Universal Social Charge - Calculations

UNIVERSAL SOCIAL CHARGE (USC)

Some important points relating to the calculation of the USC:

· The Universal Social Charge is collected in the same manner as PAYE and on the same calculation basis

· No pension relief on income chargeable to USC

· Employees must pay USC on Employer contributions to a PRSA but not to RBS or RAC pension arrangements.

The USC is payable on gross income, including Notional Pay, before employee pension contributions.

Where an Employer makes a contribution to a PRSA then the employee gross income for USC purposes is adjusted to include employer PRSA contributions so that the employee is now charged USC on this employer contribution. This is not the case where an employer is contributing to an RBS.

From 01st January 2012 each Employer will be notified of the specific USC deduction method for each individual employee in the same manner as they are notified about an employees PAYE deductions, i.e. on the P2C on an employee by employee basis.

From 01st January 2013 Illness Benefit issued to employees (or claimed by employees made payable directly to employers) by the Department of Social Protection is to be taxed by the employer (in all circumstance), the employer must calculate and collect PAYE. Illness Benefit is not subject to subject to USC.

CALCULATING USC

EXAMPLE 1

Weekly paid employee

P2C advises: Cumulative Basis - effective from 1 January 2014

|

Rates of USC

|

|

USC Rate 1

|

2%

|

|

USC Rate 2

|

4%

|

|

USC Rate 3

|

7%

|

|

|

Weekly COP

|

|

USC Rate 1 Cut-Off Point

|

193.00

|

|

|

|

|

USC Rate 2 Cut-Off Point

|

308.00

|

Week 12 Payroll

Employee earns €700 per week. To date the employee has paid €1,001.86 in tax and

€394.90 in USC

Cumulative USC Gross Pay: €8,400.00 (€700.00 x 12)

USC on €2,316 @ 2% € 46.32 (€193 x 12)

USC on €1,380 @ 4% € 55.20 ((€308 x 12) - (€193 x 12))

USC on €4,704 @ 7% € 329.28 (balance €8400 - €2316 - €1380)

Gross USC €430.80 (€46.32 + €55.20 + €329.28)

Cumulative USC paid up to Week 11 €394.90 as above

USC Due This Week: € 35.90 (€430.80 - €394.90)

EXAMPLE 2

Weekly paid employee

P2C advises: Week 1 / Month 1 Basis - effective from 1st February 2014

|

Rates of USC

|

|

USC Rate 1

|

2%

|

|

USC Rate 2

|

4%

|

|

USC Rate 3

|

7%

|

|

|

Weekly COP

|

|

USC Rate 1 Cut-Off Point

|

193.00

|

|

|

|

|

USC Rate 2 Cut-Off Point

|

308.00

|

Week 10

An employee earns €300 per week.

The Year to date Pay, USC and USC cut off points are irrelevant for the purpose of this period calculation. All that is relevant is the single week USC cut off point attributable solely to week 10.

USC

USC Gross Pay THIS PERIOD: €300.00

USC on €193 @ 2% € 3.86

USC on €107 @ 4% € 4.28 (€193 - €300)

Gross USC THIS WEEK € 8.14 (€3.86 + €4.28)

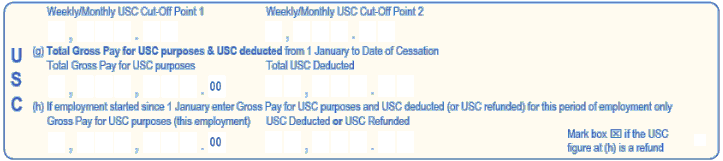

CESSATION OF EMPLOYMENT

The Form P45 includes a dedicated section for the return of USC information and must be completed by all employers when an employee ceases to be employed by them.

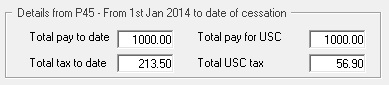

EMPLOYEES COMMENCING EMPLOYMENT

When a new employee commences employment with you, you must capture the USC already paid by the employee as per the P45 issued from his previous employer.

The Revenue screen facilitates the recording of the additional USC information from the P45.

Where the week 1 basis is used, the tax credits and cut-off points (both tax and USC) information on the P45 can be used on a week 1 basis but the previous pay, tax, pay for USC and USC deducted should not be used to operate the cumulative system. The previous pay, tax, pay for USC and USC deducted will be notified to the employer on the P2C issued by Revenue.

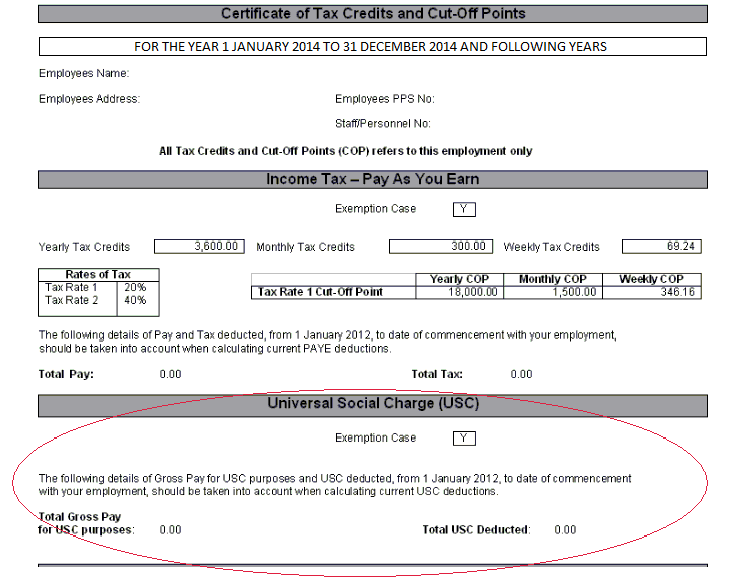

USC EXEMPTION MARKER

Where Revenue determine that the employee/pensioner’s total annual earnings (from all USC-able sources) will not exceed the USC exemption threshold (2014: €10,036), the USC exemption will be stated on the P2C issued by Revenue. This USC exemption marker is an instruction to the employer/pension provider not to deduct USC from payments being made.

Where the employer holds a P2C which does not show exemption and the employee/pensioner advises them that USC exemption applies to them, the employee/pensioner should be instructed to contact their local Revenue office to arrange to have a revised P2C issued. While awaiting a revised P2C the employer should continue to use the P2C currently held.

If an employee is exempt from USC the Tax Credit Certificate will show this:

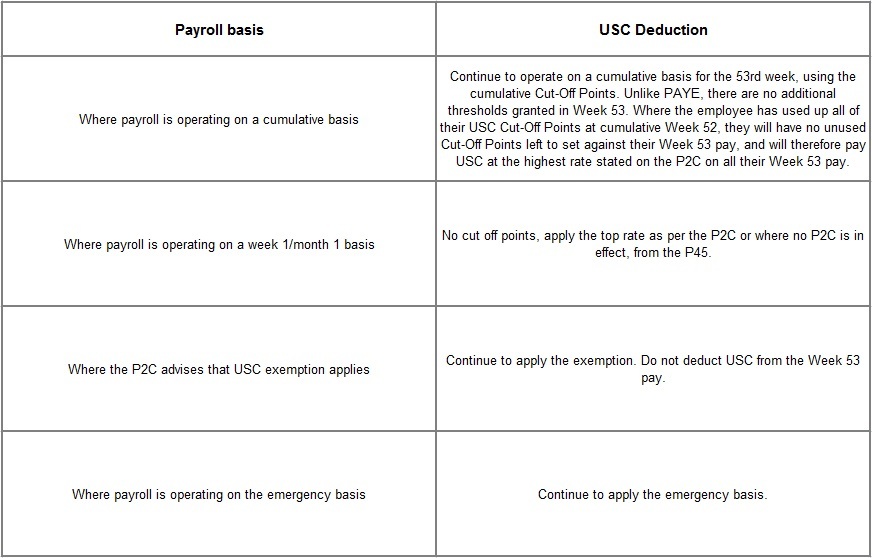

CALCULATING USC ON WEEK 53

The following rules apply to the operation of USC on week 53: