Bike to Work Scheme

To setup 'Bike to Work' in Thesaurus Payroll Manager you create a tax allowable deduction.

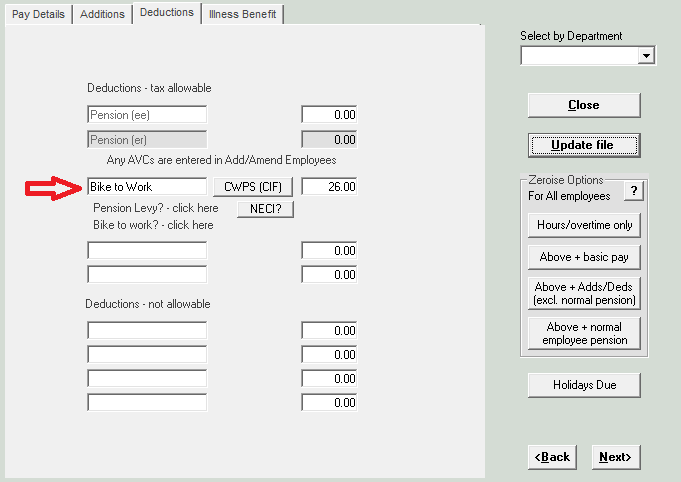

To do this go to Payslips > Weekly/Fortnightly/Monthly Input > Choose the relevant employee > Select Deductions > Enter a description e.g. Bike to Work in one of the fields provided for 'deductions - tax allowable' and to the right enter the periodic value of the deduction.

For example, if the total cost of the bicycle and equipment is €780 and the repayment period is 30 weeks the weekly deduction amount will be €26.

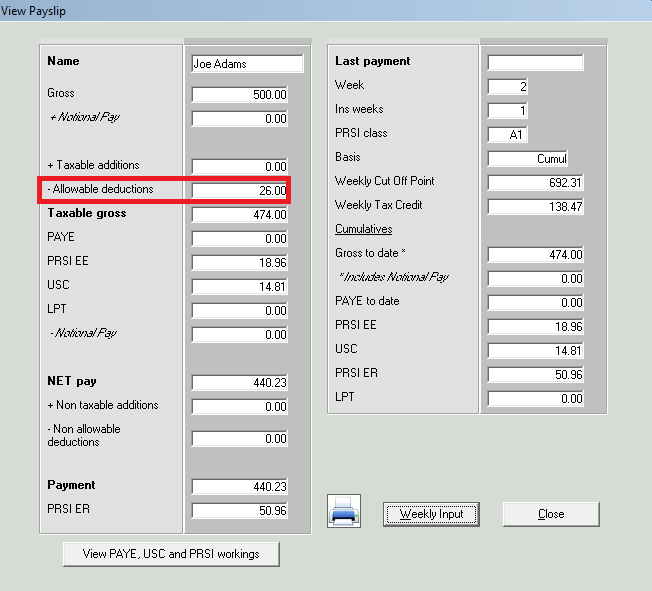

When the payroll is processed, the amount entered above will be deducted from the employees wage before PAYE, PRSI and USC are calculated.

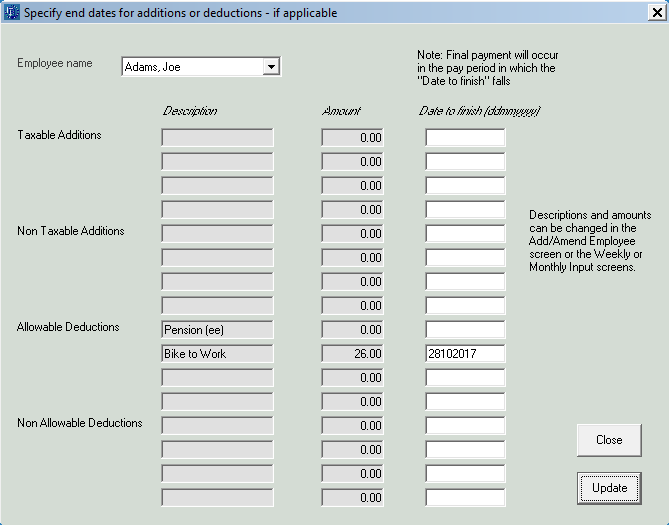

An end date can be entered for the deduction by going to Utilities > 'Specify end dates for additions or deductions'.

If an end date is not entered it will be up to the payroll user to stop/remove the deduction from the employee's payslip once the total cost of the bicycle and equipment has been recouped.

Please note, under the scheme there is no PAYE, USC or PRSI due on the cost of the bicycle and/or accessories up to the limit of €1,000.

The maximum term for the repayment of the bicycle and equipment is 12 months.

Need help? Support is available at 01 8352074 or thesauruspayrollsupport@brightsg.com.