Submit Batch P46 to ROS

SUBMIT BATCH P46 TO ROS

A P46 should only be submitted to Revenue where a P45 has not been received from the new employee.

If you have received a P45 from the new employee then a P45 Part 3 should be submitted.

All P45 Part 3 and P46 submissions must include a valid employee PPS number.

Revenue and ROS will not accept either of these submissions without a PPSN.

This utility facilitates the submission of a multiple P46s for new employees at the one time, who do not have a P45 from their previous employment, through ROS. Each new employee must be entered in the Add/Amend employees section before proceeding

Important Notes

New Employees

P46

On 9th July 2009, ROS made a P46 employee form available. Using this form employer's (and their agents) can notify Revenue of a new employee's commencement where there is no P45 supplied from the previous employer.

Setup each new employee within the Add/Amend Employee menu.

In order to submit a P46 to ROS for a new employee at least 2 lines of address must be completed within their Personal Details.

Go to Employees > Submit details of new employee to ROS> P46 Batch File>

All new employees who fulfill the minimum P46 requirements will be listed. Each employees start date is denoted in brackets after the name, this should help identify those employees required for submission.

Ø Select Employee's name

Ø Click Add, repeat this process to add each required employee to the "Include in ROS P46" file for submission

Ø Click Prepare File

Ø Indicate the name in which you would like to save the file

Ø Click Save

Ø The P46 file is now ready to be uploaded to ROS - Go to www.ros.ie > click login

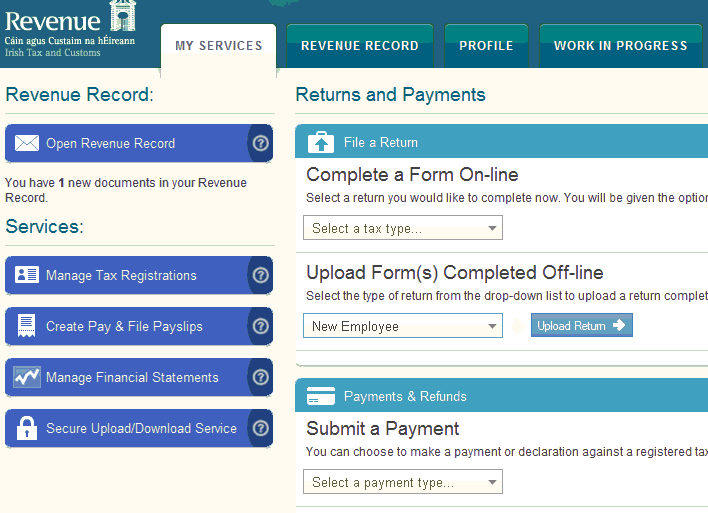

Ø Under My Services - Select Upload Forms Completed Offline

Ø Select New employee

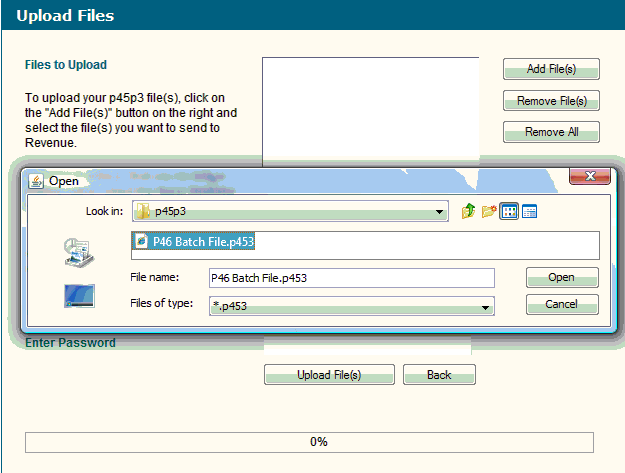

Ø Select saved file - normally employee's PPS number.P453

Ø Click Add File(s)

Ø Enter password

Ø Click Upload File(s)

Need help? Support is available at 01 8352074 or thesauruspayrollsupport@brightsg.com.