Civil Service Mileage Rates

Where employees use their own private cars or motorcycles for business purposes, reimbursement in respect of allowable motoring expenses can be effected by way of flat-rate mileage allowances.

There are two types of mileage allowance schemes which are acceptable for tax purposes if an employee bears all the motoring expenses:

- The prevailing schedule of Civil Service rates; or

- Any other schedule with rates not greater than the Civil Service rates

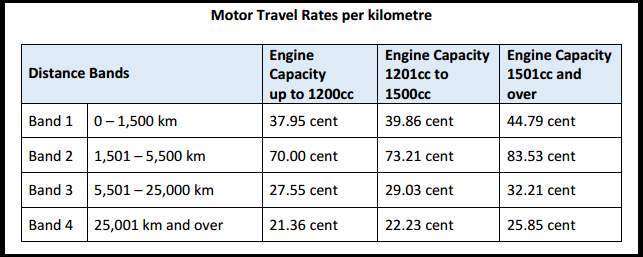

The Department of Public Expenditure and Reform has recently published circulars with new Civil Service Travel Rates, the revised rates are effective from 1st April 2017. The distance bands have increased from two to four with a lower recoupment rate for the first 1,500 kilometres.

Business travel carried out between 1st January and 31st March 2017 will not be affected by these new bands and rates, business travel to date from 1st January 2017 will count towards the cumulative business travel for the year.

Motor Travel Rates - Effective from 1st April 2017

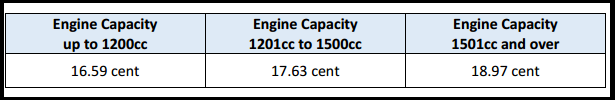

Reduced Motor Travel Rates per kilometre

The reduced rates are payable to Civil Service employees who undertake a journey associated with their job but not solely related to the performance of their duties, such as:

- Attendance at confined promotion competitions

- Attendance at approved courses of education

- Attendance at courses or conferences

- Return visits home at weekends during a period of temporary transfer

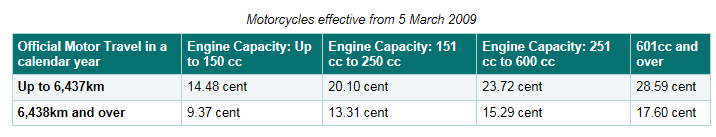

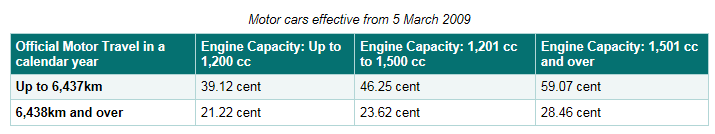

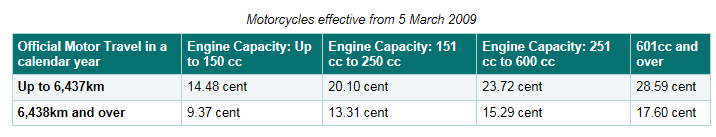

The Motor Travel Rates for motorcycles and bicycles remain unchanged as follows:

Bicycle: 8 cent per km

Motor travel rates effective from 5th March 2009 to 31st March 2017 (not be used for travel from 1st April 2017)

Rates per kilometre:

For further information, please refer to Revenue's Leaflet IT51 - Employees' Motoring/Bicycle Expenses.

Need help? Support is available at 01 8352074 or thesauruspayrollsupport@brightsg.com.