Submit P46 to ROS

SUBMIT P46 TO ROS

A P46 should only be submitted to Revenue where a P45 has not been received from the new employee.

If you have received a P45 from the new employee then a P45 Part 3 should be submitted.

All P45 Part 3 and P46 submissions must include a valid employee PPS number.

Revenue and ROS will not accept either of these submissions without a PPSN.

This utility facilitates the submission of one new employee, who does not have a P45 from their previous employment, online through ROS. The new employee must be entered in the Add/Amend employees section before proceeding

Important Notes

New Employees - P46

When a new employee commences employment, and was not employed previously within the tax year, the new employer must register the employee as commencing employment with him with Revenue. This m=notification to Revenue is a P46 which can be submitted via ROS.

The employees details can be entered to Thesaurus Payroll Manager, the payroll will facilitate the preparation of an electronic P46 for submission to Revenue via ROS.

The submission of the P46 will result in Revenue issuing a Tax Credit Certificate to the new employer (P2C via ROS).

The P46 should only be used where an employee has NOT given a P45, from their previous employer, to the new employer.

Go to Employees > Submit details of new employee to ROS

- Click P46 for single employee

- Select Employee's name

- Click Prepare file

- Click Save

- P46 file will save as employees PPS number - this can be renamed if you wish

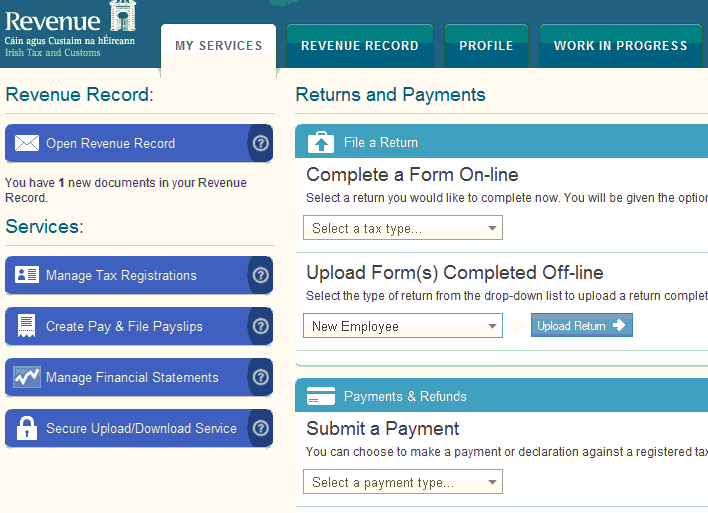

- The P46 file is now ready to be uploaded to ROS - Go to www.ros.ie > click login

- Under My Services - Select Upload Forms Completed Offline

- Select New employee

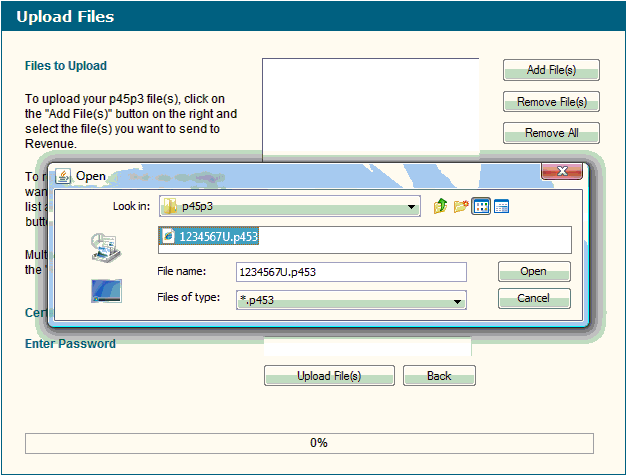

- Select saved file - normally employee's PPS number.P453

- Click Add File(s)

- Enter password

- Click Upload

Need help? Support is available at 01 8352074 or thesauruspayrollsupport@brightsg.com.