NECI Pensions

NECI’s Electricians Pension Mortality & Sick Pay Scheme

The NECI pension scheme has been approved by the Revenue Commissioners and is fully regulated by the Pensions Board.

This scheme also allows employers to join.

The total contribution to the NECI pension scheme is at a rate of 6.2% of the employees salary subject to a minimum payment of €5.14 by the employee.

The NECI rate changed on 01st April 2014.

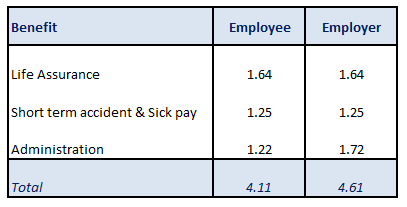

A qualifying benefit week must meet the minimum benefit payment of €8.72 (€10.78 prior to 01st April 2014) which is broken down as follows:

The employee portion of the benefit, €4.11, is always the initial deduction from the employees salary, this is not tax allowable. The balance of the deduction is a pension contribution which is tax allowable.

Employers contribute 3.7% for every hour worked by each employee.

Employees contribute 2.5% for every hour worked.

Example – Employee earns €450 per week

Gross Income €450.00

NECI Pension Deduction

€450 x 6.2% €27.90

Less minimum Benefit €8.72

Attributable to Pension €19.18

(€27.90 - €8.72)

Employee Pensions Contribution €7.73 (Tax Allowable)

(Rate of 2.5/6.2 applicable to €19.18)

Employer Pension Contribution €11.45

(Rate of 3.7/6.2 applicable to €19.18)

Setting up NECI Deduction within Thesaurus Payroll Manager

SETTING UP THE DEDUCTION

Within Thesaurus Payroll Manager select Payslips> Weekly/Monthly Input>

- Select the employee to whom the NECI deduction applies

- Enter the Employee Hourly Rate and Hours worked for the pay period or Weekly/Monthly Basic pay figure

- Select Deductions

- Click NECI

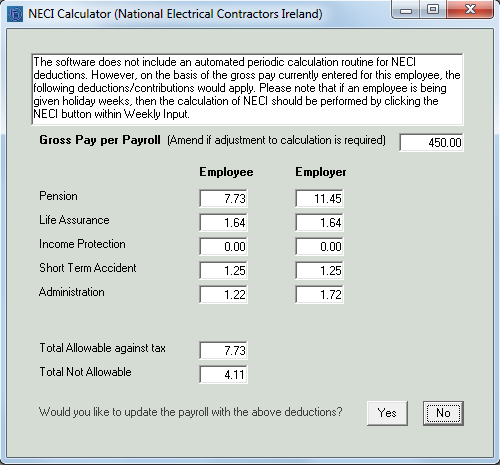

Based on the Employees Total Pay for the period the program will prompt the NECI deduction to be made for that pay period as per the below example:

The breakdown of the deduction is shown on screen.

You may choose to update the employee’s record with the figures shown. Simply click “Yes” to do this or “No” to change the employee pay on which the NECI contribution is to be made.

Click Update to save employee pay record and to preview the payslip

Once the payslips have been updated and the pay period is rolled forward to the subsequent pay period, the NECI figure as calculated in the previous period is carried forward.

If the user amends the employees gross income the NECI deduction will not automatically recalculate based on the new gross income figure, the user must repeat the above process in order to recalculate the deduction and ensure accuracy.

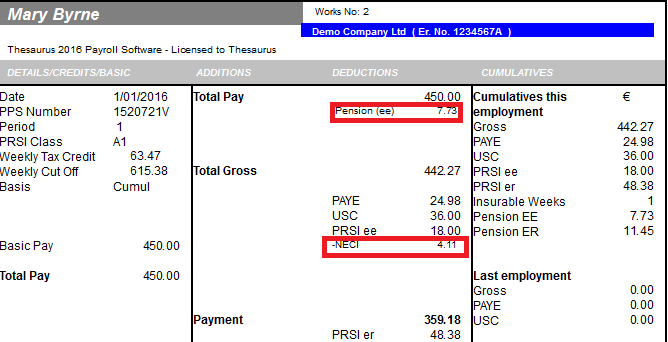

PAYSLIP

The employee’s payslip will reflect the split of the NECI deduction. Based on the above example the

employee pension contribution of €20.65 will be tax allowable and the remaining contribution of

€5.14 is not tax allowable.

The employee payslip will show as follows:

The Employer Pension element will show under the cumulative column (far right), which will be accumulated with each update. The employer’s contribution (excl pension element) is not reflected on the payslip.

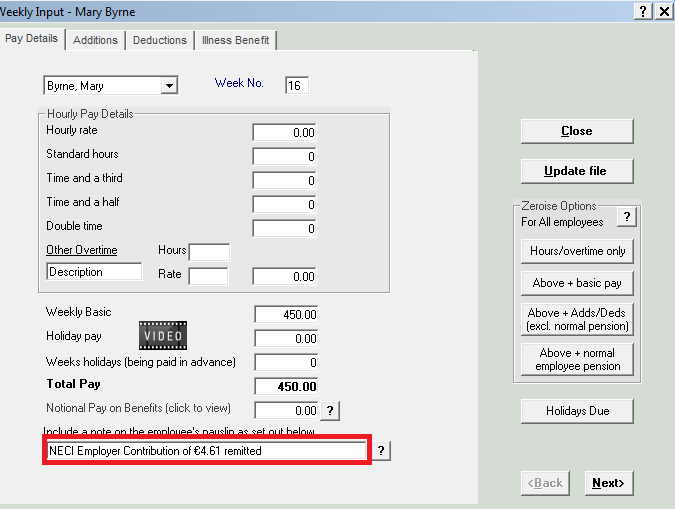

Should the employer wish to include a note of the balancing contribution on the employees payslip this may be done using the payslip note option.

SET UP NOTE ON THE EMPLOYEE PAYSLIP

Within Thesaurus Payroll Manager select Payslips> Weekly/Monthly Input>

- Select the employee to whom the NECI deduction applies

Click into the narrative bar at the bottom of the screen and enter a suitable narrative to disclose the employer’s contributions to the scheme.

REPORTING NECI DEDUCTIONS

There are two specific NECI reports available.

NECI Full Report

An NECI pension report breaking down the entire NECI deduction for both employee and the employers contribution is available from the Reports menu.

Select Reports> Pensions> NECI> Full Report>

- Select "All" employees or a specific employee for whom you wish to generate the report

- Select the starting period "From"

- Select the ending period "To"

- Select "Prepare" to generate the report

NECI Pension / Risk Payment Report

An NECI payment report is available to accompany remittance of the deduction for both employee and the employers contribution.

Select Reports> Pensions> NECI> Pension / Risk Payment Report>

- Select "All" employees or a specific employee for whom you wish to generate the report

- Select the starting period "From"

- Select the ending period "To"

- Select "Prepare" to generate the report