Computational Anomaly

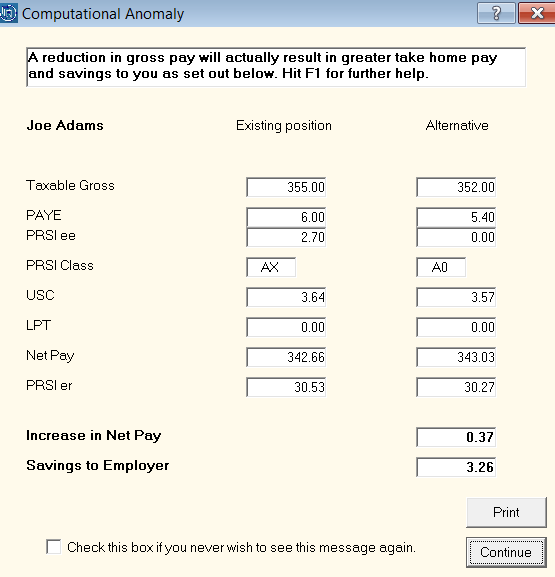

Using the PRSI and USC thresholds being applied to an employee’s Gross Pay, the software will identify where possible changes to the Gross Pay will result in a more beneficial Net Pay to the employee, i.e. where a reduction in Gross pay will result in an increase in Net Pay.

The anomaly is a result of an increase in Gross Pay being so marginal that it forces the employee’s salary into a higher threshold of PRSI and/or USC.

Where this is detected by the software, a calculation screen will be presented to the user providing a comparison between the current computation and the computation that would pertain if the Gross Pay was reduced to result in a lower PRSI and / or USC threshold.

Please note: the Gross Pay prompted within this computational anomaly refers to the "Taxable Gross Pay" after Pension Deductions. In addition, PRSI Class B, C, D and H anomalies are ignored.

If you have any queries in relation to this recalculation you should consult your Accountant / Tax Advisor.

Need help? Support is available at 01 8352074 or thesauruspayrollsupport@brightsg.com.