P35 - Medical Insurance eligible for tax relief

The tax relief on medical insurance premiums is capped to €1,000 per adult and €500 per child. Where premiums exceed these thresholds, the excess will not qualify for tax relief.

2016 P35 requirement

Where an employer pays medical insurance on behalf of an employee, employers are now required to include the portion of the medical insurance premium that is eligible for tax relief for each employee on the P35.

Medical insurance providers will advise employers of the amounts for each employee. You must then input this information for all applicable employees into Thesaurus Payroll Manger prior to submitting the P35.

Important Note: Thesaurus Payroll Manger will not prepare a ROS P35 until this requirement is met. This only affects employers with employees on the payroll for whom a medical insurance benefit is entered in the Benefit in Kind section.

Update Medical Insurance Eligible for Tax Relief

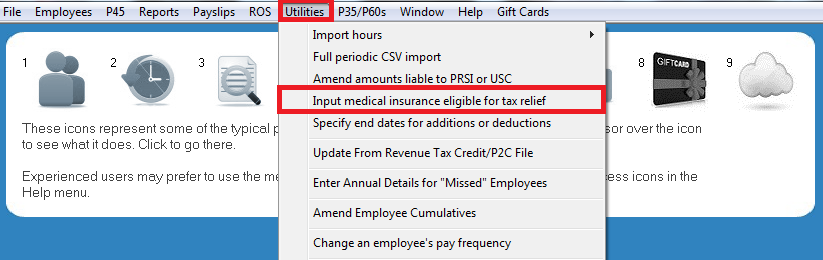

- From the Utilities menu, choose Input Medical insurance eligible for tax relief

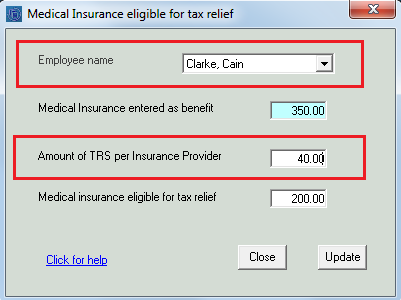

- All employees will be listed - choose the first employee record, for whom a medical insurance benefit in kind exists, from this listing.

- Enter the Tax Relief at Source (TRS)/ medical insurance eligible for tax relief value, as advised directly by the company medical insurance provider.

Thesaurus Payroll Manager will automatically increment the TRS to give the Medical Insurance Premium which is eligible for tax relief which is the Revenue P35 requirement. This amount cannot exceed the taxable premium paid by the employer, i.e. the value of the benefit that the employee has been taxed on through the payroll year to date (as will be shown from the benefit in kind screen).

- Select Update to save the entry and proceed through the employee listing until all relevant employee records have been updated. Because the tax rate for tax relief at source is 20%, the amount that is eligible for tax relief will be 5 times the TRS amount.

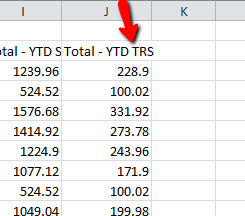

- For VHI policies,the VHI report that you need to access in your VHI Online Group Profile (OGP) is the "TRS Year to date report" to December 2016. The TRS amounts for input into the above screen are in column J.

Need help? Support is available at 01 8352074 or thesauruspayrollsupport@brightsg.com.