Issuing a P45

When an employee leaves your employment, you should issue them with a Form P45.

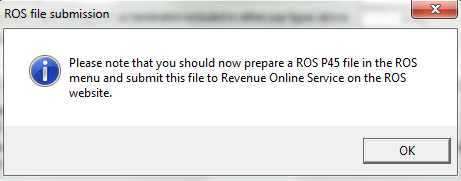

Part 1 of the P45 must be returned/submitted to the Revenue Commissioners through the Revenue Online Service (ROS) to inform them that the employee has left your employment.

After uploading part 1 of the P45, parts 2, 3 and 4 of the employee's P45 will then be sent to your ROS Inbox for printing on to official Revenue P45 paper. Revenue P45 paper can be ordered by phoning the Revenue Forms and Leaflets helpline on 1890 306 706.

Before issuing a P45, it is important to ensure that all final payments have been made to the employee and all relevant payslips have been updated, so that the correct year to date figures are included in the P45.

ISSUING A P45 WITH NO FURTHER PAYMENTS DUE

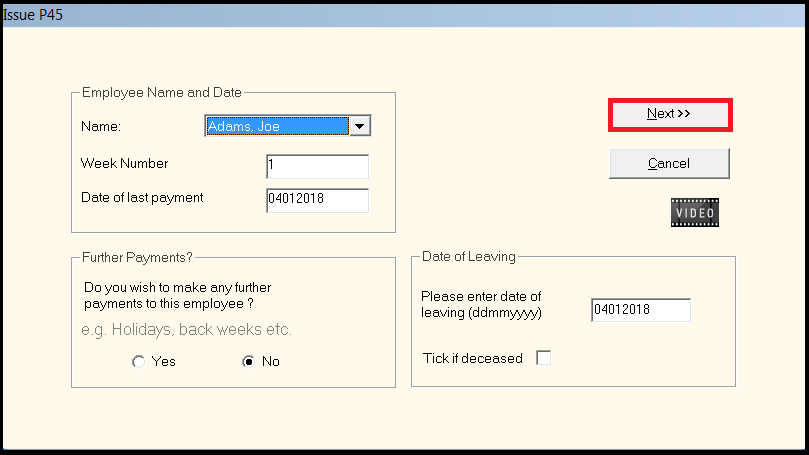

To issue a P45 within Thesaurus Payroll Manager with no further payments due, go to P45 > Issue P45:

- Select the Employee

- Enter Date of leaving

- Click Next

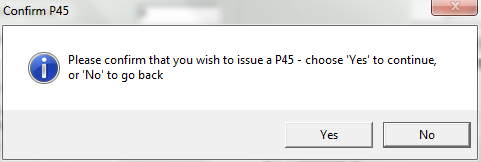

- Click Yes to confirm that you wish to issue a P45

- Click Print Pro Forma to print a file copy for your own records

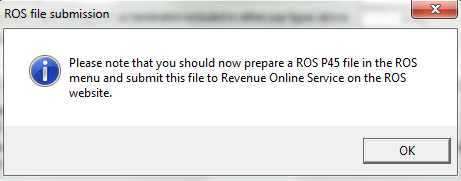

- You are now ready to prepare and submit the ROS P45 file to Revenue. For assistance with this, click here

Please note, if the date of leaving has been entered incorrectly it can be amended as follows:

- Go to Employees > Add/Amend Employees or Process Icon No. 1

- Select the employee from the dropdown menu in the surname field

- Click 'Ok' on the P45 issued message

- Click 'Mid Year Cumulatives'

- Change the date in the 'Date of leaving' field

- Click 'Update' to save the change

You can then proceed to prepare the ROS P45, further information can be found here

Important Note: The pro-forma P45 that can be printed within Thesaurus Payroll Manager is not a valid P45 form and must not be given to an employee. It is simply a file copy for your own records. An employee's official P45 must instead be printed from within the Revenue Online Service (ROS) onto official Revenue P45 paper after uploading the ROS P45 file.

ISSUING A P45 WITH A FURTHER PAYMENT DUE

A P45 can be issued to an employee for whom you wish to make a further payment - this facilitates employees who are leaving mid-month or mid-week and are due a P45 before you next process your normal pay run. It can also facilitate any holiday pay or arrears of pay still owing to an employee.

Please note, as this payment is outside of the regular payroll update payments processed via the P45 menu do not flow through to the bank payments file.

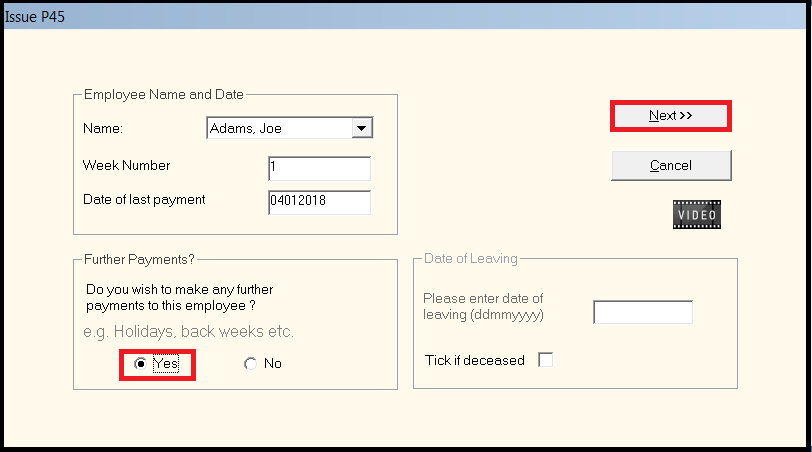

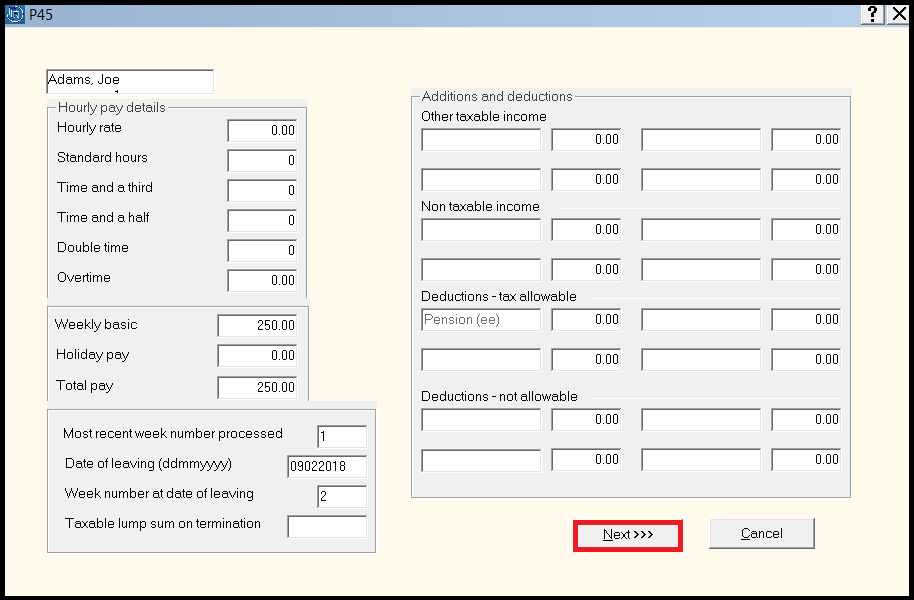

To issue a P45 with further payments due to an employee, go to P45 > Issue P45:

- Select Employee

- Click Yes to make a further payment to the employee

- Select Next

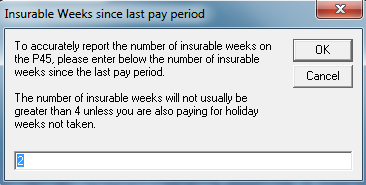

- If the employee is on a monthly pay schedule, you will be asked how many insurable weeks the employee is to be paid for since the last pay period - enter accordingly and click OK

- Enter all amounts owing to the employee e.g. basic pay, holiday pay, additions

- Enter any deductions due from the employee

- Enter Date of Leaving

- If employee is paid weekly, enter Week Number at date of leaving

- Click Next

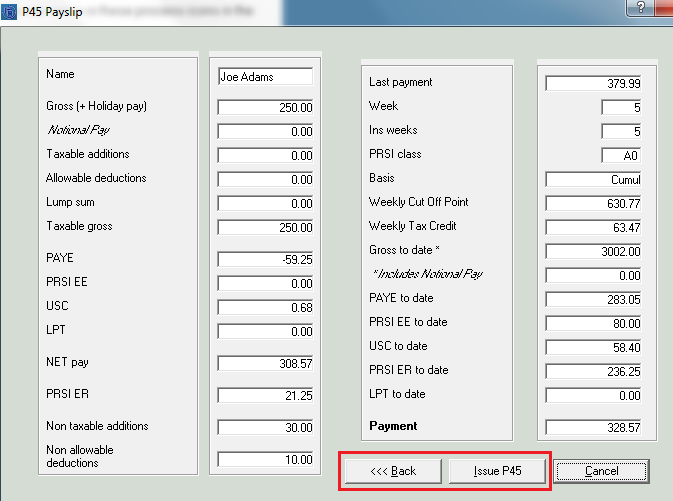

- Preview the payslip to ensure pay details are correct. To amend amounts, simply click Back

- Click Issue P45

- Click Print Pro Forma to print a file copy for your own records

- You are now ready to prepare and submit the ROS P45 file to Revenue. For assistance with this, click here

- To produce a payslip for this payment go to Payslips > Print/Email Payslips

Important Note: The pro-forma P45 that can be printed within Thesaurus Payroll Manager is not a valid P45 form and must not be given to an employee. It is simply a file copy only for your own records. An employee's official P45 must instead be printed from within the Revenue Online Service onto official Revenue P45 paper after uploading the ROS P45 file.

Need help? Support is available at 01 8352074 or thesauruspayrollsupport@brightsg.com.