PAYE

The Pay As You Earn (PAYE) system is a method of tax deduction under which an employer calculates and deducts any income tax due each time a payment of wages, salary etc. is made to an employee.

The PAYE system of tax deduction applies to all income from offices or employments (including directorships and occupational pensions) other than a few isolated cases where the employers concerned are given special instructions.

Apart from the following:

- Ordinary Superannuation Contributions

- Additional Voluntary Contributions

- Revenue Approved Permanent Health Deductions

- Personal Retirement Savings Accounts (PRSA)

- Retirement Annuity Contracts (RAC)

- Salary sacrificed for a travel pass scheme or Cycle to Work Scheme

No other deductions made from pay should be taken into account in calculating employee taxable pay subject to PAYE.

An employee may claim a tax credit from Revenue for expenses that are wholly, exclusively and necessarily incurred in the performance of the duties of the employment.

If due, it will form part of their tax credits and standard rate cut off point and will not reduce the employee's taxable pay as already calculated.

Tax Credit

Each employee is entitled to tax credits depending on their personal circumstances, e.g. married person's or civil partner’s tax credit, employee (PAYE) tax credit, etc. These tax credits are used to reduce the tax calculated on an employee's gross pay. Tax credits are non-refundable. However, any unused tax credits in a pay week or month are carried forward to subsequent pay period(s) within the tax year. After your tax is calculated, as a percentage of your income, the tax credit is deducted from this to reduce the amount of tax that you have to pay.

Standard Rate Cut Off Point (SRCOP)

Tax is charged as a percentage of your income. The percentage that you pay depends on the amount of your income. The first part of your income, up to a certain amount, is taxed at 20%. This is known as the standard rate of tax and the amount that it applies to is known as the standard rate tax band. The remainder of your income is taxed at the higher rate of tax, 40%. The amount that you can earn before you start to pay the higher rate of tax is known as your standard rate cut off point.

Tax Exemption and Marginal Relief

A small number of employees/pensioners are entitled to tax exemption and marginal relief each year. Any individual/married couple whose total income from all sources is less than or equal to the exemption limit appropriate to them will not have to pay tax for that year.

Any individual/married couple whose total income from all sources is over the exemption limit may qualify for marginal relief. This means that when their wages or pension exceeds a certain limit, they are taxed at 40% instead of the higher rate of tax in operation for that year (co-incidentally the higher rate of tax and the marginal rate of tax are the same for 2019). If the employee/pensioner is entitled to tax exemption and marginal relief, the higher rate of tax shown on the tax credit certificate will be 40%.

The decision regarding any individual's entitlement to exemption and marginal relief is made by Revenue - not by the employer. The employer must operate PAYE in accordance with the Tax Credit Certificate/RPN issued.

BASIS TO APPLY PAYE

PAYE can be deducted on any of the following calculation methods:

- Cumulative

- Week One/Month One

- Emergency

Cumulative

Year to date calculation of tax which ensures that an employee's tax liability is spread evenly over the year. Each pay period tax deduction is calculated as the total tax due from 1st January to the date of payment and reduced by the amount of year to date tax previously deducted. This ensures that any tax credits and standard rate cut off point which are not used in a pay period are carried forward to the next pay period within that tax year. The cumulative basis facilitates the payment of tax refunds where due.

Week One/Month One

Each pay period is treated separately without any consideration of previous pay or deductions. The tax credits and cut off points are applied to each pay period and tax is deducted accordingly. No tax refunds may be made by an employer where this basis applies.

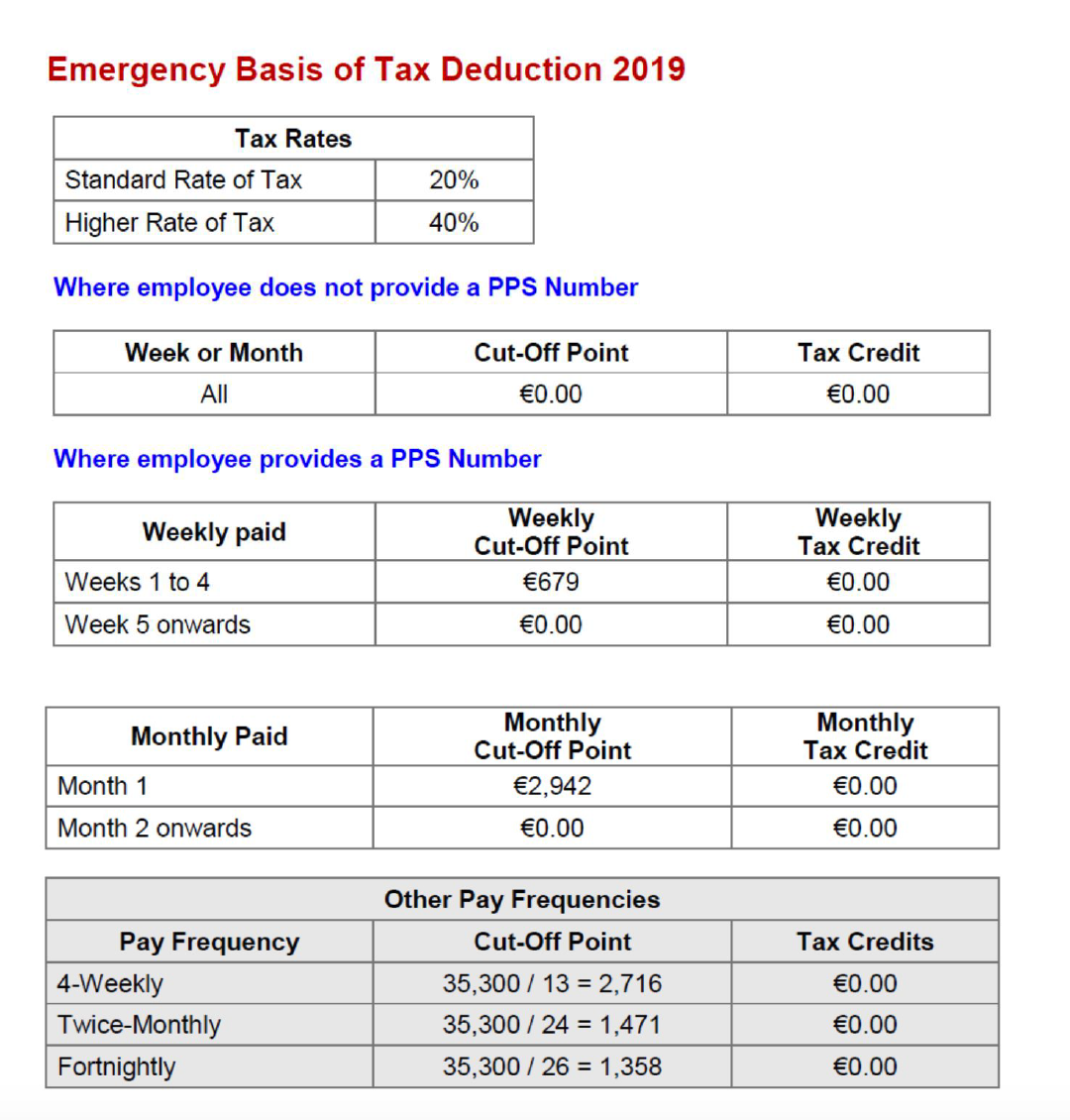

Emergency

An employer is oblige to operate emergency tax when they do not receive a Revenue Payroll Notification (RPN) for an employee.

RPNs will not be received when:

- An employee has not provided their Personal Public Service Number (PPSN)

- Employee is not registered for Pay As You Earn (PAYE)

Employees will automatically be registered for PAYE when they register a job or pension using the 'Jobs and Pensions' service.

The basic simplified steps to calculating the PAYE deduction are:

Gross Pay - Calculate the Gross Pay subject to PAYE

Gross Tax - Any pay less than or equal to the SRCOP, calculate at 20%

If the taxable Gross pay exceeds the SRCOP - calculate the balance of pay at 40%

Tax Credit - Reduce the Gross tax by the tax credit, reducing the tax payable

Balance - The remaining balance is the PAYE tax payable