P30 FOR ROS

PREPARING A ROS P30 FILE

This utility facilitates fast, effective upload of your P30 to ROS. In order to use this facility, your company must be registered to use ROS.

The P30 is the total of:

- the tax deducted from the pay (PAYE, USC, LPT) of all employees less any tax refunded to them

plus

- the total PRSI contributions (the amount deducted from pay plus the amount payable by the employer)

and should be remitted to the Collector General within 14 days from the end of the income tax month during which the deductions were made.

For employers who file their returns and associated tax payments via ROS, time limits are extended to the 23rd of the month immediately following the income tax month during which the deductions were made.

Where a return and associated payment are not made electronically by the extended deadlines, the extended time limits will be disregarded so that, for example, any interest imposed for late payment will run from the former due dates and not the extended dates.

To access this utility go to ROS > P30 > P30 by Week Number/ P30 by Date

-

Click ROS displayed at the bottom of the P30 Report

-

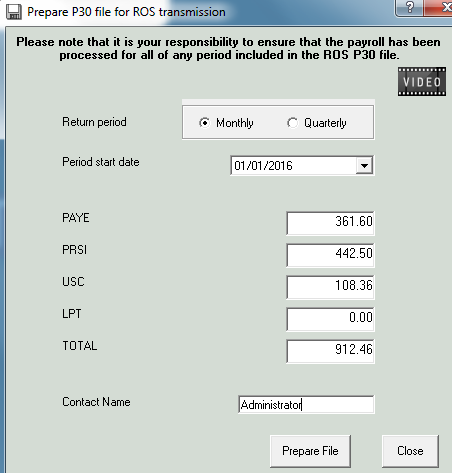

Select the Return Period i.e. Monthly/Quarterly.

-

Choose the period start date e.g. 01/01/2016.

-

The system will automatically populate the fields with the correct figures.

-

Enter a contact name.

-

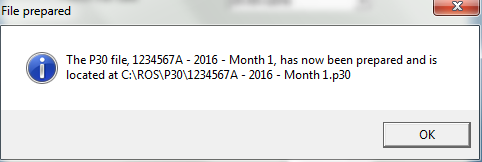

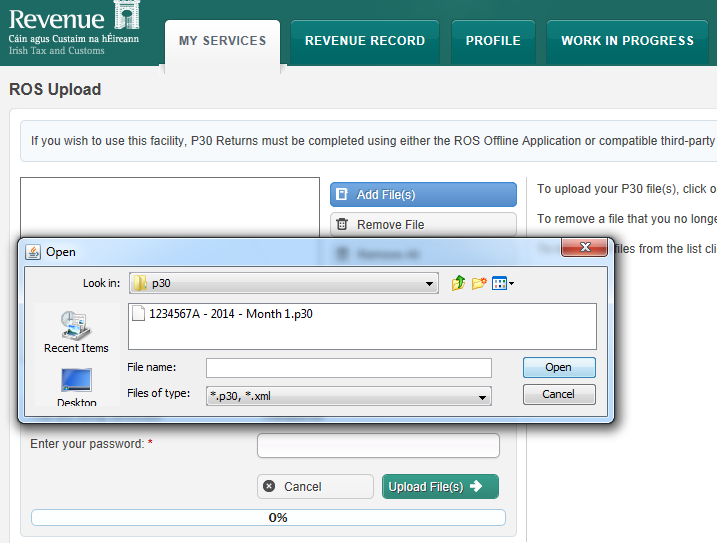

Click Prepare File, the file will be saved to C:\ROS\P30 and will be named the PAYE Number - Year - Period e.g. 1234567A - 2016 - Month 1

SUBMITTING A P30 TO ROS

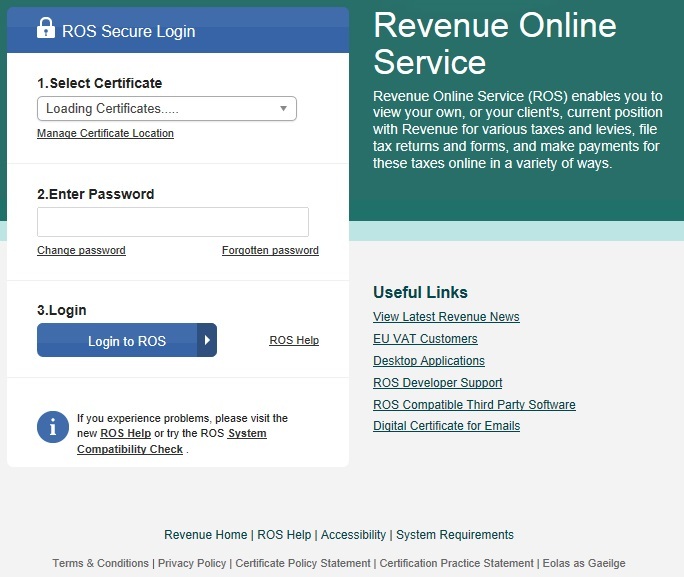

To access this utility go to www.revenue.ie > ROS Login

- Select Certificate

- Enter Password

- Click Login to ROS

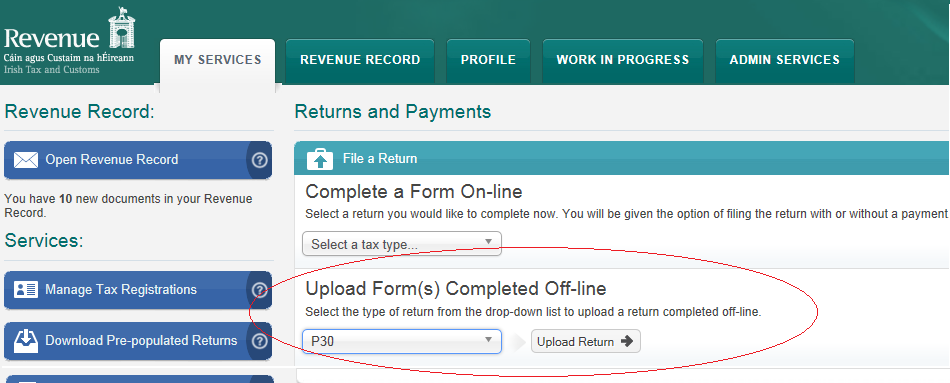

- Under My Services - Select Upload Forms Completed Offline

- Select P30

- Click Add file

- Select P30 file - e.g. 1234567A - 2016 - Month 1

- Click Add

- Select Certificate

- Enter Password

- Click Upload

- Confirm that P30 details are correct - Click Next

- Tick file return only to make a P30 return with NO payment - Use this option if you wish to return a P30 without payment or if you have NO payment to make.

- If you wish to make a return with a payment - Choose your Payment type

- Confirm your file upload by entering your password

- Click Sign & Submit

- An acknowledgement of your P30 return will be sent to your ROS Inbox

Need help? Support is available at 01 8352074 or thesauruspayrollsupport@brightsg.com.