Pension Related Deduction (PRD) or Pension Levy

Pension Related Deduction (PRD) / Pension Levy

** See important note below re changes effective from 30th November 2015 (FEMPI Bill 2015) **

With effect from 01st March 2009 the Pension Related Deduction must be applied to the remuneration of public servants.

Who does the Pension Related Deduction apply to?

The Pension Related Deduction applies to public servants who:

(i) Are members of a public pension scheme

(ii) Are entitled to benefit under such a scheme

or

(iii) Receive a payment in lieu of membership in such a scheme

What pay does the Pension Related Deduction apply to?

The Pension Related Deduction applies to all Schedule E remuneration covering all elements of gross pay, including overtime, arrears, all taxable allowances, Notional Pay on Benefits and taxable portions of Illness Benefit.

PRSI Relief on Pension Related Deduction Abolished

With effect from 1st January 2011 Gross income before the PRD deduction will be subject to PRSI.

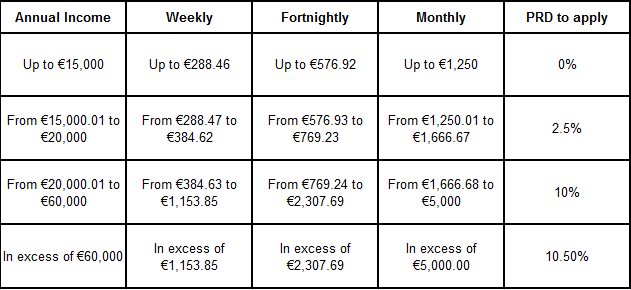

PRD RATES AND THRESHOLDS 2015

Budget 2015 did not introduce any changes to the PRD rates or thresholds.

See note below:

Important note: FEMPI Bill 2015

Changes in 2015:

For 2015 only the exemption threshold (0%) will increase from €15,000 to €17,500 per annum. PRD is applied on a cumulative basis; the 2015 adjustment, if implemented on the 2015 payroll, will automatically be calculated back to the start of 2015, and a refund of PRD where appropriate will appear on the payslip for that week. It is envisaged that the majority of staff will be entitled to a refund. The 2.5% rate of PRD will then apply from €17,500 to €20,000 only in 2015.

(a) Up to €17,500 @ 0%

(b) Greater than €17,500 but not over €20,000 @ 2.5%

(c) Greater than €20,000 but not over €60,000 @ 10%

(d) Balance @ 10.5%

The vast majority of public sector employees dealt with through Thesaurus Payroll Manager do not have their PRD calculated in the above fashion. Typically the bands are applied in their normal employment and then payments processed through Thesaurus Payroll Manager are assessed at either the full 10% or 10.5% PRD rate.

Accordingly we have not released a general upgrade for the new bands as this will inevitably lead to a duplicate refund in the vast majority of cases.

Where a refund is genuinely due for an employee dealt with through Thesaurus Payroll Manager, we recommend that the refund is made in the very last pay period of 2015. Employees who have earned above €17,500 will be entitled to a refund of €62.50. Those who have earned below €15,000 will not be entitled to any refund. Amounts between €15,000 and €17,500 will be entitled to a refund of total pay less €15,000 @ 2.5%. This amount can be entered in the weekly or monthly input screen of the payroll.

Issuing a P45 to an Employee

No changes are required to the P45 issued to employees who leave employment from whom a Pension Related Deduction has been deducted, however, a statement of Pension Related Deductions should be issued with the P45 to the employee.

Issuing P45 to an Employee with a Pension Related Deduction within two years of commencement

Where an employee leaves employment within two years and neither transfers to another public service employment nor retains any pension benefits they are due a refund of both the pension contributions and the Pension Related Deduction. Per the Department of Finance this refund is to be calculated manually outside of the payroll software.

SETTING UP THE PENSION RELATED DEDUCTION WITHIN THESAURUS PAYROLL MANAGER

For the purposes of setting up the Pension Related Deduction within Thesaurus Payroll Manager the deduction will be known as Pension Levy throughout the program.

To access this utility go to Process ICON no. 1 OR Employees > Add/Amend employee details > Deductions Tab

Select the Employee to whom the deduction will apply.

The Pension Levy must be entered into the “Other Allowable Deduction” field as indicated.

To enter the Pension Levy simply type “Pension Levy” into this dedicated narrative field, once you start to type the narrative the program will automatically complete the field for you.

Please note that you must use this default narrative of “Pension Levy”, otherwise the deduction will not be recognised as the Pension Levy deduction by the program and will not be applied accordingly.

The amount of the deduction to be applied need not be entered within this “Additions / Deductions” screen as the program will automatically apply the published rates and bands to the employee’s earnings as they fluctuate. Therefore the nominal amount can be left as zero.

Payslips> Weekly Input / Monthly Input>

Select the Employee from the drop down list to whose earnings the Pension Levy applies.

Select “Additions / Deductions”. The Pension Levy deduction will automatically calculate in line with the rates and bands and this automated deduction amount will be shown.

To view the calculation of the Pension Levy simply double click on the amount. A breakdown of earnings across each band and with the applicable rate will be shown.

Adjust the Pension Levy (override)

Should you disagree with the automated calculation of the Pension Levy calculated by the program then simply type the desired deduction over the automated deduction amount. This manually entered amount will now be applied to the employee’s salary.

Payslips

The Pension Levy will display separately on the Employees Payslip under its official title of “Pension Related Deduction”.

Issuing a P45 to an employee

The Department of Finance indicates that once a P45 has been issued to an employee from whom the Pension Levy has been deducted a statement of Pension Related Deductions should accompany the P45.

Thesaurus will release an upgrade to automate this statement of deduction once the Department of Finance and Revenue finalise the requirements of this statement.

SETTING UP THE PENSION RELATED DEDUCTION WITHIN FEATURE PAYROLL

To set up the Pension Levy within Feature Payroll go to:

Employees > Feature Payroll > Payment / Deduction Setup>

Edit Deductions File

To assign a deduction field to the Pension Levy Deduction choose “Edit Deduction File”. Within the list of Deductions choose the “Allowable Deduction”. You must assign the name of this deduction as “Pension Levy”, using any other narrative will not apply the Pension Levy rules to the deduction calculation. Click “Update” to save the change.

Default Deductions

Enter the “Default Deduction” as 1.00. The Pension Levy will automatically calculate within the Periodic Input screen when processing payroll.

Periodic Input

Enter the periodic pay details as normal, the Pension Levy deduction will automatically calculate in line with the rates and bands and this automated deduction amount will be shown.

To view the calculation of the Pension Levy simply double click on the amount. A breakdown of earnings across each band and with the applicable rate will be shown.

Once all relevant fields are complete simply click “Update” to save the entries and continue to the next employee.

Benefits

Any Benefits setup for an employee will automatically be included in the pension levy calculation.

Payslips

The Pension Levy will display separately on the Employees Payslip.

Deductions Report>

Once the Pension Levy is set up in the above sequence then the “Other Allowable Deduction” field within the “Add/Amend Employee” menu will be automatically updated as the “Pension Levy” update.

The amount of the deduction will automatically update from the “Periodic Input” screen.

This will facilitate reporting of the Pension Related Deduction at a later stage.