PAYE

The Pay As You Earn (PAYE) system is a method of tax deduction under which an employer calculates and deducts any income tax due each time a payment of wages, salary etc. is made to an employee.

The PAYE system of tax deduction applies to all income from offices or employments (including directorships and occupational pensions) other than a few isolated cases where the employers concerned are given special instructions

Apart from the following:

- Ordinary Superannuation Contributions

- Additional Voluntary Contributions

- Revenue Approved Permanent Health Deductions

- Personal Retirement Savings Accounts (PRSA)

- Retirement Annuity Contracts (RAC)

- Salary sacrificed for a travel pass scheme or Cycle to Work Scheme

No other deductions made from pay should be taken into account in calculating employee taxable pay subject to PAYE.

An employee may claim a tax credit from Revenue for expenses that are wholly, exclusively and necessarily incurred in the performance of the duties of the employment.

If due, it will form part of their tax credits and standard rate cut-off point and will not reduce the employee's taxable pay as already calculated.

Tax Credit

Each employee is entitled to tax credits depending on their personal circumstances, e.g. married person's or civil partner’s tax credit, employee (PAYE) tax credit, etc. These tax credits are used to reduce the tax calculated on an employee's gross pay. Tax credits are non-refundable. However, any unused tax credits in a pay week or month are carried forward to subsequent pay period(s) within the tax year. After your tax is calculated, as a percentage of your income, the tax credit is deducted from this to reduce the amount of tax that you have to pay.

Standard Rate Cut Off Point (SRCOP)

Tax is charged as a percentage of your income. The percentage that you pay depends on the amount of your income. The first part of your income, up to a certain amount, is taxed at 20%. This is known as the standard rate of tax and the amount that it applies to is known as the standard rate tax band. The remainder of your income is taxed at the higher rate of tax, 40%. The amount that you can earn before you start to pay the higher rate of tax is known as your standard rate cut-off point.

Tax Exemption and Marginal Relief

A small number of employees/pensioners are entitled to tax exemption and marginal relief each year. Any individual/married couple whose total income from all sources is less than or equal to the exemption limit appropriate to them will not have to pay tax for that year.

Any individual/married couple whose total income from all sources is over the exemption limit may qualify for marginal relief. This means that when their wages or pension exceeds a certain limit, they are taxed at 40% instead of the higher rate of tax in operation for that year (co-incidentally the higher rate of tax and the marginal rate of tax are the same for 2017). If the employee/pensioner is entitled to tax exemption and marginal relief, the higher rate of tax shown on the tax credit certificate will be 40%.

The decision regarding any individual's entitlement to exemption and marginal relief is made by Revenue - not by the employer. The employer must operate PAYE in accordance with the tax credit certificate/P2C file issued.

BASIS TO APPLY PAYE

PAYE can be deducted on any of the following calculation methods:

- Cumulative

- Week One / Month One

- Temporary

- Emergency

Cumulative

Year to date calculation of tax which ensures that an employee's tax liability is spread evenly over the year. Each pay period tax deduction is calculated as the total tax due from 01st January to the date of payment and reduced by the amount of year to date tax previously deducted. This ensures that any tax credits and standard rate cut off point which are not used in a pay period are carried forward to the next pay period within that tax year. The cumulative basis facilitates the payment of tax refunds where due.

Week One/Month One

Each pay period is treated separately without any consideration of previous pay or deductions. The tax credits and cut-off points are applied to each pay period and tax is deducted accordingly. No tax refunds may be made by an employer where this basis applies.

Temporary

The temporary basis must be used when the employer has been given parts 2 and 3 of a form P45 stating:

- the employee's PPS number and

- the employee was not on the emergency basis and the employer has sent the P45 Part 3 to Revenue and are awaiting the issue by Revenue of a tax credit certificate/P2C file

On the temporary basis PAYE is deducted on a non-cumulative basis (week 1/month 1 basis). A refund of tax should not be made to the employee where the temporary basis is in use. The temporary procedure continues until a tax credit certificate is received from Revenue, at which point the employer should follow the instructions on the new tax credit certificate issued to him.

Emergency

An employer applies the Emergency basis of tax to a new employee's earnings where:

- a tax credit certificate has not been received by Revenue for the employee

- he has not received a form P45 for the employee

- he has received a P45 but it indicates that the Emergency basis applied to the employee in their previous employment

- he has received a P45 without a PPS number stated

Separate periods of employment with one employer treated as one continuous period for emergency basis purposes

It is important to note that where an employee has separate periods of employment with one employer in one income tax year, to which the emergency basis applies, the employment is deemed to commence at the start of the first of these periods and continue to the end of the last period of employment or 31 December whichever is earlier.

Example

A weekly paid employee commences work in income tax week 10, leaves in week 14, resumes work with the same employer in week 28 and leaves finally in week 29. The emergency basis applies throughout.

Weeks 10, 11, 12 and 13 are the first four weeks of employment for the purposes of the emergency procedure.

Week 14 is the fifth week.

Week 28 is the nineteenth week (i.e. fourteen weeks after week 14).

Week 29 is the twentieth week for the purposes of the emergency procedure.

Accounting for previous emergency weeks

When an employee recommences employment with you, within the same tax year, for which the previous period of employment the emergency tax basis applied, you must indicate the number of weeks in this previous period of employment in order to recommence the emergency rules at the correct week.

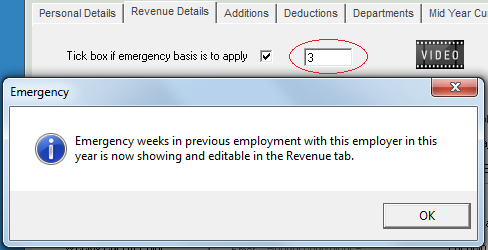

Set up the new employee

In Revenue Details flag Emergency Basis

An automated message will appear, enter the number of weeks previously employed by you for which emergency basis applied

If the employee did not work previously simply enter the number zero

The entry of the number of weeks has no effect on insurable weeks etc, it simply indicates where the employee is in terms of the previously used portion of emergency basis tax credit and SRCOP, remember these can only be allocated once within the tax year.

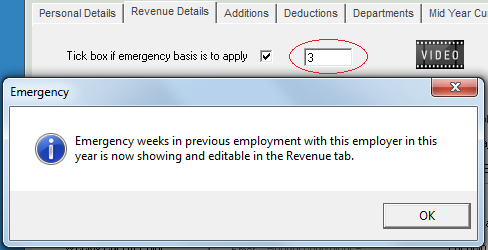

Correct an error in entering the number of previously employed emergency weeks

If you discover that you entered the incorrect number of weeks to which emergency basis previously applied this can easily be corrected.

Go to Add/Amend Employees

Select the Employee

Choose Revenue Details

Press Ctrl+E simultaneously

The number of weeks that was entered previously will display, simply amend as required.

Select Update to save the change to the record.

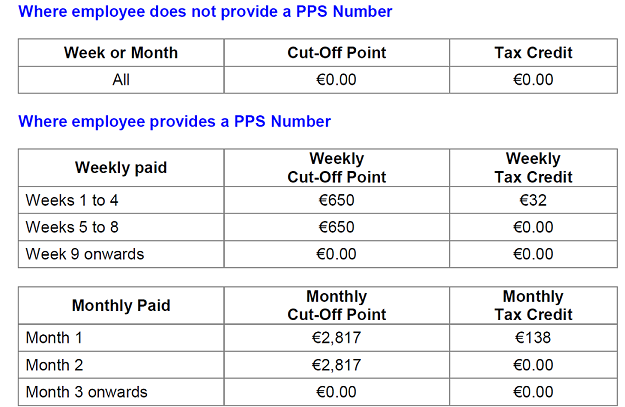

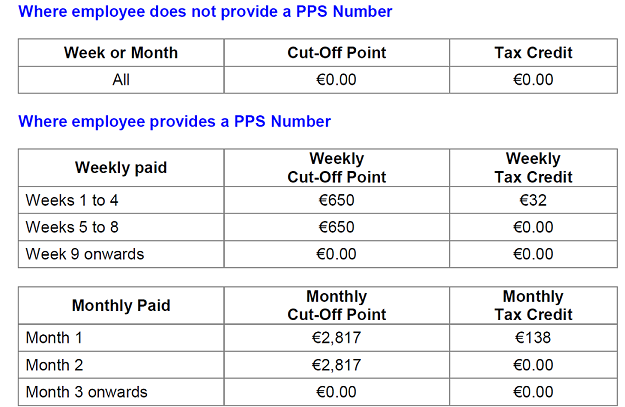

Emergency Basis of Tax Deduction 2017

An employer may not make a refund of tax under the Emergency basis. In these circumstances the employer applies the Revenue set emergency tax credits and cut-off points to an employee's earnings dependent on the presence of a PPS number and the length of time for which the emergency basis continues to apply.

The basic simplified steps to calculating the PAYE deduction are:

Gross Pay - Calculate the Gross Pay subject to PAYE

Gross Tax - Any pay less than or equal to the SRCOP, calculate at 20%

If the taxable Gross pay exceeds the SRCOP - calculate the balance of pay at 40%

Tax Credit - Reduce the Gross tax by the tax credit, reducing the tax payable

Balance - The remaining balance is the PAYE tax payable