Submitting a P45 Pt 3 to ROS

All P45 Part 3 and P46 submissions must include a valid employee PPS number. Revenue and ROS will not accept either of these submissions without a PPSN.

This utility facilitates the submission of new employees online through ROS. The new employee must be entered in the Add/Amend employees section before proceeding - Go to Employees > Add/Amend employee details > Click F1 for help.

New employees

P45 Part 3

On commencement of employment an employee, who was previously employed during the year, will give the new employer Part 3 of the P45 issued to them by the previous employer. This P45 Part 3 should be submitted to Revenue via ROS to notify the Revenue of the employee's commencement of employment with the new employer, this will result in the Revenue issuing a Tax Credit Certificate instruction (P2C via ROS) to the new employer.

The P45 Part 3 details can be entered in Thesaurus Payroll Manager which will then facilitate the preparation of an electronic P45P3 for submission to Revenue via ROS.

To access this utility go to ROS > P46 and P45 (Part 3) > P45 (Part 3)

Ø Select Employee

Ø Enter Registered number of previous employer

Ø Enter Date of leaving and any LPT deducted

Ø Click Prepare file

Ø Click Save

Ø The P45 file will save as the employee's PPS number - this can be renamed if you wish

Ø The P45 Part 3 file is now ready to be uploaded to ROS

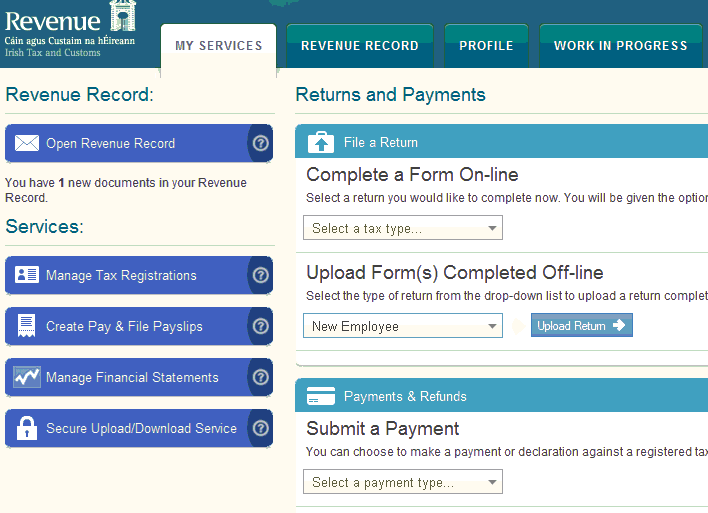

Ø Under My Services - Select Upload a file Completed Offline section

Ø Select New employee

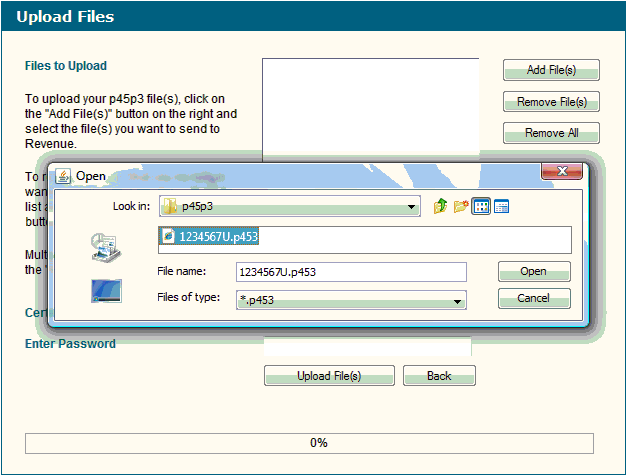

Ø Select saved file - normally employee's PPS number

Ø Click Add File(s)

Ø Enter Password

Ø Click Upload File(s)

Need help? Support is available at 01 8352074 or thesauruspayrollsupport@brightsg.com.