Share Based Remuneration

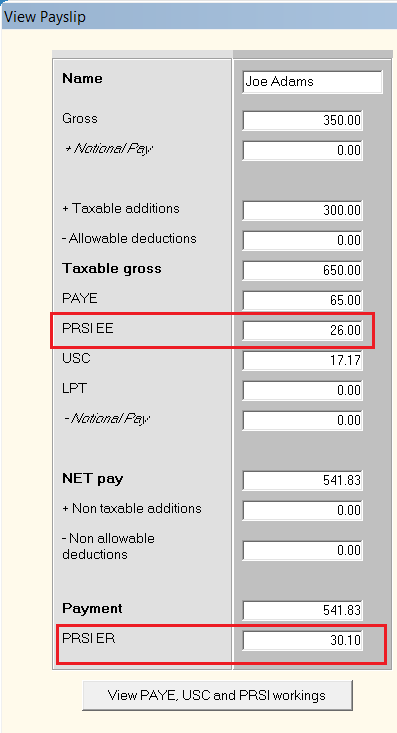

Where an employee is in receipt of Share Based Remuneration, it is subject to PRSI at a flat 4%, regardless of other earnings.

- Share Based Remuneration is subject to Employee PRSI only, it is not subject to Employer PRSI

- Share Based Remuneration should be included as income in determining the appropriate PRSI subclass to apply to the employee's total income, but at all times ensuring that the total portion of Share Based Remuneration is subject to 4%

- Share Based Remuneration should NOT be included as income in determining the appropriate Employer PRSI subclass to apply and in charging Employer PRSI.

- In some cases this may result in a different subclass being applied to the employee and employer PRSI. If this is the case it is always the Employee's subclass that is recorded against the pay period and subsequently returned.

By entering the narrative 'Share based pay' against a taxable additions, the software will split the PRSI calculation accordingly. If the Share based pay is awarded in shares, as opposed to income, then enter a non allowable deduction to the same value.

Calculating PRSI with Share Based Remuneration

Employee PRSI

Share Based Remuneration €300.00

Share Based Remuneration €300.00

No Employer PRSI chargeable under Class S

Entering Share Based Remuneration in Thesaurus Payroll Manager

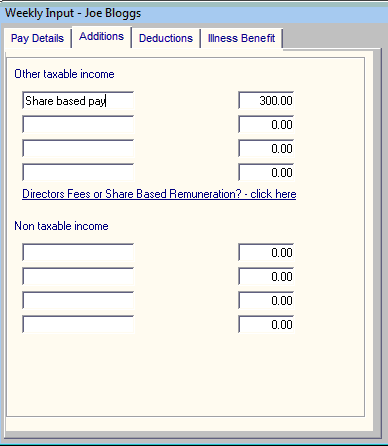

To enter share based remuneration, go to Process Icon No. 3 or Payslips > Weekly/Monthly/Fortnightly Input

- Select the employee

- Select their "Additions" tab

- Within an available "Other Taxable Income" field, enter "Share based pay" as the narrative, in order to allocate this field to Directors Fees and to allocate the correct PRSI treatment to any amount entered.

- Once you start to enter "Share based pay" the field will auto fill.

- The PRSI will be deducted accordingly

Need help? Support is available at 01 8352074 or thesauruspayrollsupport@brightsg.com.