Issue P45

ISSUE P45

When an employee leaves your employment, you should issue them a Form P45.

The Form P45 states the amount of pay you received to date, the amount of PAYE paid to date, income subject to USC to date, USC deducted to date, PRSI paid to date, the name of your last employer, etc.

P45 Part 1 are submitted / returned to the Revenue Commissioners online through ROS www.ros.ie

To access this utility go to P45 > Issue P45

Before proceeding you must ensure that all payments have been made to the employee for work carried out.

Ø Select Employee

Ø Enter Date of leaving

Ø Click Next

Ø Click Yes to confirm that you wish to issue a P45

Ø Print Pro Forma P45 details

Ø Fill details from Pro Forma P45 onto an official Form P45 OR prepare ROS P45 file

If an employee leaves your employment mid month, you will need to issue a P45 before month end.

To access this utility go to P45 > Issue P45

Ø Select Employee

Ø Click Yes to makea further payment to the employee

Ø Select Next

Ø To accurately report the number of insurable weeks on the P45 - Enter the number of insurable weeks since last pay period

Ø Click OK

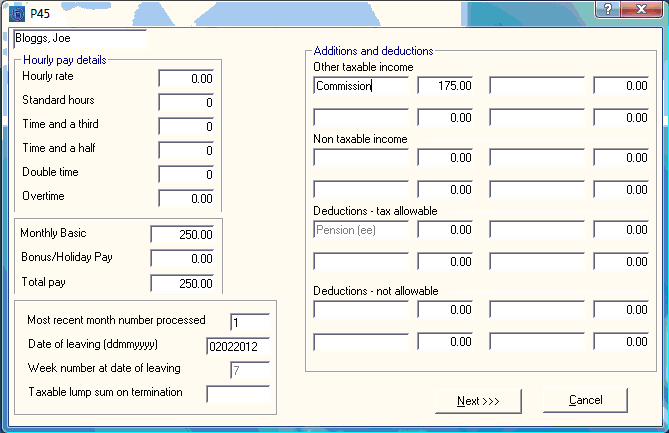

Ø Enter Monthly basic

Ø Enter Holiday Pay if applicable

Ø Enter Additions & Deductions if applicable

Ø Enter Date of Leaving

Ø Enter Week No of leaving

Ø Click Next

Ø Preview payslip to ensure pay details are correct

Ø Click Issue P45

Ø Print Pro Forma P45

Ø Fill details from Pro Forma P45 onto an official Form P45 OR Prepare ROS P45 file

Ø Enter Monthly basic

Ø Enter Holiday Pay if applicable

Ø Enter Additions & Deductions if applicable

Ø Enter Date of Leaving

Ø Enter Week No at date of leaving

Ø Click Next

Ø Preview payslip to ensure pay details are correct

Ø Click Issue P45

Ø Print Pro forma P45

Ø Fill details from Pro Forma P45 onto an official Form P45 OR prepare ROS P45 file

The P45 Part 1 can be submitted online through Revenue Online Services website (www.ros.ie). This utility is only available if you have registered to use ROS.

If you wish to register go to www.ros.ie > Click Register > Complete Steps 1-3.

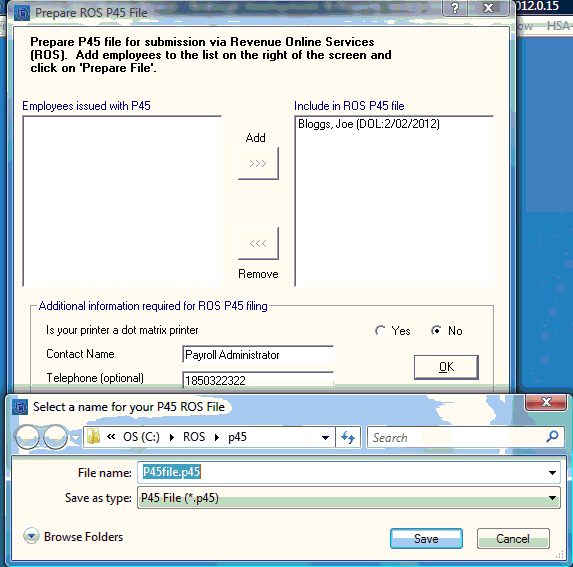

To access this utility go to P45 > Prepare ROS P45

Each employees P45 must be issued before proceeding. To issue P45 - Go to P45 > Issue P45 > Click F1 for help.

To prepare ROS P45 file:

Ø Select Employee

Ø Click Add

Ø Repeat this step until the all employees are listed on the right of the screen

Ø Click Prepare File

Ø Enter Contact name

Ø Enter Telephone Number

Ø Click OK

Ø Save P45 file - the file name can be amended if applicable

Ø Click Save

You can now submit this file to ROS. See instructions below.

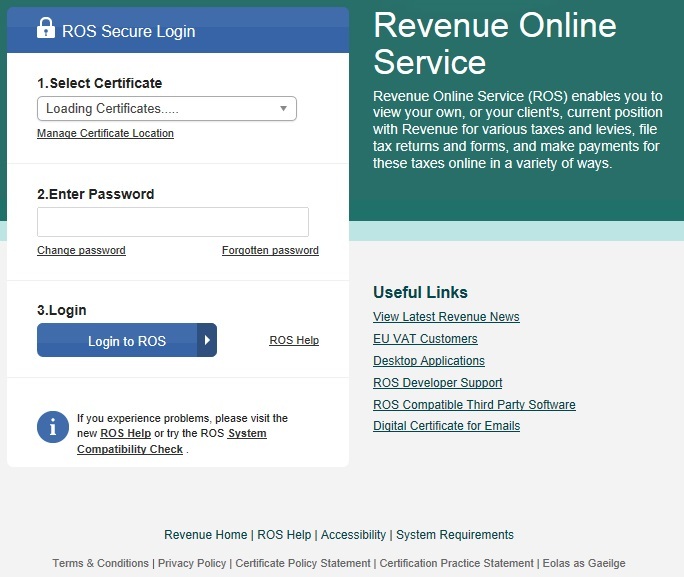

Ø Open website www.ros.ie

Ø Login

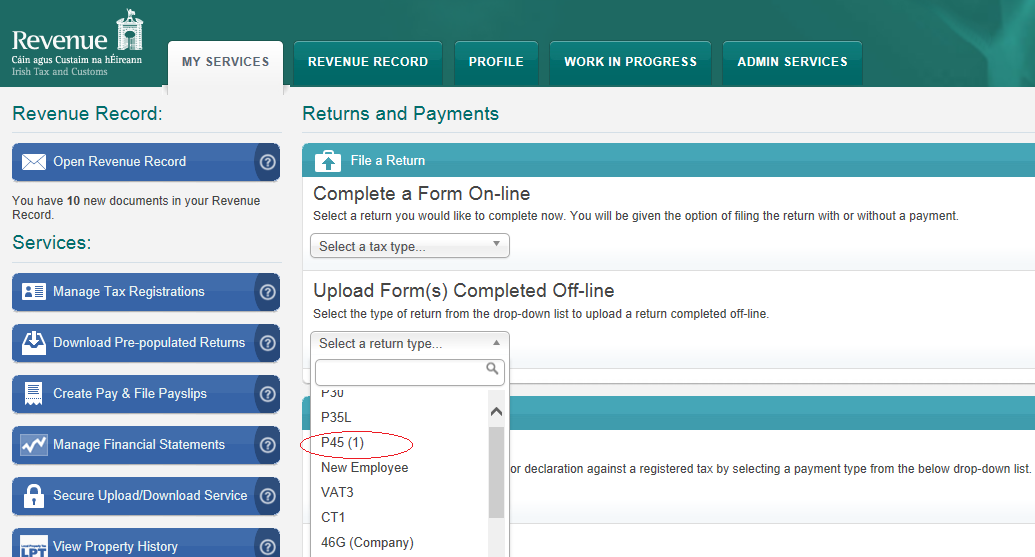

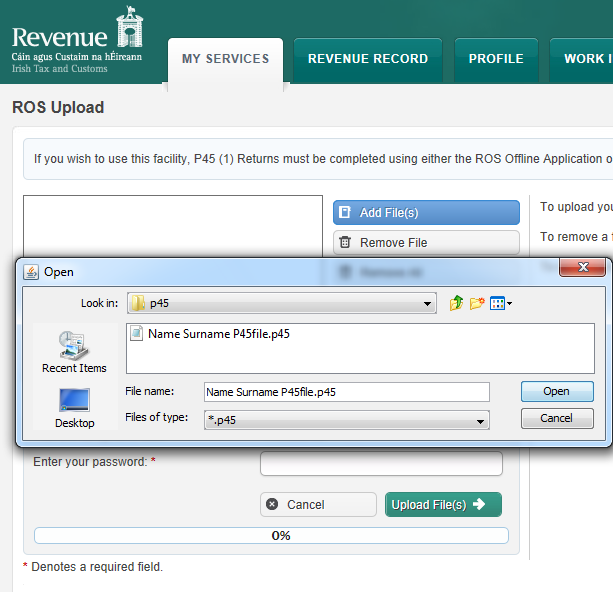

Ø Under My Services - Select Upload Forms completed offline

Ø Select P45 (1)

Ø Click Upload Return

Ø Click Add File

Ø A browser will open, select the drive and directory where you saved the P45 file to.

Ø Selectthe P45 File

Ø Click Open

Ø Select Certificate

Ø Enter Password

Ø Click Upload File(s)

When upload is completed successfully a confirmation number for the return will display on screen.

Access your ROS Inbox to view, save and print part 2, 3 and 4 of P45. The P45 stationery is available from Revenue’s forms & leaflets section (1890 30 67 06).

Need help? Support is available at 01 8352074 or thesauruspayrollsupport@brightsg.com.