Additional PAYE registration numbers

You may choose to have separate registration numbers for different groups of employees. For example, where you:

• have a number of branches, with each registered separately for Pay As You Earn (PAYE) (employees in each branch must be paid from that branch, not from head office)

• have separate wages records for different employee groups (for example, office and factory)

• pay an employee a salary and a pension

• are a limited company and wish to make PAYE, Pay Related Social Insurance (PRSI) and Universal Social Charge (USC) returns under a separate registration number for directors.

To register an additional Employers PAYE registration number:

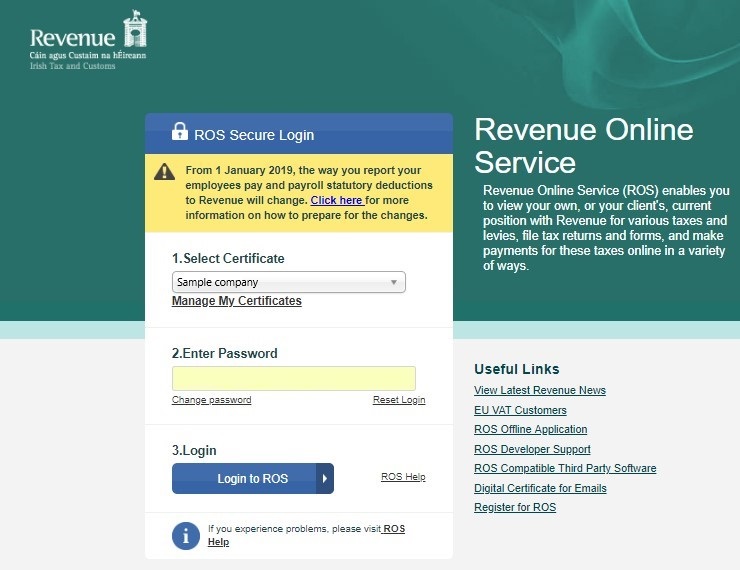

• First, log into ROS using your ROS certificate and password

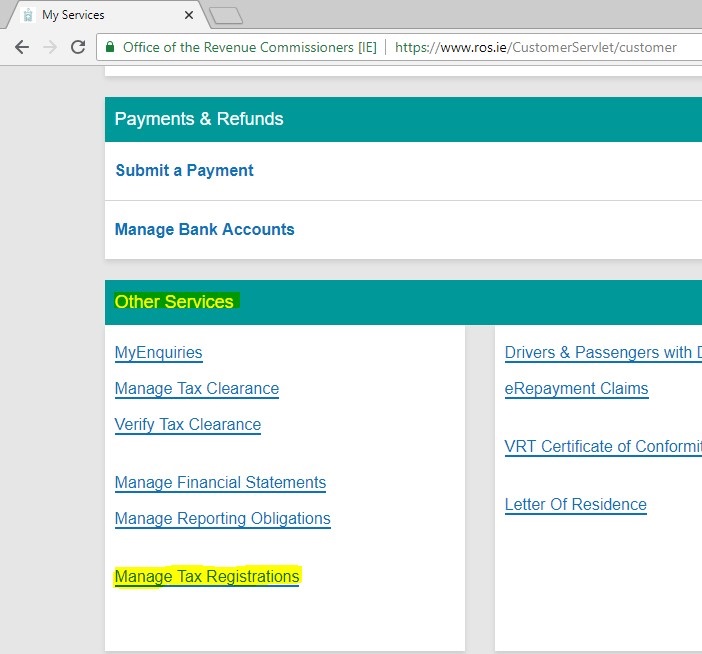

• Once you are logged in, on the My Services tab, scroll down to the Other Services section and click on Manage Tax Registrations

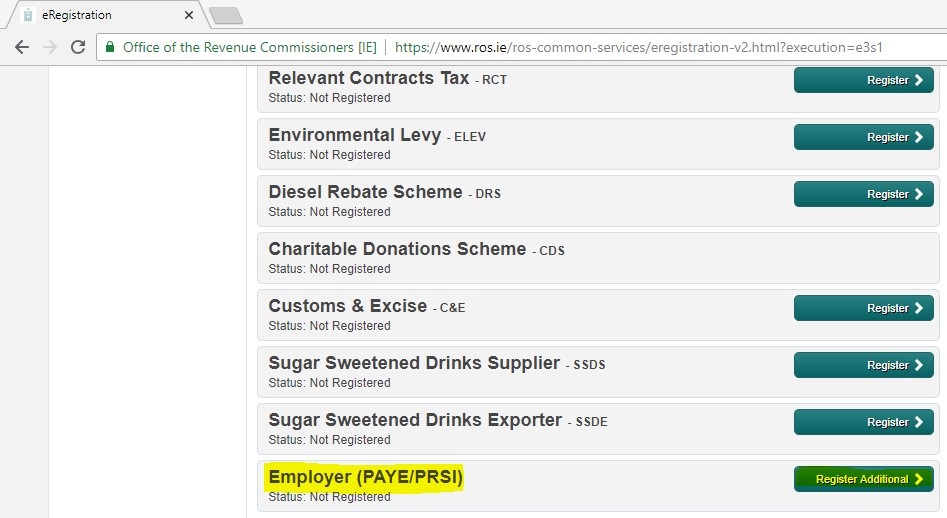

• You will now see a list of your different tax registrations under each of the tax headings. Near the top you will see an active registration for Employer (PAYE/PRSI), this is the registration you are currently using to file and pay P30s/P35s etc. Near the bottom of the list you will see another Employer (PAYE/PRSI) heading with a status of Not Registered. You will have the option to Register Additional. Click this to register your additional registration.

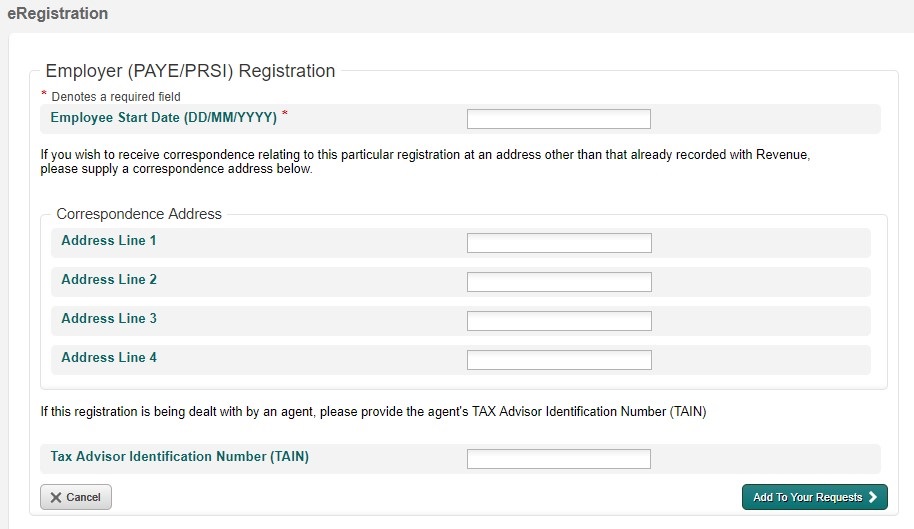

• You will be asked to fill in the Employee Start Date, a separate address if you want the correspondence for this additional registration to be posted by Revenue to a different address to where you currently receive PAYE documents, and a TAIN if this registration is being done by an agent. If you are not a tax agent this should be left blank. Once you are done click Add To Your Requests.

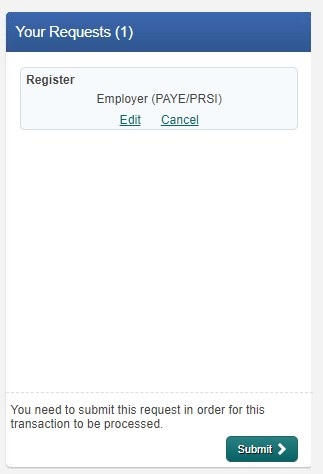

• Once your have submitted your request you will be brought back to the Manage Tax Registrations screen where you will see you have a new request ready to be submitted on the right. Click Submit.

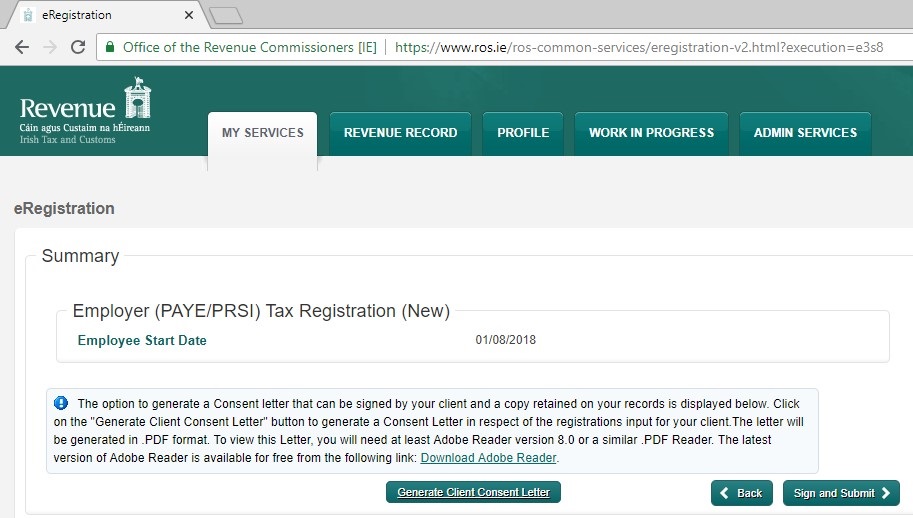

• Once you click Submit you will be brought to the Summary screen with a summary of the information you have entered. Once everything is correct you can click Sign and Submit. There is an option for agents to Generate Client Consent Letter, which generates a PDF confirmation to be signed by the tax agent and client. If you are not a tax agent this option should be ignored.

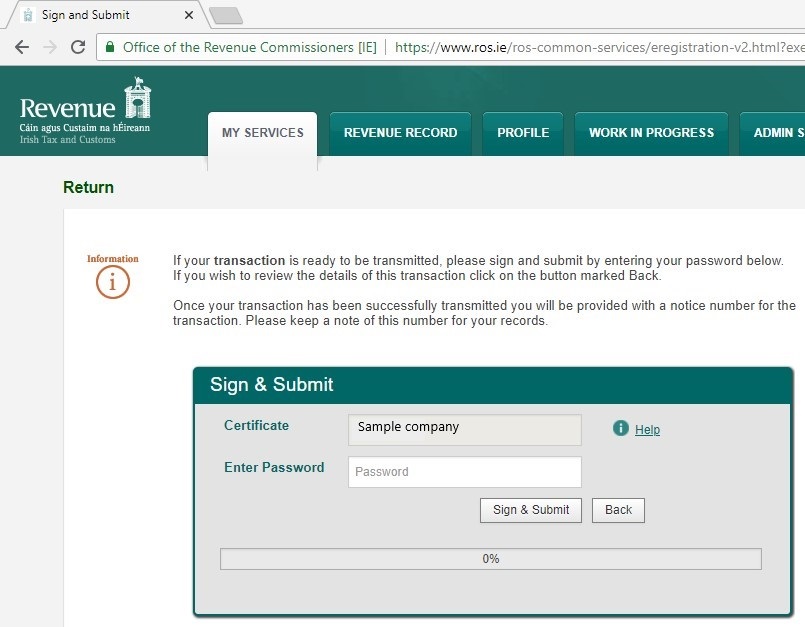

• Once you click Sign and Submit, you will be asked to enter your ROS certificate password to confirm. Enter your password and click Sign & Submit.

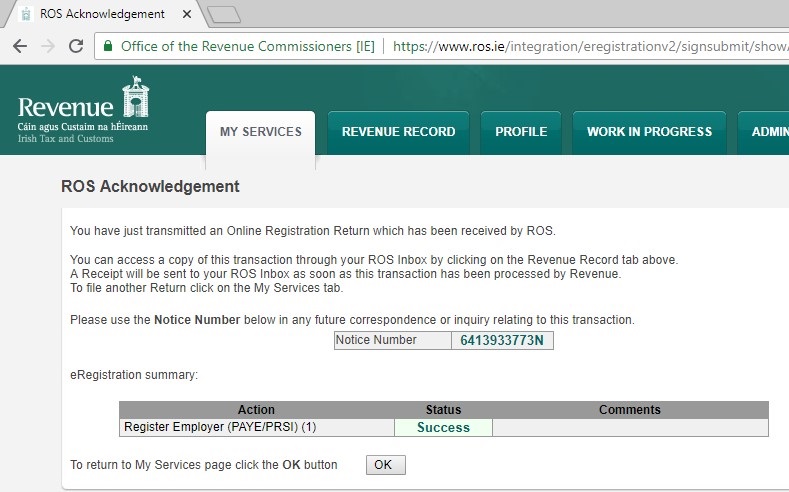

• Once submitted you will get a ROS confirmation. You will receive a Notice Number which you can quote to Revenue if you have any problems with the application. You will also receive a copy of this in your ROS inbox. The status on your eRegistration summary should be Success. If you do not see this please contact Revenue.

• Once you see the success message you are finished your additional registration. Revenue will review the application and send you correspondence once the additional Employers PAYE registration has been created.

• For additional information regarding splitting multiple PAYE registration numbers on ROS, please click here.

• For additional information regarding saving and reloading ROS digital certificates, please click here.

Need help? Support is available at 01 8352074 or thesauruspayrollsupport@brightsg.com.