more than 3 days"

![]()

Indicate that you the employer are receiving the Illness Benefit payment form DSP either directly from DSP or indirectly from DSP, i.e. from the employee

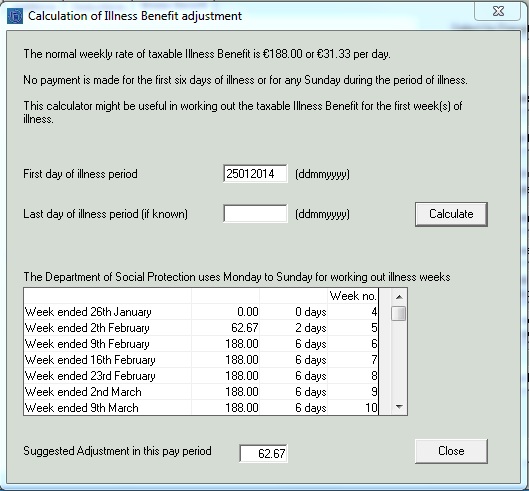

Illness Benefit Calculator

A built in Illness Benefit calculator will help you to calculate how much Illness Benefit the employee is eligible for in the pay period.

To access the calculator select the "?"

![]()

Enter the first date of sick leave (not the start date of Illness Benefit)

The calculator will predict the Illness Benefit that the employee is eligible for in this pay period and all future pay periods for as long as the sick leave continues.

The calculator will determine start dates from the date of the last pay period.

Enter the Illness Benefit

Enter the amount of Illness Benefit the employee is entitled to in this pay period (regardless of whether they have actually received it or not)

Click Update File

Eventhough the employer is continuing to pay the employee and receives the Illness Benefit payment, it is important that the Illness Benefit feature is used to record the Illness Benefit so that this amount is subjected to PAYE only and not USC or PRSI.

Employers must use the dedicated Illness Benefit feature in order to isolate the Illness Benefit figure from the employees normal pay as it must be declared to Revenue on all employee related Revenue returns;

P45

P35

P60

Need help? Support is available at 01 8352074 or thesauruspayrollsupport@brightsg.com.