Preparing the ROS P35 file

This utility facilitates fast, effective upload of your P35 to ROS. In order to use this facility, your company must be registered to use the Revenue Online Service (ROS).

If you have not yet registered - go to www.revenue.ie > Register for ROS

IMPORTANT NOTES

THE DEADLINE FOR YOUR P35 IS THE 15TH FEBRUARY.

FAILURE TO MAKE A P35 RETURN BY THIS DATE WILL RESULT IN A FINE (or 46 days after cessation of the business).

THIS IS EXTENDED TO 23RD FEBRUARY FOR ROS CUSTOMERS WHO PAY AND FILE ONLINE.

YOUR P35 CAN BE SUBMITTED TO THE REVENUE COMMISSIONERS ONLINE THROUGH THE REVENUE ONLINE SERVICE (ROS) OR MANUALLY ON PAPER IF YOU ARE NOT REGISTERED WITH ROS.

***Please note: it is possible for employers with more than one payroll operating under a PAYE registration number to upload multiple files. All files must be selected at the "add file" stage of the ROS upload by using the shift/ctrl button to select all relevant files. Totals from each file will amalgamate and create one declaration. ROS will only allow the upload of multiple files when the files are in one location. Thesaurus Payroll Manager will give the same file name to the P35s, so one/some of the files must be renamed to enable all relevant files to be saved in one location.

MOST COMMON VALIDATION ISSUES

Invalid PPS Number

If an employee's PPS number is invalid, go to Employees > Add/Amend Employee Details - amend the employee's PPS number if the correct number is known OR remove the invalid PPS number and replace with the employee's address and date of birth. Update the employee's record when completed.

Employee with NO PPS Number

If an employee's PPS number has been omitted in error, simply go to Employees > Add/Amend Employee Details - select the employee's name, enter the PPS number and 'Update'. If however an employee's PPS number is unknown, please ensure that their address and date of birth are entered instead.

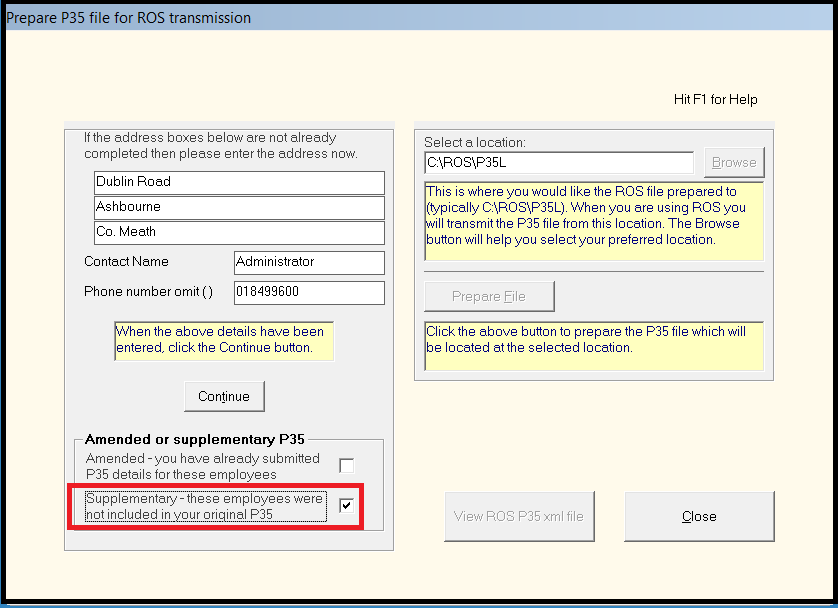

Preparing Your P35 ROS File

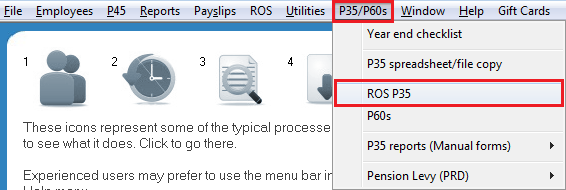

To prepare your ROS P35 file, go to P35/P60s > ROS P35:

-

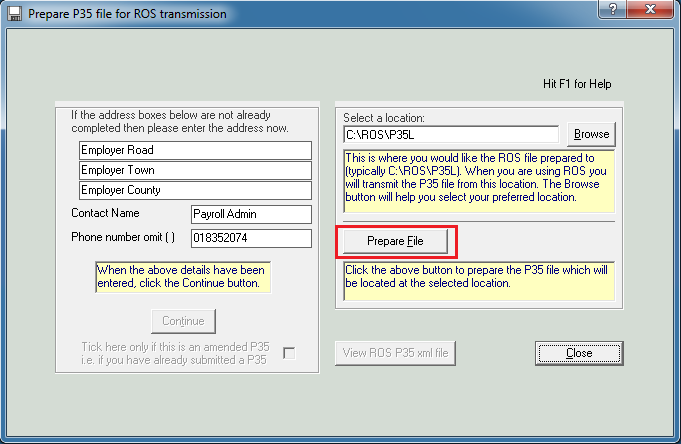

First ensure all validation issues have been resolved

-

Enter company address, telephone number & contact name if this information is not already stated

-

Click 'Continue'

-

The payroll software will automatically save the P35 file into C:\ROS\P35L. If you wish to save the P35 into a different location, click Browse > select new location for P35 > Click OK

-

Click 'Prepare File'

-

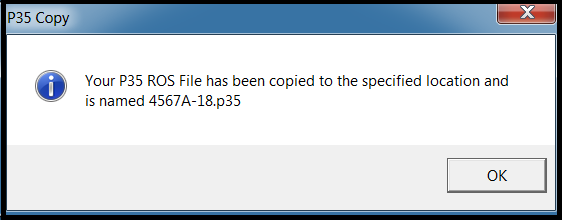

You have successfully prepared your ROS P35 file:

Your ROS P35 is now ready for submission to ROS - simply go to www.revenue.ie > Login to ROS > click 'Upload Form Completed Off-line' > Select P35L & follow the on-screen instructions. For assistance with submitting your P35 to ROS, please view the relevant support documentation on this topic.

Preparing an Amended P35

An amended P35 should only be prepared and submitted to Revenue if you have already returned a P35 and have since made changes to employees' data who were included in this P35.

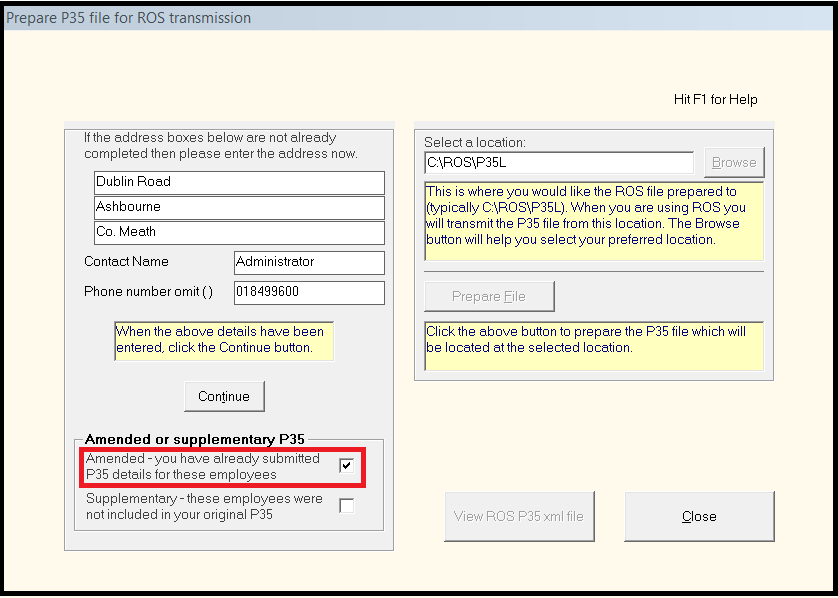

To prepare an amended P35, go to P35/P60s > ROS P35:

- Enter company address, contact name & phone number if not already stated

- Tick the box provided to indicate that you wish to prepare an amended P35

- Confirm you wish to create an amended P35

- Click 'Continue'

- Click 'Prepare file'

- You have successfully prepared an amended P35 file

Your amended ROS P35 is now ready for submission to ROS - simply go to www.revenue.ie > Login to ROS > click 'Upload Form Completed Off-line' > Select P35L & follow the on-screen instructions. For assistance with submitting your P35 to ROS, please view the relevant support documentation on this topic.

Preparing a Supplementary P35

A supplementary P35 should only be prepared and submitted to Revenue if you have already returned a P35, but have employees who were omitted from this P35 and need to be reported to Revenue.

It is only appropriate to select this option within Thesaurus Payroll Manager if the entire payroll file needs to be reported to ROS as a supplementary. For example, you have two employers set up under one PAYE Reference Number and one P35 has been submitted to ROS, you can use the supplementary option to prepare and submit a supplementary P35 for the second employer file.

To prepare a supplementary P35, go to P35/P60s > ROS P35:

- Enter company address, contact name & phone number if not already stated

- Tick the box provided to indicate that you wish to prepare a supplementary P35

- Confirm you wish to create a supplementary P35

- Click 'Continue'

- Click 'Prepare file'

- You have successfully prepared a supplementary P35 file

Your supplementary ROS P35 is now ready for submission to ROS - simply go to www.revenue.ie > Login to ROS > click 'Upload Form Completed Off-line' > Select P35L & follow the on-screen instructions. For assistance with submitting your P35 to ROS, please view the relevant support documentation on this topic.

Need help? Support is available at 01 8352074 or thesauruspayrollsupport@brightsg.com.