Illness Benefit

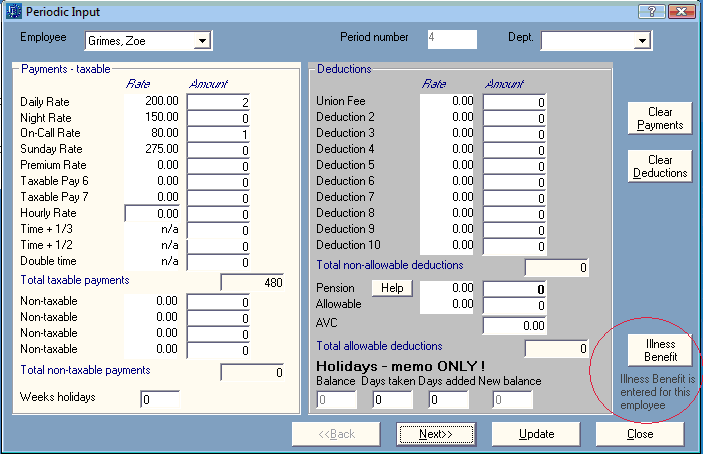

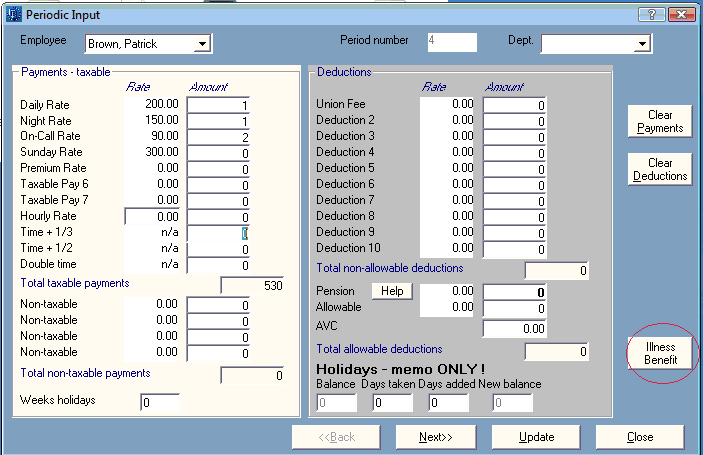

- The pay period will be shown at the top of the screen for the period that you are now processing for.

- Choose the employee from the drop down menu that you are processing payroll for.

- To enter Illness Benefit choose the Illness Benefit button.

To tax the Illness Benefit in Thesaurus Payroll Manager

Payslips> Weekly/Monthly Input> Select the employee

If you are not paying the employee, while they are on sick leave, zeroise the employee hours or basic pay so that the employer reflects zero pay for the period.

If you are paying the employee while they are on sick leave then reduce the pay as appropriate to company sick pay scheme.

In all scenarios the employer must record illness benefit in each pay period for which it is due and deduct PAYE accordingly.

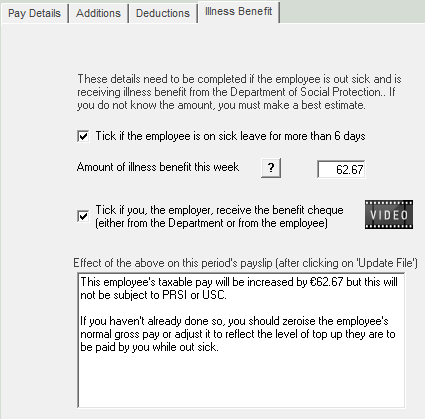

Select the Illness Benefit tab

Indicate that "... the employee is on sick leave for more than 6 days"

![]()

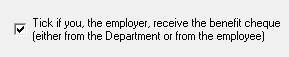

If you, the employer, are receiving the Illness Benefit payment, indicate that you the employer are receiving the Illness Benefit payment from DSP either directly from DSP or indirectly from DSP, i.e. from the employee

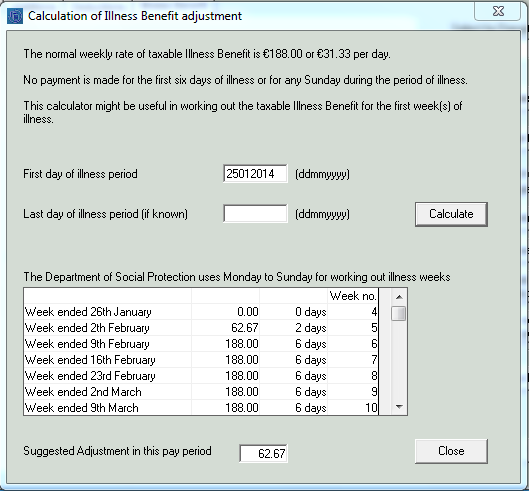

Illness Benefit Calculator

A built in Illness Benefit calculator will help you to calculate how much Illness Benefit the employee is eligible for in the pay period.

To access the calculator select the "?"

![]()

Enter the first date of sick leave (not the start date of Illness Benefit)

The calculator will predict the Illness Benefit that the employee is eligible for in this pay period and all future pay periods for as long as the sick leave continues.

The calculator will determine start dates from the date of the last pay period.

Enter the Illness Benefit

Enter the amount of Illness Benefit the employee is entitled to in this pay period (regardless of whether they have actually received it or not)

Click Update File

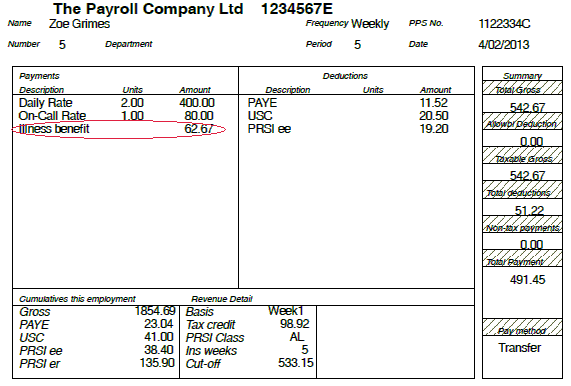

If the employer is continuing to pay the employee and receives the Illness Benefit payment, it is important that the Illness Benefit feature is used to record the Illness Benefit so that this amount is subjected to PAYE only and not USC or PRSI.

The periodic input screen will indicate that Illness Benefit has been entered and applies to this payslip.

Click Update to save the changes entered for the pay period.

Once the Payslips are updated for the period the Illness Benefit will be detailed on the payslip.

For more information on Illness Benefit select the dedicated Illness Benefit menu from the Help menu.

Need help? Support is available at 01 8352074 or thesauruspayrollsupport@brightsg.com.