Local Property Tax (LPT)

The Revenue Commissioners are in charge of collecting the payment and have powers to chase those who attempt to avoid it.

How does LPT affect employers?

Householders can opt to pay their Local Property Tax (LPT) in one single payment or to phase their payments over the period January to December. One of the phased payment options being made available is deduction at source from salary or occupational pension.

To opt for deduction from Irish Salary, Wages or Occupational Pension the property owner provides:

-

Employer or Pension Provider’s Name.

-

Employer or Pension Provider’s Tax Registration Number.

If this option is selected, payment will be spread evenly over the period 1st January to 31st December. The amount of each installment will depend on the number of salary, wages or pension payments the employee is due to receive in this period.

General Rules around making payment of the LPT through a salary deduction

- The Householder/employee cannot choose when the deduction starts. The employer must follow the instruction on the Tax Credit Certificate (P2C) issued by Revenue and is required to start the deduction from the next pay period after the date of receipt of the P2C.

- Once the LPT deductions commence, the employer is obliged to continue the deductions and spread them evenly over the remaining pay days in the year. The employee cannot request that the employer pause the deduction, nor can the employer make this decision either.

- Employers must collect the total LPT liability for the year by spreading it evenly over the remaining pay dates in the year.

- LPT cannot be deducted in any pay period for which the employee is not in receipt of payment. However, once salary payments resume employer will have to adjust the amount of LPT being deducted to ensure that the total liability is paid by the end of the tax year. This will result in a slight increase in the amount of LPT being deducted from the remaining salary payments in the tax year.

For Example:

Original P2C states a total annual LPT deduction of €120 for the tax year (the P2C will not indicate a periodical deduction)

Schedule of deductions from 01st January to 31st December for monthly paid employee.

Employee receives payment from January to May, with an LPT deduction of €10 applied to each monthly salary payment

€120 / 12 monthly salary payments = monthly deduction of €10

Employee takes unpaid leave for the months of June, July and August (3 months) without any salary payment

Employee resumes work and payment from 01st September to 31st December, LPT must be adjusted for period of no deduction.

Annual LPT liability €120

€120/12 monthly salary payments = monthly deduction of €10

January to May LPT deducted €50

(5 months x €10)

June to August LPT deducted nil

(no payment from which to deduct LPT)

01st September LPT outstanding is calculated as €120 - €50 = €70

€70/remaining 4 months = €17.50 per remaining month

Sept to Dec LPT deducted €70

(4 months x €17.50)

Total €120

If there is an underpayment of LPT at the end of the tax year due to insufficient salary from which to deduct LPT then the outstanding balance due for payment will be settled between the employee and Revenue through another payment method (cash/cheque etc)

- Once an LPT deduction instruction is issued to the employer to commence LPT deductions from an employees payroll an employee can arrange an alternative payment method with Revenue if they wish.This can be done by accessing the online filing system using your Property ID, PIN and your PPSN, or by calling the LPT Helpline on 1890 200 255. To establish how much LPT an employee/householder still has to pay for the tax year, the amount of LPT already paid by them through their wages (as confirmed on the payslip) should be subtracted from their total LPT liability for the year (as per P2C).

- Once the new payment method is confirmed, Revenue will send an instruction to the employer to stop deducting LPT for that employee by issuing a new Tax Credit Certificate (P2C).

Applying the LPT deduction to an employee record

If an employee elects, or is compelled, to make the LPT payment as a deduction from salary Revenue will issue an instruction to the employer informing the employer of the annual deduction of LPT for that tax year. The Revenue instruction is in the form of a Tax Credit Certificate (P2C).

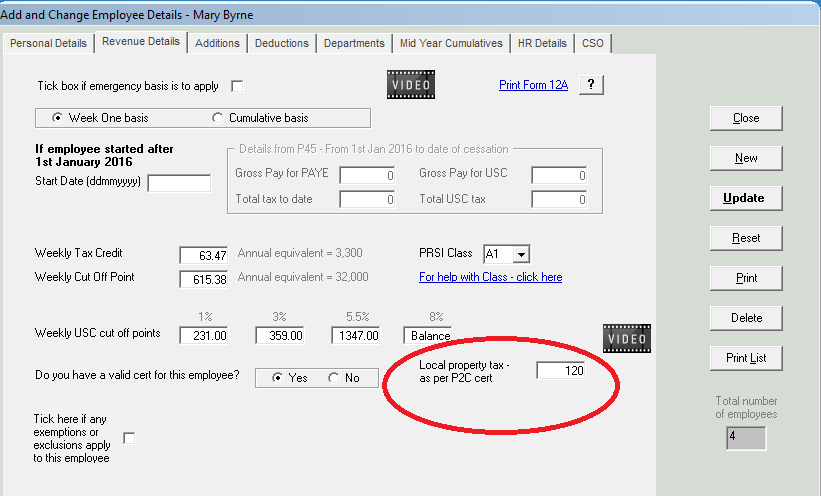

Thesaurus Payroll Manager has a dedicated LPT field where the ANNUAL LPT deduction is to be entered:

- Within Thesaurus Payroll Manager go to Employees > Add/Amend Employees

- Select the Employee

- Choose Revenue Details

- Enter the ANNUAL LPT deduction in the dedicated field

- If you are importing your P2C from ROS, the LPT Revenue instruction will automatically import for each employee to which it applies from the P2C file. No further action is required by the employer.

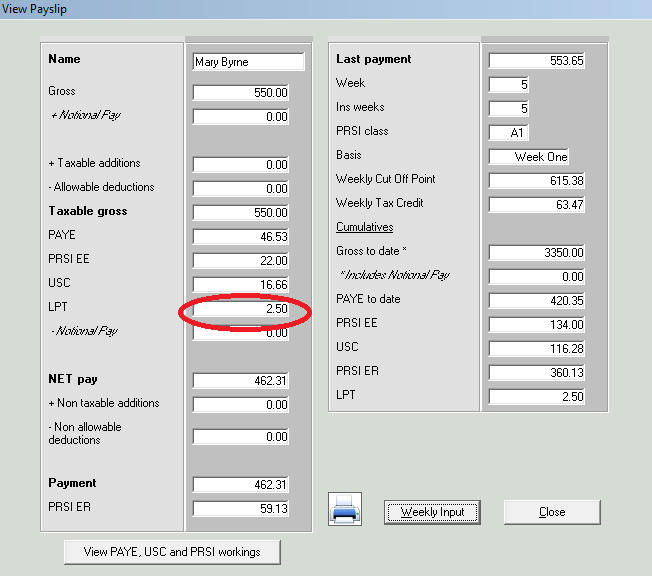

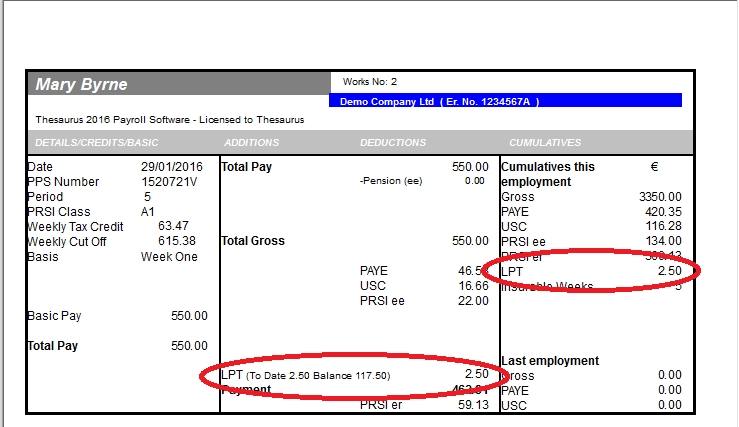

Processing Pay

- When processing the employees periodical pay Thesaurus Payroll Manager will automatically spread the annual LPT deduction equally over the remaining pay periods.

- If an LPT deduction commences after 01st January (new employee commencing after 01st January) the annual LPT deduction will be spread over the remaining pay periods.

- If there is a pay period in which the employee is not due salary and is processed with a zero payslip then the outstanding amount of LPT will be adjusted accounting for the zero pay period and spread evenly over the remaining pay periods.

- Any adjustments required to the LPT deduction due to unpaid pay periods etc are automated by Thesaurus Payroll Manager. No manual adjustment is required.

- Details of the LPT deduction must be recorded on the payslip to give a statement of deduction to the employee.

WHAT PRIORITY WILL BE APPLIED TO THE DEDUCTION OF LPT IN PAYROLL

-

Where a Court Order is already made at the time of issuing the P2C (advising LPT deduction) the Court Order will take precedence over the LPT deduction. If the Court Order is made after the P2C (advising LPT deduction) has issued, the LPT deduction will take precedence.

- LPT takes precedence over all non-statutory deductions.

A Court Order is made before the P2C (advising LPT deduction) is issued.

A Court Order is made since 2010. A P2C showing LPT of €260 issues in January 2017. As the Court Order was made before the issue of the P2C, the Court Order deduction will take precedence.

Order of deductions:

-

Allowable pension contributions / PAYE / USC / PRSI

-

Court Order (e.g. child maintenance)

-

LPT

-

Non-statutory deductions (e.g. employee social club, lottery syndicate contributions)

A revised P2C showing LPT of €220 issues in October 2017. The date of the original P2C for 2017 applies for priority of deductions. The order of deductions will not change.

Order of deductions from October 2017 continues to be the same with the application of the new P2C;

-

Allowable pension contributions / PAYE / USC / PRSI

-

Court Order (e.g. child maintenance)

-

LPT

-

Non-statutory deductions (e.g. employee social club, lottery syndicate contributions)

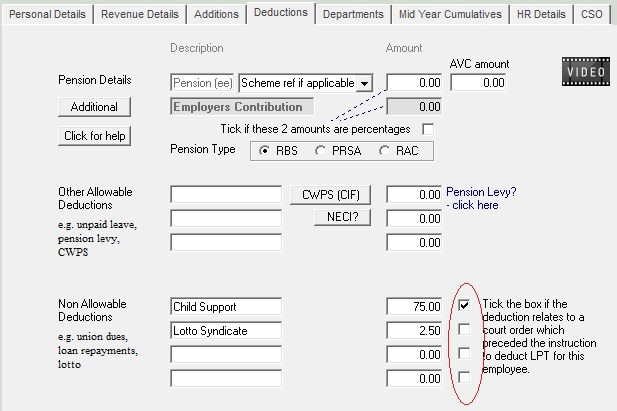

SETTING THE PRIORITY OF DEDUCTIONS WITHIN THESAURUS PAYROLL MANAGER

As a default LPT deductions are taken as priority over all other deductions.

Based on the above explained rules pertaining to the priority order of deductions the user must specify if a deduction should take priority over the LPT deduction.

The Annual Local Property Tax (LPT) deduction is set up in the Revenue Details of the employee, Thesaurus Payroll Manager will apply the periodical deduction accordingly.

To set up your deductions:

-

Go to Employees > Add/Amend Employees

-

Choose Deductions

-

Set up the periodical deduction to be applied to the payslip, enter a narrative as it is to appear on the employee payslip,

-

The deduction will default to be deducted AFTER LPT, giving LPT priority

-

To give the deduction priority over LPT, still in the deduction set-up, press F2

-

Tick each deduction which is to take priority over LPT so that it is deducted BEFORE LPT

Need help? Support is available at 01 8352074 or thesauruspayrollsupport@brightsg.com.